mokee81/iStock via Getty Images

Investment Thesis

The new US government restrictions may cause Nvidia (NASDAQ:NVDA) to lose another $400M in sales derived from China in FQ3’22, assuming delays in licensing approval for its accelerators and data center-related chips. Combined with the multiple headwinds of its PC destruction, lowered forward guidance, and the Fed’s aggressive rate hikes through 2023, the NVDA stock may, unfortunately, find itself decimated with little catalysts for short-term recovery.

Intel (INTC) and Advanced Micro Devices (AMD) are similarly affected by the recent events, prompting an eye-watering combined loss of $149.13B in enterprise value for the three semi-companies in the past month. Devastating, since the time of maximum pain is not even here yet, given the Fed’s upcoming meeting on 20 September 2022.

NVDA’s Financial Performance Was Smashed In The PC Demand Destruction

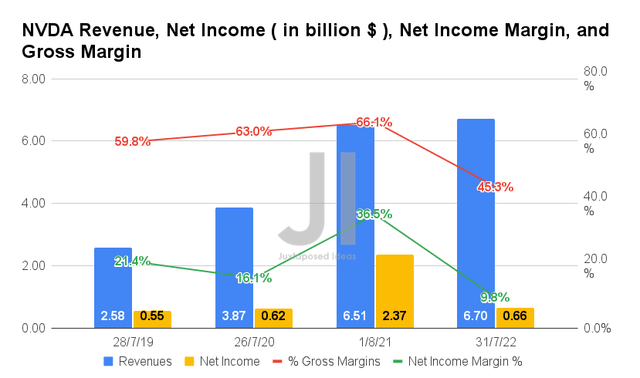

In FQ2’23, NVDA reported revenues of $6.7B and gross margins of 45.3%, representing a minimal increase of 2.9% though a drastic decline of -20.8 percentage points YoY, respectively. Naturally, this has affected its profitability, with net incomes of $0.66B and net income margins of 9.8% reported in the latest quarter. It represented a tremendous decline of -72.1% and -26.7 percentage points YoY, respectively.

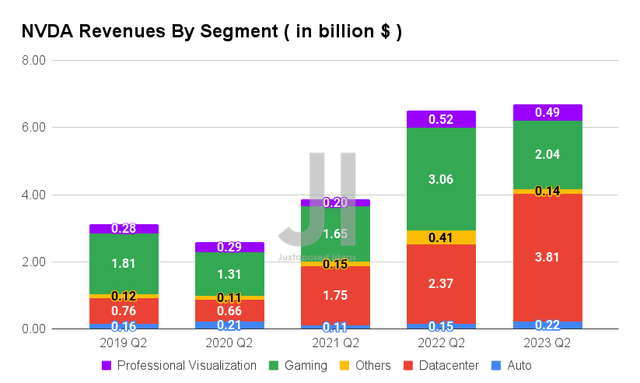

With a rising inventory balance of $3.88B in FQ2’23, NVDA also reported under-shipping in the Gaming and Professional Visualization segment, totaling $5B of headwinds for both FQ2’23 and FQ3’23. Nonetheless, it is evident that these declines were well balanced by the robust 60.7% YoY growth in the data center segment in the latest quarter. However, the automotive segment continues to underperform at $0.22B despite the $11B pipeline.

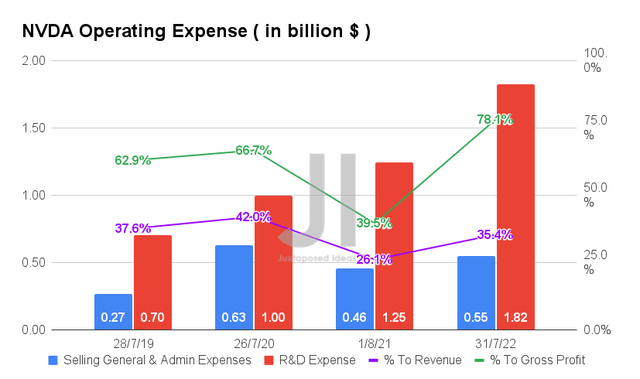

Its reduced profitability is also highly attributed to NVDA’s elevated operating expenses of $2.37B in FQ2’23, representing a tremendous increase of 72.1% YoY, otherwise 244.3% from FQ2’20 levels. No wonder the ratio to its relatively in line sales has suffered, with the operating expenses accounting for 35.4% of its revenues and 78.1% of its gross profits in the latest quarter. Thereby, impacting its net income margins then.

However, long-term investors must not be discouraged, since 27.1% of NVDA’s revenues are poured back into its robust R&D efforts in FQ2’23, otherwise a more accurate 19.4% in FQ1’23. These investments would definitely be top and bottom lines accretive since they ensured the company’s continued leadership in the intensely competitive semiconductor market. Comparatively, this ratio benchmarks well against AMD’s R&D expenses of 19.85% of its revenues in FQ2’22, efficiently monetizing its investments to sustain and/or increase its market share moving forward.

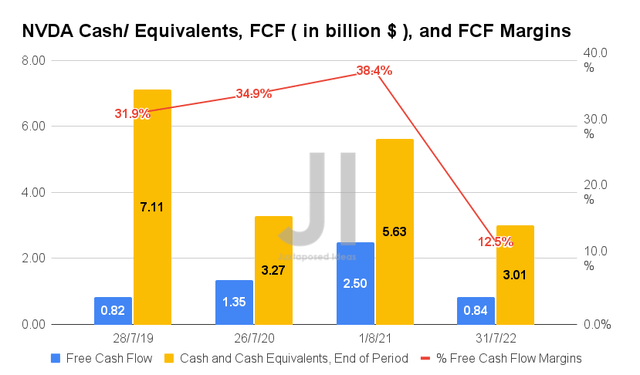

In the meantime, NVDA reported a lower FCF (Free Cash Flow) generation of $0.84B and an FCF margin of 12.5% in FQ2’23, representing a massive fall of -66.4% and -25.9 percentage points YoY, respectively. This is partly attributed to its increased capital expenditure of $0.43B in the latest quarter, indicating an increase of 238.8% YoY. Otherwise, a notable increase of 32%, from a total Capex of $0.97B in FY2022 to $1.28B in the last twelve months.

In addition, NVDA also repurchased $3.34B worth of shares in FQ2’23, indicating a massive increase of 67.8% QoQ at $1.99B, with $11.93B of authorization remaining. Combined with its $100M quarterly dividend payouts, these additional expenses contributed to the company’s lower liquidity at $3.01B of cash and equivalents on its balance sheet for the latest quarter.

The Plunge Was Unfortunately Due To The Market’s Overly Bullish Expectations

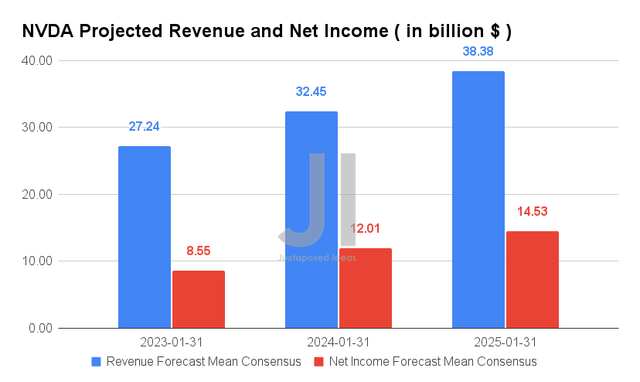

Over the next three years, NVDA is expected to report revenue and net income growth at a CAGR of 12.56% and 14.22%, respectively. These numbers represent an immense decline of -27.5% in consensus estimates since our last analysis in May and -22% since June 2022. In addition, NVDA’s profitability has also been downgraded to projected net income margins of 37.8% in FY2025 based on the latest estimates, compared to 44.2% in May 2022. Notably, nearer to its FY2021 levels of 35.3%, pointing to NVDA’s normalized growth post-reopening cadence.

In the meantime, NVDA is expected to report revenues of $27.24B and net income of $8.56B in FY2023, representing a minimal increase of 1.2% though a decrease of -12.2% YoY, respectively. This reflects another severe downgrade of -21.6% and -40.5%, compared to the previous bullish increases of 29.2% and 47.5% YoY, respectively.

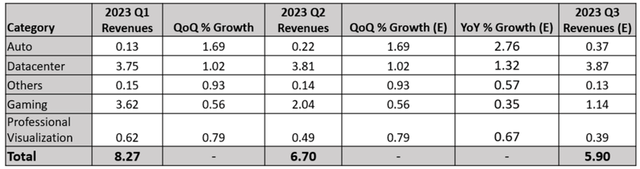

NVDA Revenues By Segment In FQ3’22 ( Projected)

S&P Capital IQ, Author Own Charts

The NVDA management delivered a double whammy as well, with FQ3’22 revenue guidance of $5.9B against consensus estimates of $6.92B, representing a massive decrease of -11.9% QoQ at $6.7B and -16.9% YoY at $7.1B.

Based on those numbers, the FQ3’22 projected breakdown of its segments further indicates the destruction in Gaming and Professional Visualization segments. The Automotive and Data Center segments would still grow at an exemplary rate of 276% and 32% YoY, with Gaming and Professional Visualization, unfortunately, declining drastically by -65% and -33% YoY, respectively. Thereby, pointing to further inventory glut and weakness in the PC, gaming, and cryptocurrency mining globally.

It is no wonder then that the NVDA stock continued to plunge by -15.1% from $177.93 on its pre-announcement on 8 August 2022 to $172.22 on its FQ2’22 earnings call on 24 August 2022, and finally to $150.94 on 31 August 2022 at the time of writing. These are mainly attributed to the massive miss from overly bullish projections, since the hyper-growth post-reopening cadence is unsustainable. Obviously, hindsight is always perfect.

Unfortunately, the NVDA stock would likely have more to fall, given the Fed’s recent hawkish commentary on aggressively tamping down growth and the rising inflation. Thereby, indicating significant interest hikes ahead through 2023. As a result of the worsening macroeconomics and tighter consumer spending moving forward, it is unlikely that we will see any positive catalysts for the semi-industry recovery in the short term, since Qualcomm (QCOM) reported that the mid-tier smartphone segments are showing weakness ahead as well.

In the meantime, we encourage you to read our previous article on NVDA, which would help you better understand its position and market opportunities.

So, Is NVDA Stock A Buy, Sell, or Hold?

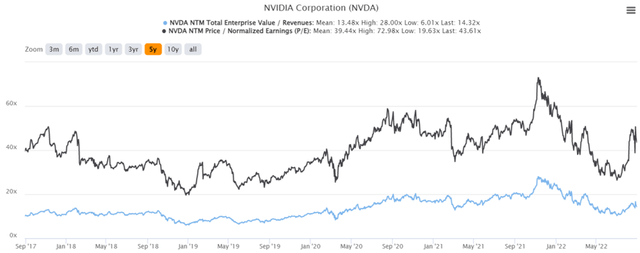

NVDA 5Y EV/Revenue and P/E Valuations

NVDA is currently trading at an EV/NTM Revenue of 14.32x and NTM P/E of 43.61x, higher than its 5Y mean of 13.48x and 39.44x, respectively. The stock is also trading at $137.14, down 60.4% from its 52-week high of $346.47, nearing its 52-week low of $132.70. It is evident that the recent recovery post CHIPS Act has also been digested by now, pointing to Mr. Market’s concerns on the semi-glut, demand destruction, and loss of the Chinese market.

NVDA 5Y Stock Price

Though consensus estimates continue to rate NVDA as an attractive buy with a price target of $215.37 and a 42.69% upside from current prices, it is evident that the period of maximum pain has just started, with a reprieve possible only by mid-2023.

However, we are more bullish, since these levels represent highly attractive points for entry for long-term investing and growth ahead. The current destruction of demand for the PC market would only pave the way for maximum growth in the automotive and data-center segments, given the massive unmet demand globally. We are not surprised if NVDA reports immense growth ahead, since the global EV market is expected to grow aggressively from $287.3B in 2021 to $1.31T in 2028, at a CAGR of 24.3%, and the global data center market from $187.3B in 2020 to $517.17B in 2030 at a CAGR of 10.5%.

Many auto companies such as Tesla (TSLA), General Motors (GM), and Ford (F) continue to report impressive order books for their EV models, despite the perceived economic downturn. GM had recently reported over 95K vehicles approximately worth $5.7B undelivered in Q2’22, due to reduced chip availability. Furthermore, GM, amongst others, utilizes NVDA’s autonomous vehicle platform, Nvidia Drive, for their Robo-Taxi capabilities, with the global Robo-Taxi market expected to grow exponentially from $1.71B in 2022 to $108B in 2029, at an impressive CAGR of 80.8%. Thereby, indicating the massive runway for NVDA’s growth ahead, despite the temporary headwinds.

In the meantime, no glut and demand destruction lasts forever. The demand cycle for gaming and PC segments will also return once the macroeconomics improve. Furthermore, the cryptocurrency winter will pass as it has always done, between January 2018 and December 2020, 2014 and 2015, and 2012. Furthermore, there is no reason to dump NVDA, since its excellent management team continues to impress with excellent margins and highly relevant technology over the next decade.

As a result, investors with a higher tolerance for risk and long-term trajectory may want to nibble at these levels, while backing up the truck and loading at the next bottom by the end of September. Long NVDA!

Be the first to comment