suman bhaumik/iStock via Getty Images

Investment Thesis

Amazon’s Jeff Bezos (NASDAQ:AMZN) appeared to have made the right decision in investing $1B into the Lord Of The Rings franchise, given the rave reviews that “The Rings of Power” has received thus far. The e-commerce giant had reported an impressive 25M global viewers tuning in for the first two episodes of the LOTR series, compared to Stranger Things’ 781.04M hours viewed for the first two and a half weeks and the House of the Dragon’s 4.43M viewers for the first two episodes.

Armed with its investments in the LOTR franchise, AMZN seeks to battle the incumbents in an intensely competitive streaming market, against Netflix’s (NFLX) highly successful “Stranger Things” and Warner Bros Discovery’s (WBD) “House of the Dragon.” This strategy would also help the company increase its e-commerce market share moving forward. Especially, since AMZN reported that its TV and film service remains one of the biggest drivers for the growth of its Prime subscriptions. Jay Marine, the European chief of Amazon Prime Video, said:

People renew their [Amazon Prime] membership at a higher rate if they take Prime Video. And those on free trials convert to paid membership at a higher rate if they are Prime Video watchers. We love the value and it is working. (The Guardian)

AMZN’s Prime Day

Digital Commerce 360

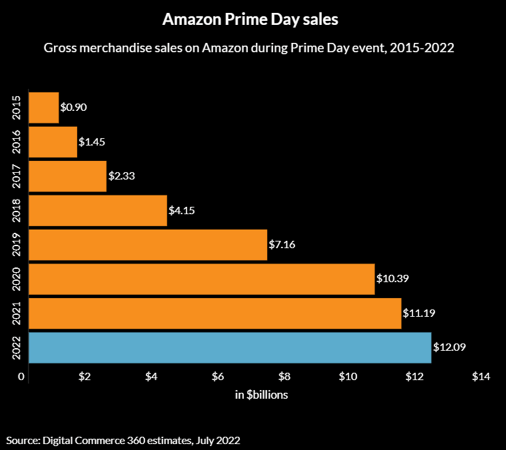

Investors must not forget the fact that AMZN continues to command the lion’s share in the US e-commerce market at 37.8% as of June 2022, compared to second place at 6.3% for Walmart. Furthermore, Q3’22 looks promising since the former experienced 17% QoQ growth in e-commerce sales boosted by Prime Day, based on credit and debit card data.

With over 200M Prime subscribers globally and a significant 163M members concentrated within the US (accounting for approximately 81.5%), there are many reasons for AMZN’s aggressive fulfillment and streaming investments over the past few years indeed. For FY2022’s Prime Day, analysts are also projecting an impressive $12.09B in sales, representing a significant increase of 8% YoY, 16.3% from FY2020 levels, and 68.8% from FY2019 levels.

Impressive indeed, despite the rising inflation, the Fed’s interest hikes, and perceived economic downturn. Thereby, pointing to AMZN’s rock-solid strategies in the e-commerce and streaming market.

The Management Is Finally Steering The Boat In The Right Direction

AMZN’s previously over-aggressive expansion plans have landed the management in hot waters, with notable stock price declines over the past two quarters. These led the company to report lowered adjusted net income profitability due to the unsustainable surge in headcount growth and lowered Free Cash Flow (FCF) generation from the elevated capital expenditures.

However, that is about to change from now on, since the AMZN management is following through with its promise in rationalizing growth and expansion moving forward. Bloomberg reported that the company had terminated many of its existing and planned facilities within the US and the EU, including delivery stations, fulfillment centers, and warehouses, while also looking to sub-lease excess capacities. Furthermore, AMZN has also slowed hiring and increased cost efficiencies by cutting 6.1% of its workforce to 1.52M thus far. We would probably hear more details in its FQ3’22 earnings call, though early signs have been promising thus far.

In the meantime, AMZN has also exited its telehealth care ambitions, Amazon Care, despite the fanfare nine months ago. Assuming further streamlining, we may see a potential pull-out from its previous One Medical deal, due to the management’s shift towards sustainable profitability ahead. I suppose it helps that the US Federal Trade Commission is looking into this acquisition, since it could form the basis for termination ahead, albeit with a hefty break-up fee.

We shall see, since the rationalization would help AMZN in regaining its focus and cost efficiencies on the e-commerce (Amazon Prime) and AWS growth. Thereby, preventing the cash burn reported by Teladoc (TDOC) and improving its bottom line moving forward.

AMZN Is Expected To Report Improved Profitability Ahead

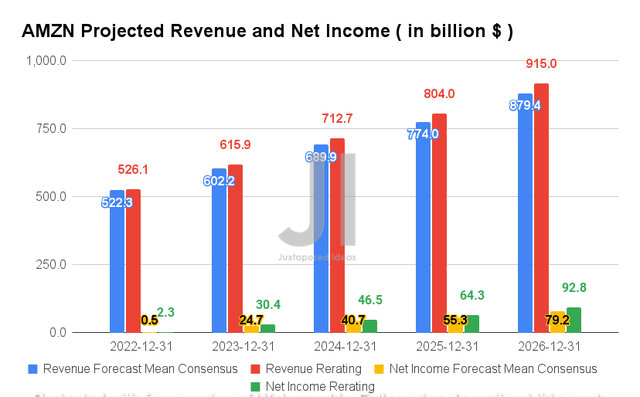

Though consensus estimates continued to assume a similar growth rate since our previous AMZN analysis in August 2022, we expect an upwards rerating of its profitability ahead, to the midpoint of previous estimates. Over the next five years, the company is expected to report revenue growth at a CAGR of 14.26%, while optimistically recording a net income growth at an impressive CAGR of 45.06% between FY2023 and FY2026. This marks a massive upgrade of 17.1% from previous estimates, given AMZN’s deft cost-cutting measures thus far and the potential recovery of the macroeconomics from 2024 onwards.

In the meantime, there is a good chance that AMZN may be able to report improved profitability with a net income of $2.3B in FY2022, instead of the previous estimate of $0.5B. Though this number is still a far cry from its previously robust profitability of $11.5B in FY2019 and $33.3B in FY2021, we must remind investors that the decline is temporary. The company is expected to report exemplary growth in its net income margins to 4.9% in FY2023 while further doubling to 10.1% in FY2026, compared to 4.1% in FY2019 and 7.1% in FY2021. Thereby, further boosting its stock performance over the next few years.

We encourage you to read our previous article on AMZN, which would help you better understand its position and market opportunities.

- Amazon Is Growing At All Cost While Being A Jack Of All Trades

- Amazon: Fed’s Rate Hike Spells Trouble For Its Growth And Profitability

So, Is AMZN Stock A Buy, Sell, Or Hold?

AMZN 1Y EV/Revenue and P/E Valuations

AMZN is currently trading at an EV/NTM Revenue of 2.47x and NTM P/E of 76.63x, lower than its 1Y EV/Revenue mean of 2.93x though higher than its 1Y P/E mean of 71.70x. The stock is also trading at $129.46, down -31.1% from its 52 weeks high of $188.11, though at a premium of 27.8% from its 52 weeks low of $101.26.

AMZN 1Y Stock Price

Given the market pessimism post-Powell’s speech, AMZN has also declined from $144.78 to $126.12 over the past three weeks, with more pain possibly coming during the Fed’s upcoming interest hike on 20 September 2022. We may likely see another bottom at the low $100s then, which would provide investors with a highly attractive entry point for long-term investing and growth.

Do not miss the next expected dip as we had in May and July 2022. Long Amazon!

Be the first to comment