Miro Nenchev

With the Baltic Dry Index trading at normalized levels ~1,000, it is clear the shipping cycle has turned. Forward revenues and earnings for Star Bulk Carriers Corp. (NASDAQ:SBLK) will be much lower than the last few quarters. Investors should stay clear from dry bulk shippers like SBLK until there is another catalyst to squeeze shipping rates higher.

Company Overview

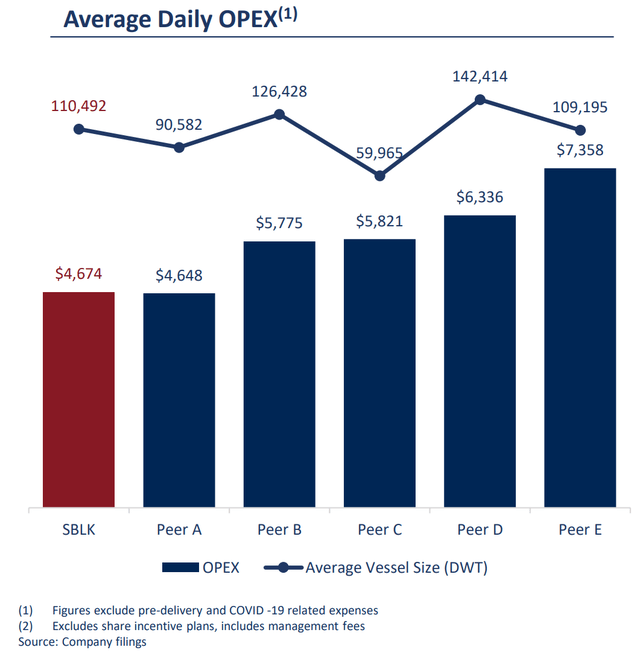

Star Bulk Carriers Corp is one of the largest dry bulk shipping companies in the world with a fleet of 128 bulk carriers. The average ship age of SBLK’s fleet is ~10 years. SBLK has one of the lowest operating costs in the industry, which helps maximizes margins (Figure 1).

Figure 1 – SBLK has one of the industry’s lowest OPEX (SBLK Investor Presentation)

Bonanza Earnings From Supply Chain Disruptions

Since the recovery from the COVID-19 pandemic, the global dry-bulk shipping fleet has enjoyed bonanza profits, as supply-chain constraints have meant port delays and increased time on the water for carriers.

The Baltic Dry Index (“BDI”), a measure of dry bulk shipping rates, bottomed at 393 in the immediate aftermath of the pandemic and reached as high as 5,650 in late 2021, the highest level since 2008 (Figure 2).

Figure 2 – Baltic Dry Index (StockCharts.com)

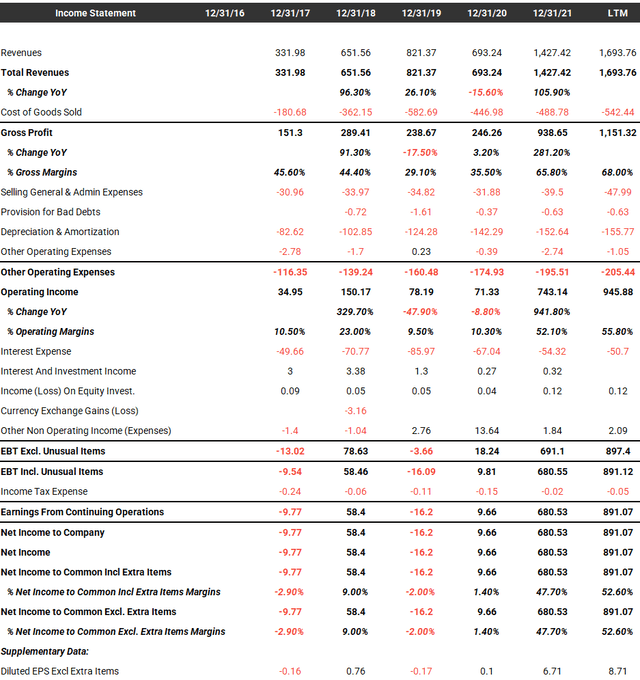

This rise in shipping rates led to incredible revenues and earnings for dry bulk carriers like SBLK. Revenues grew 106% YoY in 2021 to $1.4 billion, the highest level ever for the company, and earnings per share were $6.71/share in 2021 (Figure 3).

Figure 3 – SBLK summary financials. (TIKR.com)

Strong earnings continued into 2022, as many time charters entered into at the end of 2021 were at elevated shipping rates.

Shipping Rates Normalizing; Don’t Expect Bonanza To Continue

However, we must note that shipping rates have since normalized, with the BDI falling to 965 recently. What this means is that in the coming quarters, we should expect Star Bulk’s revenues and earnings to normalize as well.

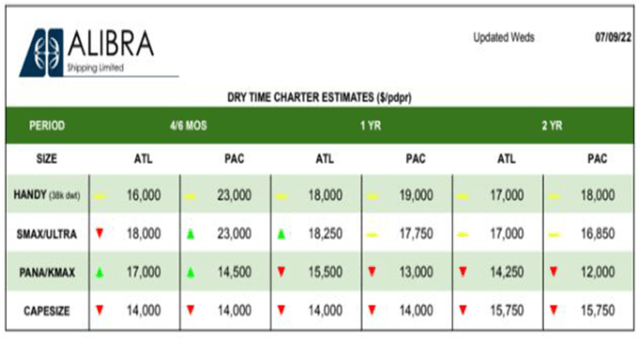

Although SBLK reported in its latest quarterly that 61% of the upcoming Q3 has been covered at a Time-charter equivalent (“TCE”) ~$29,000/day, we see spot rates are currently far below that level (Figure 4).

Figure 4 – Recent TCE charter rates, Sept 7, 2022 (hellenicshippingnews.com)

This means that any charters signed recently or in the coming period will be at rates far below the $30,400 TCE rates SBLK reported in Q2 or the ~$29,000 rate that has been ‘covered’ so far in Q3.

In fact, the current level of BDI ~1,000 is broadly similar to 2019, when SBLK’s TCE rates were $13,000 for the full year (ranging from $10,600 in Q1/19 to $15,500 in Q4/19). If the BDI/TCE rates were to stay at these levels, SBLK’s revenues and earnings would be dramatically lower. Every $10,000 in TCE is equivalent to ~$115 million in quarterly operating income (assuming 11,000 operating days and 128 ship fleet).

Note, $20,000 TCE is a historically profitable rate for the industry and prior to 2021, the last time SBLK had achieved ~$20,000 in a full year TCE was in 2011, when TCE was $19,500. Absent industry-wide catalysts like the COVID-19 pandemic, there is no reason to expect TCE rates to be above $20,000 for an extended period of time.

Use Baltic Dry Index To Time Entries And Exits

I believe shipping companies like SBLK are highly cyclical and are more suitable for trading than buy & hold. Since its listing in 2005, SBLK has made cumulative net income of -$217 million, inclusive of the bonanza $681 million in 2021. Over the long run, returns on capital have been poor.

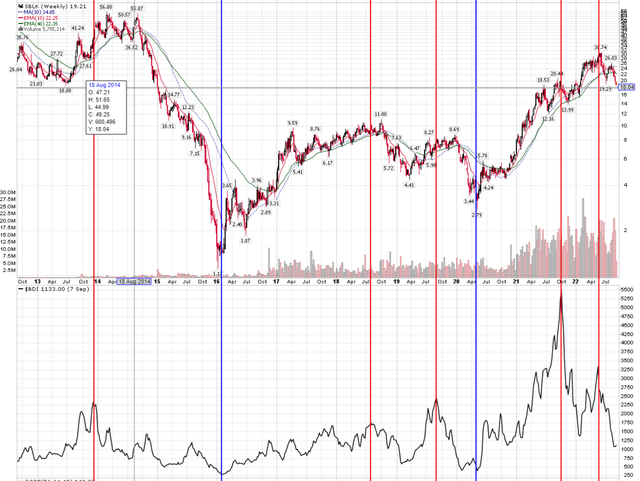

The best way to trade SBLK is to look at the BDI and understand factors that could tighten or loosen shipping rates. When the BDI has plunged and looks unsustainably low (like early 2016 and 2020), investors should buy SBLK for a rebound. When BDI has peaked and rolls over (like 2014 and 2018, 2019), investors should sell.

Figure 5 – Use BDI to time entries/exits from SBLK (Author created with price chart from StockCharts.com)

2019 is a good example of mini shipping cycle. In Q1/2019, the BDI bottomed in the low 600s and SBLK reported TCE ~$10,600. Then the BDI rallied to over 2,400 by early September 2019, and SBLK’s TCE rates increased to $14,700 in Q3/19. This positive momentum in BDI/TCE rates helped boost the stock from under $4.50 in March 2019 to over $8 by September 2019.

However, after peaking in September 2019, BDI began to plunge in Q4/19, closing the year sub 1,000. For SBLK, the negative rate impact was delayed (like they are currently), as the company had signed charters at the higher rates. SBLK TCE rates stayed strong throughout Q4/19, with the full quarter coming in at TCE of $15,500. However, SBLK’s stock price was forward-looking and essentially made no headway once BDI had peaked.

Similarly, if we study the late 2013 peak in BDI, we see that SBLK’s TCE did not peak until Q1/2014 at $14,300 TCE. However, the stock price failed to advance meaningfully once BDI had peaked. The declines in 2015-2016 were exacerbated by a shipbuilding spree that kept the BDI/shipping rates low for many years.

Dividends Are Nice, But Total Returns More Dependent On Stock Price

Bulls will argue that SBLK has paid $6.55/share in dividends or a 34% trailing dividend rate. If they hold onto their shares, they will get paid back all their invested capital within 3 years. My rebuttal is that 12 months ago, SBLK was trading at $26/share, and now it is $19. What you gain in dividends, you lose in price, once the shipping cycle has turned.

Shipping Rates Dependent On China

Critically, dry bulk shipping rates are very dependent on the Chinese economy, as China is the world’s largest consumer of many dry commodities like iron ore, coal, and grains. The stumbling Chinese real estate sector has caused a dramatic slowdown in its steel production, which has led to decreased demand for water-borne iron ore. This issue is compounded by China’s zero-COVID policies and a historic drought that has further curtailed steel production, causing shipping rates to plunge in 2022.

Until the Chinese economy stabilizes (especially the real estate sector), shipping rates are likely to stay depressed.

Conclusion

In conclusion, with the Baltic Dry Index trading at more normalized levels of ~1,000, it is clear the shipping cycle has turned and future revenue and earnings from SBLK will be significantly lower than the recent past. Investors should stay clear from dry bulk shippers like SBLK until the next industry catalyst that will squeeze shipping rates higher.

Be the first to comment