Ibrahim Akcengiz

October’s CPI numbers surprised most to the downside, and the market reaction was extremely positive. Weaker CPI figures were inevitable though, as upstream deflationary pressures have been building for months. Ignoring the impact of temporary deflation, consumer inflation is probably still slightly above where the Fed would like it but should continue to soften over the next 12 months. The market reaction to this was somewhat surprising, many quality growth stocks have been unfairly beaten down by concerns over monetary policy and rightly received some reprieve, but in general stocks are expensive and are not factoring in a deterioration in profits.

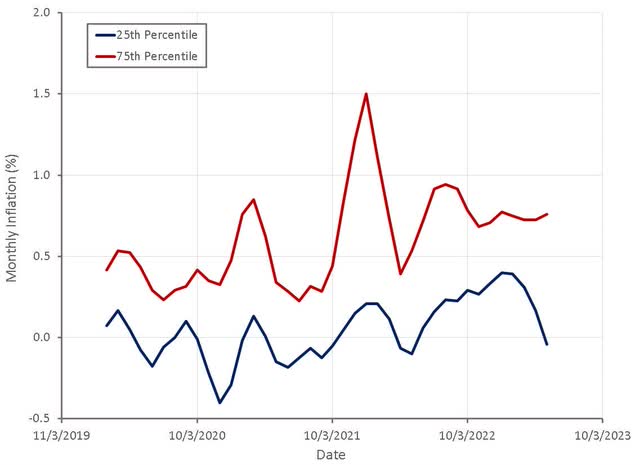

Inflation remains elevated across a number of categories, like energy food and shelter, but deflation for a number of items is now beginning to have a large impact. Used car price deflation finally showed up in BLS data, and based on Manheim’s index could soon be down something like 20% year over year. The prices of a significant proportion of the items in the CPI basket are now declining and this will have an increasingly large impact over the next 12 months. It is not clear what the response of the Federal Reserve to this will be. They should look past deflation as a temporary anomaly rather than basing policy decisions on it, but this is something they have completely failed to do in recent months.

Figure 1: CPI Inflation by Percentile (source: Created by author using data from BLS)

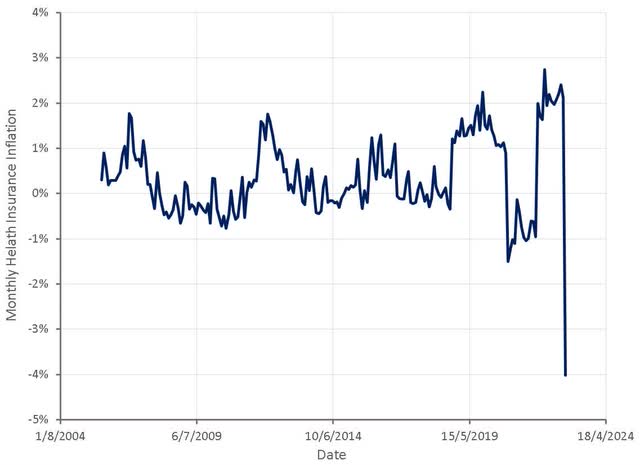

October saw an update to the calculation of health insurance prices, and this is set to have a fairly large deflationary impact over the next 12 months (on the order of 0.7%). Health insurance prices in CPI have little to do with the premiums paid by consumers and employers. The number is based on the utilization of healthcare by patients and the resulting insurer profits. BLS tracks what is referred to as “retained earnings,” the portion of those premiums that aren’t paid out to cover medical costs. This is done because it is difficult to control differences in quality between insurance plans, which would be necessary to track changes in premium costs. BLS data on retained earnings in updated each year in October, and this change has resulted in a shift from high health insurance inflation last year to high health insurance deflation this year.

Figure 2: Monthly Health Insurance Inflation (source: Created by author using data from BLS)

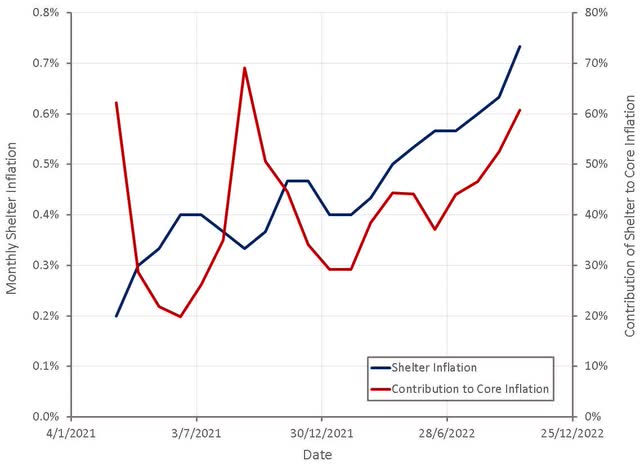

Consumer price inflation is now largely being driven by the shelter component, which is not really reflective of current housing market conditions. Based on current market data, core inflation was fairly close to zero in October. Shelter inflation is likely to continue increasing in coming months, but this is fairly meaningless as it is just the result of BLS data catching up to inflation that occurred last year.

Figure 3: Monthly Shelter Inflation (source: Created by author using data from BLS)

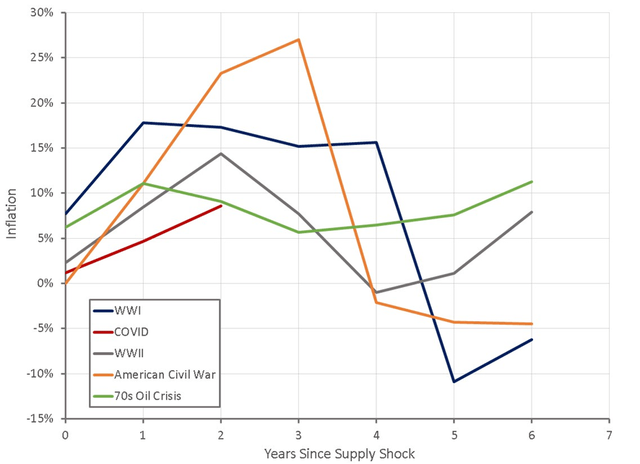

The current situation is exactly what should be expected in the event of a large supply shock (COVID and war), rapid inflation followed by rapid deflation. Compared to past events, services are now a far greater contributor to the economy and hence inflation has been somewhat muted and slower to show up in the data. Going forward, deflation should be expected, although this may be less than in the past due to the predominance of services.

Figure 4: Post Supply Shock Inflation (source: Created by author using data from The Federal Reserve)

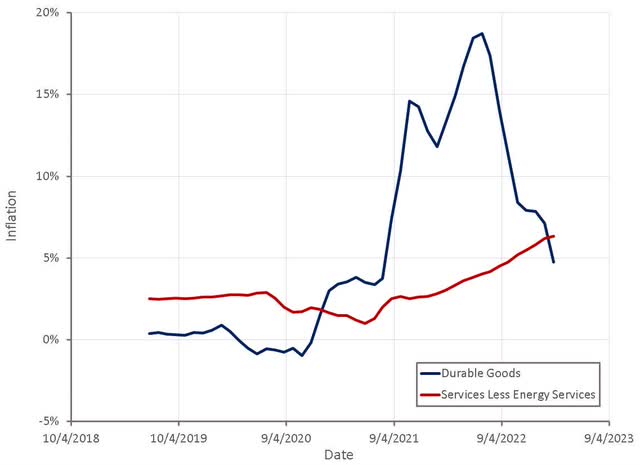

Spending and hence inflation is rotating from goods to services, although the inflationary impact on services has been somewhat muted and taken longer to show up in the data. Services inflation now also appears to have peaked and could begin to decline going forward.

Figure 5: Durable Goods and Services Inflation (source: Created by author using data from The Federal Reserve)

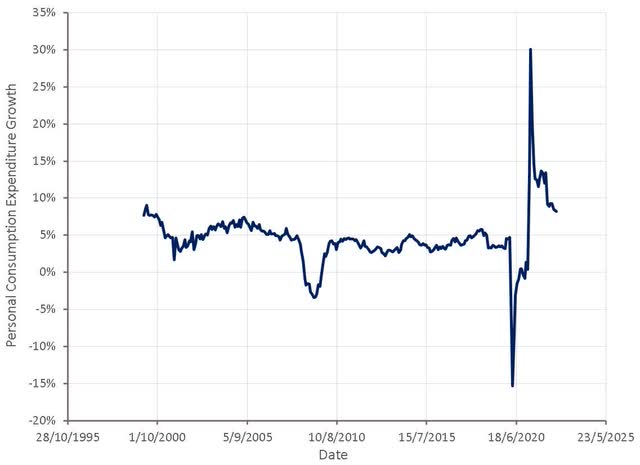

In addition to the impact of supply chain pressures easing and consumer spending patterns beginning to normalize, the impact of total consumer spending also needs to be considered. Personal consumption expenditures remain strong, but will inevitably weaken as consumers are spending more than they can afford. The personal savings rate is extremely low and personal debt is rising rapidly. Expenditures may not drop for some time though as consumer balance sheets are still fairly strong (high savings and low debt).

Figure 6: Personal Consumption Expenditure Growth (source: Created by author using data from The Federal Reserve)

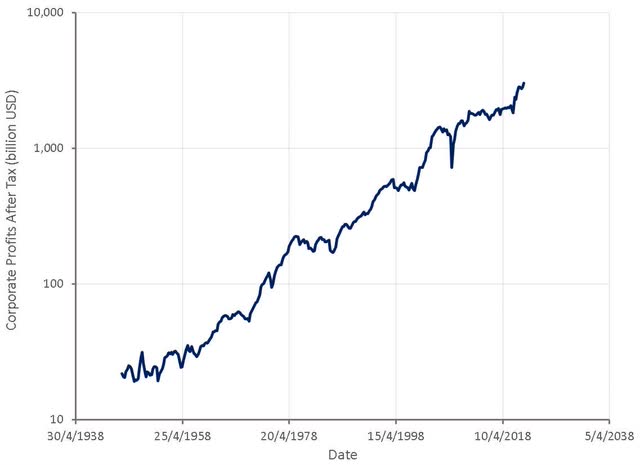

While lower discount rates are generally favorable for stocks, particularly high duration stocks, the current situation isn’t that constructive. Corporate profits are high, but they are also high relative to personal consumption expenditures. S&P 500 profit margins are also at record levels, although some of this is a reflection of the growing importance of relatively high margin tech businesses. With personal consumption expenditures set to fall, a decline in corporate profits appears likely. Even if profits do not fall significantly from current levels, it is difficult to see them growing much for a number of years.

Figure 7: Corporate Profits After Tax (source: Created by author using data from The Federal Reserve)

Conclusion

Inflation has peaked and will continue to soften in coming months, absent more supply shocks. Deflation for many items will become increasingly important, but it should be kept in mind that this is just a reversal of prior extreme supply chain conditions. Lower inflation should be more supportive of high duration assets, but overall it is difficult to see how this is particularly favorable for stocks in general, given the potential for a decline in earnings.

Be the first to comment