Michael Vi

Introduction

Coupang (NYSE:CPNG) is the largest e-commerce business in the fast growing South Korean market. Over time, Coupang has expanded from their core first-party (1P) and third-party (3P) e-commerce offerings into other adjacent business segments, such as advertising, grocery delivery (Rocket Fresh), food delivery (Coupang Eats), an “Amazon-esque” subscription membership service (WOW), and video streaming (Coupang Play). Nonetheless, in Coupang’s latest quarter (Q3 2022), 97% of net revenue was generated from their core product commerce segment, so it remains primarily an e-commerce and grocery delivery business.

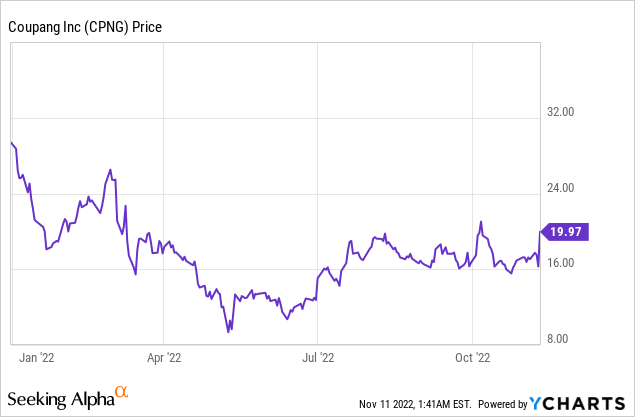

While Coupang’s share price has fallen almost 60% since their IPO in March 2021, shares have rebounded strongly in recent months, up over 100% since May 2022.

What accounts for this sharp rebound? Coupang has been investing heavily over the past few years to build out their logistics and fulfilment capabilities, but is now approaching the end of this major “CapEx cycle”. As a result, costs have reduced, leading to significant increases in gross, adjusted EBITDA, and net income margins over the past few quarters. Pleasingly, the timing of Coupang’s rapid margin expansion coincides with a renewed focus from public market investors on profitability and unit economics.

In this short article, I discuss my seven key takeaways from Coupang’s latest Q3 2022 results and why I think the company remains a buy despite the recent run up in share price.

1) Revenue growth remains strong and Coupang continues to gain market share

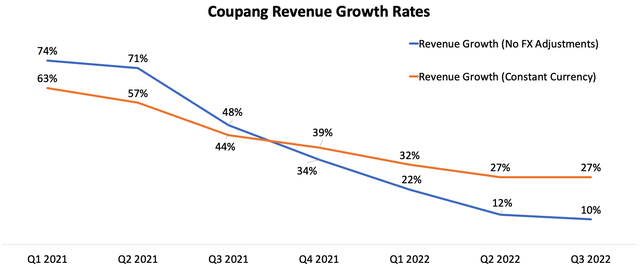

In Q3, Coupang reported $5.1b in net revenue, up 8% QoQ (in constant currency) and 27% YoY (in constant currency). While Coupang benefited from currency tailwinds throughout the first three quarters of 2021, this trend has now flipped and Coupang has faced major currency headwinds throughout 2022, resulting in large divergencies between their currency adjusted and non-currency adjusted growth rates. I believe Coupang’s net revenue growth rate in constant currency (the orange line) provides a more accurate picture of the trajectory of Coupang’s growth over time.

Coupang’s 27% YoY net revenue growth was particularly impressive considering: (1) the tough macroeconomic conditions and (2) their deliberate focus on reducing growth investments in their developing offerings segment. Coupang’s core product commerce segment (e-commerce and grocery delivery) grew at 28% YoY (in constant currency), which was almost 4x the rate of the broader Korean product e-commerce market, resulting in significant market share gains. Indeed, Coupang has gained domestic market share in the product commerce market each quarter since IPO, a trend which I expect to continue for the foreseeable future.

Coupang Revenue Growth Rates (Author Generated from Company Filings)

I believe Coupang’s continued strong growth is a product of their relentless focus on maximizing customer experience via offering: (1) the lowest prices and (2) widest range of products. As such, it could be argued that Coupang’s market share gains could accelerate in a recessionary or high-inflation environment due to the relative cost-attractiveness of their products. The below quote from Coupang’s CEO Bom Kim illustrates Coupang’s maniacal obsession with pleasing their customers:

Our focus in Wow continues to be on creating extreme value surplus for our members. We want the benefits to vastly exceed the price they pay. We’ve added 7 services to Wow, since launch. We’re still looking to invest in more. We’ll keep expanding the value proposition, so that it is in excess of the price they pay for while members for years to come. That’s our strategy and that’s our plan.

– Coupang CEO Bon Kim, Q3 2022 Earnings Call

2) Coupang continues to grow and better monetise their customer base

Coupang’s two main drivers of revenue growth are: (1) total active customers and (2) total net revenue per active customer.

In Q3, Coupang reported continued growth across both metrics. Total active customers increased 1% QoQ and 7% YoY to 18.0m, while total net revenue per active customer increased by 7% QoQ and 19% YoY (both in constant currency). In short, Coupang continues to grow both the top of their funnel (total active customers) and also penetration within that active customer base due to their ability to cross-sell auxiliary products (e.g., food delivery and video streaming).

3) Another quarter of solid gross margin expansion

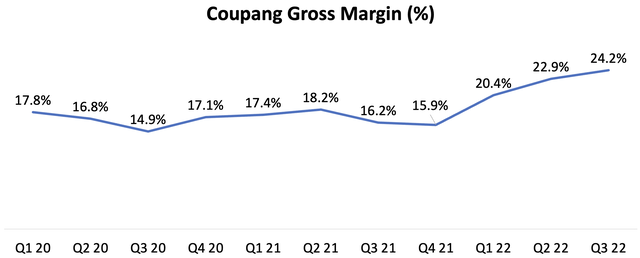

During their high-growth years, Coupang focused primarily on 1P e-commerce where they purchased inventory directly from suppliers, stored it in their own warehouses, and managed distribution to the end customer. This 1P approach leads to better control over the customer experience but adversely impacts gross margins.

Over time as Coupang has built a trusted brand, they have increased the proportion of their e-commerce business coming from higher-margin 3P transactions where Coupang simply acts as the marketplace intermediary connecting suppliers/sellers who ship products directly to customers.

This increasing shift to 3P e-commerce, in addition to realising the benefits of past investments in logistics, technology, and automation, led to another quarter of significant gross margin expansion in Q3.

On gross profit margin, you are seeing benefits from continuous improvement programs and many years of investment in technology, infrastructure supply chain optimization among others.

– Coupang CEO Bom Kim, Q3 2022 Earnings Call

As can be seen in the below diagram, Coupang’s gross margin hovered between 15-18% during their major “CapEx cycle” from 2020-2021, but has exploded higher in recent quarters to a high of 24.2% (Q3). Gross profit rose a whopping 64% YoY in Q3, well ahead of their net revenue growth rate.

Coupang Gross Margin (Author Generated from Company Filings)

Coupang’s Q3 gross margin expansion resulted from improvements across both business segments. Product commerce gross margin increased YoY from 17.4% to 24.6%, while gross margin for their developing offerings segment improved YoY from (15.7%) to 10.6%, primarily due to a stricter focus on managing costs and unit economics for their food delivery business.

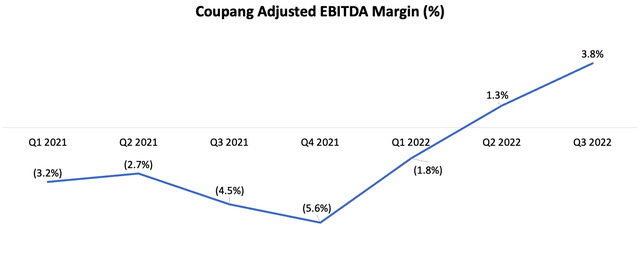

4) Climbing towards their 7-10% adjusted EBITDA margin target

Coupang’s core measure of profitability as a public company has been adjusted EBITDA with a stated long-term goal of 7-10% adjusted EBITDA margins (or higher). Given CEO Bom Kim’s track-record of “underpromizing and overdelivering” with guidance, I wouldn’t be surprised if Coupang had internal goals to reach 10-15% adjusted EBITDA margins at scale.

In Q3, Coupang reported adjusted EBITDA of $195m (equating to a 3.8% margin), continuing their recent trend of adjusted EBITDA margin expansion.

Coupang Adjusted EBITDA Margins (Author Generated from Company Filings)

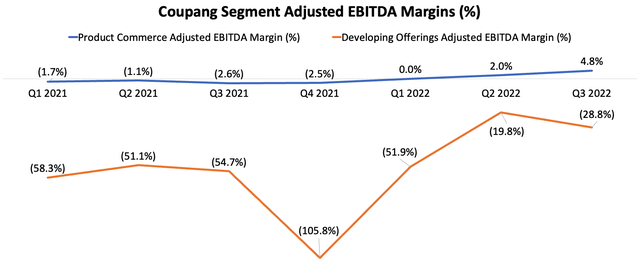

If we break down Coupang’s adjusted EBITDA margins by their two business segments, we can see that their core product commerce segment has remained consistently near break-even or had low single-digit margins (4.8% in Q3), while margins for their developing offerings segment have improved substantially throughout 2022, but still remain sharply negative at (28.8%) in Q3.

Coupang Segment Adjusted EBITDA Margins (Author Generated from Company Filings)

5) Coupang is now GAAP profitable

With good reason, the use of adjusted EBITDA as a profitability metric has attracted significant investor criticism, largely due to the adjustment of “one-off costs” (which somehow frequently happen to reappear the following year!) and exclusion of costs related to depreciation and amortization. Thus, the true test of Coupang’s profitability is whether they can generate positive GAAP net income.

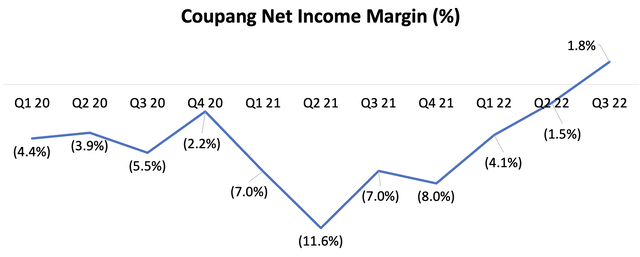

In Q3, Coupang silenced the doubters, reporting $91m of net income (1.8% margin), their first quarter of positive net income since IPO. I expect Coupang to continue to generate consistent net income (albeit not every quarter) over the next 12-18 months, despite macroeconomic headwinds.

Coupang Net Income Margin (Author Generated from Company Filings)

6) A solid balance sheet

Coupang has a solid balance sheet that will allow them to withstand another 12-24 months of global macroeconomic pain. As of Q3, Coupang had $3.1b of cash, cash equivalents, and restricted cash, and $723m of short-term and long-term debt. Given that Coupang is now GAAP profitable and soon expects to be free cash flow positive (more on this below), we should see Coupang’s net cash position continue to improve over the coming quarters.

7) Coupang expects to soon be free cash flow positive

In their Q3 earnings call, Coupang’s CEO Bom Kim stated that their “next milestone” is to become free cash flow positive. He also noted that Coupang’s free cash flow margins have historically been equal to or better than their adjusted EBITDA margins, but that this relationship decoupled over the past 18 months as they made large CapEx investments to build out their warehouses and bolster inventory. However, as Coupang begins to normalise their CapEx investments, free cash flow margins should trend towards their adjusted EBITDA margins, which currently sit at 3.8% (Q3).

Now historically prior to 2021, our free cash flow was roughly equivalent to or better than our adjusted EBITDA. This year specifically we have made some strategic investments, including one-time CapEx in owning facilities and building facilities, large inventory buys in areas of growth. But overtime, we expect this relationship between free cash flow and adjusted EBITDA to normalize. That’s our next milestone to deliver.

– Coupang CEO Bom Kim, Q3 2022 Earnings Call

Conclusion

Coupang has followed the Amazon (NASDAQ:AMZN) playbook of relentless customer obsession and rapidly grown to become the dominant e-commerce business in South Korea. With their “test-and-iterate” approach, they have also developed a whole host of auxiliary products, which massively increase their TAM and provide a long runway of growth for the years to come. In recent months, the market has begun to recognize the tremendous operating leverage within Coupang’s business and sent shares higher. Despite the recent run up in share price (including the 23% pop after Q3 earnings), I remain a buyer at these levels.

Be the first to comment