Sundry Photography

Introduction

Coursera Inc. (NYSE:COUR) has been down roughly 52% YTD as Q2 results disappointed investors due to macroeconomic conditions affecting degree enrollment and the rising number of job opportunities as the pandemic eases. However, these results could be only temporary as the market remains to have huge growth potential and the company’s fundamentals remain resilient. Most importantly, Coursera’s stock is massively undervalued after the recent sell-off.

Company Overview

Coursera has over 5000 courses from 150 universities. In contrast to many other online learning sites that provide courses, from the get-go, Coursera’s strategy focused on partnering with universities to develop courses. Many prestigious universities like UPenn, Yale, etc are included, making Coursera more credible through association and its courses appearing more valuable to students.

Coursera had a 5.5% market share in the Massive Open Online Course (MOOC) market worth $7.55 Bn at the end of 2021. COVID-19 massively increased the adoption of MOOCs, however, the trend is likely to continue as the job market rapidly evolves. With most people changing jobs every few years, MOOCs give them an edge in recruiting and help employers cheaply invest in their workers. Not to mention, the chance of a deep recession with high unemployment rates, along with the fact that colleges are becoming more expensive, provide tailwinds for the market as students seek resources to develop new skills for the job market. Furthermore, the continued adoption of technology worldwide will no doubt generate additional demand for MOOCs in developing countries.

Coursera’s Q2

Compared to projections of -$0.31 EPS, Coursera had an EPS of $-0.34. Its revenue grew 22% YoY to $124.75M but missed expectations by $6.15 million. Sales for the entire year are now anticipated to be between $509M and $515M, down from a previous range of $538M to $546M.

Sound Fundamentals

Some investors are hesitant about Coursera as its sales growth fell short of expectations, particularly given the poorer conversion rates that were seen in several international regions like the EMEA. However, this was largely due to the current macroeconomic headwinds. Management is taking action and attempting to improve conversion rates through their efforts of focusing on current users – providing individualized recommendations on their platforms and using performance marketing on social media platforms to drive conversations. Furthermore, user growth has sustained as Coursera saw a 23% YoY increase in registered learners, adding 5 million learners. Therefore, the combination of better platform optimization with an economy headed for a “soft landing” could mean the stock might see a rebound.

Valuation

Coursera’s sell-off has presented a very good buying opportunity on its valuation alone. To value Coursera, I want to take into account all of its growth potentials while staying conservative. I started by calculating its expected revenue in 10 years. Assuming that they retain their 5.5% market share, that leaves $3.52 Bn in revenue in 2029 from the expected $64 Bn market. Using a conservative P/S ratio of 1.84 (which is the educational average), gives it a market cap of $6.477 Bn in 2029. Finally, Discounting it back using a 10% discount rate yields an intrinsic market cap of $3.32 Bn, an 87% upside.

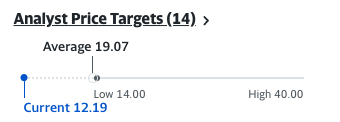

Wall St also thinks the stock is undervalued, with a range between $14 to $40, and an average price target of $19.07. At its current market value, analysts are projecting an average upside of over 56%.

Yahoo Finance

Conclusion

Coursera is a formidable competitor in a vital and expanding business. While investors might be more skittish during this current economic cycle, its recent sell-off has been overdone. At its current price levels, Coursera has an attractive valuation that provides a significant margin of safety. Therefore, its sound fundamentals, growth potential, and valuation make Coursera a “Buy”.

Be the first to comment