Beton studio

This is a follow-up to my previous article covering AdvisorShares Pure US Cannabis ETF (NYSEARCA:MSOS). For anyone new to the sector, I highly encourage you to read my original article as I endeavored to cover the macro reasons for my bullish stance as well as discuss how a changing legal landscape could benefit MSOS over time.

Today, I’d like to examine recent financial performance and commentary from the three largest companies represented in the MSOS ETF. But before doing so…

An Anecdote to Start

Unrelated to any of my investing activities, I’ve recently become a huge fan of a new-to-the-scene freestyle rapper, Harry Mack. One of his novel ways of performing is to go on to Omegle (a video chat site that randomly connects viewers) and then to perform a freestyle based on words that his video match suggests. I’m happy to discuss Harry Mack in the comments, but as it pertains to investments, I’ve noticed that most of the video chatters – whether young or middle-aged – partake in either vaping or consuming cannabis. It’s a much smaller percentage who are drinking. In any case, I think this reinforces this observation in my original article:

I believe that cannabis is a relatively safe drug and that its consumption is actually safer than that of alcohol. Owing to my age and generation, I’m a social drinker and not a cannabis user, but as I survey those younger than me, I see a definite trend of a greater tendency to use cannabis relative to alcohol the younger one is. Thus I believe there is a generational shift in place that should yield long term investment returns.

MSOS Top 5 Holdings – Valuation & Growth

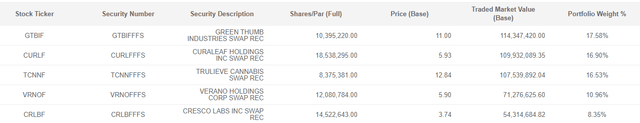

From the ETF’s website, here are the current top 5 holdings which account for more than 70% of the total portfolio:

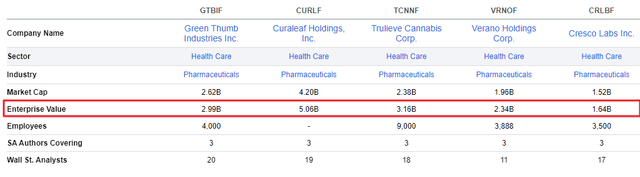

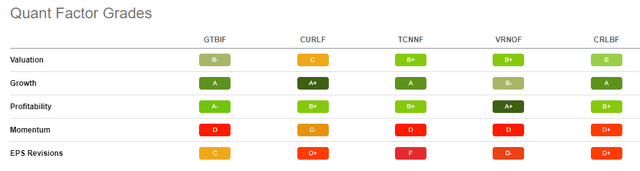

I find it convenient to add these to a comparison screen using Seeking Alpha’s handy comparison tool. Here are a few screenshots from it which help characterize the size, growth, valuation and factor grades of these companies.

First off, these companies all fall in an EV range of $1.5B to $5.1B. In my view, this means they are large enough to be well-established and able to access capital while still being small enough to be both nimble and able to grow very rapidly.

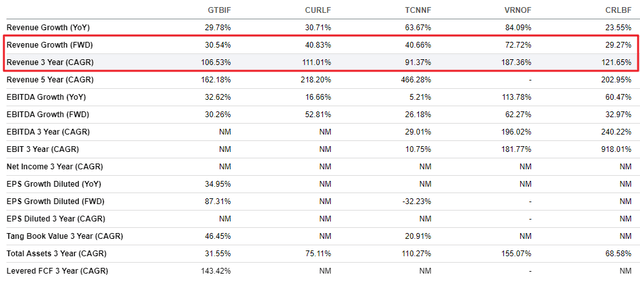

Next, we turn to the growth profile of the five companies. Their three-year compounded annual growth rates have averaged around 120% and their expected forward growth rates are all above 29% with Verano (OTCQX:VRNOF) expected to grow 72% next year. This is an exciting time for the industry.

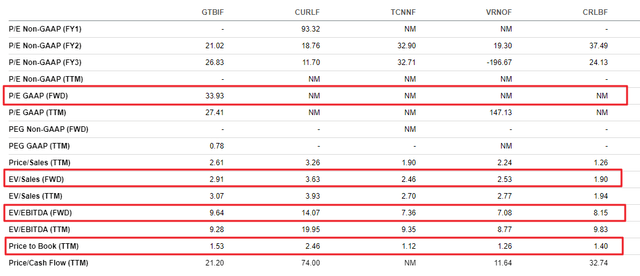

In terms of valuation, only Green Thumb (OTCQX:GTBIF) is expected to be profitable next year, but all of the companies trade at reasonable forward EV/EBITDA multiples and relatively cheap EV/sales and Price to Book ratios.

Finally, the factor grades for these companies match my evaluation; however, since the stock share prices have been dropping relentlessly, the momentum factor grades are poor, as are the EPS revision ratings. It may be most prudent to wait for these to turn more positive, but I personally am engaging in a slow accumulation process while prices are this low.

With these summaries in mind, let’s turn to this past quarter’s developments from the three largest holdings in MSOS.

Recent Earnings & Color

Green Thumb Industries

GTBIF’s second quarter was very encouraging with the company beating on top and bottom lines and with YoY revenue growth of 14.6%. Moreover, it was the eighth consecutive quarter in which the company showed positive GAAP net income.

As to color, the company highlighted the opening of the New Jersey market and strong growth in Illinois. The company generated sales from 77 retail stores across 14 states. One negative was that comparable sales growth (for stores open at least 12 months) was down marginally at 1.5%.

Highlights from the earnings call include (all emphasis mine):

- A discussion of the importance of cash in an “unbanked” industry:

Given the nature of the cannabis industry, the punitive tax code and the fickle capital markets we continue to be focused on cash at Green Thumb. We believe operating cash flow is the best measure of a company’s financial and operational health and we are not alone. With the prospects of a bear market and recession we’ve noted Wall Street is paying close attention to the fundamental attributes of a business such as cash flow, balance sheet and earnings quality. All of which support a company’s health and ability to weather, whatever comes its way. When you’re out of cash you’re out of options and optionality is very important to us, regardless of any volatile external environment over which we have little or no control. What we can control is our capital allocation decisions and our balance sheet both of which are strong, competitive advantages and why we constantly evaluate our business to ensure we are operating as efficiently as possible.

- Examples of how the various restrictions in states where cannabis is nominally legal are slowly being removed. I think this is the trajectory that most states will take, and it’s part of why I think cannabis is a multi-decade long growth industry.

On the product front, we’re excited to offer edibles to Minnesota patients for the first time as of August 1st and we saw very strong demand, a good sign of things to come. In Virginia, patients are no longer required to have a medical cannabis card issued by the Virginia Board of Pharmacy as of July 1st.

- Discussion implying that larger companies, like the five top MSOS holdings, are going to be better able to survive than smaller mom & pops if/when there is an industry shakeout due to over supply. In particular, larger companies’ vertical structure and access to capital should benefit them relative to smaller players.

- How brand development is affected by the lack of a nationwide campaign (due to cannabis still being illegal on the federal level). To me, this again is an advantage for larger companies.

We believe in the power of the brand. We see consumers relating to the brand, especially if some of these products differentiate from others on the shelf. There is not a massive national marketing campaign and awareness remains low. So the focus of a lot of it is brand awareness and building loyalty. And in flower with Rhythm, with where you’re talking and the core product is flower, you build that loyalty overtime, every time you open the jar with high quality flower. So as both of us mentioned that focus on the indoor environment, on the genetics, on the techniques, on the cure, and the grow in the jar remain paramount for us to build that in Rhythm. We see it there, we see it in Beboe, and we are excited about the brands.

Curaleaf Holdings (OTCPK:CURLF)

In its second quarter, CURLF increased revenues and improved gross margins, both QoQ and YoY, but its GAAP net loss also increased. Store count increased by 7 from 128 to 135. Cash on hand remained high at $187M.

Highlights from the earnings call include (all emphasis mine):

- Taking its expertise internationally. (Personally, I’m not sure how well US experience will translate to international markets, but it’s an experiment worth keeping an eye on.)

We have established a strong presence in Europe and intend to take that Curaleaf model to emerging markets around the world. To this point, Europe is undoubtedly the next big opportunity as an estimated $229 billion market with medical and adult use making headway in several countries.

Most notably in Germany, with the population of 80 million Germany is the economic powerhouse of the EU, and is leading the way in cannabis reform with adult use program expected in early 2024. Our early focus on Europe has given Curaleaf a formidable strategic asset and strong foundation and one of the industry’s critical global markets. We see Europe as a major driver of our growth in 2024 and beyond. In fact, I’m spending more time on Europe and traveling the continent to ensure we are best positioned to leverage this enormous opportunity.

- Coupled with the previous point, CURLF expands on the nature of branding, again showing the advantage large players have.

We have successfully taken a regional West Coast brand in four states and have now expanded into 19 states with more to come including Europe, achieving revenue growth approaching 400% since acquisition. In flower we are executing on our plan to expand the premium grassroots brand known for high quality indoor flower and premium concentrates to market throughout the U.S. Our launch of grassroots in two new markets Massachusetts and Nevada is going extremely well. More key markets are on the way including California and Florida.

- A confirmation that this type of retail operation is less economically sensitive than most businesses.

The other good news is that current customer behavior indicates that our business is a recession resistant staple. We’ve seen that despite disruptions in the economy, politics and culture, people want their cannabis. In some markets, we’re even seeing premium products showing stickiness with repeat buyers. And we continue to meet the customer where they are with value oriented products, strategic promotions, and best-in-class service.

Trulieve Cannabis (OTCQX:TCNNF)

TCNNF grew revenues 1% QoQ and 49% YoY. Gross margin increased from 56% to 57% QoQ, yet the company sported a $22.5M net GAAP loss in the quarter.

Contributing to its low EPS factor grade, the company issued downside guidance:

Based on recent trends and the impact of proactive measures we are taking to improve profitability, this morning, we adjusted our revenue outlook by 5% from the prior guidance. Our updated guidance incorporates strategic changes across our business, while accounting for the impact of inflation on consumer spending, softness in wholesale markets and the lack of visibility in the economy.

It also spoke of rationalizing its business, which I take as a positive for the industry as a whole:

In July, we decided to discontinue wholesale operations in Nevada. Our limited presence in Nevada was too shallow to justify given the bandwidth and resources required. Without sufficient depth and scale, the performance did not meet our criteria. Similarly, we have made the decision to close select California retail locations. Jettisoning non-core assets and activities allows our teams to concentrate on more impactful areas of our business.

Risks

The biggest risks for multi-state operators are threefold, in my opinion.

- The tax environment is negative, and it is subject to the vagaries of every state. Literally, anything can happen on this front (though, I personally believe that states will ultimately realize that pushing up taxes only benefits the black market players).

- Banking reform never occurs. This is a definite possibility as politicians may prefer to keep promising this, but never deliver so that they can use it in their next campaign’s platform.

- Markets go into severe oversupply. Also, a short-term possibility, but longer term, I think this risk actually benefits larger, vertically-integrated companies.

Conclusions

As I’ve tried to indicate in this and my previous article, I believe that despite tax and banking hurdles, the cannabis industry will benefit from very long-term tailwinds. Moreover, larger companies should be in a better relative position than smaller operators, in particular since the former have vertical operations and have much better access to capital.

Finally, valuations are constructive, such that I’m continuing to build a long-term position in MSOS.

Be the first to comment