Sundry Photography

Coursera (NYSE:COUR), an online education and learning platform provider, reported weaker than expected Q2 results and lowered their 2022 guidance due to increasing macro pressures.

While disappointing to investors, I do have confidence in the longer-term trajectory of the company, especially within their Enterprise segment. Businesses have continued to shift away from in-person training courses given the ongoing hybrid work environment. Online education platforms seem likely to persist for many years, something that was significantly accelerated during the pandemic.

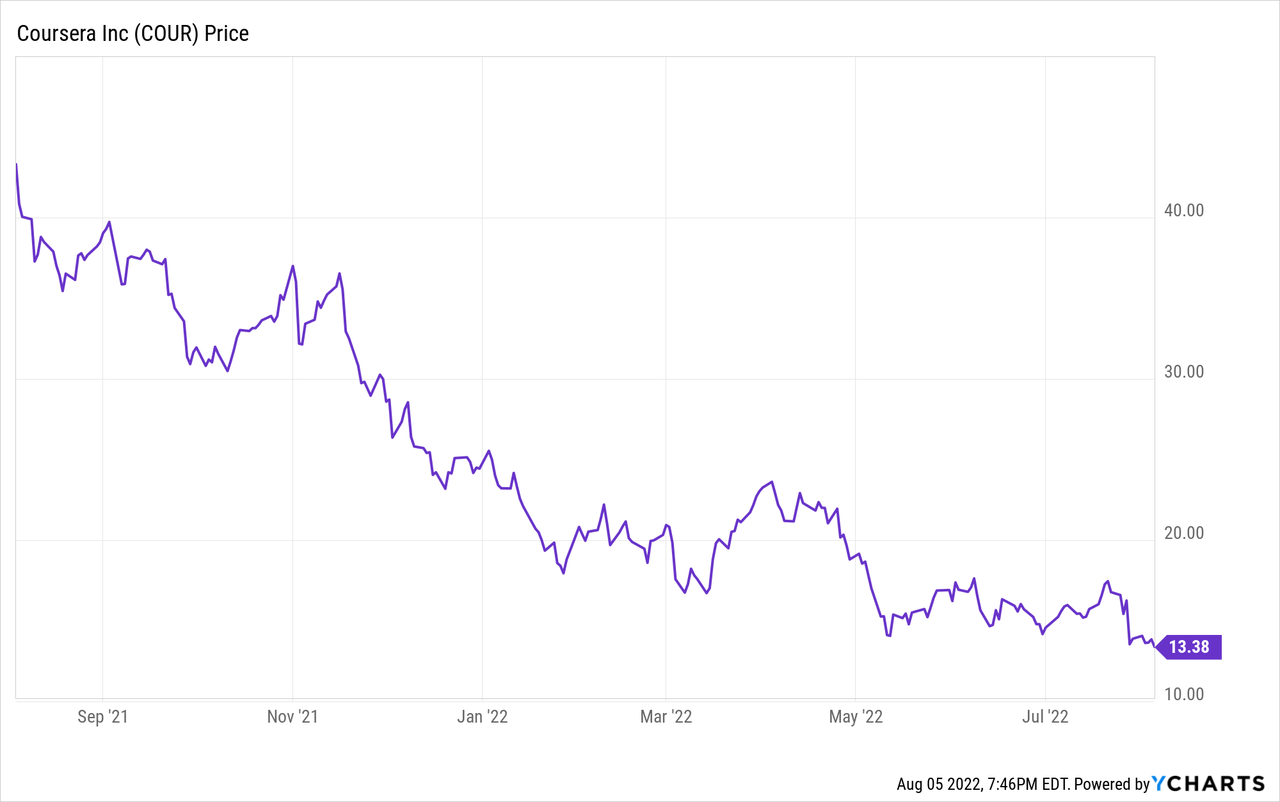

Even with the stock pulling back around 20% since the company reported earnings and is now down almost 50% year to date, I remain hesitant to step in at current levels given the ongoing macro headwinds.

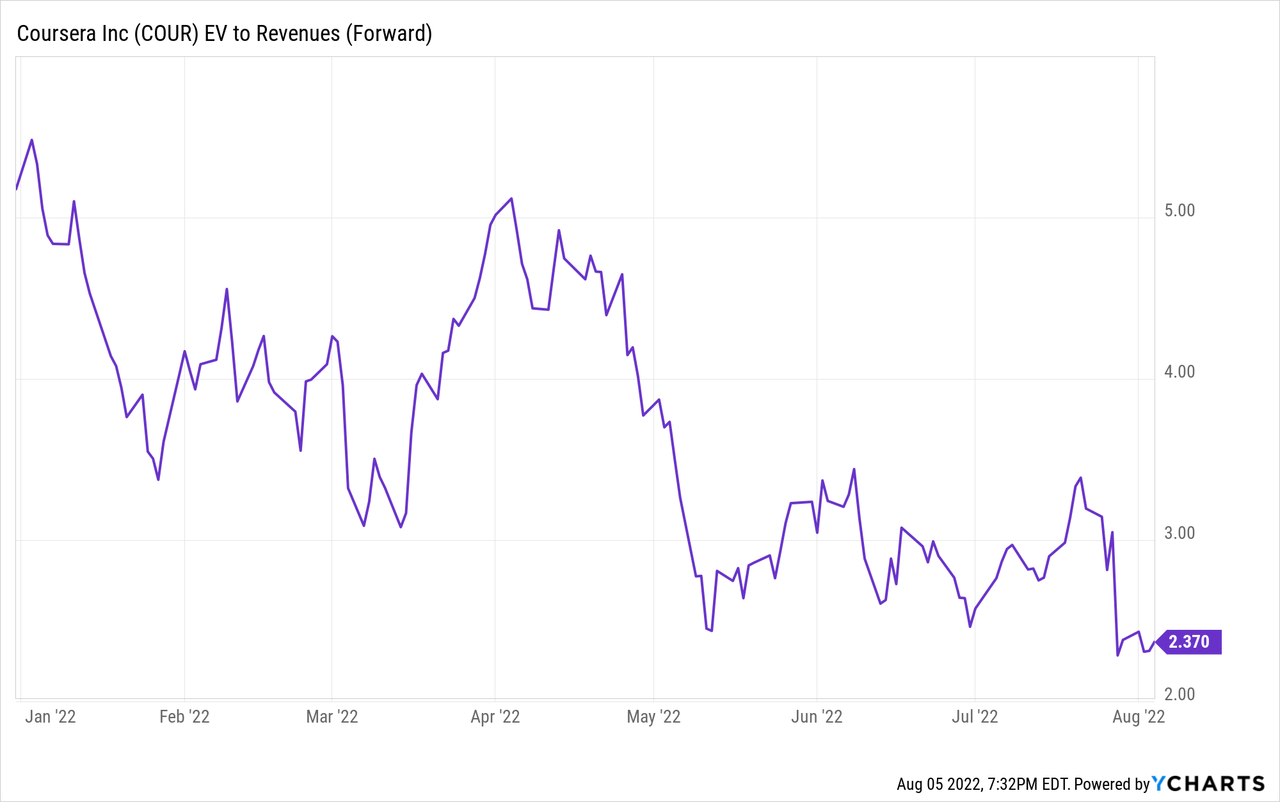

Valuation has pulled back below the company’s historical trading range, but at ~2x 2023 revenue for a company growing 20%+ and ongoing adjusted EBITDA losses, it has become incrementally more difficult to justify a higher valuation.

Longer-term, I believe the company’s business model will work and will continued to be propelled forward by industry tailwinds. However, the stock may be placed in the penalty box for the next few quarters as this remains a show-me story contingent on improving results.

Financial Review & Guidance

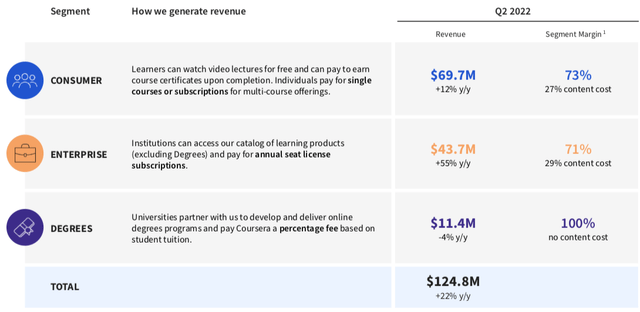

During Q2, Coursera grew revenue 22% yoy to $124.75 million, which missed consensus expectations by over $6 million. While the company’s Enterprise segment revenue growth remained strong at 55% yoy, both of the Consumer and Degrees segments experienced a more challenging environment.

Consumer growth slowed to 12% yoy as the company experienced weaker than expected conversion rates during the quarter. In addition, the Degrees segment revenue actually declined 4% yoy, driven by lower student enrollments. On the earnings call, management discussed the dynamics of slower growth within Consumer and Degrees.

Nonetheless, our overall revenue growth was lower-than-anticipated, particularly the performance in our Consumer and Degrees segments.

In Consumer, we saw somewhat weaker conversion rates in several markets outside of the U.S., with a more pronounced impact in EMEA, along with a negative impact from several pricing and payment-related tests that we ran.

In Degrees, we are seeing lower-than-expected student enrollments, particularly in mature U.S. and European degree programs where our revenue is concentrated today.

While the broader industry trends of digital transformation continue, the company experienced increasing pressure throughout the quarter, which weighed on revenue growth. I do believe the company has a lot of potential longer-term given the massive opportunity in online learning and education. Especially within the Enterprise segment, businesses are shifting their learning spend away from in-person content and more towards digital platforms, thus benefitting COUR over the long term.

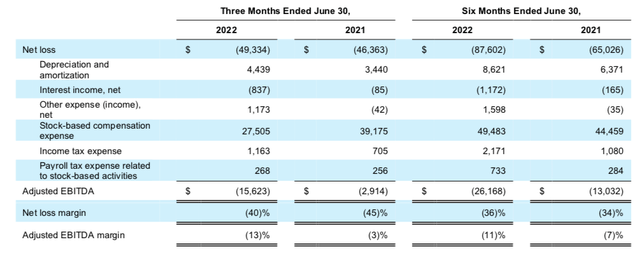

Gross margin during the quarter came in at 63.5%, which expanded ~300bps relative to the year ago quarter. However, continued investments in the company’s Enterprise sales force and marketing programs for higher-margin content, as well as investments in content development, the company reported adjusted EBITDA margin loss of -13%, worse than the -3% loss in the year-ago period.

For Q3, the company is expecting revenue of $126-130 million, which was ~10% lower than consensus expectations for $142.5 million. In addition, adjusted EBITDA loss is expected to be $10.5-13.5 million.

For the full year, the company is now expecting revenue of $509-515 million, which is lower than their previous guidance range of $538-546 million and below consensus expectations for $542 million. Adjusted EBITDA guidance for the full year is now expected to be a loss of $42.5-48.5 million. Management also provided some commentary by segment.

For Consumer, we expect to grow in the high teens for full-year 2022, which is slightly lower than our prior expectations given the softer conversion rates seen in Q2.

For Enterprise, we expect our broad momentum to continue, with full-year percentage growth in the mid-40s, inclusive of some macroeconomic headwind related to EMEA Coursera for Business customers.

And for Degrees, we anticipate a mid-single-digit decline on an annual basis given the enrollment challenges witnessed in the first half and forecasted for this fall in our most mature programs.

Valuation

Clearly, the macro trends within Consumer and Degrees have caused a material headwind to the company’s growth expectations for the second half of the year. And given these increased pressures, it becomes incrementally more difficult for investors to become comfortable with the stock over the near-term. Until we see some of these macro headwinds dissipate, I believe the stock could remain a show-me story.

On top of the challenging revenue headwinds, the company’s profitability also must be questioned. It’s one thing if the company was growing revenue at 30%+ with high gross margins, but Coursera is not a typical software company, and investors will likely want increased profitability over the coming quarters.

Since the company reported earnings, the stock has pulled back around 20%, and rightfully so.

The company has a current market cap of ~$1.9 billion and with ~$800 million of net cash, the current enterprise value stands at ~$1.1 billion.

For 2022, the company guided revenue to $509-515 million, representing around 23-24% yoy growth. And given the current revenue headwinds, it feels somewhat challenging to have full confidence in that outlook.

When looking ahead to 2023, assuming revenue comes within management’s current guidance range, we could see growth remain around the same levels. This could be driven by continued strength within Enterprise, though possibly slower growth given the law of large numbers, and potential rebound from Consumer and Degrees segment.

In this scenario, we could see 2023 revenue of around $625 million, which could imply a 2023 revenue multiple of just under 2x. Given the combination of 20%+ revenue growth and ongoing adjusted EBITDA losses, it seems difficult to justify a higher revenue multiple.

Valuation had historically been around 3-5x forward revenue, but given the more challenging outlook and continued adjusted EBITDA losses, I believe the stock could remain in the penalty box for a few quarters. For now, this company remains a show-me story and will need to execute on both revenue and profitability in order to re-gain investor’s confidence.

Be the first to comment