Sundry Photography

Investment Thesis

Coursera (NYSE:COUR) reported decent third quarter results. The company’s professional certificates were a major growth driver. I still think the company is a fantastic online learning business.

But management’s fourth quarter guidance was unimpressive. The business will still be unprofitable for the foreseeable future. Its stock based compensation is continuing to dilute shares. I’m more positive than I was in my July coverage, but I’m still staying out right now.

A Solid Third Quarter

Coursera reported a solid third quarter. The company beat expectations and raised its guidance.

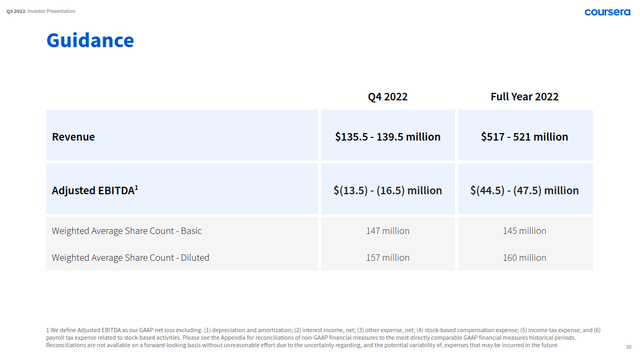

The business reported $136.4 million in revenue. This is up 24% since last year, beating management’s guidance of a 16.5% gain. The company boosted its full year revenue guidance to a midpoint of $519 million. This growth rate is up 1.9 percentage points from management’s previous guidance. It’s still down 5 points from their initial 2022 projections.

Coursera Q3 FY22 Earnings Call Presentation

I’m still being cautious. I want to point out that the business has left its fourth quarter guidance effectively flat. In the second quarter, Coursera guided for $128 million in Q3 revenue and $511 million for the full year. Based on this guidance, I can calculate an implied fourth quarter revenue of $138 million. This is about the same as the company’s current fourth quarter guidance.

This indicates to me that management still predicts continuing growth headwinds. They are expecting the fourth quarter to have essentially flat revenue compared to this quarter. The next quarter is also projected to have a larger adjusted EBITDA loss.

Professional Certificates Are A Major Growth Driver

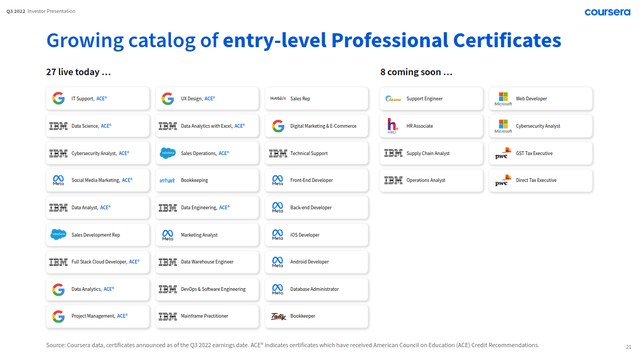

Coursera’s professional certificates were the standout growth driver in the quarter. This content is created by industry partners such as Meta (META) and Google (GOOG, GOOGL). This is different than Coursera’s usual content, which is created by universities.

Coursera Q3 FY22 Earnings Call Presentation

Most of this content helps learners change careers completely. This is different from Coursera’s usual target market of existing professionals. These certificates started to become more popular in early 2021. Since then, they’ve become a major growth driver for the company.

Coursera is focusing on this segment. It has more than doubled the available certificates on its platform this year. These certificates have lower content costs and higher margins than university content. This drove a 4% increase in gross margins for Coursera’s certificate business.

I think that these are promising trends. Coursera’s leadership has increased their focus on selling these programs to institutions. This year, the company launched its Career Academy. This offering lets enterprise customers provide job training at scale. I think that this quarter proves that professional certificates can be a major growth driver.

Strong Enterprise Growth

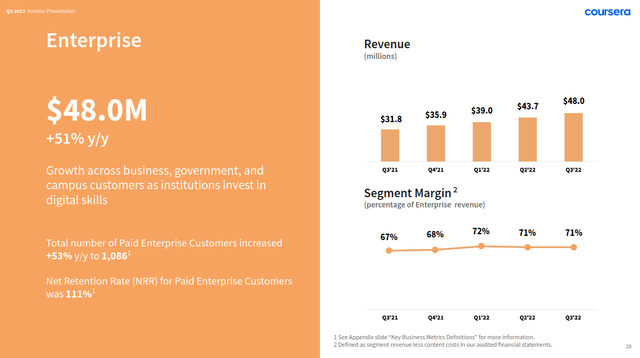

I want to call out Coursera’s strong enterprise growth. Coursera’s enterprise segment grew 51% since last year. This is well ahead of management’s guidance of a mid-40% growth rate. The company added 128 new institutional customers in the quarter. This bounced back nicely from the company’s low of 41 additions in Q2.

Coursera Q3 FY22 Earnings Call Presentation

The company is still reporting headwinds in business spending, especially in Europe. There is increasing discussion about a slowdown in tech. But I find it interesting that government spending is remaining strong. Management discussed these dynamics on their earnings call.

Yes, generally speaking, I would say that we are seeing what some of the other companies who have announced early in the quarter have also been seeing, which is a bit of cyclicality on enterprise spend, especially in more developed markets like Europe and to some degree in North America.

What we’re seeing, thus, as I kind of mentioned in a couple of the examples there — we’re seeing the government sector continue to go pretty strongly. I think that there’s some counter-cyclicality there. And we’re seeing a lot of interest as well from education institutions. We’re just kind of realizing there might be some counter cyclicality there, and they’re thinking about how could we upgrade our curriculum for better graduate placement rates.

So, yes, it’s nice to have some diversification there. We are definitely seeing a lot of the same macroeconomic things that others are seeing, but I think our diversified model is helping us a bit.

I think this is a very interesting sign. Government and educational institutions will usually increase investment as the job market cools. In the 2008 recession, higher education enrollments increased by 6.5%. These trends were strongest for vocational education institutions. This most closely matches Coursera’s professional certificate offerings. This trend hasn’t been proven yet, but I think it could add some defensibility to Coursera’s revenue base.

Decent Finances, Risky Valuation

Coursera has decent liquidity. The business has $786 million in cash and marketable securities. This is equal to about 40% of the company’s market cap.

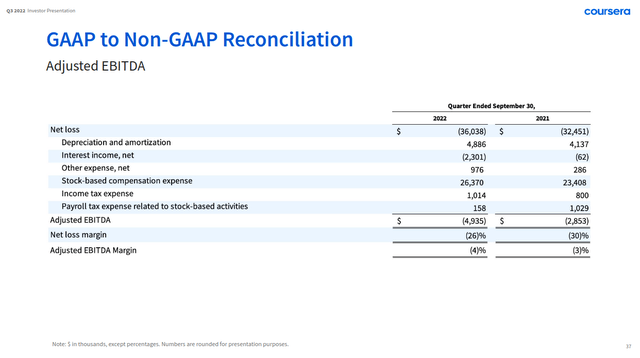

Adjusting for this cash, shares are trading at a forward EV/Sales of 2.2 times. Even after a strong third quarter, I still think that this valuation is expensive. The business is only projected to grow by 25% this year. Adding to this, the company is solidly unprofitable. Based on their earnings call, management doesn’t seem to be prioritizing profitability. The company’s CFO said that profitability is “in vogue with Wall Street” but that it’s “not how we run our company quarter-to-quarter.”

Coursera Q3 FY22 Earnings Call Presentation

The business is cash flow neutral, but its stock based compensation still concerns me. The company is on track to pay out $100 million in its shares this year. This year, stock based compensation has increased by 12%. This dilution pays for about 21% of the business’s operating expenses. The company has diluted its shares by almost 10% since its IPO, and the rate is increasing year over year. In the long run, I think that this is a major risk to the investment.

Final Verdict

Coursera’s professional certificate offerings are a key growth driver. The company’s enterprise growth trends are very promising.

But I still see major risks to this growth story. Coursera’s performance has been inconsistent in the past. This quarter’s forward guidance was modest. Because of this, I want to see more strong results to confirm the trend. I think that shares are still somewhat expensive for the risk. The business is unprofitable, and it will continue to dilute its shares as long as it keeps losing money. For these reasons, I’m still avoiding the company for the time being.

Be the first to comment