Hispanolistic

Investment Thesis

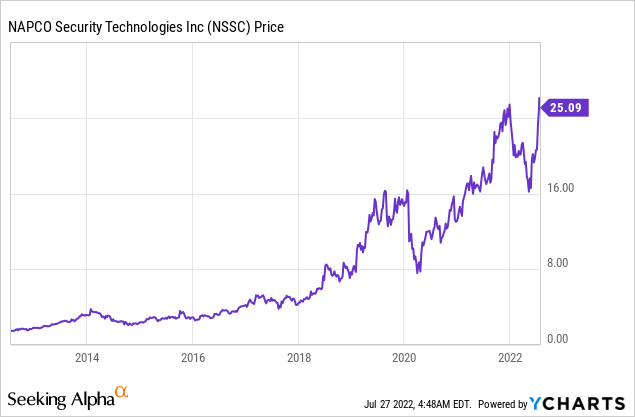

Napco Security Technologies (NASDAQ:NSSC) is one of the few companies that manage to show excellent resilience despite the market sell-off. It is currently trading at $25.09, down only less than 5% from its all-time high. The company has been a wonderful compounder in the last decade, up over 450% in the last five years and 1,500% in the last 10 years. Napco Security is a US-based provider and manufacturer of high-technology electronic security, IoT-connected home, video, fire alarm, access control, and door locking systems. It operates worldwide in commercial, industrial, residential, and government spaces.

The total addressable market for the space is really huge. The company is benefiting from a multi-decade upgrade cycle for alarm systems and security upgrades for schools, universities, and other commercial and residential buildings. It is also migrating to a SaaS model with new hardware-enabled SaaS products that generate monthly recurring revenue. The company has been growing revenue quickly, and I believe the growth will continue thanks to strong tailwinds. Therefore, I rate the company as a buy at the current price.

Huge Market Opportunity

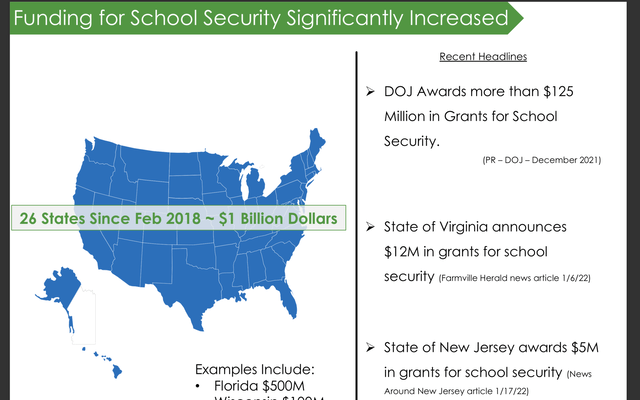

The TAM (total addressable market) for Napco Security is very big. In the US alone, school security represents a $10 billion opportunity, according to National Center for Education Statistics. The rising number of mass shootings is forcing schools to change or upgrade their existing school security and alarm systems. Since 2018, over $1 billion has been budgeted for funding school security in the US. According to the US congress, the proposed “School Violence Prevention and Mitigation Act of 2019” would authorize an additional $2 billion over the next 10 years for schools to make security improvements. Napco Security is one of a few companies that provide a fully integrated solution for schools of all sizes, ranging from K-12 to universities. Some notable Napco customers include Stanford University and Columbia University.

Besides, alarm systems are also in an upgrade cycle, as we move to a cellular-based security system that has much better capabilities. According to the company, there are an estimated 5 million commercial buildings and over 120 million homes that need a potential upgrade, which represents a $4.9 billion opportunity. Given the market cap for the company is only around $930 million, there is a lot of room for it to expand into.

Macro Environment

The current macro environment has been really volatile in the last few months. As the inflation rate continues to edge up, commodity prices persist at high levels, and the Fed raising rates and doing quantitative tightening, the economy is starting to slow down. We are seeing different signs of cracks with companies like Walmart (WMT) slashing guidance and Microsoft (MSFT) laying off employees. The last few months were really tough for most companies, yet Napco Security is quite insulated from the situation. The company operates in the security space, where spendings are essentially non-discretional. As the number of mass shootings increases, schools are not going to compromise on security spending, despite a cut in the overall budget. The same argument applies to most other companies too.

On the other hand, being a hardware-focused company, it is exposed to supply chain disruption, which has worsened due to the lockdown in China. I believe the situation will start to improve as restrictions are now starting to be lifted. Despite the gloomy economic outlook for 2H this year, I am still confident that the company will be able to show strong resilience moving forward.

Richard Soloway, CEO, on macro resilience

While the news headlines are dominated by talk of interest rate hikes and the potential for a recession in the U.S., I’d like to remind you that we are highly recession resistant in one of our primary growth drivers, the commercial fire alarm business, which is a mandatory non-discretionary item for building owners. Commercial buildings must have and maintain a fire alarm system in order to receive a certificate of occupancy. Given the high profitability and essential nature of this business, we focus on this as a key area of our resources.

Financials

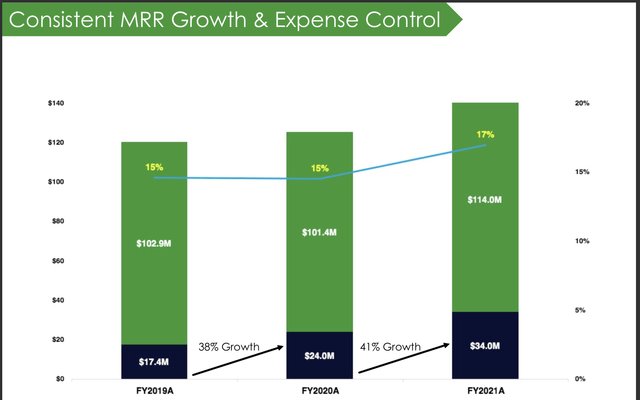

Napco Security reported its Q3 Fiscal 22′ earnings in May, and it is continuing to put out solid top-line growth. The company reported revenue of $35.9 million, up 27% YoY (year over year) from $28.2 million. Overall, gross profit margin was 40.4%. This is driven by the increase in recurring service revenue, which was up 35% YoY from $8.9 million to $12 million. The gross profit margin for recurring service revenue was 87%, and the current annual run rate is now $49.9 million. Equipment revenue grew slower but was still up 23%. The gross profit margin for equipment revenue more than doubled YoY from 8% to 17%. Gross profit was $14.5 million compared to $12.9 million, representing a 13.2% increase. I believe the overall gross profit margin will continue to edge up as recurring revenue start to account for a larger portion of total revenue. Equipment revenue should also grow further as supply chain constraint eases.

The bottom line, however, is facing temporary pressure due to increasing costs caused by supply chain disruptions. Net income for the quarter was $2.9M as compared to $4.4 million for the same period a year ago, a 34% decrease. Diluted earnings per share for the quarter was $0.08, down from $0.12, while adjusted EBITDA was $5.2 million, down 5% from $5.5 million a year ago. Operating cash flow decreased from $16.4 million to $8.4 million. This is due to inventories increasing by $11.3 million as compared to a decrease of $5.7 million in the same period a year ago. Management is stocking up inventories due to worry of a longer-than-expected supply chain impact. Cash flow and bottom line should go back to normal levels as the company now has enough inventories and parts to meet demand. The company’s balance sheet remains very healthy. It ended the quarter with over $47 million in cash and no debt at the moment, providing it with a lot of financial flexibility.

Richard Soloway, CEO, on supply chain disruptions

we continue to aggressively manage supply chain issues by developing alternative supply and sources and delivery methods while also reengineering products were necessary. We believe in the next six to nine months, our new supplier sources we are developing will begin to reinvigorate our equipment margins and return them to the levels we generated prior to the supply chain crisis.

Conclusion

In conclusion, I believe Napco Security will continue to perform well. The company has a huge TAM for it to expand into, and the upgrade cycle is only in its early innings with tons of schools and buildings needing new and improved security systems. This will provide a massive tailwind for the company moving forward. The company is also relatively immune to the weakness in the macroeconomy as security remains one of the top priorities for companies and institutions. It is facing some constraints due to supply chain disruption, but it has been working on it and stocking up inventories to meet demand. It is continuing to show strong top-line growth, led by the growth of its recurring service revenue. I really like the unique niche the company is operating in and its growth rates should be very durable, supported by its large TAM and strong recurring revenue. Therefore, I rate it as a buy at the current price.

Be the first to comment