Michael Vi/iStock Editorial via Getty Images

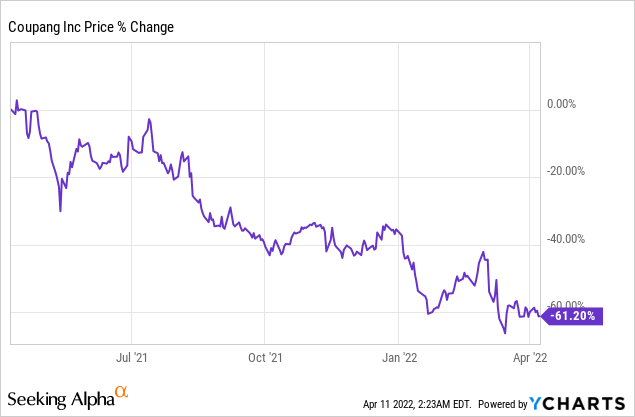

E-commerce businesses promise investors long-term potential for growth and so does South Korea’s version of America’s Amazon: Coupang (NYSE:CPNG). Coupang is rapidly expanding in its home market in South Korea, growing its market share and improving customer monetization. Shares of Coupang went through a large and undeserved 61% drop in pricing and I believe the drop creates a buying opportunity!

Explaining Coupang’s Large Price Decline

Coupang benefited from the shift to e-Commerce during the COVID-19 pandemic which served as an accelerant to the firm’s growth. With COVID-19 no longer as big a threat to the economy as it was back in 2020 and 2021, valuations for e-Commerce firms have dropped… and in the case of Coupang, too much…

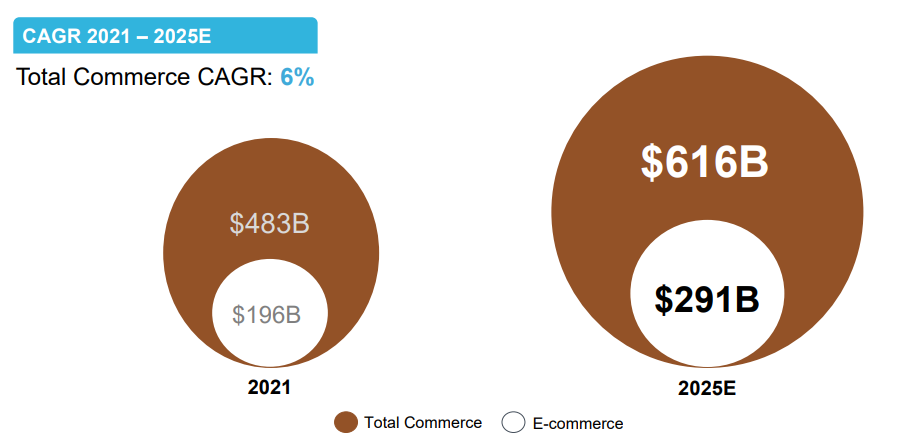

Growing Addressable Market In South Korea

What many investors may not know is that the South Korean e-Commerce market is large and rapidly expanding, creating a long term opportunity for Coupang to increase its market share and add a significant amount of dollars to its top line. The total South Korean e-Commerce market was valued at nearly $200B in FY 2021 and is expected to grow by almost half to $291B by FY 2025.

Coupang

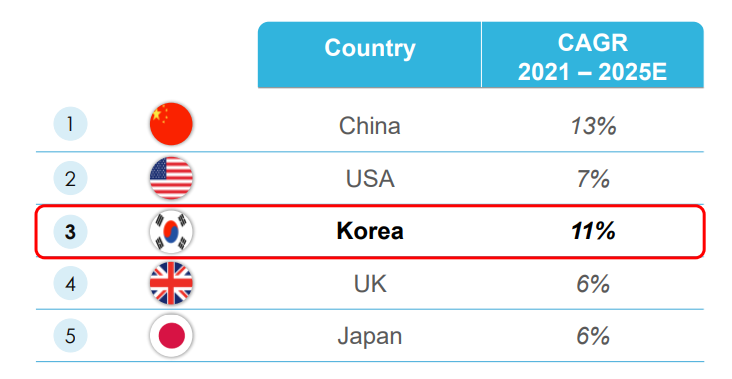

The South Korean e-Commerce market is also expected to achieve above average annual growth rates over the next four years. The South Korean e-Commerce sector is projected to grow 11% annually from FY 2021 to FY 2025 which is set to make it the second-fastest growing e-Commerce market in the world, after China and before the U.S.

Coupang

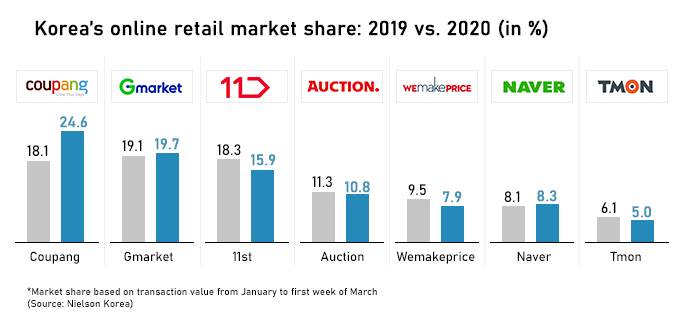

Market Share Growth And Improving Customer Monetization

Coupang has become a significant force in the South Korean e-Commerce industry and has the largest market share according to Nielsen. Based on FY 2020 year information, Nielsen’s data also proved that Coupang delivered the largest market share increase in the South Korean market that year. Coupang’s market share in FY 2020 was 24.6%, outmatching its nearest rival G Market by 4.9 PP.

Coupang

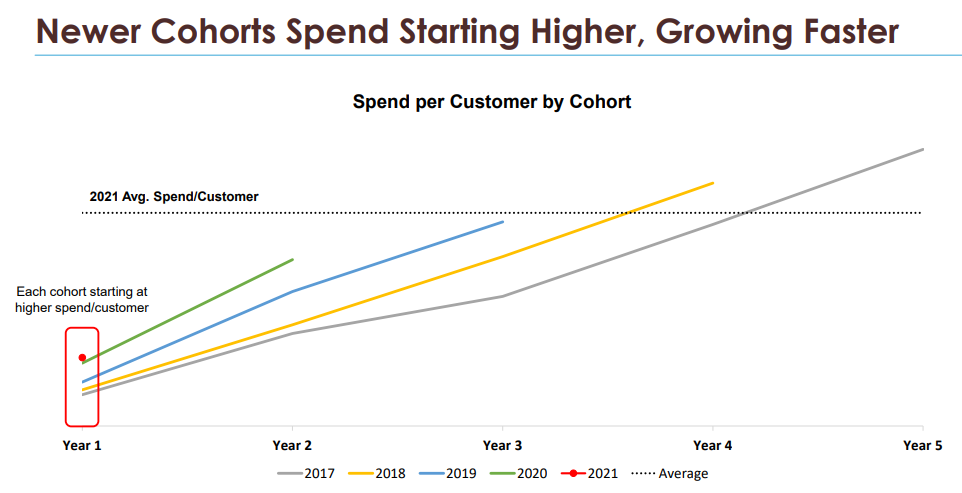

I believe Coupang will be able to expand on recent market share gains and the reason for that is that new customers on the Coupang e-Commerce platform have higher spending levels than customer groups that joined the e-Commerce company in previous years.

Coupang

Massive Potential For Revenue Growth

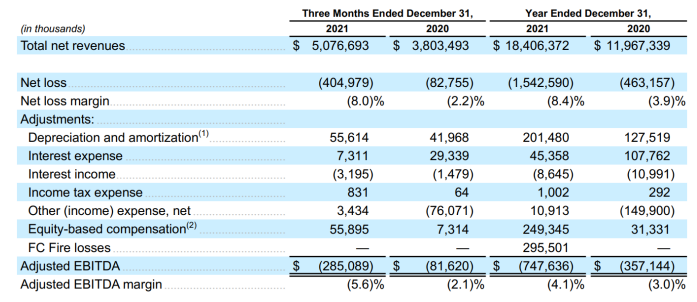

Coupang achieved net revenues of $18.4B in FY 2021, showing a top line growth rate of 54% year over year. Although Coupang is growing e-Commerce sales much faster than Amazon — Amazon grew net sales including net service sales at 22% year over year in FY 2021 — the South Korean rival is still unprofitable. Amazon reported $33.4B in profits just last year, showing 56% year over year growth.

Coupang’s net losses, on the other hand, more than tripled to $1.5B in FY 2021 because the firm is investing heavily into its growing businesses. Going forward, I expect Coupang’s investments in its various services, especially Rocket WOW, to pay big dividends. Coupang, based on consensus EPS predictions, is expected to show its first profits in FY 2024.

Coupang

Rocket WOW Growth Opportunity

Rocket WOW is a subscription service with 9M paying subscribers at the end of FY 2021, which is about half of the firm’s 18M active accounts. The subscription service is similar to Amazon’s Prime and allows free shipping of e-Commerce products ordered on Coupang and has other benefits such as travel discounts and free video streaming on Coupang Play. Coupang has huge potential to grow its active account number as well as Rocket WOW uptake going forward. I believe the e-Commerce company could have 15M Rocket WOW subscribers by FY 2025 and more than 35M active accounts that same year.

Coupang

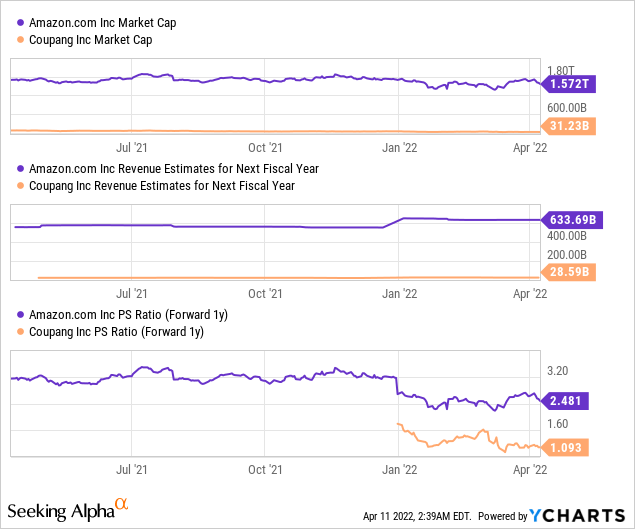

Coupang’s Growth Is Still Cheap

Coupang is expected to continue to ramp up revenues quickly in the coming years. Based off of Seeking Alpha provided estimates, Coupang is expected to see $23.1B in revenues in FY 2022 and grow its top line to $39.4B in FY 2025. Based off of $28.6B in expected revenues in FY 2023, shares of Coupang have a P-S ratio of 1.1 X… which makes Coupang’s growth significantly cheaper than Amazon’s, despite the firm growing much faster.

While Coupang is not nearly as big as Amazon regarding market cap and the amount of revenues it processes, I believe the e-Commerce company has a very attractive valuation given its potential for growth in the South Korean e-Commerce market.

Risks With Coupang

Coupang is a fast growing e-Commerce brand in South Korea that is set for long-term growth, but there are also risks that affect the investment in the company. Slowing revenue growth and declining margins related to increasing competition are risks that affect the outlook for Coupang and its stock. E-commerce margins are generally low and, at least right now, Coupang is still losing money. A decline in platform margins and delayed profitability may result in an even lower sales valuation factor for Coupang going forward.

Final Thoughts

Coupang’s large drop in pricing over the last year is undeserved because the e-Commerce company is still growing rapidly in a very attractive market and shares have become really undervalued (P-S ratio of 1.1 X). Customer monetization is also improving as more money is spend on Coupang’s platform and the Rocket WOW subscription business presents a strong growth opportunity for the e-Commerce firm!

Be the first to comment