vzphotos/iStock Editorial via Getty Images

Published on the Value Lab 8/4/22

We keep looking into Equinix (NASDAQ:EQIX) as it is a company whose proposition flies straight into the face of our holding in Tier 1 ISP Lumen Technologies (LUMN). Equinix and internet exchanges (IXs) are the reason why Lumen’s IP transit business is in a slow decline. We still hold Lumen because of how incredibly cheap it is, but we recognise that Equinix is not easily stopped. However, despite its moats and great economics as an IX player, we think that all its qualities are priced in, and are not interested in investing. To really change our mind, they’d need to accelerate growth, and we don’t see that being possible as the inflexion point associated to their network effects are quite far in the past, so we pass on them for now.

Thinking about Equinix

Equinix is an owner of IX colocation centers that provide substantial value to large networks. Essentially, instead of retrieving information from the Tier 1 backbone, IXs allow for peering agreements to be industrially managed between major networks so they can share data lower down the hierarchy. The value is that these agreements are made freely between networks on a mutually beneficial basis, so data streams don’t have to be paid for. Equinix owns the facilities in which networks must rent spots in order to make these peering agreements. Doing so has allowed networks to provide quite easily for the data needs of the modern world and the use of the cloud. Because of the very nature of these peering agreements, Equinix benefits from network effects, as the larger their facilities, the more agreements they can foster between more parties.

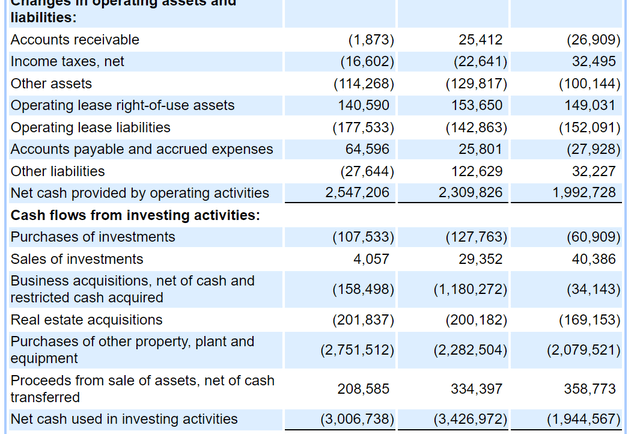

The proposition is great, and the market has therefore valued the company very highly as a magnificent compounder. Indeed, this compounder status explains much of the activities of the business. Its large debt load is one, with their massive operating cash flows being eclipsed by even more massive investing cash flows.

Cash Flow Statement (10-K EQIX 2021)

With a flywheel model, this is what you want to see, and the readily available reinvestment opportunity is a great creator of value.

Growth continues to be delivered, but the rates of yore are no longer to be expected from the company as the industry matures, the returns to peering hit diminishing returns, and the business becomes more commoditised with solutions needing to be lower cost.

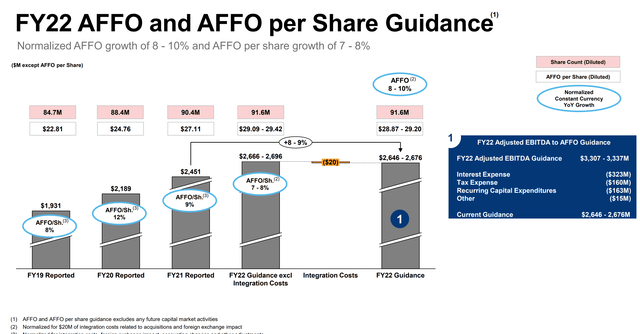

AFFO Guidance (EQIX 2021 FY Pres)

However, a 10% growth rate continues to be guided for, and the company aims for a long-term margin of 50%, about 400 bps ahead of current levels, to further increase profitability in addition to the growing revenues of 10% as well YoY. Besides some issues with incredible energy prices in Singapore, that should be transitory, we see no reason why these ambitions can’t be met.

Valuation

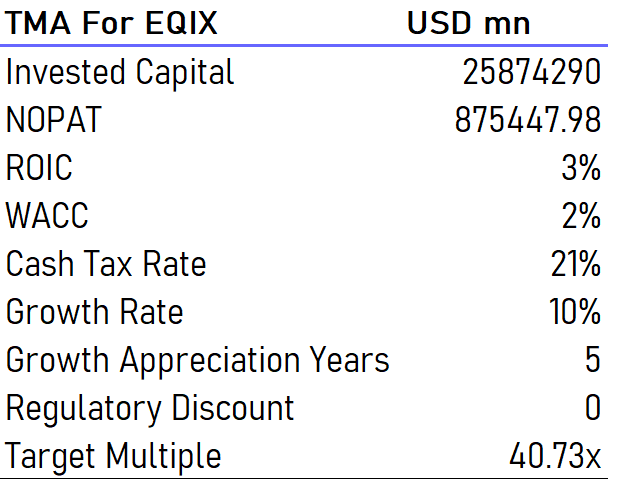

We are very positive on the Equinix business. We do have a problem with the valuation though. While not excessive, a TMA analysis, which is an appropriate analysis when considering any business that focuses heavily on reinvestment, indicates that the qualities of this company are already priced in.

TMA Analysis (VTS)

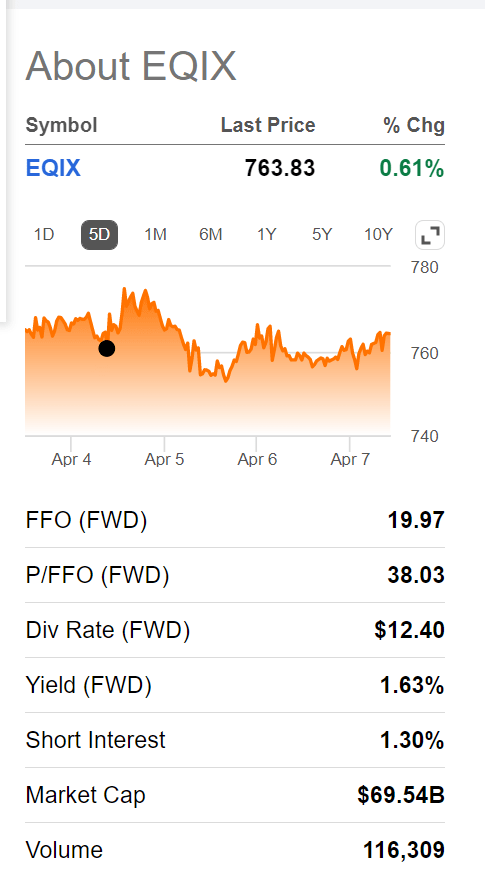

A very bloated balance sheet due to the large debt and lease load means that headline returns on invested capital end up being quite low. But due to the value of their owned assets, WACC is also exceptionally low, with very low rates on their bonds despite the quite large load with a 3.9x leverage ratio. Remember that the reinvestment value doesn’t come from the return rates, it comes from the fact that the service grows in value as it scales. Their low WACC is a testament to their capital market ability to scale, but scale they must in order to keep the drag off their flywheel. We think 5 more years of scaling is not going to be a problem for the company, and will not be a stretch at these growth rates, and therefore we come to the target multiple of 40x, which is only barely ahead of their actual multiple of 38x.

Current Multiple (Seeking Alpha)

Conclusions

While we don’t think there is much upside in the valuation, we don’t really see any issues with the business model and the guidance. They should quite easily deliver. And by having already dominated the industry and established their moats and a spinning flywheel, the risks are also more reduced. However, commoditisation risks are something to think about, which needs to be tackled with scale as there isn’t much pricing power here. Due to the importance of debt for their model, interest rate risk is not irrelevant, and meaningful rises in rates will bear on their profitability and return from scaling. So rate hikes do need to be watched a little. Nonetheless, the alarm bells are not ringing. There is nothing wrong with holding this stock. But on account of our return standards, this company seems uninteresting as of now, but if growth rates can rise substantially ahead of current levels, or horizons otherwise prove more broad, leverage in the stock could produce suddenly more upside for equity holders. So it’s definitely for the watchlist.

Be the first to comment