helloabc

On September 8, 2022, Bilibili (NASDAQ:BILI) (9626: HK), the popular online UGC entertainment platform known as the Chinese YouTube, released its financial performance for the second quarter of this year and reported weak revenue growth and notifying higher cost. Even though its net loss narrowed from last quarter and monthly active users (MAUs) reached the historical high, Bilibili’s stock prices plummeted more than 15% on both the NASDAQ and HKEX after the result was released.

Sluggish growth and uncontrolled losses

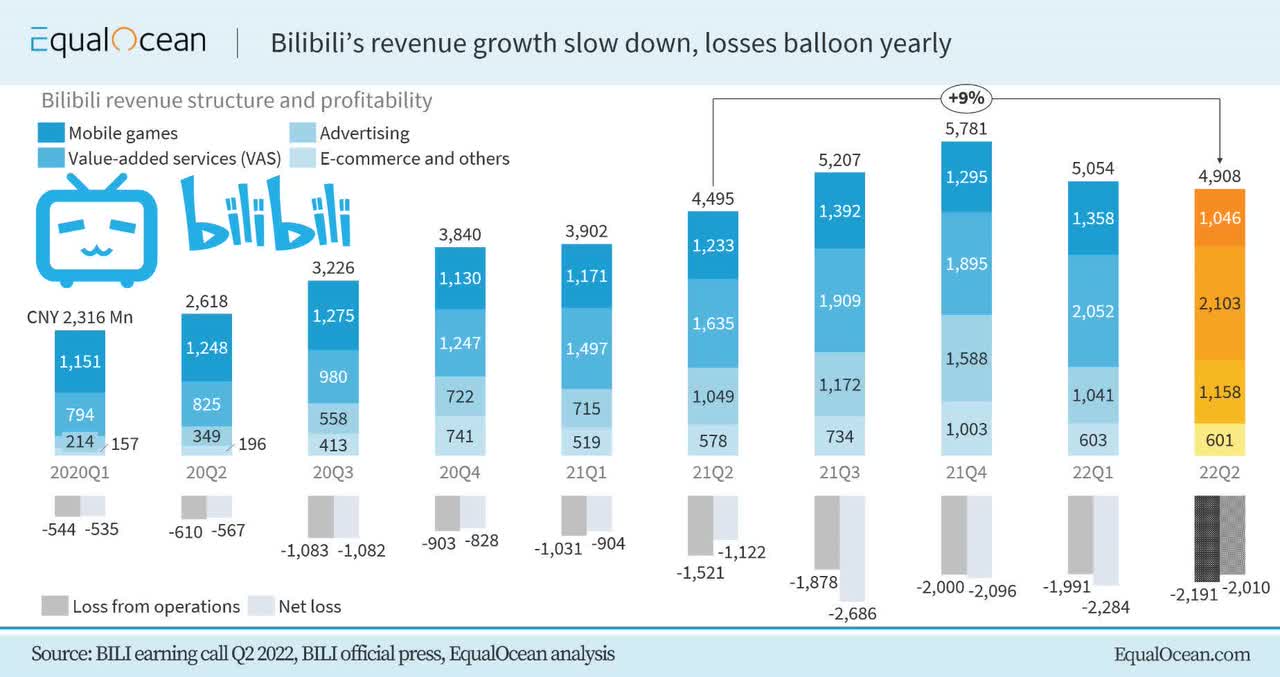

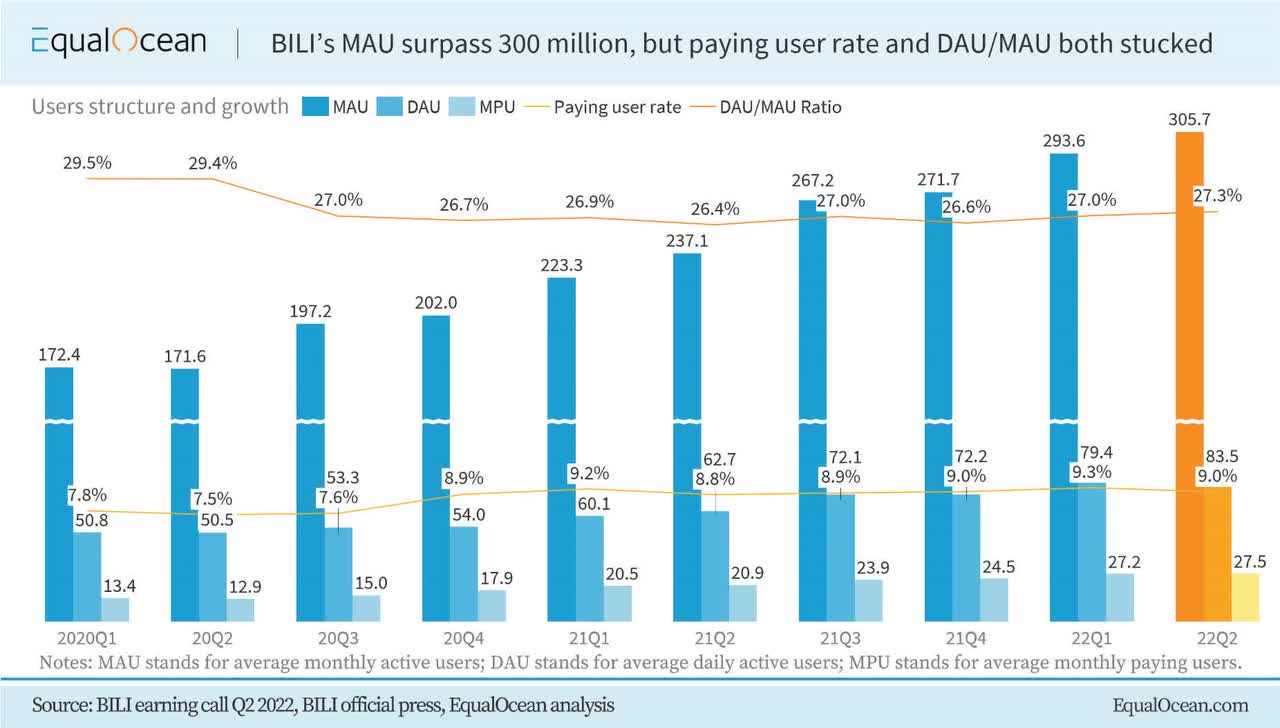

We saw an apparent disconnect between its user base growth and revenue. According to the newly released result, Bilibili achieved revenue of USD 732.9 million (CNY 4.9 billion), increasing only 9% year over year, compared with 72% in the same period in 2021. It is also the first time its growth has shrunk to one digit since being listed in 2018. However, its average monthly active users (MAUs) reached 305.7 million, up 29% year over year, smashing through the 300-million-barrier successfully. Meanwhile, its average daily active users (DAUs) surged 33% yearly to 83.5 million, and average monthly paying users (MPUs) increased to 27.5 million, up 32%. The DAU/MAU ratio raised to 27.3% but hasn’t returned to the levels from last year. Daily average time spent was 89 minutes, up 11% year over year.

EqualOcean.com

No one could deny that the most concerning thing about the report is its spiraling cost. In Q2 2022, Bilibili’s operating costs climbed to USD 606.3 million (CNY 4.2 billion), up by 19%, twice the growth of revenue, 40% of which is attributed to increased revenue sharing to the content generators, the core asset of Bilibili. From the perspective of gross profit, although the revenue increased yearly, the gross profit and gross margin decreased dramatically. At the same time, various marketing and R&D expenses increased by CNY 400 million. Though the company’s net loss narrowed by 17% to USD 300.2 from last quarter, the figure expanded by 79% over the same period of 2021 million, indicating weak controlling power of its losses. We believe that the company is getting further and further away from the goal set by the management team of turning losses into profits in 2024.

EqualOcean.com

Critical bottlenecks for all segments

Then from the perspective of a segment, despite successfully optimizing the revenue structure in the past four years, the company seems to be struggling to maintain high growth for all segments. The revenue from its mobile gaming business revenues reported USD 156.2 million, down 15% compared with the second quarter of 2021, which is mainly attributed to a “lack of popular new exclusively distributed game releases by the company itself during earning calls. Today, the revenue share of this business has dropped to 21%, compared with 83.4% at the time of listing. It can be considered that BILIBILI has realized income diversification. However, we should also see that the mobile gaming business of Station B still relies on popular games such as Fate/Brand Order, Re: Dive and Azur Lane to generate revenue. In the second quarter, the income from self-developed games accounted for only 5% of the total game revenue (mainly from Ark Order). It seems that the company needs to balance the cost of game R&D and income, which also determines whether the ‘Tencent mode acquisition model is still suitable.

Advertising also shows unsatisfied yearly growth, even though the company considers it a praiseworthy point. The platform introduced a new TikTok-like story mode last year to increase advertising income and video views, and the daily pictures of the method increased significantly (four times year over year). However, it didn’t effectively increase advertising revenue and resulted in dissatisfaction among long-existing users. E-commerce and other business contribute about 12% of the total revenue, up only 4% yearly. We believe that Bilibili’s e-commerce business has natural limitations, mainly due to the relatively small number of product categories (ACGN), which makes it difficult to compete with eCommerce giants including Alibaba, JD, Pinduoduo or black horses such as dithering and a quick hand. However, since ACGN commodities, such as card games and hand-operated products, are primarily traded in the secondary market, establishing a standardized ACGN exchange may be a way out.

The most eye-brightening segment in Q2 2022, value-added services (VAS), reported a revenue of USD 314.0 million, jumping 29% from the same period of 2021. Notably, the company’s live broadcasting conversion rate remained strong in the second quarter, with the number of active live broadcasters increasing by 107% year-over-year over the second quarter and NPUs for live broadcasting increased by nearly 70% year over year. However, we think Bilibili should rethink the differentiation of services between paid users (premium members) and non-paid users, which we believe could be the key to a continuous growing mode. At the same time, Bilibili should also take care of the censorship risk behind the core animation-subscribe business.

We could clearly see a bottleneck in the company’s financials and strategy based on the segment analysis. This begs questions: Is it the darkest hour of the company or just a cage match? Where should it head for?

S-T cut cost, L-T pre-roll ads

Though challenging, there’s a strategy to help the company from the trying situation: Cutting costs in the short term and developing innovative pre-roll ads to generate revenue for a long time.

Both iQIYI and Kuaishou are turning a profit in the same quarter by reducing costs and increasing efficiency, while BILIBILI still sticks to an aggressively expanding mode. As CEO of Bilibili, Chen Rui emphasizes that growth is the most important priority within the Bilibili community, and it is still targeting 400 million MAU by the end of 2023. This belief is so common in the 2010s among Chinese internet companies. But now the business environment has changed, and more and more companies are aiming at sustainability, an extensive growth mode may become a potential risk to the whole company.

Bilibili has realized the importance of reducing costs, and its primary approach is to lay off employees. However, it is worth noting that layoffs may make the report look healthier for one to two quarters, but there is no way to solve the problem completely. As for long-term solutions, we believe that rethinking pre-roll ads are the only way to break through.

Why cling to ads?

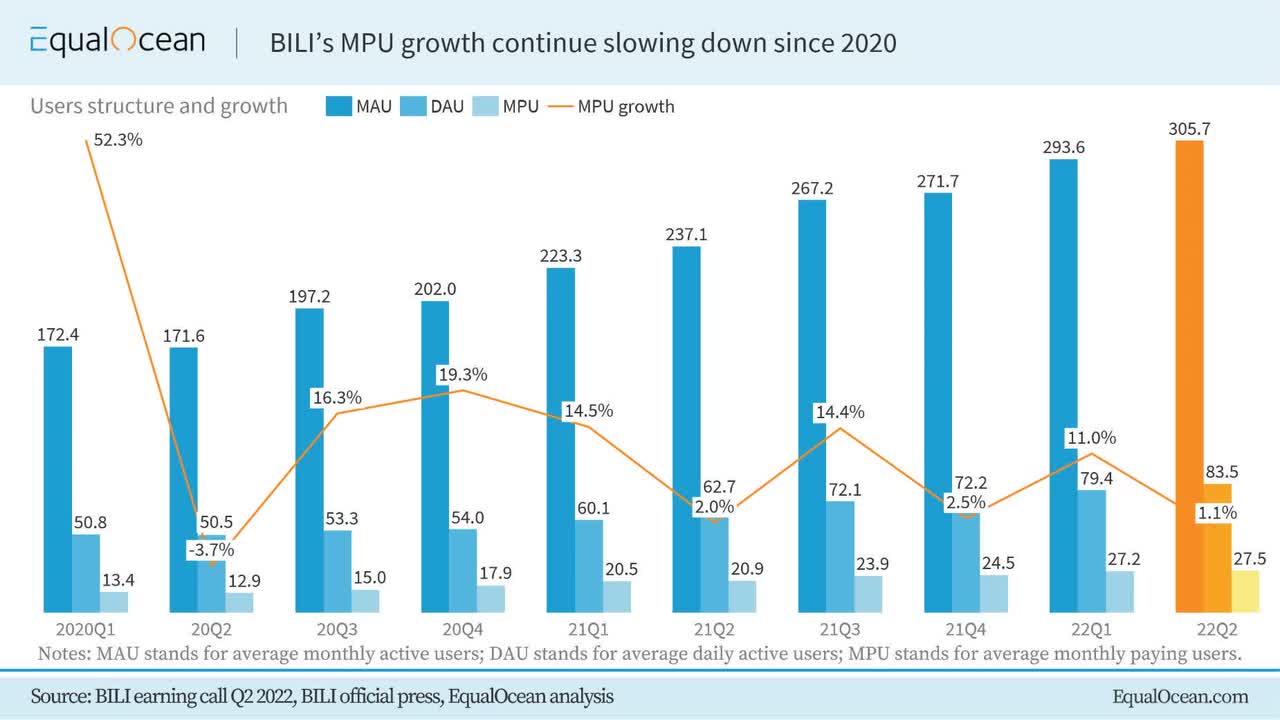

As discussed in the last article, Bilibili’s main problem is to find a way to transfer its impressive community to actual profitability. According to the report, An Atypical Guide to Marketing on Bilibili from TBWA/BOLT, OMG and OMD, about 58% of post-90s and post-00s visit Bilibili at least once per month. However, Bilibili’s desire for monetizing digital content seems not strong. Some people in the EqualOcean team are loyal users of the website, and they found that most users in the fan community mode have formed the habit of not paying. However, the problem came that, in 2022Q2, the ARPU value paid by users decreased by 16% compared with the same period last year, and the year-on-year growth of Bilibili MPU continued to slow down since the beginning of 2020. The platform has operated at a loss since listing on the Nasdaq in 2018, and it is increasingly unlikely that Bilibili will turn the loss into profit in 2024, as it always asserts.

EqualOcean.com

No one could deny the profit model is the essence of the business model. We do believe Bilibili should get rid of the current low-gross-profit mode but rely on advertising to make profits. As we all know, there are two major benefits of becoming g premium member of a content platform: ad-free access and premium exclusive content. Till now, Bilibili only provides the second benefit, which directly affects the growth rate of advertising revenue. As a result, the more uploaders’ non-profit videos are made and played, the more bandwidth load the platform will burden. After the model game business of Bilibili shows sluggish growth, the promise of never using pre-roll ads seems to have been unable to be realized logically, especially after the Q2 2022 performance was released. Therefore, we believe that if the cutdowns do not help the financials of H2 2022 much, Bilibili will be more aggressive in the layout ads business.

A unique way for ads

Nevertheless, how penetrating the advertising business wisely is a challenge for all content-based platforms, especially Bilibili, which values its community the most.

The management of Bilibili said in the second quarter of the research call that the macroeconomy has a very negative impact on advertising in the short term and is expected to last for 1-2 years. However, Chen Rui, CEO of the Group, is optimistic that Story Mode will become the key to a breakthrough. We think this is a signal that a large number of advertisements may be added to this mode, and the proportion of Store Mode pushed on the homepage will be increased, even adding a channel just for the story mood videos (like the Shorts mode of YouTube).

However, in traditional landscape mode, we are more willing to believe that Bilibili will maintain its current no-pre-roll-ads status. Nevertheless, we think Bilibili will eventually build a system to connect uploaders and advertisers and may give guidance about how to integrate the ads into the original content more smoothly and interestingly. In such a way, uploaders have more exposure to sponsors while maintaining their freedom of creation. Bilibili, in such a way, could also take part in the commissions as revenue. We believe content-integrated ads are a sustainable mode, especially will be approved by advertisers because this kind of ad adds enable them to measure the quality of their advertising. It can clearly know the attractiveness of its advertisements through the number of fast-forwarding and bullet screen comments (Similar to but different from YouTube TrueView logic) and can make adjustments according to the data gathered. Similarly, the ‘fake video’ ads in the Story Mode also have this effect (measuring the time that the user jumps to the next). Therefore, when considering cooperation with uploaders, advertisers need to consider making the brand part of the content.

In contrast, its domestic competitors’ non-skippable pre-roll ads can only collect user information instead of knowing what’s the effect of the ads, which may affect the real efficiency of advertisers. That’s why we think Bilibili has great potential in the ads business.

After all, Bilibili (including its uploaders) does not resist all kinds of ads but opposes mindless and shouting ones. In other words, maintaining the community and viewing experience is the top priority for all the stakeholders.

New Stories to tell (Catalysts)

Besides the short-term and long-term solutions, we also found three catalysts that may help Bilibili out of the profitability distress.

First, deepening cooperation with luxury brands has an overall influence on the platform. According to the report published by BCG and Tencent, A new generation of Chinese consumers remapping the luxury market in 2021, the Chinese luxury consumers are iterating, and the post-90s account for over half of the total luxury consumers in China. 25% of the new consumers are post-95s, and more than half of the annual consumption exceeds CNY 50k in this space. This, we analyzed, also means that joining Bilibili will be regarded by young people as a positive signal that the traditional luxury brands want to change. Some luxury brands such as Louis Vuitton and Fendi have carried out advertising campaigns on Bilibili. Some brands such as Dior, Givenchy and LANVIN, as well as some luxury vehicle brands such as BMW, even operate enterprise accounts. Moreover, in the process of developing innovative ads business, luxury brands may become better partners.

EqualOcean.com

Second, the group is integrating the comics resource it has or can acquire and temporarily form an oligopoly market. In 2019, Bilibili Comics launched Bilibili Comics and acquired Netease Comics right after that. In November 2021, Bilibili wholly acquired the original comics platform of Aofei Entertainment, You Yaoqi. In March 2022, Bilibili acquired Baizhi Animation. Chinese comics website U17 announced to be folded into Bilibili by year’s end 2022. Through these acquisitions, Bilibili has greatly increased its own copyright database, and the Chinese comics market has formed a tripartite trend of Tencent Animation, Bilibili Comics and Quick Look Cartoon. We noticed that Bilibili has applied for a number of bullet screen-related patents. Among them the patent for comics-based bullet screen display method and the device (CN114897668). This proves the company’s future attention to the comics business.

Finally, more creative content types such as metaverse content may bring extra cash flow. On August 27, Chen Rui, CEO of Bilibili, predicted that as a comprehensive industry, the metaverse would be the most important digital content area in the future. The world in the metaverse will be a content ecosystem, where massive content cannot be provided by several companies, and UGC content will become the mainstream of the metaverse. Users in the metaverse are both consumers and producers, which is highly in line with the mission of Bilibili. We think this is an important opportunity for Bilibili

Similarly, the issuance of digital collections may also bring some relief to the stressed Bilibili. On August 2022, the Shanghai Data Exchange (SDE) launched the first official exchange place in China for the trading of digital assets, creating in-depth integration between digital assets and the real economy. Huili DESIGN – Yuannian is the first digital asset to make its debut on the SDE Digital Assets Board, which is jointly issued by Bilibili. We think NFT could be regarded as a blue ocean in the Chinese market, and Bilibili is trying to be a gold digger.

Bottom Line and Valuation

EqualOcean.com

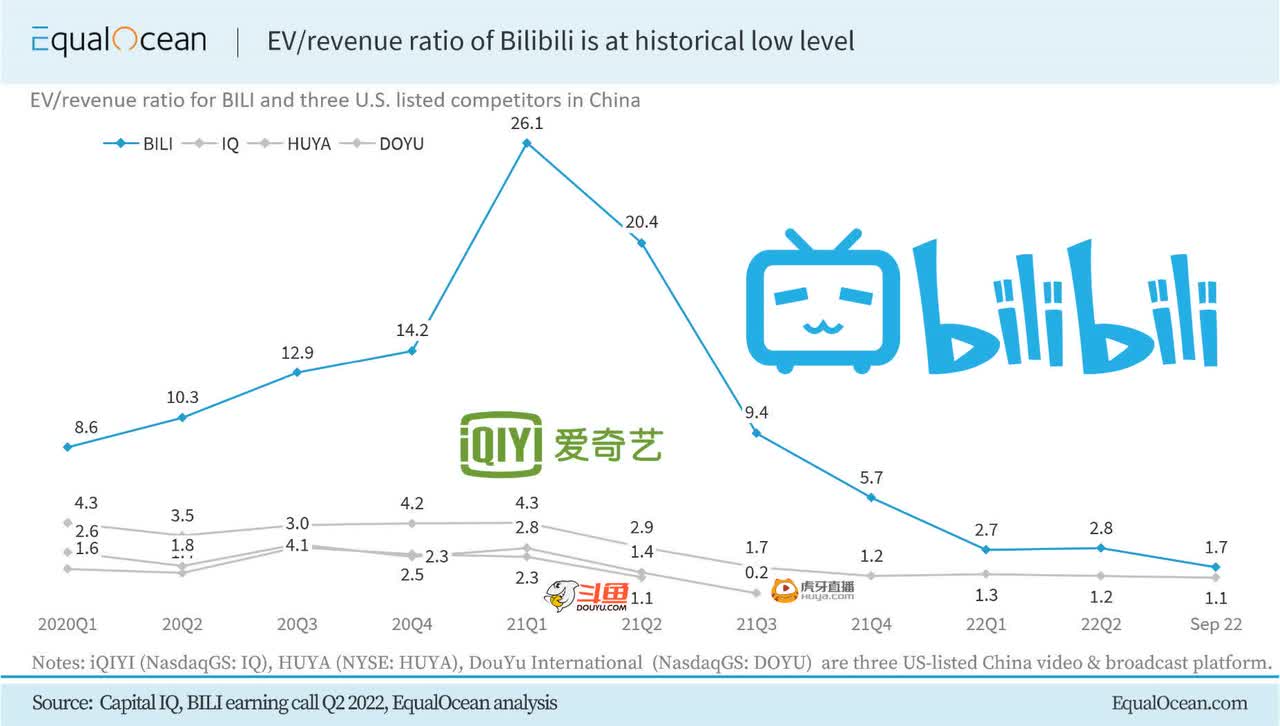

Even though Bilibili’s multiple is at a historical level, there is value trap risks exit. Based on the discussion above, we downgrade the stock to an underperform rating. We always believe that, for Bilibili, the conflict between community and commercialization has reached a situation that must be resolved. Now what the management should do is find a balance point and take measures immediately. Bilibili is still betting that the positive profit income brought by its broken circle can improve the profit structure, but it is undoubtedly driving on a long and arduous road. In this process. As we said, it may be an effective strategy to reduce costs in the short term, innovate the advertising business in the long term, and pay attention to three main growth catalysts (Luxury, Comic, and NFT) at the same time.

Be the first to comment