24K-Production

Thesis

We updated investors in our previous article on Freeport-McMoRan Inc. (NYSE:FCX) to consider waiting for a pullback before pulling their buy trigger. We are pleased to update readers that we believe the pullback from its August highs has occurred as FCX closes in on its July lows. Accordingly, FCX has fallen nearly 20% from its August highs through September, setting up another fantastic entry point for long-term investors.

Investors need to consider whether they believe the de-rating in FCX’s valuations has been adequate to reflect the near-term macroeconomic uncertainties. The Fed’s aggressive push to accelerate its rate hikes has increased volatility in the global commodities markets as global macroeconomic headwinds worsen.

Notwithstanding, Freeport-McMoRan remains confident in its long-term drivers, driven by the shift to renewables and electric vehicles (EVs). Therefore, it should help undergird the current pricing dynamics in the copper market as the world continues its push toward a greener future.

Therefore, these secular drivers could help underpin FCX’s profitability through the current cycle. Thus, investors who choose to add FCX through the coming recession should be prepared for further near-term downside volatility while focusing on its medium-term recovery.

We are confident that FCX’s valuations have been de-risked significantly heading into the looming global recession. Furthermore, China looks primed to emerge from its economic malaise ahead of the US, given a better GDP read in Q3.

Accordingly, we reiterate our Buy rating on FCX and urge investors to capitalize on the recent pullback to add exposure.

Don’t Blink Now As Copper Prices Could Stabilize

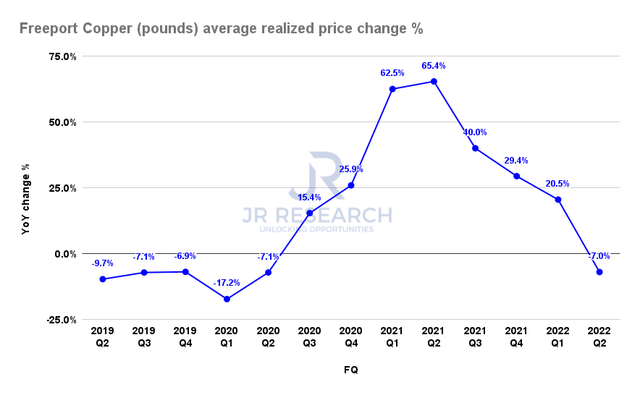

Freeport-McMoRan copper average realized price change % (Company filings)

Of course, we know that copper prices collapsed from their highs in 2021 toward their July lows. As a result, Freeport posted a 7% YoY decline in its average realized price in Q2 for copper while also comping against a highly challenging Q2’21.

However, we believe the price action in Q3 demonstrated that copper prices should be consolidating even as we move closer to a recession.

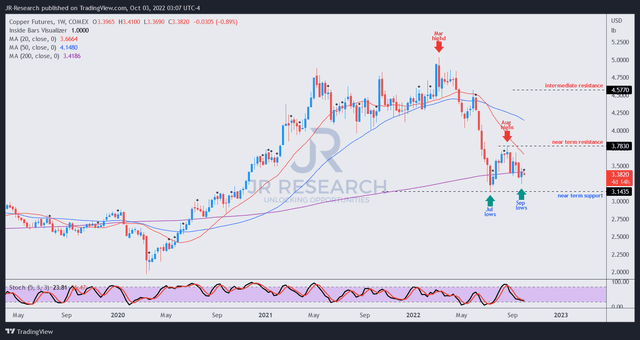

Copper futures price chart (weekly) (TradingView)

As seen above, copper futures (HG1:COM) have remained in a tight consolidation zone from July lows. Furthermore, HG1 has held its bottoming process robustly above July’s bottom. Therefore we postulate that it corroborates our thesis that a significant bottom in Copper futures has already occurred in Q2. Consequently, we expect FCX’s average realized prices to remain relatively stable on a QoQ basis moving ahead while it continues to face challenging YoY comps.

Freeport-McMoRan’s Profitability Is Expected To Remain Robust

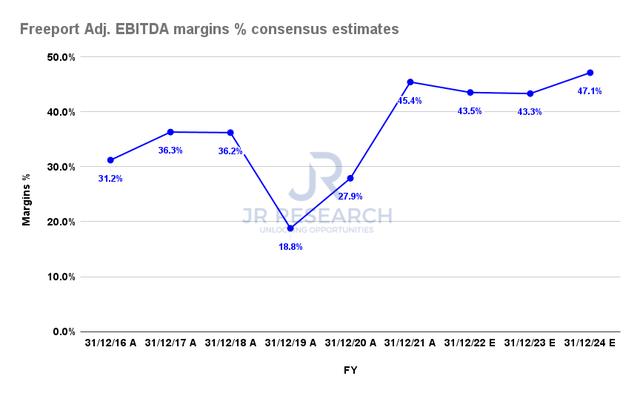

Freeport-McMoRan Adjusted EBITDA margins % consensus estimates (S&P Cap IQ)

Hence, we believe investors must assess whether they think Freeport can sustain its profitability through the cycle, as it would impact its valuations.

The consensus estimates (bullish) suggest that Freeport-McMoRan would be able to hold its margins through the cycle. Moreover, we gleaned that the price action in FCX did not suggest that the market has intended to de-rate FCX further below its July lows, given its resilient basing process.

Furthermore, China is on track to emerge from its economic headwinds from Q4, lifting the gloom on the global economy. Chinese Premier Li Keqiang highlighted that China’s economy stabilized in Q3, and Q4’s performance would be critical to continue its recovery cadence.

In addition, China is looking to provide more support for its embattled property market, as its “financial regulators told the biggest state-owned banks to provide financing worth at least $85 billion to the battered property sector.” It also led to Citigroup (C) indicating that the worst of China’s property market “is likely behind us.”

Moreover, we believe there are sufficient reasons to be sanguine that China’s continued push for growth in its transition to EVs and renewables should continue to undergird the growth drivers in copper despite the coming recession.

Is FCX Stock A Buy, Sell, Or Hold?

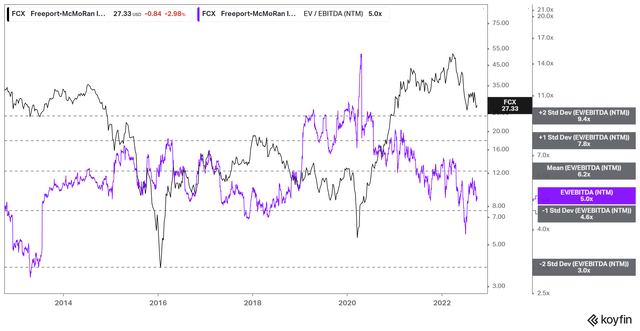

FCX NTM EBITDA multiples valuation trend (koyfin)

FCX’s NTM EBITDA multiples fell below the one standard deviation zone under its 10Y mean at its July lows. Nevertheless, we believe that the zone should underpin its recovery momentum resiliently.

Notwithstanding, the most considerable risk to our thesis is a significant impact on its EBITDA estimates, which would likely push FCX’s multiple down further toward the two standard deviation zone (3x EBITDA multiples).

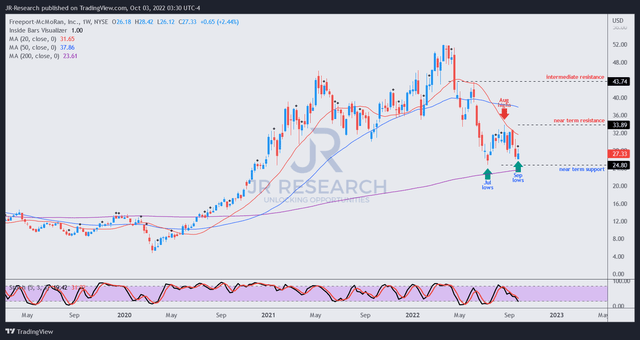

FCX price chart (weekly) (TradingView)

However, we postulate that it seems unlikely for now. FCX has been consolidating in line with the underlying copper futures, holding its September lows above its July bottom.

Therefore, the consolidation thesis remains intact, as FCX has also entered into oversold zones.

Furthermore, copper futures are no longer in backwardation, with September 2026’s contracts priced at $3.5, above the current contracts.

Therefore, we believe the current pullback represents another solid opportunity for investors to add more positions and ride through the recession with FCX.

We reiterate our Buy rating on FCX.

Be the first to comment