Michael Vi/iStock Editorial via Getty Images

Coupang (NYSE:CPNG) is a company we have been following since its IPO, but have so far not invested in. At first glance it looks attractive, with massive e-commerce market share in Korea and very fast revenue growth. Unfortunately it does not appear to have a particularly strong competitive moat to defend itself from the intense competition in the markets it operates in. This lack of competitive moat is reflected in the financials, where it is clear the company has squeezed margins and is having difficulty achieving operating leverage.

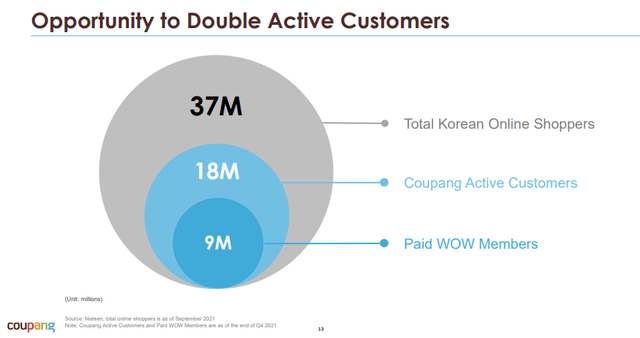

Coupang has stated that Korea is the third largest e-commerce opportunity globally, only behind China and the US, and one of the fastest growing with an estimated 2021-2025E CAGR of 11%. One problem we can identify is that about half of total Korean online shoppers are already active Coupang customers, so it is going to become increasingly difficult to grow the number of active customers for the company. Much of the growth will have to come from getting existing customers to spend more.

Coupang Financials

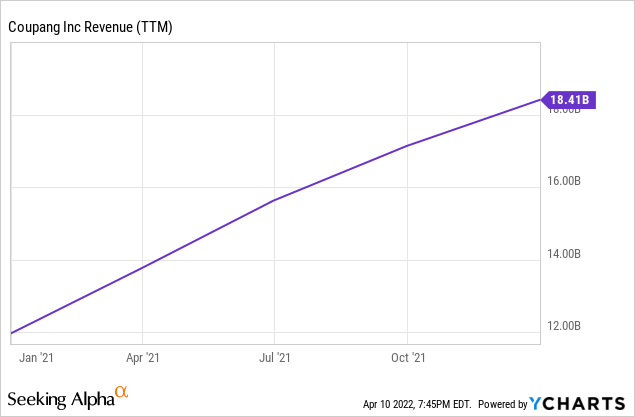

One area where we have to give Coupang credit is its impressive revenue growth, having managed to increase it by ~50% in about a year. This also tells us that the company is likely prioritizing market share over profitability, something that will be confirmed once we look at the profitability margins.

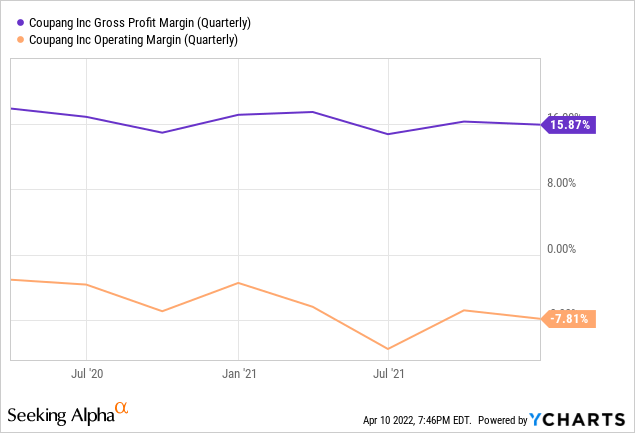

While the gross profit margin has been relatively stable at a low ~15%, operating margins have actually decreased as revenue has increased. This is alarming since it shows not only a lack of operating leverage, but that management is sacrificing profitability for market share gains. This lack of operating leverage also means that the company will likely have a complicated and difficult path to profitability. The significantly negative level of the operating margin also reflects how much cash the business is burning, and that it is still far from reaching break-even levels.

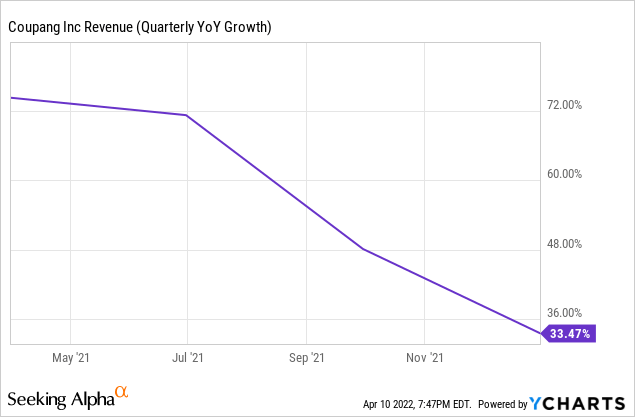

Even more concerning is that despite this sacrifice of profitability for market share, revenue growth is actually decelerating. In just a year it has gone from >70% y/y growth, to less than half at around ~33%. It’s likely this combination of lack of operating leverage and decelerating growth is what has weighted so heavily on the share price, in addition to the valuation starting pretty high.

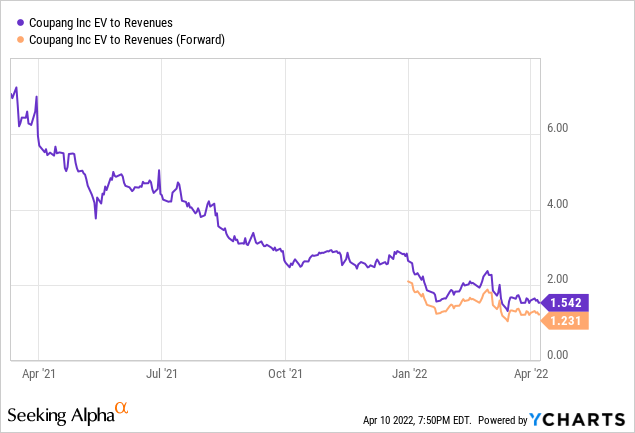

CPNG Stock – Current Valuation

Some will say that the valuation is attractive because it is trading at ~1.2x forward EV/Revenues. While this might be cheap for certain types of businesses, we think in this case it is far from a bargain, given the lack of operating leverage, negative profit margins, and decelerating growth. It is certainly cheaper than where it was previously trading right after the IPO, but it just might be because many investors are coming to the realization that a path to profitability is nowhere in sight.

Website Metrics

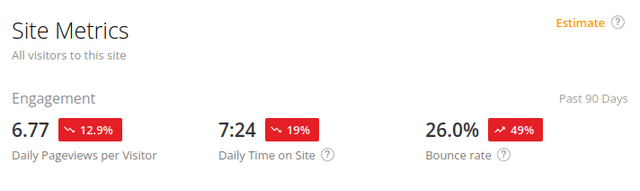

Looking at visits to their website, we see that there has been some reduction in the last few months. This might be a precursor to further disappointing growth numbers in the next quarter. Notice how the Coupang.com website went from being the #318 most popular website in the world 90 days ago, to #327 today, that shows the site popularity is going in the wrong direction.

Similarly looking at other engagement metrics such as page views per visitor, time on site, and bounce rate, they all have experienced deterioration in the past 90 days.

Conclusion

The biggest problem we see with Coupang is the lack of operating leverage and clear path to profitability at the moment. In addition, there is the issue of decelerating revenue growth which further complicates things. For all these reasons we think that Coupang is not cheap enough to warrant an investment, and we would like to see clear signals that there is a path to profitability before investing.

Be the first to comment