Sundry Photography/iStock Editorial via Getty Images

Investment Thesis

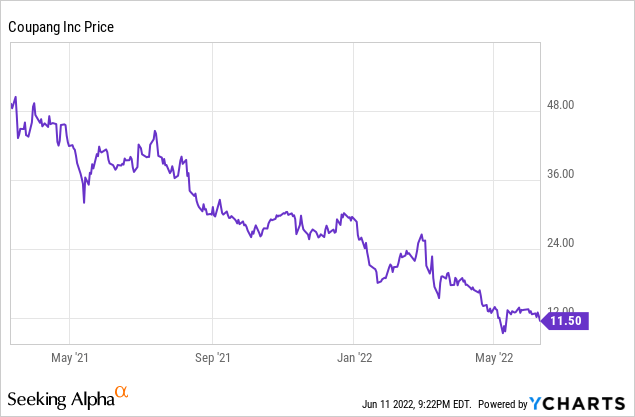

Coupang (NYSE:CPNG) is a South Korea based e-commerce company founded by Bom Kim back in 2010. The company was backed by notable firms like BlackRock (BLK), SoftBank (OTCPK:SFTBY), and Fidelity. It went public last year through an IPO valuing the company at a lofty market cap of over $80 billion. Its shares got caught up in the broad sell-off in high-growth tech stock and have fallen over 70% since its IPO. It is currently trading at $11.5, which translates to a market cap of roughly $20 billion. The company’s fundamentals remain very strong with its product commerce segment recording a positive EBITDA. It is also expanding into other areas other than commerce with multiple margin expansion opportunities. The current price translates to a compelling valuation, and I believe offers a good risk and reward ratio for long-term investors interested in the e-commerce space.

Market Opportunity

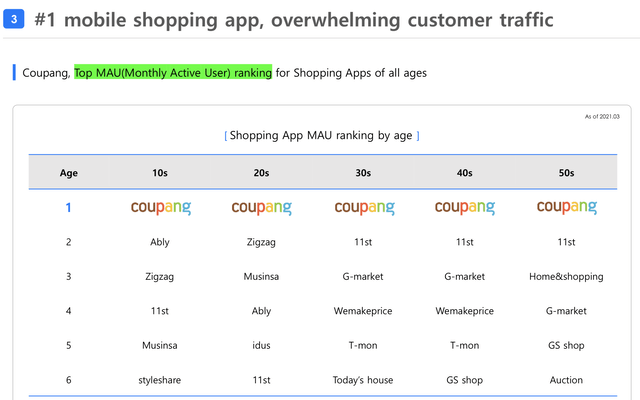

Since being founded in 2010, Coupang has been growing very rapidly. It is now the largest online retailer in South Korea and is often being crowned the Amazon of the country. The growth has been further accelerated by the pandemic, which significantly increased the adoption rate of online shopping due to lockdowns. In 2020, offline commerce dropped 5% yet e-commerce grew by 23%. Statista estimates the current online market share of the company to be around 15.7%, a 100%+ increase from 7.4% in 2017.

Coupang

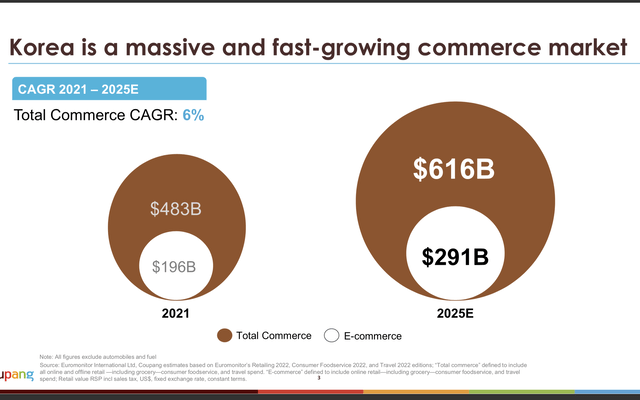

Coupang has a huge TAM (total addressable market) as the commerce market in South Korea is huge. According to Coupang, the South Korean commerce market was $483 billion in 2021 and is estimated to grow to $616 billion in 2025, representing a 6% CAGR (compounded annual growth rate), while the e-commerce market is currently $196 billion and is estimated to grow to $291 billion in 2025, representing an 11% CAGR. This puts South Korea as the 3rd largest e-commerce opportunity globally only behind China and the US.

Coupang

Huge Infrastructure Advantage

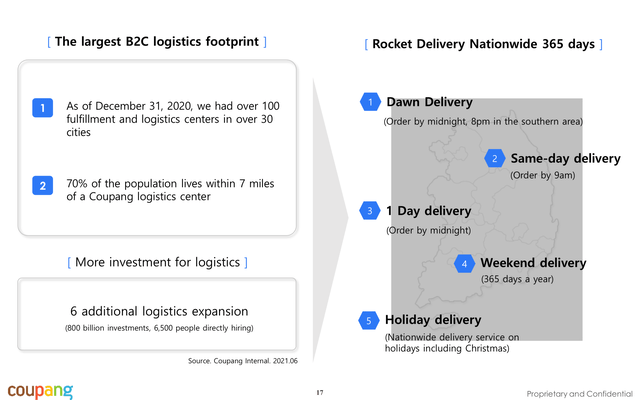

One of the biggest competitive advantages Coupang has is its logistic infrastructure network. Instead of being held hostage by third-party delivery companies, Coupang has full control of its own logistic network. Coupang’s current infrastructure footprint is 42 million square feet, up 2.4 times from 17 million square feet in 2019. This hugely benefits the company’s operation efficiency and, most importantly, its profitability.

Coupang

Sea (SE), the leading e-commerce company in South East Asia, did not invest in its own logistics infrastructure, and this is now hurting its bottom line as third-party delivery companies keep raising prices. On the other hand, the likes of Amazon (AMZN), MercadoLibre (MELI), and Coupang have been investing heavily in logistics. It is paying off for them as all of their e-commerce business is now EBITDA positive, this is thanks to the strong operating leverage from their own infrastructure.

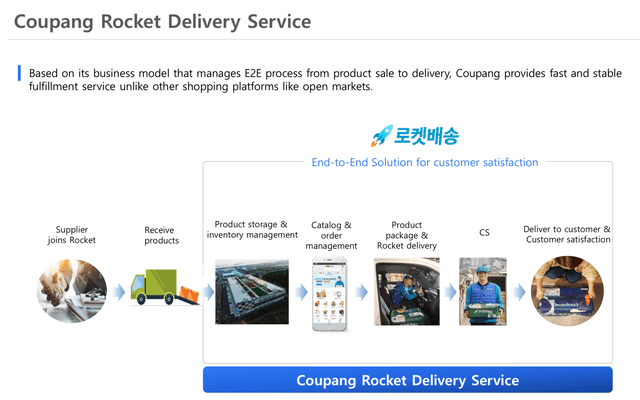

Coupang is now able to manage its logistics efficiently and provide same-day delivery for its members. This gives them a huge competitive advantage to them as they are able to provide a much better customer experience. It is also attracting more third-party sellers as they know Coupang’s delivery is more reliable. From the picture below you can see how its fulfillment service for suppliers works.

Coupang

New Offerings

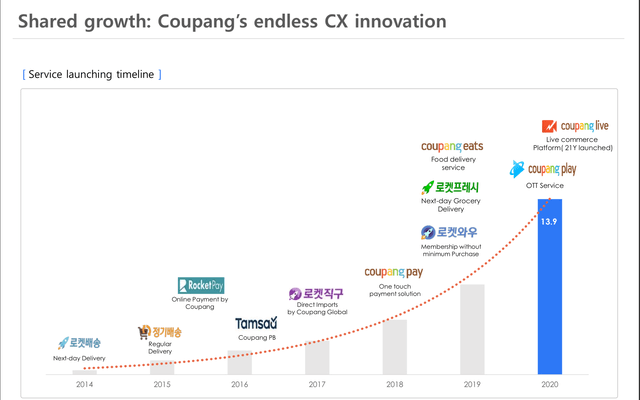

Like other e-commerce players, Coupang is actively seeking ways to expand its ecosystem by widening its services and entering other industries with higher margins. The company has been introducing new products and features almost every year. Since it already has an active customer count of 18 million, Coupang can easily leverage these users by introducing new services to them. Some notable launch includes Rocket Pay, its own integrated payment system, Coupang Pay, a one-touch payment solution, Coupang Eats, a food delivery service, Coupang Play, an OTT service, and Coupang Live, a live commerce platform.

These services improve the engagement rate of customers and increase their spending on the platform. It also integrated some of these offerings into its own WoW membership, which allows the company to have a high-margin subscription revenue stream, similar to the concept of Amazon Prime. As the company is adding more suppliers and users, it is now offering on & off-site marketing products for companies to advertise. This will provide them with another high-margin revenue stream going forward. The picture below shows the evolution of Coupang’s services.

Bom Kim, CEO, on 3P merchants opportunity

Our 3P merchant spends also continues to grow at a multiple of the overall e-commerce segment, and we see an opportunity to accelerate penetration by improving our merchant-facing tools and services. We’re excited about the potential impact of scaling our merchant services, including FLC (Fulfillment and Logistics by Coupang), in the years to come.

Coupang

Financials

Coupang recently announced its first-quarter earnings for FY22. The results are very impressive as they are showing much better than expected profitability with the product commerce segment posting a positive EBITDA, way earlier than what the street estimated. Total revenue for the quarter was $5.1 billion compared to $4.2 billion, up 22% YoY (year over year), or 32% on a constant currency basis. Gross profit was $1.04 billion, up 42% YoY from $733 million. Gross profit margin improved by 450 basis points, now standing at 20.4%.

Gaurav Anand, CFO, on Q1 results

“We also recorded the highest gross profit and gross profit margin in the Company’s history, which in turn helped our Product Commerce segment to achieve profitability in Q1. We expect our focus on customer-driven innovations as well as operational excellence to continue to bear fruit in the quarters and years ahead.”

The product commerce segment achieved a positive EBITDA of $2.9 million for the first time, compared to an EBITDA loss of $(69.3) million last year. Developing Offerings are showing strong growth with revenue up 65% (or 79% on a constant currency basis) YoY to $180.6 million. Net loss improved from a negative $(295) million to $(209.3) million, the loss is largely contributed by the loss in the developing offerings segment. Operating cash flow improved significantly from negative $(183.3) million to negative $(54.9) million this quarter. Despite tough comps from COVID, the company still managed to grow active customers by 13% YoY with revenues per customer increasing by 8% YoY. The company maintained a healthy balance sheet with $3.68 billion of cash in hand and $3.3 billion in debt.

One thing that I really like about the company is its discipline in investing and spending. Unlike other companies that are growing at all costs, Bom Kim is doing a very good job at balancing growth, profitability, and scale. This is shown in its result by achieving positive EBITDA (product commerce) much earlier than expected.

Bom Kim, CEO, on developing offerings investment

We have a capped budget. We test within that. We get proof of concept. We nail it before we scale it. And that continues to be our operating framework in many of these areas. Look, in cases like fintech, it’s an evergreen opportunity for us. You know, it continues — these are areas with vast potential. But as our ecosystem builds — as our ecosystem grows, that opportunity continues to grow. And so we’re patient and we’ll continue to, with a very — in a very disciplined way, test, iterate and learn.

Coupang

Valuation

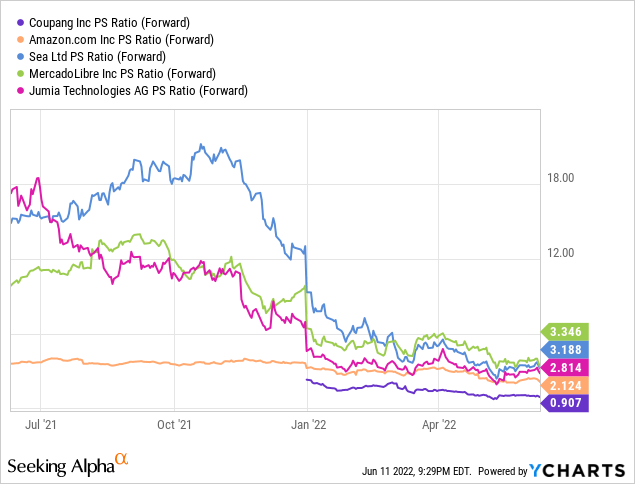

After the massive drop since its IPO, the company is now cheaply valued in my opinion. It is currently trading at a fwd PS ratio of 0.91 (I am using the PS ratio since the company is not profitable and has no positive cash flow yet). From the chart below, you can see that its valuation is much lower than other e-commerce companies like Sea, MercadoLibre, Amazon, and Jumia (JMIA). It is a bit unfair to directly compare them since most of these companies have a much higher margin due to their diverse business. Sea has its gaming segment, MercadoLibre has its fintech segment, and Amazon has AWS.

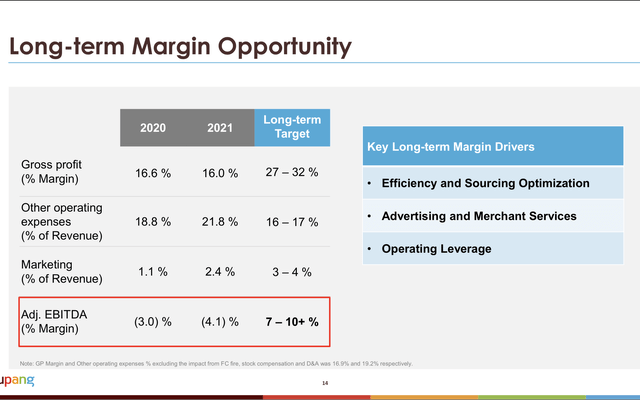

Coupang is also trying to branch out to other areas but the revenue contribution from its “developing offerings” segment is too low to be considered right now. However, management did say that they are targeting a 7%-10%+ EBITDA margin. If we take the low end and assume a conservative 5% EBITDA margin for FY23, the company EBITDA would be $1.37 billion, which translates to an EV/EBITDA ratio of 15.3. This is very compelling for a company growing revenue at 20%-30% while expanding margins. For instance, Amazon is currently trading at a fwd EV/EBITDA ratio of 16.9 while growing in the mid-teens.

Risks

The current uncertainty regarding the economy may post unprecedented risks to Coupang as e-commerce is quite exposed to the macro environment. If inflation continues to persist or a recession happens, consumers are very likely to cut off discretionary spending and only spend on staple items. Coupang’s Rocket Fresh may do relatively well as it sells groceries, but some other non-essential categories will take a hit. However, it is worth noting that the dynamic of South Korea’s economy is a bit different from the US. Its current inflation rate is 5.4% compared to US’s 8.6%. Citizens also tend to have a stronger purchasing power in general as well.

Conclusion

In conclusion, I believe Coupang is a really compelling e-commerce company with a huge TAM and a great management team. The company is facing tailwinds from the growing e-commerce market in South Korea, which is forecasted to grow at a CAGR of 11%. It is also increasing its market share with its superior customer experience. Its customer now amounts to 18 million and is still growing. The company has a huge advantage when it comes to logistics as it has an unmatched size of infrastructure that improves its operating efficiency. It is also actively expanding its new offerings to open up new revenue streams, such as advertising and fintech. Despite tough comps from COVID, the company still managed to post a strong revenue growth while improving margins significantly. After the massive drop, Coupang is now trading at a discounted valuation compared to its peers. I rate the company as a buy at the current price.

Be the first to comment