Spencer Platt/Getty Images News

Investment Thesis

We return with a follow-up to our previous Philip Morris (NYSE:PM) article in June 2021. Investors looking for a deeper dive into its business model can refer to our article here.

In a recent Altria (MO) article, we explained that PM had outperformed MO and British American Tobacco (BTI) stock over the past five years with solid revenue growth metrics. However, we think the market is too optimistic about PM’s growth. Our valuation analysis also suggests that Philip Morris could find it challenging to meet its growth targets at the current price.

Furthermore, our price action analysis indicates a potent double top bull trap in February. The recent recovery in May also met with another bull trap. Therefore, it seems increasingly likely that PM stock could face stiff resistance at the current levels. Consequently, we believe a deeper retracement is on the cards as the market looks to digest its gains from the COVID bottom.

Therefore, given its unconstructive valuation and price action, we think it’s apt to revise our rating from Hold to Sell.

The Market Needs To Normalize Its Growth Expectations

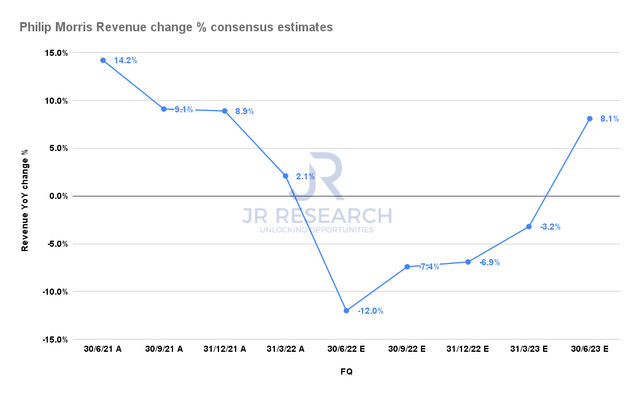

PM revenue growth % consensus estimates (S&P Cap IQ)

As discussed in our MO article, the market has priced PM for growth, given its growth premium, compared to its peers. Therefore, a falling revenue growth curve is not helpful for its stock.

As a result, we think the market needs to reset its expectations about Philip Morris’ growth deceleration through FQ2. Notwithstanding, the company is expected to lap highly challenging comps from FY21 and post negative revenue growth rates through FY23.

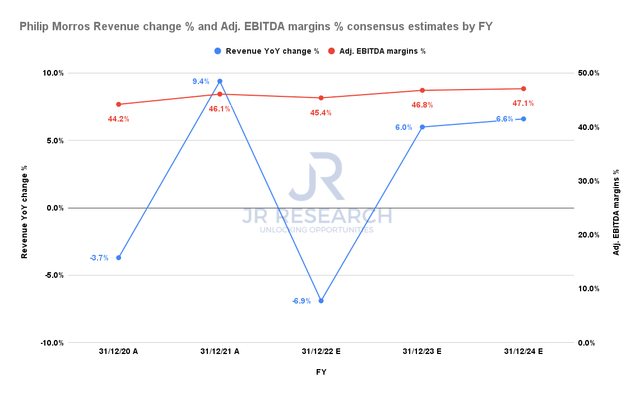

PM revenue change % and adjusted EBITDA margins % consensus estimates (S&P Cap IQ)

On an FY basis, readers can glean the revenue decline in FY22 before recovering from FY23. However, PM stock remains relatively close to its February’s double top bull trap, indicating significant digestion may not have occurred yet.

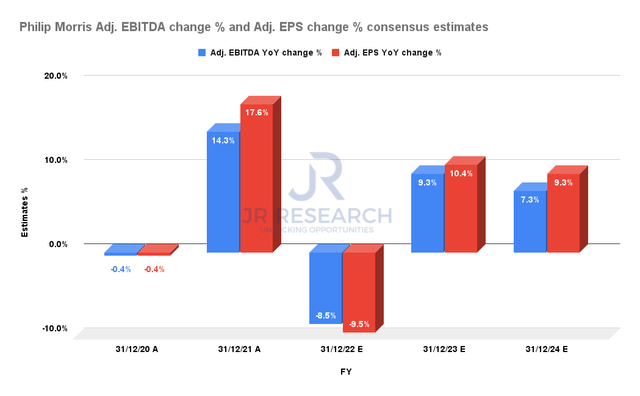

PM adjusted EBITDA change % and adjusted EPS change % consensus estimates (S&P Cap IQ)

Furthermore, we can also corral the impact on its profitability due to the revenue decline. Notwithstanding, it’s not expected to be structural but rather a transitory adjustment, given last year’s massive comps. Consequently, its adjusted EBITDA and adjusted EPS are estimated to resume their relatively consistent growth from FY23.

But, Its Valuation Suggests An Overvalued Stock

| Stock | PM |

| Current market cap | $158.62B |

| Hurdle rate (CAGR) | 10% |

| Projection through | FQ1’26 |

| Required FCF yield | 6.9% |

| Assumed FCF margins in FQ1’26 | 32% |

| Implied TTM revenue by FQ1’26 | $50.08B |

PM stock reverse cash flow valuation model. Data source: S&P Cap IQ, author

A simple valuation analysis suggests that PM stock seems overvalued, as seen above. We used a similar hurdle rate in our MO article. We believe that rather than accepting a lower hurdle rate, we would instead invest in the SPDR S&P 500 ETF (SPY) or an equivalent index ETF.

We used an FCF yield equivalent to MO stock, which posted a 10Y CAGR of about 10%. Therefore, we think it’s a fair yield to ask for to hold PM stock (also equivalent to its current NTM FCF yield).

Given the above parameters, we require Philip Morris to post revenue of $50.08B by FQ1’26, an improbable scenario. Moreover, the consensus estimates suggest that PM could post revenue of $33.03B in FY24. Therefore, it’s implausible that the company could meet our $50.08B TTM revenue requirement by FQ1’26.

Therefore, we think the market needs to reset PM stock’s growth expectations significantly before an attractive entry point can be seen.

Price Action Indicates Caution Is Warranted

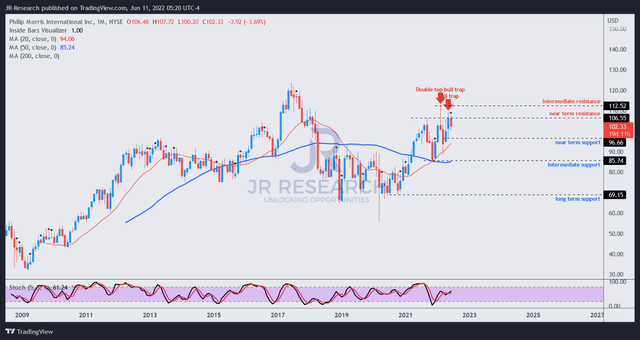

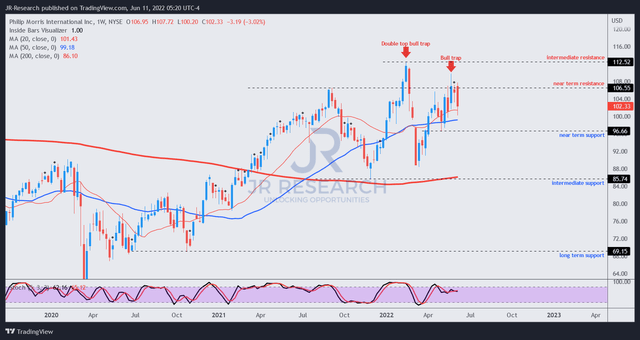

PM price chart (monthly) (TradingView) PM price chart (weekly) (TradingView)

Our price action suggested a menacing double top bull trap had already formed in February, followed by another bull trap from the May recovery. Therefore, the price action is highly susceptible to a significant trend reversal that could occur moving forward.

Even though the price retraced markedly last week (see weekly chart), we believe the digestion could likely continue, given the price action structure. Therefore, investors should at least wait for a re-test of its near-term support and assess the price action from there.

However, we are targeting further downdraft towards the gap between its near-term and intermediate support, given PM stock’s overvaluation.

Consequently, we believe investors should consider layering out, taking advantage of potential bounces / short-term rallies to cut exposure. Conversely, investors looking to add exposure should bide their time patiently for a better entry point.

Accordingly, we revise our rating on PM stock from Hold to Sell.

Be the first to comment