AerialPerspective Works/E+ via Getty Images

Overview

IMAX (NYSE:IMAX) is a relatively well-known company to theatergoers. Providing a unique big screen experience complete with custom audio, IMAX can be considered unique and the de facto market leader in upmarket cinema technology. The firm sells custom equipment for making movies within its format, although its core revenue driver has always been the screens themselves – along with the associated licensing fees and commissions on ticket sales.

SeekingAlpha.com IMAX 11.18.22

Evolution of IMAX

A 2013 Harvard Business Review article written by the CEO discusses how IMAX has iterated its business over the years. This section will highlight and contextualize the details therein that are relevant for investors as well as establish a foundation for subsequent financial analysis

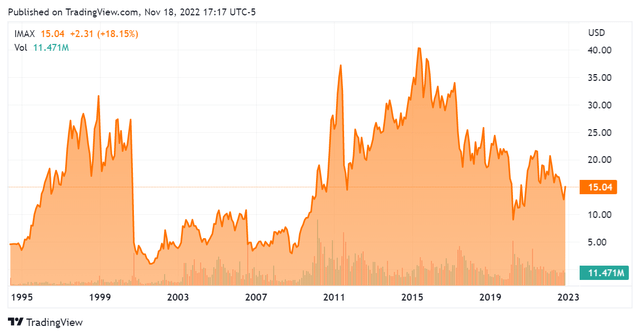

IMAX has been around for a very long time; it was first established in 1967. Even then, it was centered around leveraging novel technology to make the big screen even bigger as well as better – curved screen included. In 1994 it was purchased via leveraged buyout and subsequently taken public. The volatile stock reflects the many changes that the business has undergone; it has traded as high at $40.77 per and is now hovering at around $15 at the time of this article.

As alluded to, the company has gone through several pivots as to its business model over the years. For its first several decades in business, it focused on producing ultra-high resolution nature documentaries and installing the screens needed to watch them. Its only market was museums, with the firm receiving grants from the National Science Foundation to go about its business.

This all changed during the course of its buyout and subsequent public listing. With a completely new management team, it began to pivot to the market that the purchasers had envisioned: movie theaters.

This change involved a continuation of its business model at that point, which was centered around licensing its unique technology. Theaters would pay the cost of installation and then compensate IMAX a small commission on each ticket sale; tickets were (and still are) more expensive than those for standard formats.

This approach was continued through until late 2001, upon when the company was able to innovate its approach through leveraging new software. Movies that were already made could now be algorithmically converted into IMAX format. This yielded a shift in strategy for the firm wherein they would themselves pay to convert movies into IMAX. In the process, they negotiated a new fee schedule, set at 12.5% of gross box office receipts for IMAX locations.

The company continued to innovate. The next stage in the evolution of its business model was to begin installing IMAX at theaters with its own cash. Now, movie theaters no longer had to front the multimillion (roughly $5M) overall cost of doing so. The company still put the cost of renovating the physical area on theaters, but this was minor – less than 10% – of the previous expense incurred in the course of installing an IMAX screen. This allowed it to negotiate pricing further and it was now able to pocket 20% of top-line ticket sales for movies showed on its screens.

The company put the final piece of its present offering together in 2008 by digitizing its offering. This was a less significant change than previous ones but greatly reduced transaction costs for delivering its product from studio-to-theater. In the words of an IMAX executive: “those $30,000 film prints that required a forklift were replaced by $150 plug-and-play hard drives. Showing a film in the IMAX format became cheap and easy.” The company was now set to operate in the way that it does today.

With this context, we will look at IMAX’s financial picture throughout that period and determine if it is a sound investment from a fundamental perspective.

Financials

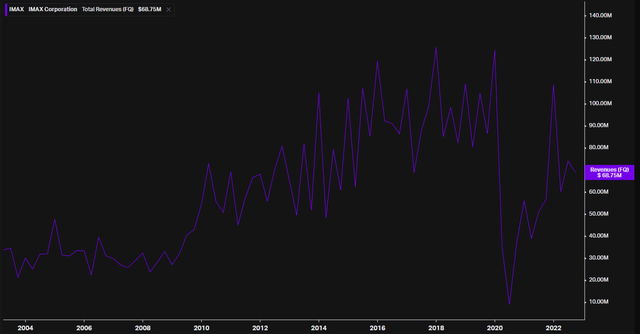

IMAX has volatile revenues quarter-over-quarter. The peak quarterly results that we see are actually not for the summer season, as may be expected, but for the Q4 reporting period of a given year.

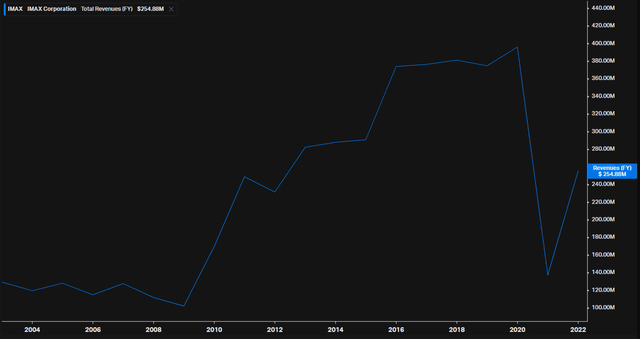

While going through peaks and valleys, the company demonstrating a clear stepwise trendline year-over-year – that is, until the pandemic hit. At this point, IMAX sales cratered to what they had been 11 years prior. Nonetheless, this chart has clearly began to reverse itself, and it is riding the secular wave of an economy that is reopening after several years of lockdown.

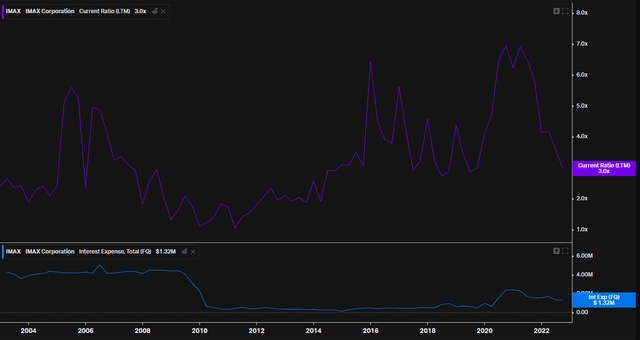

Of course, many companies had to saddle themselves with debt during the pandemic to continue operations. As such a look into IMAX’s current ratio and interest expense is worthwhile. We see here the firm did indeed take on additional debt and the associated costs, but has since gotten its current ratio back down to historical norms. The company’s interest expense is still elevated somewhat beyond the near-zero figure that it maintained for most of the 2010s, but that figure has also been coming down nicely.

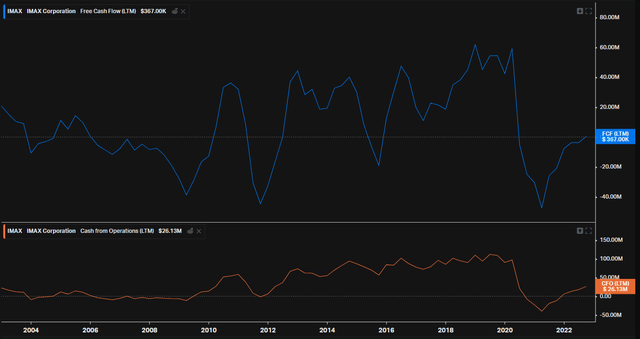

Of course cash is king, and we must also evaluate the situation here. In line with the company’s volatile quarter-over-quarter revenues, IMAX generally dips into being cash flow negative on a trailing twelve months basis. Yet, we also see that the spend a majority of their time being a cash flow positive company. This can be chalked up to there usually being one quarter out of four where it must expend cash beyond that of the others. While this may look volatile and perhaps concerning, the cash from operations picture is much more steady and has stayed well above zero for years at a time. The pandemic appears to have affected both of these significantly along with the aforementioned top-line metrics.

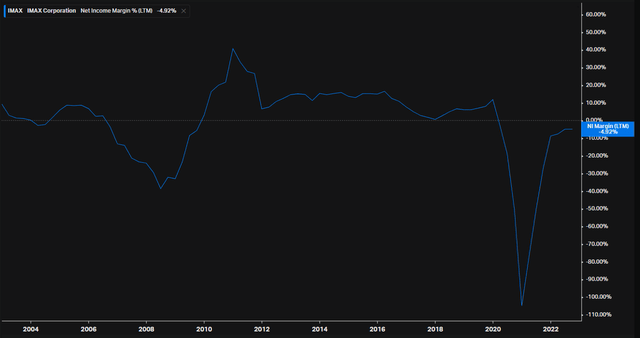

What I am seeing here is a company with a profitable – albeit volatile – business. Since the movies can certainly be considered a consumer discretionary good, this is fine. The trailing twelve months metric smooths out results and lets us see if things are really adding up. To confirm this, we can take a look at the net income margin. This chart shows us that IMAX has been able to post a consistent double-digit net margin for its time outside of the pandemic.

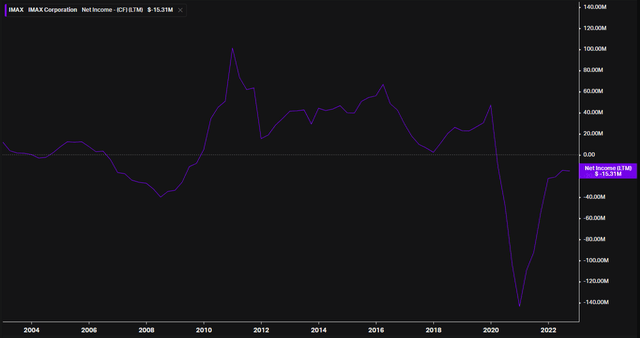

We are able to confirm this for good through the company’s net income, which was decidedly positive from the end of 2010 until the beginning of 2020.

These charts add up to an increasingly clear picture: IMAX has been a successful consumer discretionary business that has been hammered particularly hard by the pandemic.

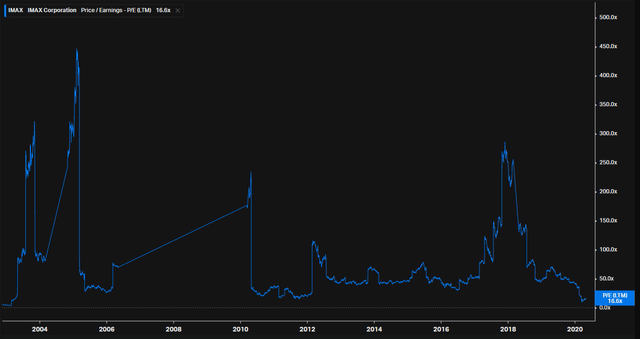

Through the vagaries of the market, it has now been repriced into a P/E ratio of 16.6x – decidedly lower than its average throughout the 2010s, and a lot lower than its peak periods. Assuming that things are now in some semblance of normalcy and that they will continue, this makes it an attractive purchase.

Conclusion

IMAX stock is a good post-pandemic play. While it was brought to its knees by the lockdown, it is demonstrating clear momentum coming out of it. Since in its steady state it is a business with positive profitability and cash flow metrics, along with a solid revenue trendline, it is well-positioned to take advantage of a world returning to normal.

Worth reiterating is the fact that this is a unique company with a unique product. By unique, I mean that it has no competitor. There is not another company providing an upmarket moviegoing experience along these lines.

This is the first year that we can consider as fully out of the pandemic. This is confirmed by the reopenings and relaxation as to mask mandates. IMAX is thus well positioned to recapture its momentum. Since the firm traditionally posts its best quarters in Q4, the next earnings call should not disappoint as I see it.

Considering all of this along with the historically cheap P/E multiple that this stock is trading at, I am calling it a buy.

Be the first to comment