Sundry Photography/iStock Editorial via Getty Images

Though the prevailing sentiment in the market is fear, it’s a great time for intrepid investors to position themselves for a rebound by snapping up beaten-down tech stocks. Within this group, there are few stocks that catch my eye more than Coupa Software (NASDAQ:COUP), the procurement software company that was once the darling of Wall Street and one of the most expensively valued stocks in the sector.

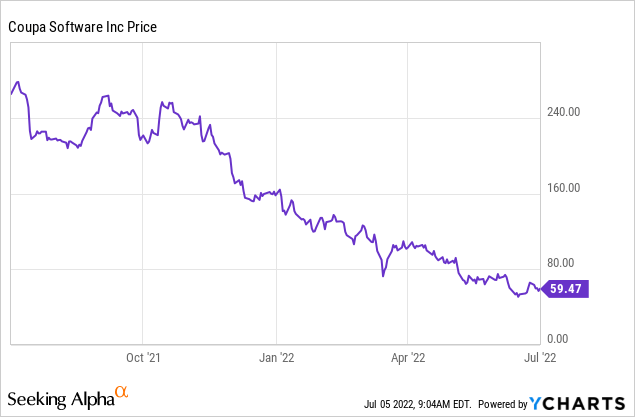

Year to date, shares of Coupa have lost 64% (two-thirds!) of its value. Yes, a lot of that value decline owes to a valuation reset: double-digit revenue valuation multiples, which for Coupa at one point exceeded 20x revenue, were bound to get a reality check when a whiff of recession came into the macro picture. But at the same time, this steep drop has been a major overreaction in what remains a very solid software business.

In light of Coupa’s much cheaper valuation amid solid fundamentals, I am upgrading my view on Coupa to very bullish. I think this is a very rare opportunity to buy a software company with fairly minimal competition and an established brand name and customer base.

To me, sentiment/fundamentals for Coupa bottomed out after its Q4 earnings release, during which Coupa released underwhelming guidance calling for mid-teens growth in FY23. Now that expectations have been reset to a much lower baseline, Coupa has plenty of room to rise higher.

As a reminder to investors who are newer to this name, here is what I consider to be the key drivers of the bullish thesis for Coupa:

- Enormous TAM, and plenty of room to “land and expand” within the existing customer base. If not evidently obvious, business procurement is a huge space. Coupa estimates that it has 100,000+ potential global customers and a market opportunity of $94 billion, indicating that even at its current respectable scale, there is still a large market out there to grab. Coupa notes it is only currently ~20% penetrated into the Global 2000. Moreover, within the company’s existing base of ~2,000 customers, Coupa is estimating a $2.3 billion “expansion” opportunity, which is roughly 3x its current annual revenue scale.

- Corporate procurement practices will get increased scrutiny after this year, when just about everything is in short supply. The hot-seat department to be working in post-pandemic is procurement. Companies around the globe are having difficulty sourcing components. Procurement practices will be in serious review after this year’s challenges, making the conversation for onboarding a modern software tool like Coupa very natural.

- Coupa Pay. Coupa is leaning more and more into Coupa Pay, which is its embedded payment solution tied to its procurement platform. Attach rates across new deals have been ~30%, and specifically for mid-market customers where Coupa is seeing the most growth, attach rates are well over 50%.

- Sticky product. By integrating itself into its clients’ supply chain, finance, and operations, Coupa makes itself a very difficult product to rip out.

- High recognition from tech analysts and reviewers. Coupa’s procurement platform has been named a leader and the industry benchmark by a number of industry analysts, including Gartner and Forrester, making it a “best in breed” and default vendor.

- Profitable on a pro forma and free cash flow basis. In FY22, Coupa generated both positive pro forma net income and positive free cash flow, another rarity for a software company growing as fast as it is.

And after years of trading at what I considered to be unbuyable levels, Coupa is now quite a bargain. At current share prices near $59, Coupa trades at a market cap of $4.49 billion. After we net off the $786.2 million of cash and $2.16 billion of debt on Coupa’s most recent balance sheet, the company’s resulting enterprise value is $5.87 billion.

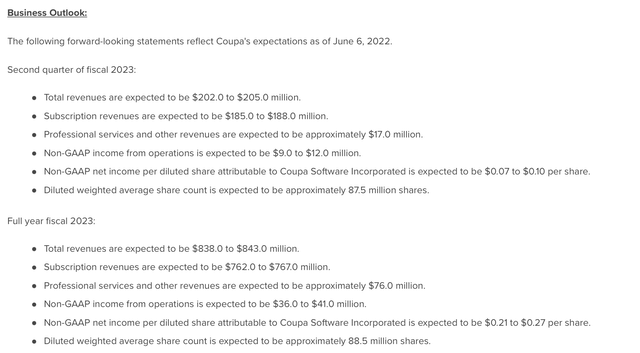

Alongside its most recent earnings release, Coupa has slightly nudged up its full-year guidance to $838-$843 million, representing 16% y/y growth (a slight raise from $836-$840 million in the company’s prior outlook):

Coupa FY23 outlook (Coupa Q1 earnings release)

Against this outlook, Coupa trades at 7.0x EV/FY23 revenue, which I think to be quite undervalued for a product of Coupa’s stature plus mid-20s billings growth.

Stay long here and take advantage of Coupa’s extensive year to date slide to build up a position.

Q1 download

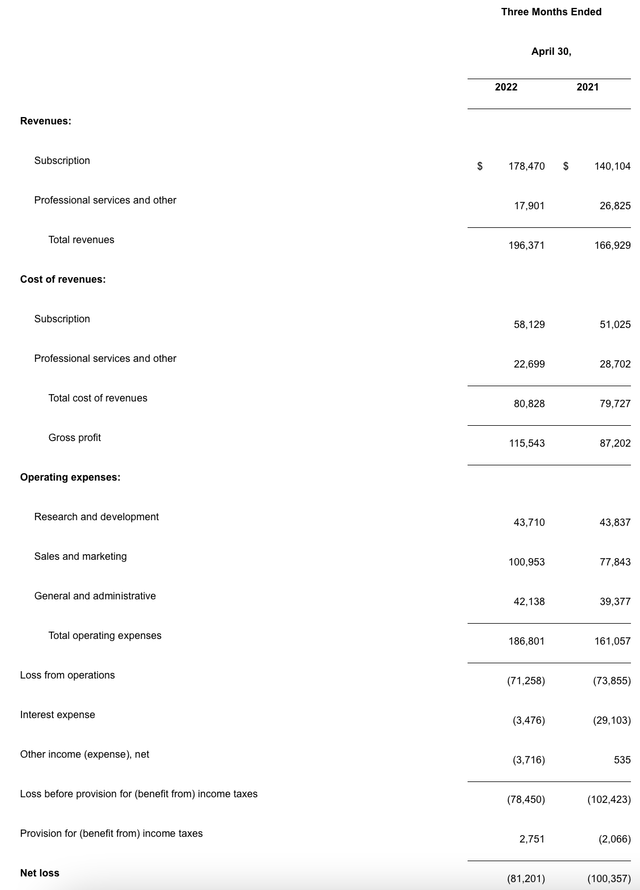

Let’s now cover Coupa’s latest Q1 results in greater detail. The Q1 earnings summary is shown below:

Coupa Q1 results (Coupa Q1 earnings release)

Coupa’s revenue grew 18% y/y to $196.4 million in the quarter, beating Wall Street’s expectations of $190.7 million (+14% y/y) by an impressive four-point margin. We note as well that Coupa’s revenue showed no deceleration versus Q4’s 18% y/y growth rate, and is also tracking ahead of the full-year growth expectation of 16% y/y.

Note as well that part of the growth overhang is due to professional services, which declined -33% y/y. This is a favorable trend for Coupa: like many other software companies, Coupa performs professional services/implementations at or below cost in a bid to get new customers onboarded. But as it scales and deepens its partnerships with third-party vendors who specialize in this type of work, it can offload this lower-margin activity. Subscription revenue, the bread and butter of Coupa’s business, grew 27% y/y and represented 91% of Q1 revenue, up from 84% in the year-ago Q1.

In other really strong news: Coupa’s billings in Q1 grew at 26% y/y to $188 million. As software investors are aware, billings represent a better indicator of long-term growth than revenue itself, as it captures deals signed in the quarter that will be recognized as revenue in future quarters. This billings growth rate makes it unlikely that Coupa’s revenue will materially decelerate to low-teens (as was the expectation this quarter) anytime soon.

The company is sounding off upbeat tones after its annual customer event as well. Per CEO Rob Bernshteyn’s prepared remarks on the Q1 earnings call:

And speaking of resiliency, we were overwhelmed with incredible positive energy from the thousands of our customers and prospects that we connected with live at our Inspire events in Las Vegas and Berlin this quarter. The resiliency they showed with respect to their businesses leveraging our platform was nothing short of humbling and inspiring for all of us at Coupa. As well, they are preparing to use our platform to help their businesses navigate the potential uncertainties ahead.

Now, as we are all acutely aware, the global business environment is currently highly volatile. We have seen some early signs of potential softening in Europe, especially as the war in Ukraine and inflationary pressures appear to be weighing more on business leaders than they were before. Yet in this context, we remain agile and pragmatic in how we run our business and make investments.

With that backdrop and a strong pulse on our business, we feel confident raising our subscription revenue guidance for both the second quarter and the full year. Now more than ever, it’s undeniable that business leaders recognize the importance of optimizing their business spend. Coupa is empowering companies to build the transformational business architecture they need to forge on into this uncertain future.”

Coupa also excelled from a profitability standpoint. The company hit a pro forma operating margin of 7.0% this quarter (one of the few high-growth SaaS companies to be above breakeven!), 280bps better than 4.2% in the year-ago Q1. It also generated $45.6 million of free cash flow, representing a 24% margin and growing at a 53% y/y pace.

Key takeaways

Don’t miss the opportunity to pick up Coupa cheaply while the rest of the market is ignoring it. Coupa remains a best-of-breed software company, with a compelling mission-critical product, a solid history of execution and profitable bones. Stay long here.

Be the first to comment