imaginima/E+ via Getty Images

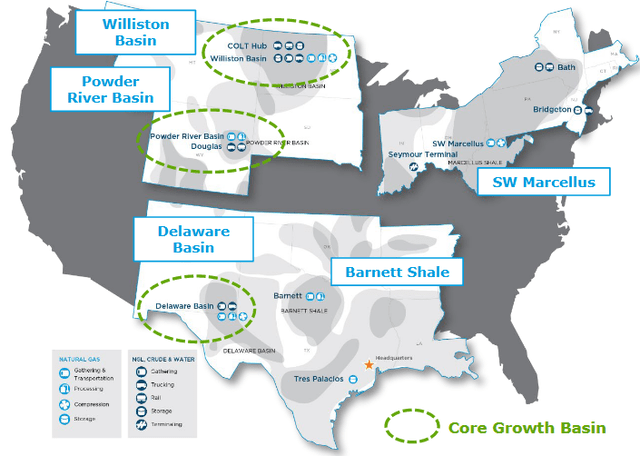

Crestwood Equity Partners LP (NYSE:CEQP) is a midsized master limited partnership that owns and operates midstream assets across numerous resource-rich basins in the central part of the United States. Crestwood Equity Partners has long been one of the most financially strong midstream companies in the sector, and indeed it weathered through the events of 2020 much better than any of its peers. Indeed, it was one of the few firms that were not forced to cut its distribution in response to the events of that year.

Unfortunately, the company’s market performance has not nearly reflected its financial performance, as the partnership units are actually down 18.46% over the past twelve months. Fortunately, though, this poor performance has also given the company a remarkable 10.69% distribution yield at the current price. It is admittedly very important not to let this poor performance get you down, as the company boasts an incredibly strong balance sheet and significant growth prospects that could certainly make it a rewarding long-term investment.

About Crestwood Equity Partners

As stated in the introduction, Crestwood Equity Partners is a midsized midstream master limited partnership that operates in various basins throughout the central part of the United States:

The company primarily acts as a gathering and processing firm for natural gas, although it is also active in the crude oil space. In total, Crestwood Equity Partners boasts 3.1 billion cubic feet per day of natural gas gathering capacity and another 1.4 billion cubic feet per day of natural gas processing capacity. This is overall a very good place to be as the fundamentals for natural gas are quite positive, which we will discuss in just a few moments.

Overall, this is a somewhat different business than what most people think of when picturing a midstream company. Crestwood Equity Partners only has a limited ability to transport resources long distances, such as through interstate pipelines. Rather, the company’s network of gathering pipelines grabs the resources at the wellhead where they are extracted from the ground and then transports them to the first step on the journey to the end-user, which is typically either a much larger long-haul pipeline of a processing plant.

As already mentioned, Crestwood itself may be the owner of the natural gas processing plant, particularly in the Bakken shale. Natural gas tends to include a great many impurities when it is first pulled out of the ground, such as water vapor and sulfur. These impurities must be removed before the natural gas can actually be used by the end consumer, which is the function performed at the processing plant. From our perspective as investors though, the most important thing is that the company’s processing plants represent an additional source of revenue and cash flow for Crestwood Equity Partners, and the expansion of these plants during the years prior to the pandemic was the biggest reason for the growth that the company benefited from during that period.

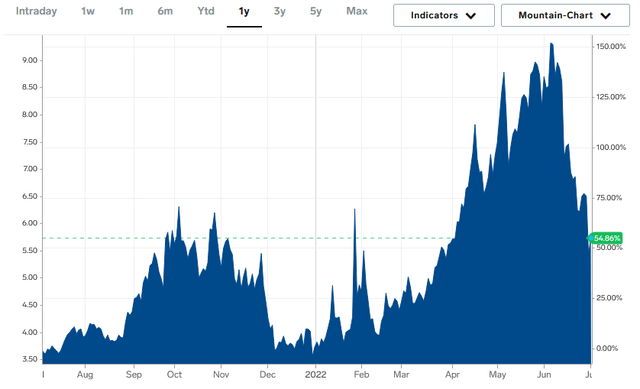

It is not going to come as a surprise to anyone reading this that the price of natural gas has increased substantially over the past year. After all, many of us had to pay much higher bills to heat our homes this past winter. As of the time of writing, the price of Henry Hub is up 54.86% over the past twelve months:

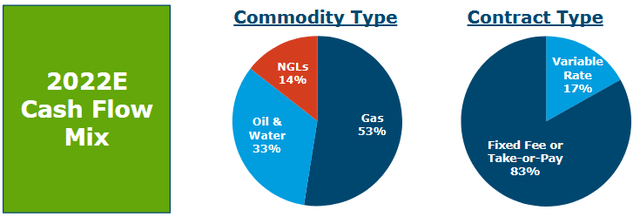

Unfortunately, Crestwood Equity Partners does not really benefit from rising natural gas prices, nor is it particularly hurt by falling gas prices. This is because of the business model that the firm uses. In short, Crestwood Equity Partners enters into long-term (typically five to ten years in length) contracts under which the customer pays Crestwood Equity Partners based on the volume of resources moving through its infrastructure and not on their values. In addition, these contracts contain minimum volume commitments that specify a certain minimum quantity of resources that must be sent through Crestwood’s infrastructure or paid for anyway. This model serves quite well to provide Crestwood Equity Partners with a great deal of protection against either declines in resource prices or upstream production. Indeed, approximately 83% of Crestwood Equity Partners’ 2022 cash flow is expected to come from this type of contract:

This business model has proven to provide Crestwood Equity Partners with surprisingly stable cash flows regardless of any conditions in the broader economic environment. We can clearly see this by looking at the company’s EBITDA over the past nine quarters, which is a period of time that included both a massive collapse in energy prices as well as an energy price surge. Here they are:

| Q1 2020 | Q2 2020 | Q3 2020 | Q4 2020 | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 | |

| EBITDA | $65.3 | $70.6 | $99.1 | $121.0 | $62.3 | $57.1 | $56.0 | $171.2 | $133.1 |

(all figures in millions of US dollars)

As we can clearly see, Crestwood Equity Partners enjoyed surprisingly stable cash flows, despite the changing conditions in the broader market. This is also despite the volatility that we have seen in Crestwood Equity Partners’ market price. This is something that any risk-averse investor should appreciate and it is this stability that has allowed the company to maintain its distribution straight through the downturn that we saw in 2020 along with today’s market strength.

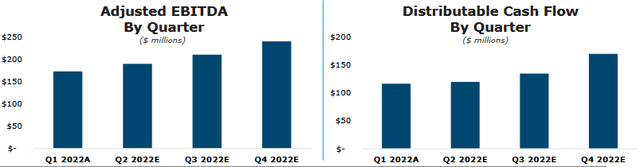

This stability certainly does not mean that Crestwood Equity Partners does not have any growth prospects, however. In fact, the company has guided towards cash flow growth in every quarter this year:

One of the major sources of this growth will be expanding production in the Bakken shale. This is not a surprise as this is the company’s largest center of operations and is one of the areas in the United States in which upstream producers are actively boosting their production. Crestwood Equity Partners expects a whopping 110 to 120 new wells to be connected to its infrastructure in the basin over the course of 2022, which should obviously represent fairly significant volume growth for the company. Fortunately, we have some good reasons to believe that this story will actually play out. This is because Crestwood Equity Partners’ tend to share their production plans with the company because Crestwood has to add the infrastructure support for the wells that the customer wishes to drill. Thus, we can be reasonably certain that the company’s projected cash flow growth will actually play out as planned.

This would represent a continuation of the growth that Crestwood Equity Partners posted in the first quarter of 2022. During that quarter, the company posted an adjusted EBITDA of $172.8 million, which represents a fairly reasonable increase over the $165.4 million that the firm had during the first quarter of 2021 (and an increase over the $149.1 million that the company posted in the fourth quarter of 2021). The tremendous surge in cash flow that we see here and will likely see over the remainder of the year is the biggest reason why Crestwood Equity Partners increased its distribution for the first quarter of this year.

Fundamentals Of Midstream

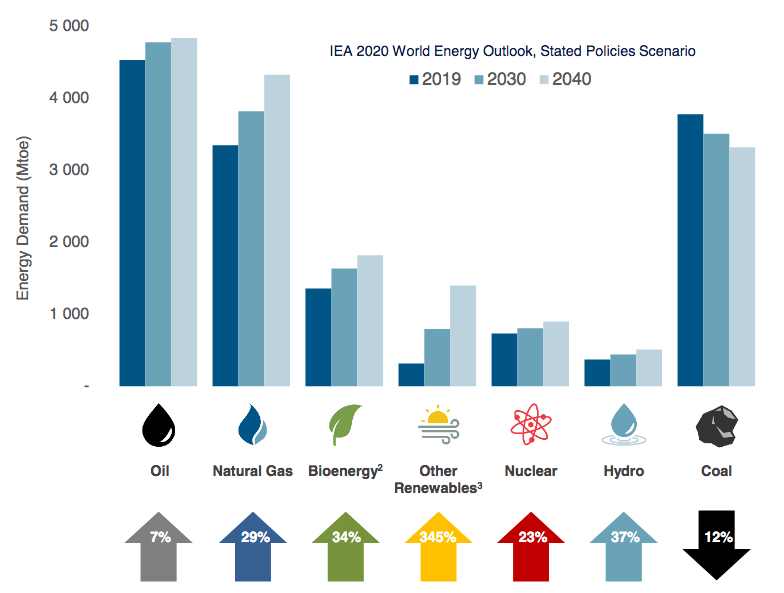

As Crestwood Equity Partners is a midstream company, its growth is ultimately dependent on growing transported resource volumes. Fortunately, it appears likely that this will be the case. One of the biggest reasons for this is that the demand for these resources is likely to grow over the coming years. This may be surprising considering that politicians and many others have been pushing for the end of fossil fuel consumption. However, according to the International Energy Agency, the global demand for crude oil will increase by 7% and the global demand for natural gas will increase by 29% over the next twenty years:

Pembina Pipeline/Data from IEA 2021 World Energy Outlook

Perhaps surprisingly, the growth in natural gas demand will be driven by the often promoted green energy transition. This is because many utilities all over the globe have been retiring their old coal-fired power plants, which are being replaced by renewables. This is mostly to reduce carbon emissions, as might be expected. However, renewables do not yet have the reliability to fully support a modern electrical grid on their own. The usual solution to this is to supplement the renewables with natural gas turbines as natural gas burns much cleaner than coal and is still reliable enough to support the electric grid. This is why natural gas is often referred to as a “transitional” fuel since it provides a way to maintain the grid and still reduce carbon emissions until renewables are able to support the grid on their own.

The case for oil consumption growth may be harder to understand, particularly considering the attitudes that many in the Western nations have toward the fuel. However, it is a different situation in the various emerging nations around the world. These nations are expected to see tremendous economic growth over the projection period. This will have the effect of lifting the citizens of these nations out of poverty and putting them firmly into the middle class. These people will naturally wish to enjoy a lifestyle that is similar to their Western counterparts. This will require growing consumption of energy, including that derived from crude oil. The populations of these nations are greater than the populations of the world’s developed nations so the rising consumption here will more than offset the stagnant-to-declining demand in the various developed markets.

The United States is one of the only nations in the world that has the ability to significantly increase its production of fossil fuels. It has in fact been doing that over the course of the past year or so as some energy producers attempt to exploit the high prices. However, it is questionable whether or not energy production will actually increase sufficiently enough to satisfy demand. As I have pointed out in the past, there are some companies that have been refraining from growing their production in order to maximize free cash flow.

In addition, Moody’s currently predicts that we will see a supply shock at some point since it seems highly unlikely that the industry will actually increase capital spending by the $542 billion annually that is needed to avoid such a scenario. After all, the industry is under tremendous pressure from politicians and environmental activists to increase the sustainability of its operations as well as pressure from investors to improve its returns. With that said though, we have been seeing some companies, especially in the Bakken shale, that are increasing production as long as energy prices remain high. As the balance between supply and demand points to this conclusion, we can assume that this will be the case. Crestwood Equity Partners’ largest source of production is in the Permian Basin so the company is likely to benefit from this.

Distribution Analysis

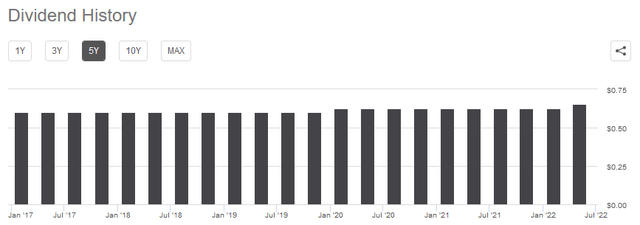

One of the biggest reasons to invest in Crestwood Equity Partners is its eye-popping 10.69% yield, which is obviously much better than the 1.58% yield of the S&P 500 index (SPY). Much more importantly, though, Crestwood Equity Partners has been remarkably consistent about its distribution over the years and was one of the midstream firms that did not have to cut its distribution in response to the events of 2020:

This consistency is undoubtedly something that will prove attractive to risk-averse investors that are looking to generate a stable and secure source of income. As is always the case though, it is critical that we ensure that the company can actually afford to make these payments as we do not want to be the victims of a distribution cut. Such a cut would almost certainly cause our incomes to decline as well as a decline in the company’s unit price.

The usual way that we judge a company’s ability to pay its distribution is by looking at a metric known as its distributable cash flow. A company’s distributable cash flow is a non-GAAP metric that theoretically tells us the amount of money that was generated by the company’s ordinary operations that is available to be distributed to the common unitholders. In the first quarter of 2022, Crestwood Equity Partners reported a distributable cash flow of $116.7 million but only paid out $64.2 million to the common unitholders. This gives the company a distribution coverage ratio of 1.82x, which is quite reasonable.

As a general rule, analysts consider anything over 1.20x to be sustainable, but I am more conservative and prefer to see this ratio over 1.30x in order to add a margin of safety to the investment. Obviously, Crestwood Equity Partners easily meets this requirement. It, therefore, appears that the company’s distribution is quite sustainable and investors should not be particularly concerned about a cut.

Conclusion

In conclusion, there appears to be quite a bit to like about Crestwood Equity Partners as an income. This is in spite of the fact that the units, in general, have performed poorly over the past year. The company boasts fairly significant growth prospects from its operations in the Bakken Shale and its very high and sustainable distribution yield is certainly nothing to sneeze at! The fact that the company has some long-term growth potential from the growing demand for natural gas and the desire of producers in the Bakken Shale to increase production in order to feed that demand adds further appeal to the company. Overall, this one is one of the most attractive names in the midstream space.

Be the first to comment