Iurii Garmash/iStock via Getty Images

Investment Thesis

Coterra Energy (NYSE:CTRA) is well-positioned to benefit from higher natural gas prices. But in reality, the real big kicker here will come into effect in 2023, as the majority of its hedges roll off.

I make the argument that Coterra is priced at very approximately 5x its 2023 free cash flows.

Meanwhile, investors will be able to sit back and see 50% of its free cash flows returning to shareholders. I estimate an 8.9% yield via repurchases and dividends at $36 per share.

Here’s why I rate Coterra a buy.

Coterra’s Near-Term Prospects

I first highlighted Coterra with a buy rating in April.

CTRA author’s coverage

Since then, a lot has changed. Not only has the share price jumped 26% in 2 months, but more importantly, the fundamental drivers have improved. In fact, as you can see below natural gas prices have shot up.

Trading Economics

And this is the crux of the argument. There’s been so much argument on the fringes about demand destruction. Why? Why would there be any significant demand destruction at $9 mmbtu? Don’t we need cooling in the summer? Don’t we need natural gas to produce fertilizer? What about the simple fact that we are an on-demand oil economy?

I hear some comments that California is becoming increasingly dependent on renewals and that EVs are going to dominate California soon. And I find those comments prosperous. I’m like, look at a map of the world!

There are billions of people that are desperate to get hold of energy to improve their quality of life. It makes absolutely no difference what California does or does not do.

We are an oil economy. And until there’s a fix to the structural imbalance between supply and demand, prices will remain elevated. It’s that simple.

That being said, there are some negative considerations we must keep in mind here.

Since I first highlighted Coterra as a buy, we’ve seen countless peers note throughout their earnings results that inflation has substantially crept into their input costs.

I’m talking about higher labor costs, supply chain disruption, and higher equipment cost all playing a role, not to mention inflation having a significant impact on margins throughout the oil field.

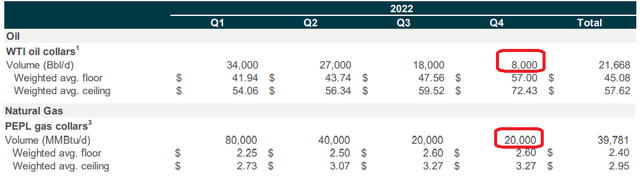

The other consideration to keep in mind is Coterra’s hedged book:

Coterra Q4 2021 earnings

Back in Q4 2021, Coterra’s oil hedges for Q4 were only 8,000 bbl/d. At the same time, natural gas hedges stood at 20,000 mmbtu/d.

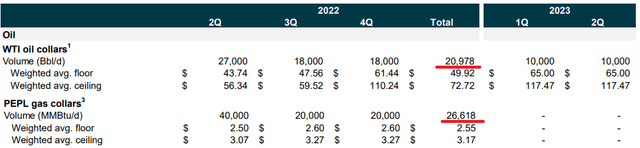

Fast forward to Q1 2022, and these hedges have gone up.

Coterra Q1 2022

For now, I would like to believe that Coterra will not look to aggressively hedge out its book in 2023, particularly when it comes to natural gas.

That said, during the earnings call, management said,

And we will continue, as we have in the past, we have a hedge committee. We were active again recently even in this week, and we will continue to lean in and monitor the market.

This is clearly something that could materially change the dynamics at play.

If Coterra has been too aggressive with its hedge book into 2023, there could be a substantial capping of the upside potential here.

I would like to believe that management is highly incentivized to prudently generate as much cash flow as possible, but that is still a consideration that I believe investors should keep in mind.

Financial Position is Improving

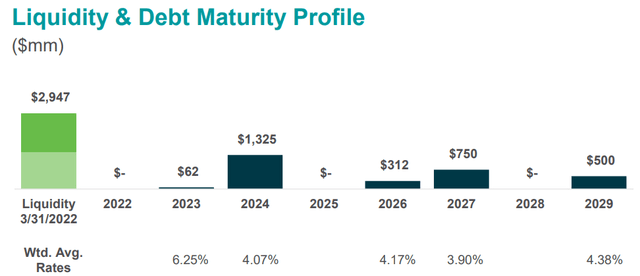

Coterra holds a balance sheet with investment-grade credit ratings. As of Q1 2022, it held a net debt to combined EBITDAX ratio of 0.41x. This figure assumes the two merged companies are combined under Coterra Energy.

Q1 2022 earnings

Furthermore, as you can see above, Coterra holds no near-term maturity, with 2024 being the next debt stack, at $1.3 billion.

Next, we’ll discuss Coterra’s capital allocation policy.

Capital Allocation Strategy, What to Think About

Coterra declares,

We remain committed to returning 50 percent plus of free cash flow via base plus variable dividends, supplemented by share buybacks and potential future debt reduction.

Coterra is committed to returning 50% of its free cash flow to shareholders. However, keep in mind the phrasing of the sentence above. Here Coterra has also signaled that future debt reduction would also count towards the 50% return.

That being said, as I noted above, Coterra hasn’t got any debt outstanding until 2024.

Hence, I would hope that Coterra would not be too aggressive in paying down its 4.07% 2024 notes when its equity carries a yield of nearly 20%. I believe that would be a total waste of capital at this juncture.

CTRA Stock Valuation – Approximately 5x 2022 Free Cash Flow

I suspect that Coterra will ultimately end up making around $5 billion to $6 billion of free cash flow this year.

However, the really big question is how much free cash flow will Coterra make in 2023?

Coterra Q1 2022 earnings

If we assume that Coterra will have at the midpoint a 25% hedged book, I estimate that its free cash flow could actually increase, and get closer to $7 billion of free cash flow at the current strip prices.

Of course, that’s a huge assumption and far from a guaranteed outlook.

The Bottom Line

Coterra is priced at very approximately 5x this year’s free cash flows and close to 4x free cash flow looking out to next year.

Given that its balance sheet is in terrific shape already, I believe that the bulk of its excess free cash flow will be returned to shareholders.

Yet, for now, Coterra has only signaled its intention to return 50% of its excess free cash flows to shareholders.

However, I believe that Coterra could go further than this when it reports its Q2 2022 results. Indeed, I suspect that investors could be positively surprised by its Q2 earnings.

In sum, I believe that total capital returns could approximate $2.5 billion as a run rate over the next twelve months. This equals an 8.9% shareholder returns are now on the cards.

Be the first to comment