hapabapa/iStock Editorial via Getty Images

Introduction

Charlie Munger serves as independent director of Costco (NASDAQ:COST). He is a long-term investor who is highly regarded for his principles, philosophy and, of course, his investment skills.

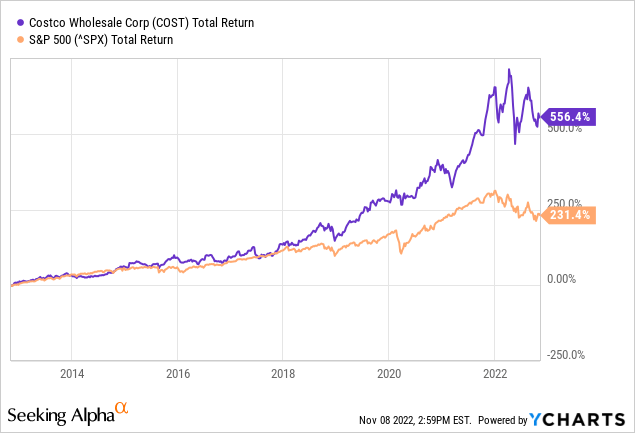

Costco is a sought-after stock, as evidenced by its rising share price over the past 10 years. Total stock price return averaged 20.6%. The sharp rise in share price makes the stock expensively valued. This reminds me of Coca-Cola in 1998.

The Fed’s current policy does not justify a high valuation of the stock. Costco will have to continue to perform in the coming years to justify this high share valuation. Unfavorable quarterly earnings could correct the stock significantly. Expectations for future earnings are high, and probably too high. Therefore, I think the share is a hold.

Earnings Are Strong

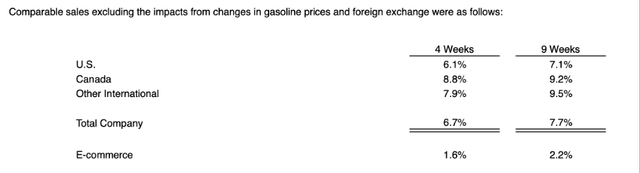

Costco reports its sales figures each month on its investor relations website. Sales increased less than the previous 9 weeks during the October retail month. Still, sales growth was good with 6.7% growth.

October retail month (Costco Investor Relations)

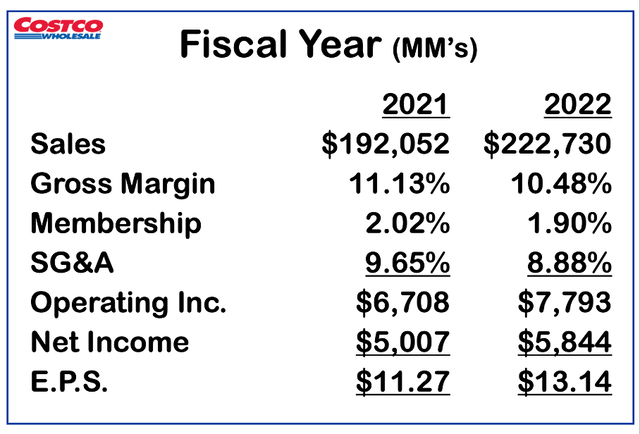

Costco is currently the third largest global retailer, with locations in the US, China, Mexico, Japan, the UK and so on. Costco’s fiscal year ends in August 2022, sales increased 16% year-on-year and gross margin improved to 11.13%. Due to higher SG&A expenses, operating income and earnings per share fell 14%.

Fiscal Year 2022 Earnings (Costco investor relations)

Expectations for the coming years are high. Analysts expect revenue growth of 7% and earnings per share growth of 12% for fiscal year 2024. Earnings per share growth of 15% is expected for fiscal year 2025. Analysts slightly lowered their expectation for earnings per share for fiscal 2025 to $18.82. The expected PE ratio for fiscal year 2025 is 26.

Dividends And Share Repurchases

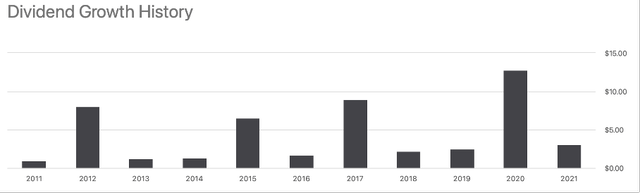

Costco pays a FWD dividend of $3.60 per share. At a share price of $490, this equates to a dividend yield of 0.73%. In recent years, Costco also paid a special dividend.

Dividend Growth History (COST Ticker Page On Seeking Alpha)

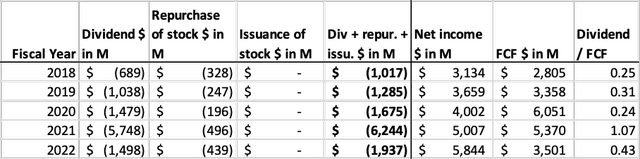

Management purchases its own shares so that dividends per share and earnings per share grow faster than consolidated earnings. The compound annual growth rate of dividend per share is 13%. In fiscal year 2022, management repurchased $439 million worth of shares, representing a repurchase yield of 0.2%.

Costco’s Cashflow Highlights (SEC and Author’s Own Calculation)

Both dividend payments and share repurchases combined are lower than free cash flow. As a result, Costco has a net cash position of $3.6B. The net cash position is advisable given the low operating profit margin of only 3.4%.

Valuation Looks Expensive

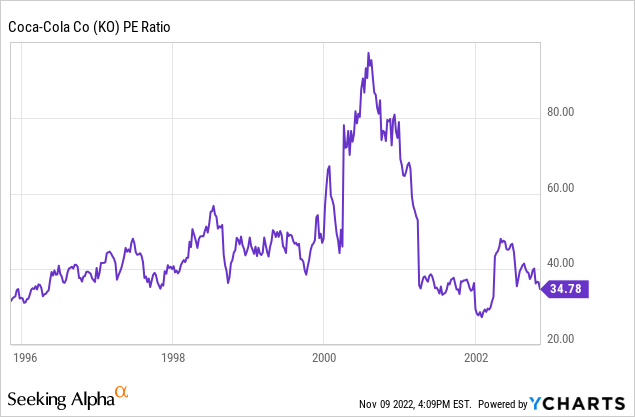

Costco’s total return over 10 years is stunning. Coca-Cola (KO) at the end of 1998 also showed stunning returns over the past 10 years. Coca-Cola grew strongly in sales, profits and free cash flow. And the strong cash flow was distributed to shareholders through a dividend and a robust share repurchase program. As a result, dividends per share and earnings per share grew stronger than earnings growth. Investors were enthusiastic and bought the shares en masse, giving Coca-Cola a PE ratio of nearly 50 by the end of 1998.

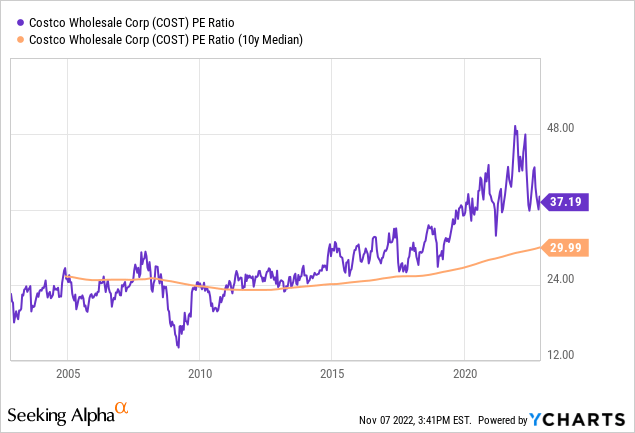

When I compare Coca-Cola with Costco, I see quite a few similarities. Costco also had a PE ratio of about 50 in 2022.

Coca-Cola reported lower earnings in 1999. The high valuation of the stock was not justified for the profit decline. From 1998, Coca-Cola fell from $44 peak to $19 in 2004. Representing 6 years without share price growth.

Over the past 20 years, Costco’s stock valuation has increased strongly. The 10-year average PE ratio stands at 30, still very high compared to average measures of the S&P500.

Investors should keep a close eye on Costco, as the stock’s valuation is very high compared to that of the S&P500. Costco expects strong growth in sales and earnings per share in the coming years, and does not expect stagnation. The projected PE ratio for 2025 is 26, but this high valuation is not sustainable during a rising interest rate environment. Costco will have to perform to deliver on this high stock valuation, any doubts about sales and earnings growth could push the stock downward. Costco is a growing company, but at a high valuation. There are better opportunities in the market.

Conclusion

Costco is a sought-after stock, as can be seen by its sharply rising share price. Over the past 10 years, the total return of the stock averaged 20.6%, including dividend payments. Charlie Munger serves as independent director of Costco. His principles, philosophy and investment skills add great value to Costco. Costco is the third largest retailer operating internationally. Sales increased 16% year over year in fiscal 2022. High SG&A costs reduced earnings per share by 14% year over year. Management is very shareholder-friendly by paying dividends and buying back shares. Costco does not return all of its cash to shareholders and thus has a net cash position of $3.6B on its balance sheet. This is favored to absorb any setbacks because of its low profit margin of 3.4%. Expectations for the coming years are high: analysts expect strong growth in sales and earnings per share. The enormous optimism of investors has led to high stock valuations, the expected PE ratio for fiscal 2025 is 26. The 10-year median PE ratio is 30, which is very high by today’s standards as the Fed raises interest rates. Due to the high valuation, I expect little growth in the share price and Costco will have to perform to make the stock worthy of valuation. Therefore, I think the stock is a hold.

Be the first to comment