xefstock

Investment thesis

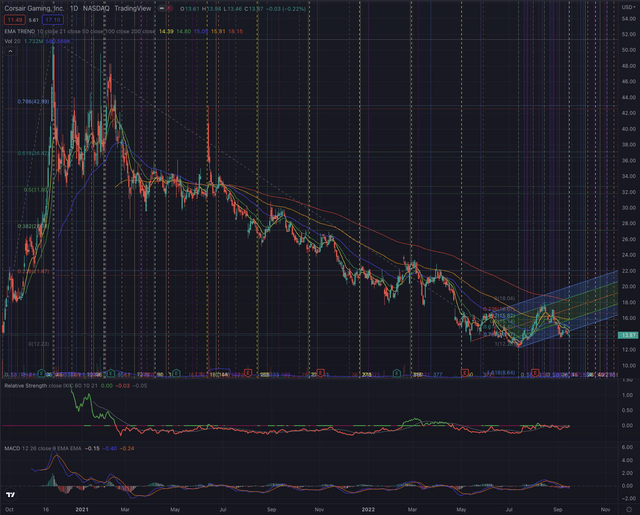

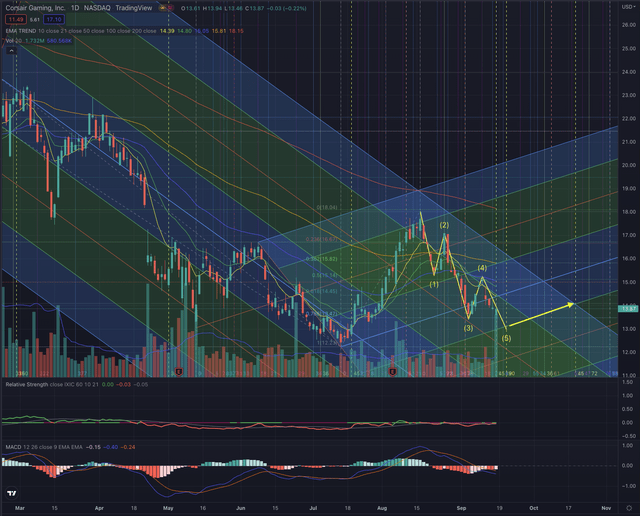

Corsair Gaming, Inc. (NASDAQ:CRSR) has been in a downtrend since February 2021, by significantly underperforming its industry, with just sporadic relative strength. The stock bottomed on July 14, 2022, and is trying to form a sound base from where it is eventually trying to break out. Although fundamentally the stock could offer some opportunities, technically the risks are still significantly overweighting. The recent price action suggests a higher likelihood for further weakness with a first price target seen at $13 and a possible retracement from that level until $14-$14.50, in an attempt to form a stronger base from where the stock may try to break out from its overhead resistance. A failure of these assumptions is likely to lead the stock to test the lows of July, and further could lead the stock to the next target seen at $11.90.

A quick look at the big picture

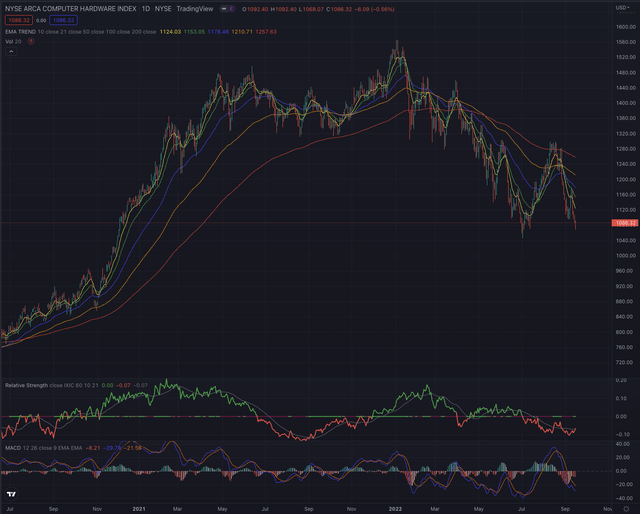

The technology sector in the US is among the winners in the last 3 months, led by a rebound in solar stocks, followed by companies in the consumer electronics and software application industries, while companies in the computer hardware industry are still among the losers of the group.

The NYSE Arca Computer Hardware Index topped in January 2022 and has since severely corrected, losing more than 33% until July 5 when it bottomed and immediately rallied 24% in an attempt to reverse the long-term downtrend. After being rejected at its EMA200, the reference index followed through in its downtrend and is now approaching its low set in July, while showing significant relative weakness when compared to its reference.

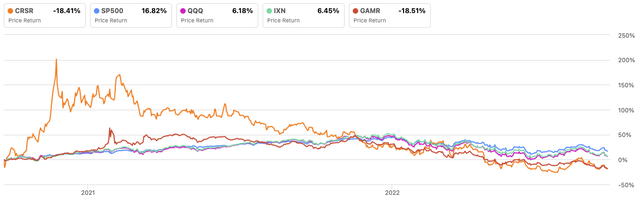

Looking back even further, Corsair significantly underperformed its main reference indexes, reporting -18.41% performance since its IPO on September 23, 2020, in line with the negative performance of the Wedbush ETFMG Video Game Tech ETF (NYSEARCA:GAMR), but significantly lower than the iShares Global Tech ETF (NYSEARCA:IXN) and the broader tech market.

Author, using SeekingAlpha.com

Where are we now?

Since my last article Corsair: There May Be A Good Reason For Its Actual Valuation published on February 17, where I warned of a possible extended negative performance, the stock lost more than 40%, by even breaking under its low of 2020.

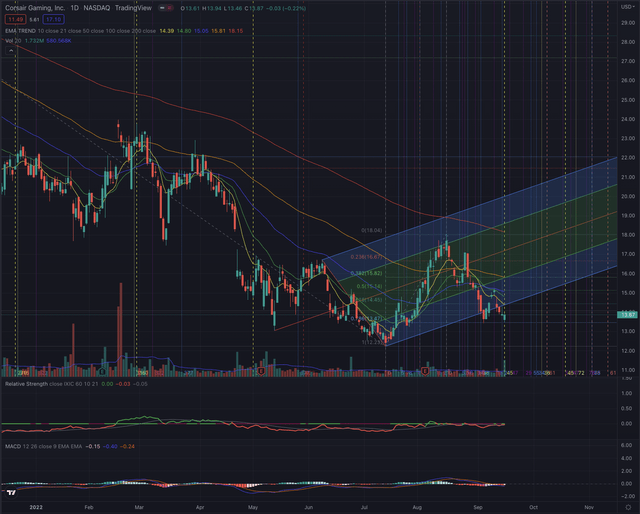

Recently the stock bottomed at $12.23 on July 14, 2022, and formed a rally with increasing volume, projecting the stock 24% higher over the following month. The stock got rejected on a strong resistance at $18.04 and has since lost more than 25% of its value, by failing in its attempt to reverse its medium-term downtrend with all its most important moving averages suggesting the bottoming process isn’t still completed.

Although some relative strength seems possibly building up, the stock still shows a strong negative momentum confirmed by its MACD, and relatively stronger selling pressure. It will need substantial volume and conviction to overcome the strong overhead resistance now formed by its EMA50, which just rejected an early breakout attempt, and further the already confirmed strong resistance levels.

What is coming next

I expect the stock to continue to underperform its reference industry and sector, while some sporadic relative strength can offer some short-term opportunities, the stock seems to be more likely to form a sideways movement or continue in its downtrend.

The stock is completing its impulse sequence, which could likely lead to the last leg down until around $13. At that level, a phase based on a new Elliott corrective sequence could likely begin. My projection, based on Fibonacci’s theory, suggests the most likely price target to be around $14-$14.50 if the stock doesn’t pull back more in its mentioned last leg. If the stock fails to follow this modelization, the next possible target would be the lows seen in July at $12.23, with a significant risk to see even lower price levels, with a first target estimated at $11.90.

Investors should observe the price action and how the stock behaves at the next support levels, and how an eventual attempt to overcome its resistances is confirmed or rejected, by particularly observing the trading volume in both directions. As the last session showed a substantial spike in buy-side volume, this should eventually be confirmed by a slowdown in the actual negative trend, but it’s too early to make any statement in this sense. I don’t see a significant chance for the stock to rise above the mentioned strong overhead resistance levels in the near term and would particularly observe the EMA50 at this price level, as it could serve as a trailing resistance and lead to further weakness.

The bottom line

Technical analysis is not an absolute instrument, but a way to increase investors’ success probabilities and a tool allowing them to be oriented in whatever security. One would not drive towards an unknown destination without consulting a map or using a GPS. I believe the same should be true when making investment decisions. I consider techniques based on the Elliott Wave Theory, as well as likely outcomes based on Fibonacci’s principles, by confirming the likelihood of an outcome contingent on time-based probabilities. The purpose of my technical analysis is to confirm or reject an entry point in the stock, by observing its sector and industry, and most of all its price action. I then analyze the situation of that stock and calculate likely outcomes based on the mentioned theories. Corsair has many elements that indicate the stock is a long-term laggard in its industry, and its downtrend seems to be intact, despite recent attempts to overcome significant resistance. I see the stock likely falling further until $13 from where it could start a short-term retracement, and would wait until a clearer setup would manifest, and most of all, a sound base has formed. Today the stock is still highly speculative and despite fundamentally it may show its opportunities, from a short-to-medium-term perspective it’s not a stock I would like to own, as the likelihood to test the recent lows and even fall further, is still too high.

Be the first to comment