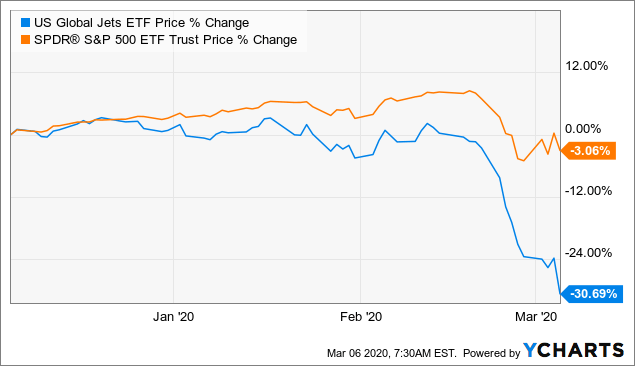

The airline stocks have been battered by the coronavirus stock market. The outbreak first impacted the markets on Jan. 23, 2020. From there it climbed to a new record high on Feb. 19, 2020 before entering a volatile correction. JETS is an ETF that tracks the airline stocks. 48% of the ETF is made up just four major airline stocks: LUV, DAL, UAL and AAL.

JETS has fallen 29.8% from the height of the market compared with just 10.7% for the S&P 500. Over a slightly longer period dating back to before the coronavirus outbreak in December, JETS fares even worse against the S&P 500.

Data by YCharts

Data by YCharts

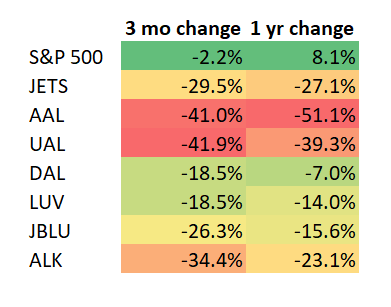

There is quite a significant deviation of movement for airline stocks. This variance is even larger when comparing one-year movements and then again against the three-month movement.

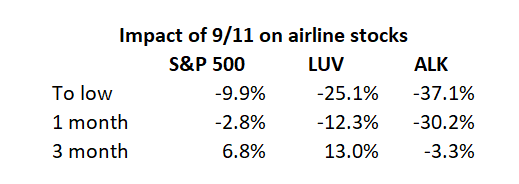

In trying to understanding the long-term impact of coronavirus on the sector it is worth considering the impact of 9/11 on the airline sector. At the time the stock markets were closed for several days, so the initial panic sell did not occur with its usual extreme level. The S&P 500 hit its low on Sept. 21, 2001 at 9.9% below its Sept. 10 level. It had pretty much recovered within one month and three months later was 6.8% up.

At the time LUV and ALK were both traded stocks. There was initial extreme disruption to flight schedules and significant confusion about the implication to security measures. There was also significant consumer fear. As the S&P 500 hit its low on Sept. 21, LUV was down 25.1% and ALK 37.1%.

At the three-month mark, despite significant changes to airport and airline security, the industry had recovered and the average return of the two stocks was 9.7%, even slightly above those of the S&P 500.

At the three-month mark, despite significant changes to airport and airline security, the industry had recovered and the average return of the two stocks was 9.7%, even slightly above those of the S&P 500.

The percentage fall of the stock market caused by the coronavirus crash is similar to that seen after 9/11. The fall in the airline sector is also similar. The big question is whether the disruption caused by covid-19 will be longer lasting than that of 9/11.

There are two good reasons to be more optimistic than not. Firstly, there are several vaccines being actively developed that could be released to the general public within months. Second, the warmer weather of the spring and summer may halt the virus’ spread. Irrespective of this, it is unlikely the world will learn to live without air travel. It is too much a part of our routine and rhythm. Therefore it is likely that the industry will learn to adapt to covid-19.

In conclusion, the response of the airline stocks to 9/11 was similar to their current response to the coronavirus. Within three months, performance of the airlines had recovered after 9/11. That pattern is a good bet now. JETS is an ETF worth considering to get exposure to the sector.

If you enjoyed this article, please follow me via the button above.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in AAL, JETS, UAL, DAL, LUV, ALK over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment