South_agency/E+ via Getty Images

One thing that almost every person has in common is the love of some sport or game. Although there are a number of companies with different areas of emphasis that cater to this sort of almost universal desire, one prospect that investors should take a close look at is Escalade, Incorporated (NASDAQ:ESCA). Despite experiencing some volatility in recent years, the company has done well to grow its business over time. This was most recently demonstrated in the firm’s first quarter earnings release for its 2022 fiscal year. On top of this, shares of the company are currently trading at levels that should be considered cheap. All combined, this makes the enterprise a compelling ‘buy’ opportunity at this time.

A company focused on fun

The management team at Escalade focuses on manufacturing, importing, and distributing popular sporting goods brands across a variety of different categories. Examples include brand names such as Bear Archery and Trophy Ridge under the archery category, STIGA and Ping-Pong under the table tennis category, Goalrilla and other related brands under the basketball goals category, and so much more. The company also focuses on other product categories like pickleball, play systems, fitness offerings, safety products, game tables like hockey and soccer, water sports, billiards tables and accessories, darting, and outdoor games like Zume Games and Viva Sol. As of the end of its latest fiscal year, the company said that 21% of its sales were attributable to Amazon‘s (AMZN) website. It generates a further 11% of sales from DICK’S Sporting Goods (DKS). The company also owns distribution and manufacturing properties amounting to roughly 1.24 million square feet, plus it leases a further 154,000 square feet of other assets.

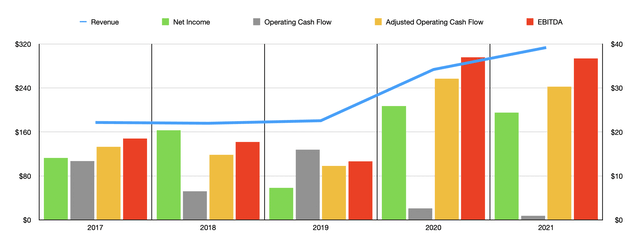

Over the past few years, the company’s top line has been surprisingly attractive. Revenue increased from $177.3 million in 2017 to $313.6 million last year. It is worth noting that most of this increase came since the end of its 2019 fiscal year. From 2019 to 2020, sales grew by 51.6%, climbing from $180.5 million to $273.6 million. Management attributed much of this revenue increase to strong demand across almost all of its product categories thanks to increased product placement and high demand for outdoor and fitness products. In 2021, sales rose by a further 14.6% due in large part to their outdoor product categories like archery and pickleball, as well as other product categories management did not discuss in detail.

Profitability for the company has been a bit mixed. Over the past five years, net income has ranged from a low point of $7.3 million to a high point of $25.9 million. In 2021, the company generated net profits of $24.4 million. Operating cash flow has been similarly volatile, ranging from a low point of roughly $1 million to a high point of $16 million. Last year was the low point for the business. However, if we adjust for changes in working capital, the picture looks a bit different. The range here is from a low point of $13.3 million to a high point of $32.1 million. In 2021, this metric came in at $30.3 million. A similar trend could be seen when looking at EBITDA, with the metric ultimately totaling $36.7 million last year.

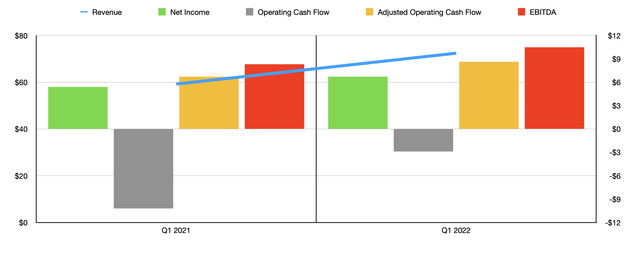

Before the market opened on April 14th, the management team at Escalade reported financial performance for the first quarter of its 2022 fiscal year. Revenue came in at $72.4 million. This represented an increase of 22.3% over the $59.2 million the company generated one year earlier. It also beat analysts’ expectations to the tune of about $9.7 million. Once again, management attributed this rise in sales to strong organic growth across many of the company’s product categories. However, another contributor to the increase was the acquisition of Brunswick Billiards.

On its bottom line, the company also delivered. Earnings per share totaled $0.49. Not only was that higher than the $0.39 reported one year earlier, it was also $0.21 greater than what analysts anticipated. Expressed in dollar terms, the company’s net profits increased from $5.4 million to $6.7 million. Although the company saw its gross margin shrink, declining from 29.5% of sales to 27.8%, selling, general, and administrative costs declined from 16.7% of sales to 14.5%. Unfortunately, management did not provide any significant details on why this change took place. There are, of course, other profitability metrics to look at. Operating cash flow went from a negative $10.2 million in the first quarter last year to negative $2.9 million the same time this year. Adjusting for changes in working capital, it went from a positive $6.7 million to a positive $8.6 million. Over that same window of time, EBITDA for the company increased from $8.3 million to $10.5 million. Management has not provided any guidance for the 2022 fiscal year. But if we assume that the first quarter of the year will be indicative of the rest of the year, then investors should expect net profits of about $29.8 million, operating cash flow of $38.9 million, and EBITDA of $46.4 million.

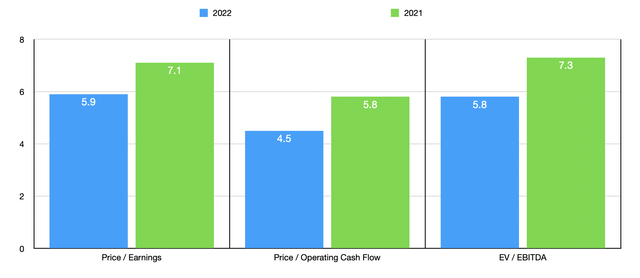

Taking all of these figures, we can effectively price the business. Using 2022 estimates, the firm is trading at a price-to-earnings multiple of 5.9. This compares to the still low 7.1 reading that we get if we use 2021 results. The price to adjusted operating cash flow multiple would be 4.5. This is down from the 5.8 if we use the 2021 results. And the EV to EBITDA multiple for the company would be 5.8. That compares to the 7.3 reading we get if we rely on 2021 results. For the purpose of being conservative, I decided to compare the company’s 2021 multiples to the multiples of five similar firms. On a price-to-earnings basis, these five firms ranged from a low of 5 to a high of 10.9. Only one of the five prospects was cheaper than Escalade. Using the price to operating cash flow approach, the range was from 7.4 to 119.1. In this case, our prospect was the cheapest of the group. And finally, using the EV to EBITDA approach, the range was from 4.3 to 8.6. In this scenario, two of the five companies were cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Escalade | 7.1 | 5.8 | 7.3 |

| Vista Outdoor (VSTO) | 5.0 | 8.4 | 4.3 |

| Brunswick Corporation (BC) | 10.0 | 10.3 | 7.4 |

| Sturm, Ruger & Company (RGR) | 8.2 | 7.4 | 4.5 |

| Callaway Golf Company (ELY) | 9.2 | 14.0 | 8.6 |

| Johnson Outdoors (JOUT) | 10.9 | 119.1 | 5.6 |

Takeaway

Based on the data provided, I can say that Escalade makes for a compelling opportunity for value-oriented investors. Given the company’s low market capitalization of $174.3 million, it definitely does not have the robustness that larger players might. But at the end of the day, the company is doing well to grow its top line and to generate attractive cash flows. This was demonstrated most recently in the first quarter of its 2022 fiscal year. Add on top of this the fact that shares of the company look attractively priced on both a relative basis and on an absolute basis, and I cannot help but think that it offers some attractive upside moving forward.

Be the first to comment