Buena Vista Images/DigitalVision via Getty Images

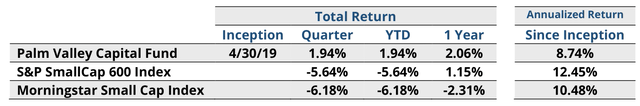

INVESTMENT PERFORMANCE (%) as of March 31, 2022

“And I will not play my hand just yet.” -Jimmie’s Chicken Shack, “Dropping Anchor”

Dear Fellow Shareholders,

We’re currently recruiting investors to work as volunteer counselors at your local County Juvenile Detention Center. The role would require two hours of your time per week for a minimum of two years.

You would serve as a Big Brother (Sister) to one of the boys (girls) at the detention home. Would you be interested in one of these positions? No? Would you at least be willing to chaperone a group of juvenile delinquents on a trip to the zoo for about two hours one afternoon or evening?

Just kidding.

In 1973, the famous psychologist Robert Cialdini (author: Influence) conducted an experiment on reciprocal concessions where 72 random subjects on a university campus were first asked the extreme Big Brother request above, which when declined was followed by the smaller request. Other students were only asked the smaller request to be a zoo chaperone for two hours. Everyone who was asked to mentor troubled youth for two years refused. However, three times as many subjects from this group subsequently agreed to be a one-time chaperone as those who were only asked to be a one-time chaperone (50% vs 16.7%). The authors of the study wrote:

“It is clear from the findings…that making an extreme initial request which is sure to be rejected and then moving to a smaller request significantly increases the probability of a target person’s agreement to the second request.“

The anchoring effect is powerful.

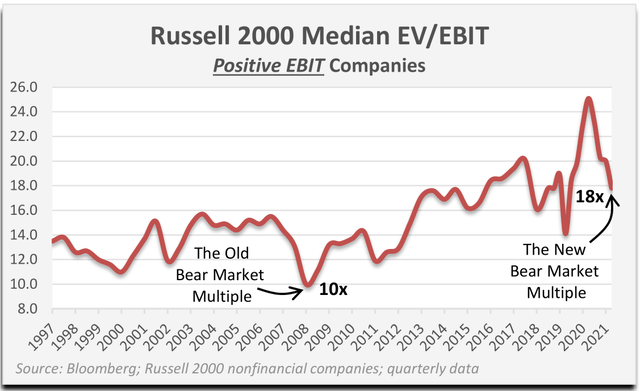

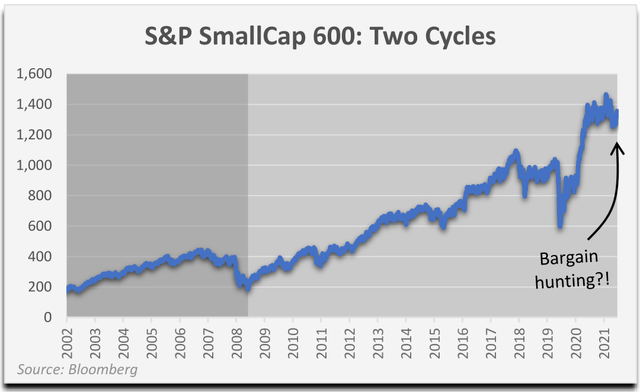

It’s been well-documented that investors anchor to peak prices, no matter how extreme. On January 27, 2022, the Russell 2000 Index reached a decline of more than 20% from its November 2021 peak. At one point in the first quarter, the S&P 500 had fallen 13% from its record high. A February 11, 2022, article from the Wall Street Journal was titled, “The Stock Market Hasn’t Looked This Cheap in Nearly Two Years.” Two whole years, you say? Stock prices were more than 50% lower in March 2020. A couple of decades ago, if you would’ve told investors that nearly half of publicly traded nonfinancial small caps would be unprofitable and that the median valuation of the profitable ones would be 18x EV/EBIT after they entered a so-called bear market (20% decline), the reaction may have been, “You must be joking,” instead of, “Let’s go bargain hunting.”

Given the extended duration and magnitude of the bull market that began in 2009, it may be tempting for disciplined investors to deploy capital at the first signs of market pain. For money managers, there is immense pressure to act. If you wait too long, you might miss the boat. However, if you buy too early, you could still face a material drawdown. We’re not good at predicting what’s going to happen to the market in the near-term, so we’ve chosen to not play that game. We buy individual stocks when they meet our expected double-digit return criteria.

While the pullback from November to late January temporarily improved the attractiveness of many small cap securities, the decline did not produce panic or a significant number of undervalued equities, in our opinion. That the drop felt severe to some demonstrates that many investors’ expectations are anchored to high-water marks. The modest turbulence in equities in 2022 has not unwound the impact of the last dozen years of Fed excesses, with the pillars of quantitative easing and paltry interest rates, topped off by a fiscal splurge of epic proportions. No, not even close. We are reminded of family vacation road trips when the kids asked if we were almost there before the car had even made it out of our hometown. If investors zoom out to examine the history of market cycles, the scale of the existing bubble should be apparent. Let go of the anchor!

Inflation dominated the investing news cycle in the first quarter. Analysts are predicting a 9% year-over- year increase in the cost of living for March, driven by surging energy, food, and shelter costs. The Bureau of Labor Statistics’ shelter estimates continue to lag reality, with only a 4.7% year-over-year rise in housing costs reported for February 2022, compared to a 17% increase in rents nationally (Zillow Observed Rent Index). The average price of a new car is $45,000 versus $22,000 twenty years ago, while the hedonically- adjusted CPI claims new car prices have risen only 18% over that period.

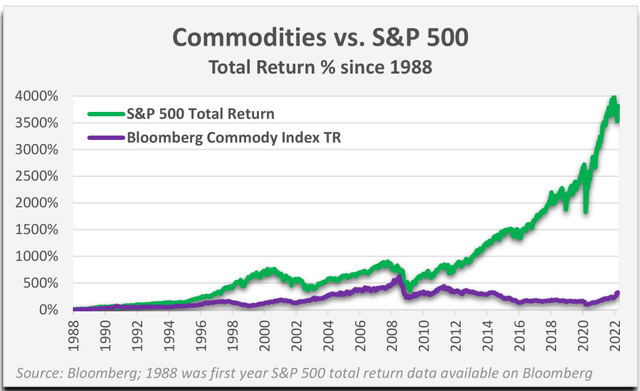

Politicians have transitioned from assuring the public that inflation will be transitory to casting blame for it, and usually in the wrong direction. While commodity prices are contributing to the current acceleration in inflation, a basket of commodities (energy, grains, metals, livestock, etc.) is still underwater from the 2008 zenith (Bloomberg Commodity Index). Real estate, in contrast, has been pushing to new highs since 2017. Meanwhile, financial assets have shot to the moon. Astonishingly, the Fed’s reputation, which should be in tatters, remains sterling across the upper socioeconomic class, who frequently turn a blind eye to the destructive long-term effects of Fed policies. Absurdly, Chairman Powell is being compared to Paul Volcker because Powell reluctantly raised rates 25 basis points and promised more. The last time inflation was registering in the high single digits, the Fed funds rate exceeded the CPI and you could earn a positive real yield on a bank CD.

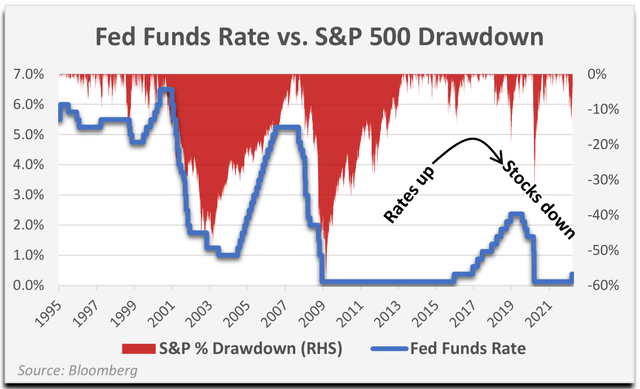

During the first quarter, interest rates saw the light of day for the first time in two years, as the bond market began pricing in Fed hikes. In real terms, cash is still suffering mightily, but at least cash is now growing slightly on a nominal basis. Unfortunately for many equity investors, the market’s track record after a series of rate hikes is not bullish.

Chairman Powell recently acknowledged that deglobalization could give legs to inflation being sustained above levels experienced over the last generation. The U.S. job market is scorching hot. While we think current inflation will eventually moderate, especially if new stimulus programs are not renewed, how much damage to purchasing power will have been done? In this case, the Fed will undoubtedly channel its inner Elsa: “The past is in the past! Let it go!” Those in power benefit from asset inflation because it allows them to borrow and spend without a viable fiscal plan. However, when inflation strikes the broader population by elevating the cost of living beyond wage gains and accentuates the economic disparity between those with financial assets and those without, politicians and their enablers are eventually forced to feign compassion. There are currently multiple harebrained bills brewing in Congress to “fix” inflation by handing out more checks and reducing the incentive for energy firms to drill.

“Homes Earned More for Owners Than Their Jobs Last Year” (Wall Street Journal, March 17, 2022). That’s a headline tailor-made for an asset bubble. Nevertheless, if the year-to-date boost in interest rates persists, it seems unlikely that real estate will escape unscathed. The jump in mortgage rates has pummeled housing affordability. During the first quarter, bonds experienced some of the steepest declines ever. The 10-year U.S. Treasury has lost 7% of its value this year, while the 30-year bond is down 11% in 2022 and more than double that since August 2020.

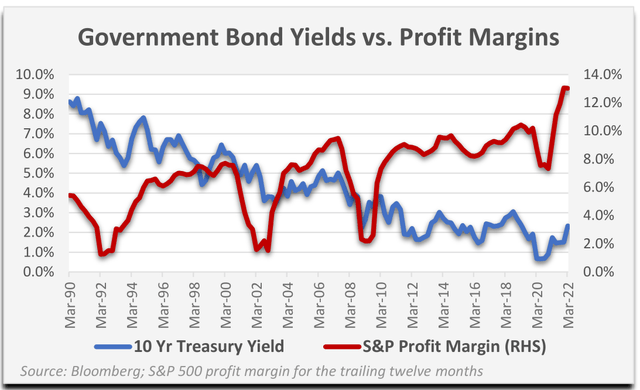

Equities, those long duration assets, have mostly withstood the march higher in interest rates, as investors are conveniently ignoring the new adverse input to valuation models in favor of re-embracing the “stocks are inflation hedges” narrative. Equity valuations withered significantly during the 1970s inflation and started from more reasonable levels back then. Additionally, corporate profit margins have thrived from the multidecade tailwind of declining interest rates. If falling rates have been favorable for profitability, shouldn’t higher borrowing costs have the opposite effect?

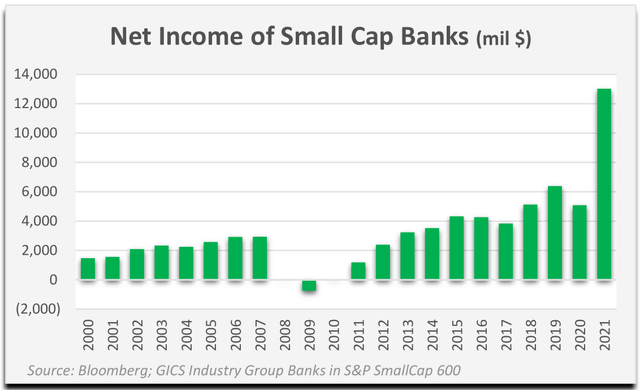

The past year was the first time ever that aggregate small cap earnings actually achieved the forward estimates established by analysts one year earlier (SmallCap 600 Index), due to the GDP revival that came from record government spending. For many small caps, we believe unsustainable earnings are creating the illusion of lower valuations, which is a reversal from the prior year, when multiples jumped on the profit hit from COVID lockdowns. In 2021, small cap bank net earnings were more than double any previous year.

Retailer profits exploded higher during the pandemic. Many of these companies are trading at low multiples of trailing earnings, as investors assume lower normalized cash flows (appropriate, in our judgment). Oil and gas producers are finally delivering returns, while most energy service businesses are losing money, as they’ve endured a newfound spending restraint by their customers. We also saw how quickly sentiment can shift when growth companies stop growing, after investors hacked $200 billion off Meta’s market capitalization on February 3rd. Much further down the quality and capitalization food chain, 271 of the 293 biotechs in the Russell 2000 Index reported losses over the trailing twelve months. Comes with the territory, we suppose, but at $248 billion of aggregate index market cap, the small cap biotechs still outweigh small cap energy firms ($224 billion), even after the recent commodity spike.

Precious metals shined during February and early March and were one of the few assets that rose in value during the risk-off period. The combination of accelerating inflation and a desire for safe havens spurred by Russia’s invasion of Ukraine lifted gold prices near the 2011 record of $2,075 per ounce. The U.S. government froze Russia’s U.S. dollar currency reserves, leading many to believe that potential targets of sanctions would be wise to own gold instead of U.S. Treasuries. Time will tell. We wonder whether the financial warfare tactics will have longer-term repercussions for the dollar’s reserve currency status. We aren’t brave enough to predict the end of the exorbitant privilege-we’re only pointing out that recent developments could shift some demand for dollars to gold.

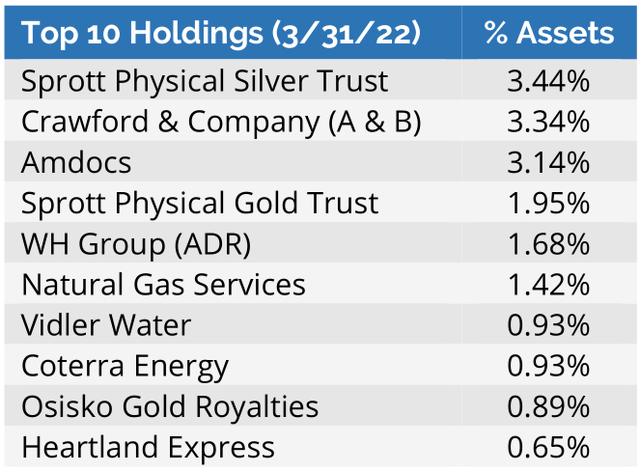

During the quarter ended March 31, 2022, the Palm Valley Capital Fund (the Fund) gained 1.94% versus a 5.64% decline in the S&P SmallCap 600 and a 6.18% drop in the Morningstar Small Cap Index. The Russell 2000 fell 7.53% for the quarter. The Fund’s securities (ex-cash) gained 10.85% over the three months and were primarily bolstered by gains in our precious metals and energy holdings. Cash ended the period at 80% of Fund assets.

The Fund benefited from the flight to hard assets in Q1. Our energy, gold, and silver securities appreciated during the beginning of the quarter while most other stocks were falling, and we reduced our positions. We sold completely out of Dril-Quip (DRQ) and Triple Flag Precious Metals (OTCPK:TRFPF) after they reached our valuations, although neither was a large holding. Commodities sold off into quarter end, when we had a smaller, but still important, weighting. There were no positions negatively impacting the Fund by more than 10 basis points during the quarter. The top three contributors to the Fund’s first quarter return were Coterra Energy (CTRA), Sprott Physical Silver Trust (PSLV), and Amdocs (DOX).

We acquired three new stocks over the first quarter: Heartland Express (HTLD), Preformed Line Products (PLPC), and Miller Industries (MLR). While many of the companies on our buy list fell in Q1, they were generally declining from lofty levels. The prices did not reach a level where we believed we could meet our required return threshold. Additionally, stocks partially rebounded in the last two weeks of March.

Founded in 1978, Heartland Express is an established short-to-medium haul trucking company serving the entire United States. Since going public in 1986, Heartland has grown revenues from $22 million to $607

million in 2021. Heartland has differentiated itself by keeping its equipment new and deliveries on time. As an efficient provider of premium transportation services, Heartland has a long history of generating above average profit margins and has received multiple customer service awards.

Although Heartland produced record earnings last year, its revenues declined as the company reduced its fleet. Similar to other transportation companies, Heartland is having difficulty finding enough qualified labor to fill its trucks. We believe the challenging labor market and decline in revenues has contributed to Heartland’s poor stock performance (down 28% from its 2021 high). Heartland has been on our possible buy list for many years, and we were pleased to see its stock trade below our calculated valuation. We believe the company is a high-quality cyclical business that has historically generated abundant free cash flow and has maintained one of the strongest balance sheets in the industry.

Preformed Line Products (PLP) makes products that protect, connect, terminate, and secure cables and wires for energy, communications, and cable networks. The products are often used to revitalize aging infrastructure to reduce lost revenue from events like malfunctioning power lines or fiber optic cables. Approximately 70% of U.S. transmission lines are over 25 years old, and many are well past their original life expectancy.

Repair work occurs after emergencies or natural disasters such as hurricanes, tornadoes, and floods. The 75-year-old company has established a strong competitive position by investing in technology and manufacturing its own products. PLP’s performance trends with the capital spending of utilities (~two- thirds of revenue) and communication service providers (~one-third of revenue) around the world. International sales account for half of revenue. While operating results are cyclical, free cash flow is consistently positive. Insiders hold a third of the shares. The company owns most of its real estate.

PLP’s stock price had fallen with the broader market and over concerns about the impact of raw materials cost inflation. We acquired shares near 6x trailing operating profit and very close to tangible book value. Shortly after we began establishing our position, the company disclosed strong fourth quarter results, including a more than doubling of its backlog from the prior year.

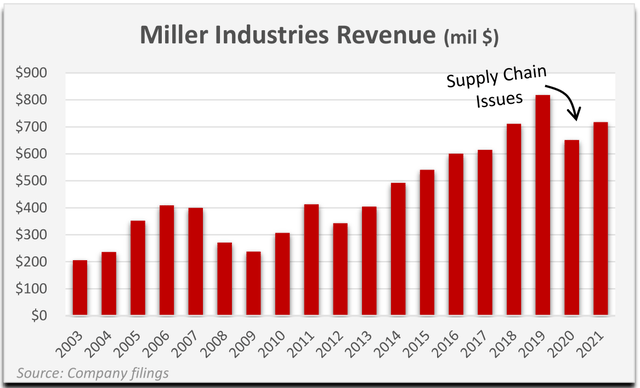

Miller Industries (MLR) is the world’s largest manufacturer of tow trucks and is based near Chattanooga, Tennessee. Its only major domestic competitor is Jerr-Dan, a division of Oshkosh Corporation (OSK). Miller has grown towing equipment revenues at a 10% organic compound annual rate since exiting its towing services operation in 2003. The company invested heavily in modernizing and expanding its U.S. manufacturing facilities, and the firm also sells to European customers. Demand for tow trucks is primarily connected to miles driven of U.S. vehicles and the age of the fleet. Miller’s earnings fell significantly but remained positive during the 2008 recession, when tow truck operators who buy from the company’s distributors found it more difficult to finance purchases. Miller’s stock initially held up well during the COVID pandemic, despite temporary business pressures. The shares peaked at $47 in April 2021 but retreated below $30 in 2022. Tangible book value per share is $24.

While Miller is currently benefiting from record demand, supply chain disruptions and labor shortages have prevented the company from capitalizing. Miller produces the vehicle body but relies on other manufacturers for the chassis that completes a tow truck. The company raised prices four times in 2021.

While the firm is still run by the Miller family, their ownership in the business has significantly decreased over the years. As with Heartland Express and Preformed Line Products, Miller Industries is a cyclical small cap business with a solid balance sheet that has endured through multiple business cycles.

During the first few weeks after we launched the Palm Valley Capital Fund on May 1, 2019, when we only owned a few stocks, changes in the Fund’s Net Asset Value (NAV) were rare. As small cap investment turtles, we would get excited when our NAV gained a penny. We would also cringe a bit when we lost a cent. In fact, we briefly toyed with the idea of including the image below on our website as Palm Valley’s motto. EveryPennyCounts. One of us even jokingly assigned the other the nickname Pennywise.

You’ve probably heard the advice, “Don’t be penny wise and pound foolish.” In other words, don’t safeguard pennies while risking pounds (dollars). Applied to investing, its meaning could adapt to a range of styles, and the risk can be an opportunity cost too. For example, Palm Valley would be penny wise and pound foolish if we tried to time the absolute bottom before deploying capital as opposed to acting when implied returns become attractive. Other investors might be penny wise if they thought they could scalp additional multiple expansion on valuations that are already bursting at the seams, thereby risking a material loss of capital. This is more commonly known as picking up nickels in front of a steamroller.

Given the popularity of Stephen King’s IT, nowadays “Pennywise” evokes thoughts of a killer clown instead of aphorisms about using money prudently. The witty, red-nosed Pennywise dwelled in the sewers and preyed on the unique fears of members of the Losers Club (an organization familiar at times to any experienced absolute return investor!). Poor little Georgie ‘s fate was sealed in a storm drain after the clown asked him if he wanted a balloon.

Georgie: “Do they float?“

Pennywise: “Oh yes, they float, Georgie. They float. And when you’re down here with me, you’ll float too!“

We aim to deliver a successful outcome to you over a full cycle by consistently applying a well-grounded investment process. Our portfolio is nimble, and our approach is anchored by a respect for financial history and our experience navigating past cycles. The peak-to-trough market losses in these cycles were severe, and unmoored investment strategies often fared poorest because they changed positioning at the worst time. A disciplined process with an appreciation for downside risk can avoid such pitfalls, in our opinion. Before confronting a market storm, you want to ensure your mental anchor reaches the metaphorical seabed reflecting true bear market capitulation.

There was a short-lived period in the first quarter of 2022 when investors feared how Putin would respond to global isolation and a crumbling Russian economy. By quarter end, peace discussions were afoot, and U.S. stocks had recovered all losses since the invasion. When we consider the foremost risks to U.S. equities, one stands above all others: What happens if Americans stop viewing the Federal Reserve as an economic candy man and instead as a millstone around the neck of our country’s future?

The past year made clear that the Fed’s priority was nurturing the asset bubble more than preventing inflation from accelerating. What if everything the Fed has done to preserve the economic illusion comes crashing down along with their credibility? Such bearish outcomes have been predicted for years, and

since they haven’t come true, the Fed has been increasingly emboldened. While there are many things for stock investors to be concerned about today-inflation, rising interest rates, debt, tough earnings comparisons, and war-valuations appear to imply that none of these will derail the bull market. We worry that the perspective of too many investors has been biased by their recent experience when buying dips is always rewarded. Turn on the TV, read financial websites, or talk to friends, and the message is the same: buy stocks and you’ll float too! Far be it from us to stand in front of those chasing returns, but we sincerely hope they aren’t blind to the attendant risks.

We’re all living with a bubble. How many are living in the bubble?

Thank you for your investment.

Sincerely,

Jayme Wiggins & Eric Cinnamond

Definitions:

Basis point: One hundredth of a percentage point (0.01%).

Bloomberg Commodity Index: A broadly diversified commodity index distributed by Bloomberg that tracks prices of futures contracts on physical commodities.

CPI (Consumer Price Index): A measure that examines the weighted average of prices of a basket of consumer goods and services.

EV/EBIT:EV/EBIT represents the Enterprise Value of a company (Market Capitalization – Cash + Debt) divided by its trailing twelve-month Earnings Before Interest and Taxes (i.e., operating income).

Federal Funds Rate: The interest rate banks charge each other for lending money on an overnight basis.

Free Cash Flow: Free Cash Flow equals Cash from Operating Activities minus Capital Expenditures.

GDP: The total value of goods produced and services provided in a country during one year.

Hedonic adjustment: Adjusting prices when the estimated quality of a good changes.

NAV:Net Asset Value is the value of an entity’s assets minus its liabilities.

Quantitative Easing (QE): Monetary policy where a central bank purchases government bonds or other financial assets to create liquidity in an economy.

Russell2000:The Russell 2000 Index is an American small-cap stock market index based on the market capitalizations of the bottom 2,000 companies in the Russell 3000 Index.

S&P500:The Standard & Poor’s 500 is an American stock market index based on the market capitalizations of 500 large companies.

Tangible book value: Shareholders’ equity, or total assets excluding goodwill and other intangibles minus total liabilities.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment