nevodka/iStock via Getty Images

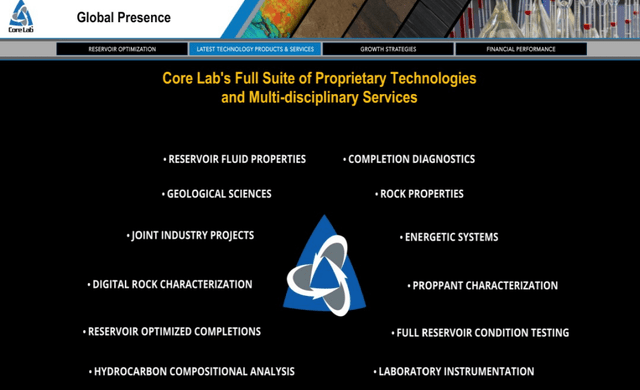

Core Laboratories N.V. (NYSE:CLB) is a leading provider of reservoir description and production enhancement services to the oil and gas industry. Simply put, energy companies hire Core Labs to perform testing and categorization of resource deposits as part of their development and production activities. The company’s technology is also used to optimize the life cycle of oil and gas fields to maximize recovery.

With energy prices at the highest level in a decade, the attraction here is an expectation that the sector CAPEX cycle is set to ramp up considering oil companies are flush with cash in a positive earnings environment. Core Labs is well-positioned to capture the increasing demand for its value-added services through a global footprint and diversified customer base. We are bullish on CLB with a view that stronger growth going forward supports a positive outlook that can add upside momentum to the stock.

CLB Fundamentals Recap

CLB last reported its Q4 earnings back in February highlighted by an ongoing improvement against deeper pandemic disruptions in 2020. Q4 revenue at $125 million, came in slightly above expectations and up 10% year-over-year. The company was able to achieve profitability with non-GAAP EPS of $0.20, which compares to $0.18 in the period last year.

The result was achieved despite higher cost pressures across raw materials, labor, packaging, and transportation costs amid headline-making global supply chain issues. Management is carrying larger amounts of inventory to mitigate disruptions. Overall, this was the company’s best quarter since Q1 2020 with the leverage ratio at 2.1x also narrowing and approaching pre-pandemic levels suggesting the financial trends are moving in the right direction.

By operating segment, Q4 and 2021 benefited from strength in the “Production Enhancement” group with revenues of $45 million, up 15% y/y. The business here includes integrated diagnostic services to evaluate and monitor the effectiveness of well completions and oil recovery projects. Momentum in the international markets was also a strong point in Q4.

On the other hand, the “Reservoir Description” operations which is more of the lab work related to the analysis of petroleum reservoir samples posted moderate growth, up just 2% y/y. Management noted initial work on a large reservoir evaluation project in the Middle East that had been delayed by local government-imposed Covid shutdowns. This type of post-pandemic reopening dynamic is expected to boost growth through 2022.

That said, ongoing Covid challenges were a theme during the Q4 earnings conference call with the Omicron-variant wave ending up affecting nearly 15% of its workforce facing quarantine restrictions into Q1. There is also a seasonally component with an expectation for typically softer demand at the start of the year compared to particularly larger orders in Q4.

Furthermore, the company released an update in mid-March with comments noting the impact of the ongoing Russia-Ukraine conflict. For Core Labs which had operations in the region, management sees a marginal hit to Q1 results and revised its quarterly revenue guidance into a range between $110 and $113 million compared to a prior estimate closer to $119 million. Favorably, the company expects to remain profitable with a Q1 2022 EPS estimate between $0.05 to $0.08. Looking ahead, the comment for the rest of the year is that the 2022 outlook is still positive, projecting a “multi-year international cycle to unfold”.

CLB Stock Price Forecast

Core Laboratories is expected to report its Q1 results on April 27. Outside of any major surprises, we believe the stock can gain momentum with positive comments from management assessing the operating environment through Q2 working as an upside catalyst.

Recognizing what is thus far modest growth and earnings trends, the picture improves looking out towards 2023 and 2024 with the company benefitting from a more normalized operating environment.

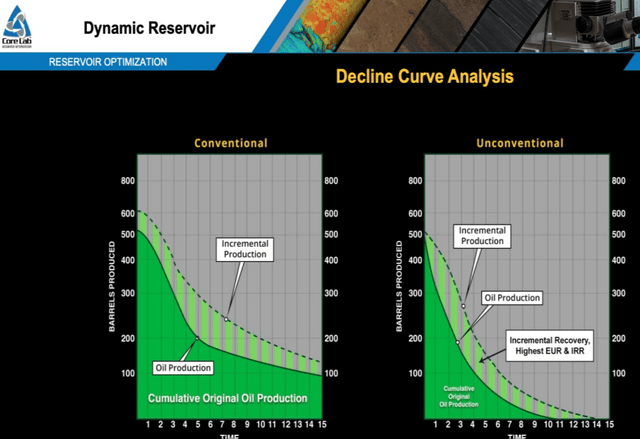

The thinking here is that oil companies between major national oil companies, and independent oil and gas operators are on track to have a record year in 2022 and will begin to expand their investment budgets, taking on new projects representing a tailwind for CLB. The selling point for the company is the data that shows its production enhancement solutions flatten the oil well decline curve which translates into improved client IRR and cash flows. These measures are critical for companies looking to maximize margins and extract the most value from their assets.

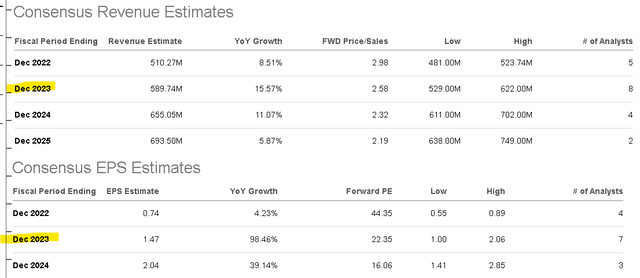

According to consensus estimates, the market is forecasting CLB 2022 revenue to reach $510 million, up 9% y/y but picking up towards 16% in 2023 and 11% in 2024. The top-line momentum is also expected to support higher earnings with EPS accelerating from a forecast of $0.74 this year to $1.47 in 2023, a 98% increase.

We make the case that these estimates are not only in reach but possibly conservative given the current strength in the sector. The potential that CLB can outperform expectations by consolidating its leadership position and growing market share is part of the bullish case for the stock.

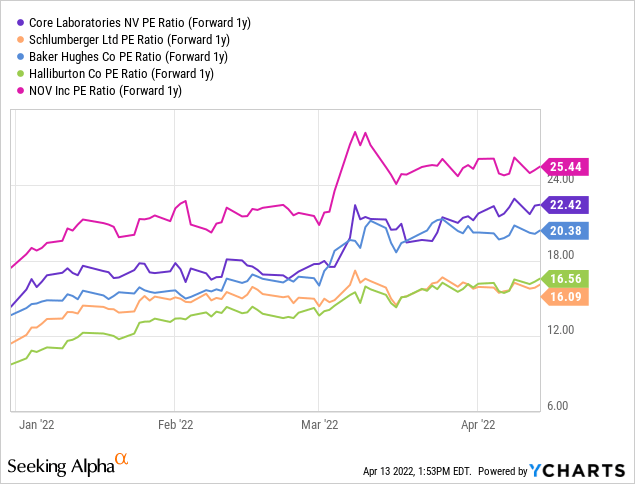

In terms of valuation, the metrics we’re looking at include the 1-year forward P/E of 22x on the consensus of 2023 which is in the context of double-digit revenue growth and earnings expected to nearly double next year. This measure is at a premium compared to a peer group of oil services stocks like Schlumberger Limited (SLB), Baker Hughes Co. (BKR), Halliburton Co. (HAL), and NOV Inc. (NOV), for example, with an average for the group closer to 20x.

Still, we believe this earnings premium is justified given Core Lab’s unique profile within the industry and what is a stronger earnings growth outlook relative to the sector.

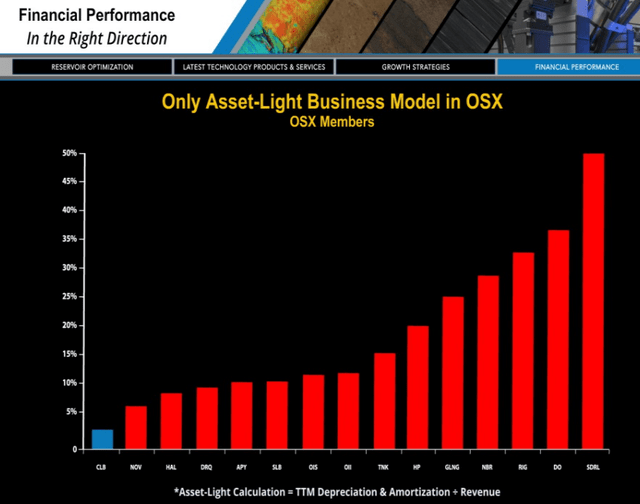

Recognizing these oil service companies are different, one advantage of CLB is its “asset-light” business model is more related to services compared to the other names that are more focused on rigs and drilling equipment. CLB notes that it has the lowest capital asset depreciation expense as a percentage of revenue relative to the industry. Over time, this dynamic should support higher margins with less cash flow volatility.

Is CLB a Buy, Sell, or Hold?

Core Laboratories is an overall solid small-cap oil services stock that is a good option for energy investors that are bullish on the commodity price but looking for some diversification away from pure-play oil and gas producers.

We rate CLB as a buy with a price target for the year ahead at $45 representing a 1-year forward P/E of 30x on the current consensus EPS. With the strong oil and gas pricing, the demand for Core Laboratories reservoir description and production enhancement services gets a boost which can ultimately lead to stronger than expected top-line and earnings trends.

The company remains exposed to global macro conditions. The main risk would be the potential of a sharp slowdown in global economic activity hitting the demand for oil and sending prices sharply lower which would force a reassessment of the company’s earnings outlook. Similarly, weaker than expected results over the next few quarters can also open the door for shares to decline. The operating margin and free cash flow trends are key monitoring points going forward.

Be the first to comment