mabus13

Global X Copper Miners ETF (NYSEARCA:COPX) is appropriate for those who want to avoid looking into the nitty gritty of individual copper mining names in order to pick stocks. Instead, as shown in the table below, the exchange-traded fund (“ETF”) provides exposure to some of the world’s largest miners.

Top Holdings (www.globalxetfs.com)

For investors who are interested to put some money at work into COPX, which pays dividends at a 30-day SEC yield of 3.27%, I provide some insights into the opportunities provided by copper mining, but first, it is important to understand the factors which determine the ETF’s price action.

Understanding the Price Action

Looking at its uses, copper remains the third most used metal in the world after iron and aluminum and one of the oldest to have been mined by man, with the first copper objects dating back more than 6,500 years. The reddish-colored metal is an excellent thermal and electrical conductor which makes it popular in the electrical industry for the manufacturing of cables, batteries, and electronic circuits as well as for piping uses in refrigeration and transport. Moreover, just like gold and silver, it is ductile and easily malleable and is also widely used in alloys such as bronze or brass.

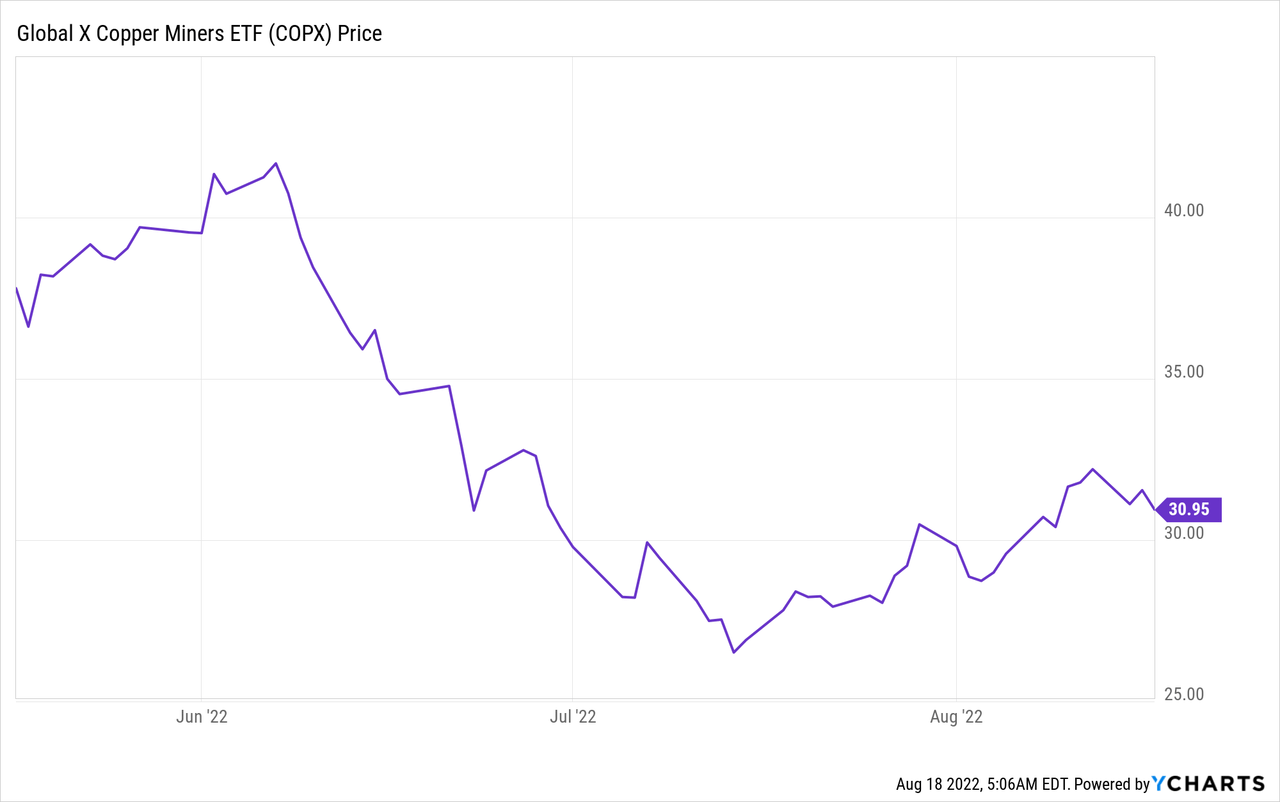

The price of copper is particularly sensitive to economic conditions and often when there are talks of recession, the price of the commodity tends to fall, as has been the case since May of this year when it has become increasingly evident that rising rates by the Federal Reserve in order to combat inflation may have unintended consequences on the economy. There has also been some adverse economic data coming from China, the world’s largest manufacturing base, processing a significant quantity of copper used today in the world, after the mining step.

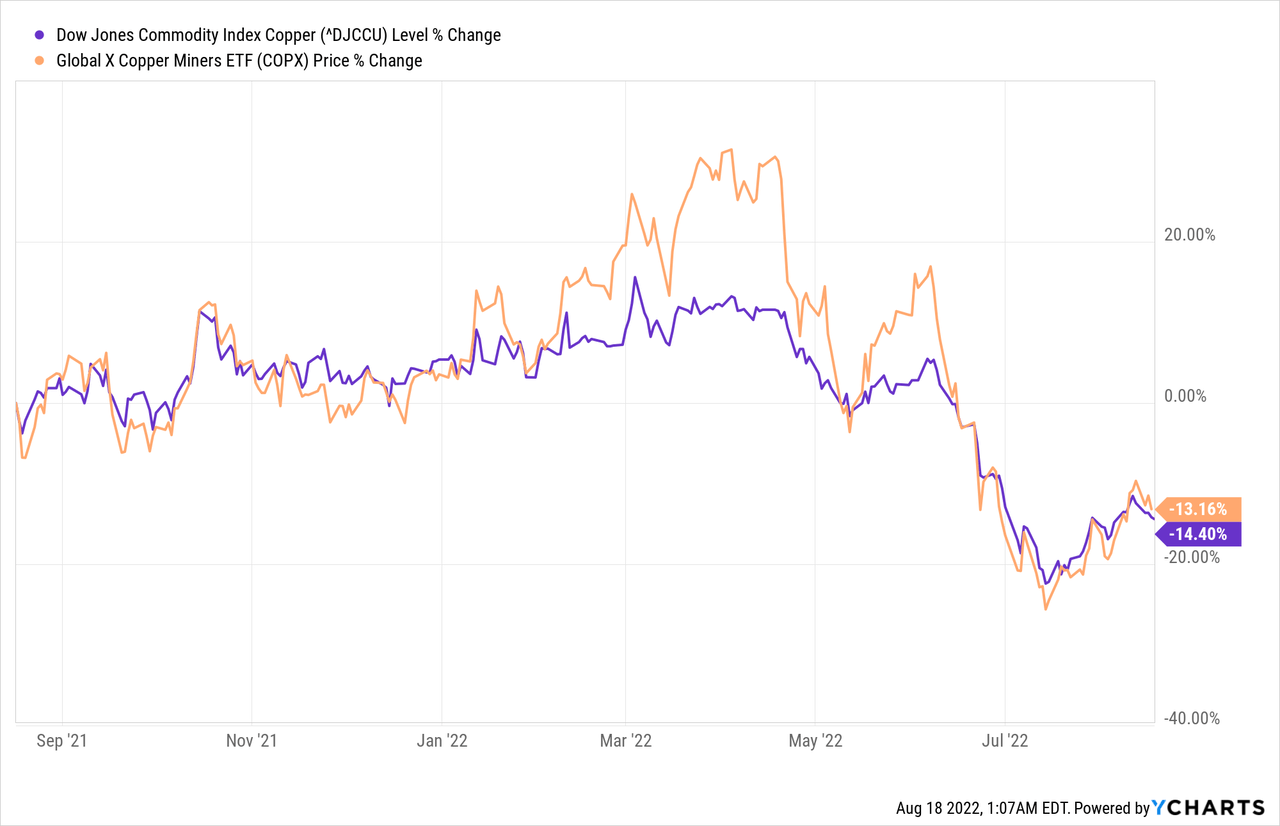

As a result of the above uncertainties, the Dow Jones Commodity Index Copper has been trending down since May as shown by the blue chart below. The effect was also felt on COPX (orange chart below) as lower prices mean fewer profits for miners.

Now, there is a debate among the investment community about whether the Fed can usher in a soft landing in the economy. Also, China’s zero-Covid-19 policy which consists of imposing drastic lockdown measures for whole cities and regions has resulted in reduced industrial activity. These two factors as well as high energy costs impacting Europe’s economic powerhouse or Germany have brought fears of a global recession.

In these circumstances, it is unlikely for the price of copper to rise rapidly to its April highs in the short term.

On the other hand, the different miners whose shares are held by COPX have their own operating models which they use to optimize on costs of production, and depending on their financial results, their stocks can rise or fall, in turn, determining the ETF’s price performance. However, as evidenced by the above charts, it is the price of the commodity which largely determines COPX’s share price.

Thus, this ETF can be used as an alternative to investing in commodities directly and it is also attractive due to the fact that it pays dividends too, which makes it a buy for buy-and-hold income-seeking investors. Thus, I explore the long-term drivers.

Long-Term Drivers Like Energy Transition

While everyone seems to be focused on lithium, copper should also play a determinant role in the energy transition together with nickel, cobalt, graphite, and rare earth metals. According to a new report by S&P Global, the demand for copper globally will reach approximately 53 million metric tons by 2050. By comparison, only 23.5 million metric tons were consumed in 2020.

As to nations that are most likely to benefit the most from the energy transition, first, there are the countries that are leaders in the extraction of minerals like Chile, Australia, Peru, Russia, and others. Now, out of the identified reserves, 75% lie in just 13 countries.

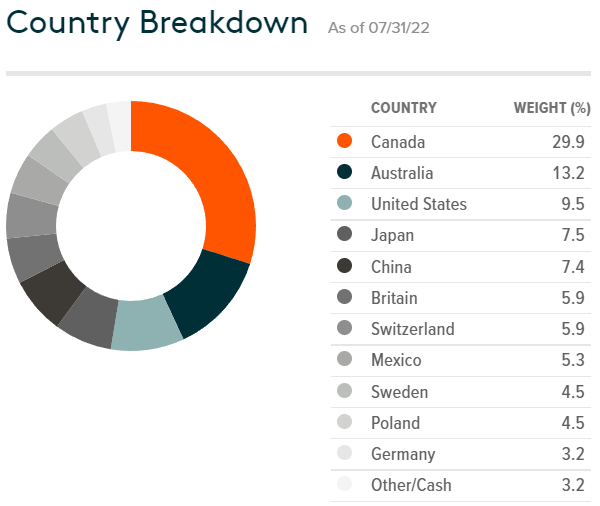

The country breakdown below essentially shows where the miners held by COPX are domiciled. Their operations lie elsewhere in the countries I just mentioned, except for Australia, which has about 10% of the world’s identified reserves.

Country Breakdown (www.globalxetfs.com)

Second, there are those countries that lead the processing or transformation of the extracted copper ore to items like sheets, pipes or wires. Here, there is essentially China, and this is one of the reasons other countries have been keen to put forward their own energy transition plans. Thus, geopolitical factors also play in the drive for renewable energy, in addition to the need for carbon emission reduction.

Now, it is difficult to predict which miners will benefit the most from the energy transition because it will ultimately depend on where they are positioned in the value chain, as well as government policies, both in the country where copper is mined and, to where they are exported to. Again, for those who do not want to go into the details of identifying which stock exhibits the best risk to reward ratio, the ETF option to invest in copper makes sense.

Pursuing further, in view of their rising importance, I envision that copper miners should play a broader role in the energy transition during the coming years and scale their market values just like the oil majors which dominated the stock markets in the 1980s.

Viewed from this angle, it comes as no surprise that in the midst of high inflation and the Ukrainian conflict the U.S. Administration has invoked the Defense Production Act to stimulate domestic production of critical minerals where there is too much reliance on other countries, namely China for batteries used in EVs (electric vehicles) and clean energy grids. The aim of the act is also to involve America’s partners and allies which ultimately means that the country-weight which is currently a combined 68.3% (as per the above chart for the U.S., Canada, Australia, Britain, and Mexico) should increase.

However, stimulating production will not be an seamless task as there are other market dynamics that have to be considered in order to position oneself on this ETF.

Exploring Market Dynamics

First, as seen by the early June upside in the value of COPX, output from copper mines could not keep pace with rising demand, as supply still remains tight.

Second, after being commissioned, mining projects to extract metals can take more than a decade to become fully operational, and therefore shortages in copper are likely as more renewable projects go online, motivated by high oil prices. Also, there are disruptions preventing more supplies to reach the market such as energy issues impacting production in drought-impacted Sichuan or Covid-19-related lockdowns potentially blocking workers to reach factories in other parts of China. Exploring further, there may be shortages in German copper pipe production as factories cannot switch to diesel from natural gas in time. Consequently, there are a number of events which may decrease supply, but may also play against demand as industrial activity declines.

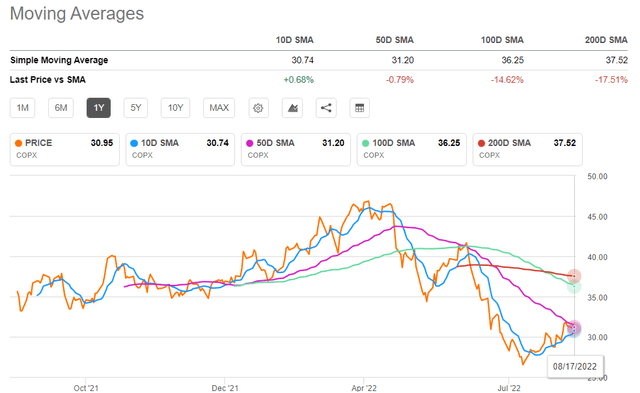

Looking for market indicators, commodity specialists remain divided as to whether copper will rise or fall from its current price of $7,974.85 per ton. This position seems to be confirmed by COPX’s price momentum with the price being only slightly above the 10-day SMA and remains below the 50-day SMA. This means a lack of direction, whether on the way up or down.

Momentum factors (seekingalpha.com)

Thus, I have a neutral position on this ETF, which I consider to be more of a long-term buy.

Conclusion

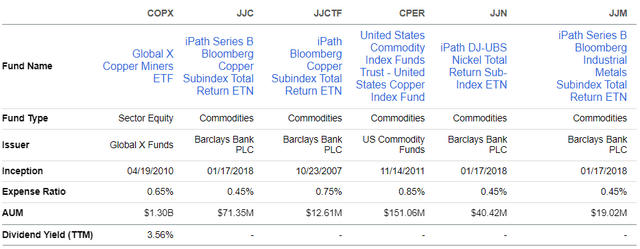

As an active ETF that charges 0.65% of fees to manage its 41 holdings (as of August 16), COPX should see significant changes in its holdings as more mining projects are commissioned by miners from the U.S. and its allies in view of the energy transition to green.

Its main advantage is the number of assets under management which at $1.3 billion, way above peers as shown in the table below. It pays dividends, too. Thus, COPX represents a better way of getting exposure to copper than ETNs, or exchange-traded notes.

Comparison with peers (www.seekingalpha.com)

Finally, after having considered economic slowdown risks as well as reduction in supply due to a fall in industrial activity, it is difficult to evaluate copper prices in the short term. On the other hand, upbeat demand in the longer term as a result of the energy transition should be beneficial for COPX, whose above-3% dividend yields remain attractive.

Be the first to comment