aapsky/iStock via Getty Images

Investment Thesis

Although the airline industry supply and demand remain slightly imbalanced, and revenue per passenger is growing at a record pace, companies will not fully pass the rising costs on to the consumer. The main problem remains oil, and in particular the crack spreads that have skyrocketed. We believe that in terms of cost management next year will be even harder for Alaska (NYSE:ALK) than the current one. The stock has exhausted its potential given the margin decline, so we don’t recommend buying at current prices.

High passenger yields will stay there for some time

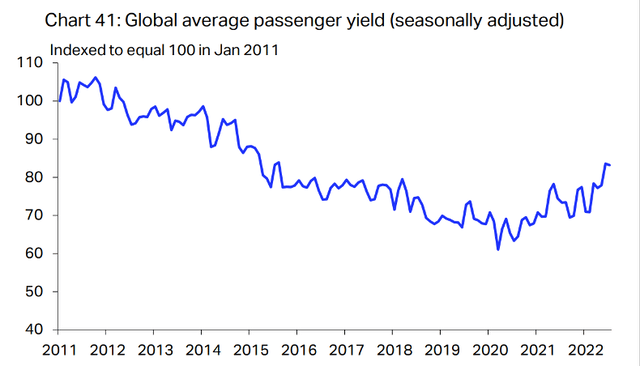

The recovery in demand for air travel services after the pandemic has significantly driven up airline fares, according to IATA. While the domestic demand in the US has almost recovered to its pre-pandemic level, supply is still constrained by labor shortages and spare fleet after the 2020 cuts.

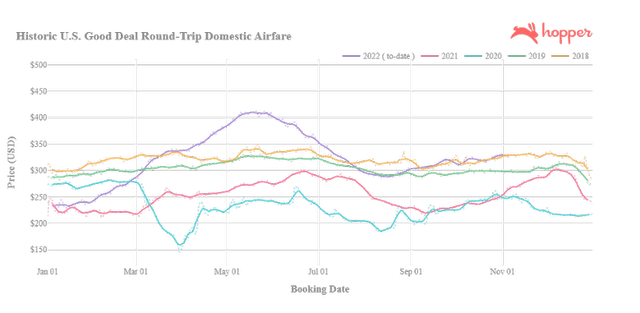

Thus, due to imbalance of supply and demand, consumers are willing to pay high rates for airline tickets. Although prices slightly normalized this fall, according to Hopper Media, they are still quite high, and we believe they are unlikely to decrease soon. First, fuel prices remain high, which is usually considered by carriers when setting prices, and second, the current rate of fleet supply is insufficient for a quick recovery.

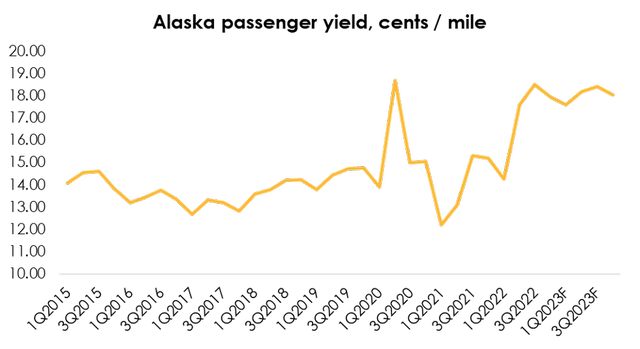

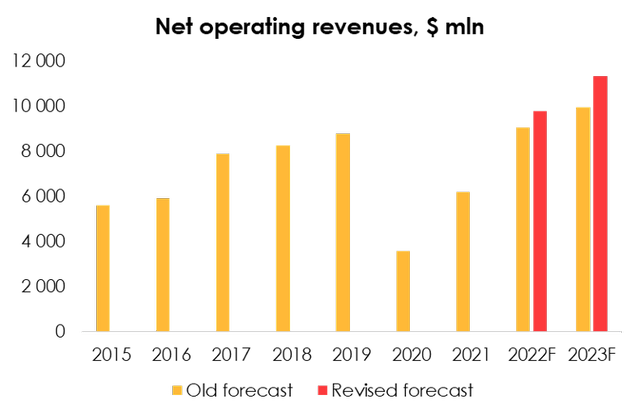

We believe that strong revenue growth per passenger of Alaska Air Group is not a one-time phenomenon, and in 2023 we expect Passenger Yield to average 18.07 cents per mile.

Since Alaska Airlines is planning a significant fleet renewal, we expect the total capacity to increase to 62 731 mln miles (+12.89% YoY). Thus, we estimate revenue to be $11 306 mln in 2023 (+15.68% YoY).

Labor deal

In addition to PP&E disposal, there were massive job cuts in the airline industry in 2020, involving pilots. Airlines faced labor shortages after the pandemic and are still affected. This results in regular flight postponements and fewer flight hours.

The pilots’ union demanded to improve working conditions, and after prolonged discussions, a deal was agreed with almost all airlines. The terms of the deal vary widely among companies, so pilots have reacted differently to the agreed-upon measures. In some companies (e.g., United Airlines) the original terms did not satisfy the union, so the company had to raise wages additionally.

Alaska immediately offered good terms, which in our opinion, look even too loyal relative to actions of other companies.

- The wage increase will depend on the pilot’s seniority and may be up to 23%.

- The Air Line Pilots Association (ALPA) will be involved in scheduling flights, schedule will be more flexible.

- Post-service payments will be increased.

- Career advancement will be negotiated within the company.

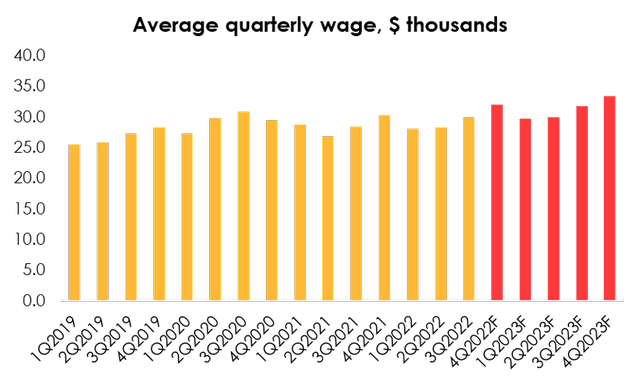

We originally expected a 15% wage increase over three periods but have revised our average wage forecast to reflect the terms of the deal. Even though there are ~3 000 pilots per average FTE (~23 000), even a conservative 13% wage increase would add about 2% YoY growth to the total average wage increase.

We believe that generosity of Alaska Airlines to its own employees may slow down the company’s return to high profitability. Although ticket prices are dramatically increasing, the industry remains quite competitive, and consumers may have hard times reacting to further strong price increases despite the persistent supply shortage.

Crack-spreads will likely expand

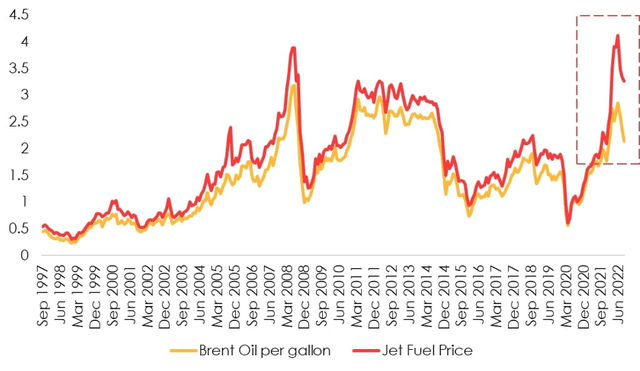

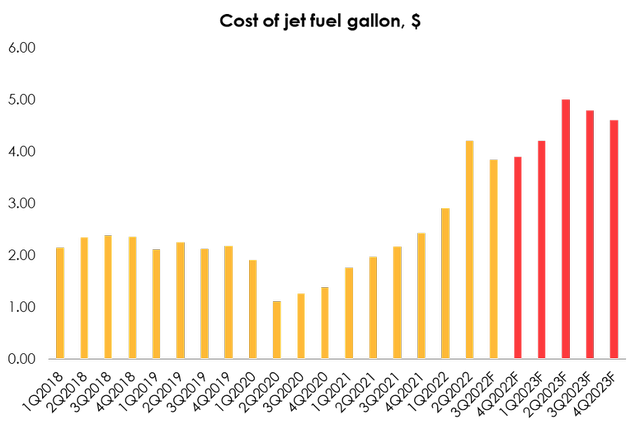

Fuel is the largest expenditure item for airlines. In case of Alaska, it represents ~30% of the company’s total operating costs. Even though we’ve seen oil price drop in summer and fall, jet fuel prices continue to be very high.

According to IndexMundi, in September the crack spread was ~ $1.11, or more than 50% of the cost of a gallon of Brent crude. The historical average is ~20%.

We believe that it relates to sanctions on Russian oil and refusal of insurance companies to work with Russian exporters.

In our view, this spread will expand further in Q4 2022 – Q1 2023 due to increased sanctions pressure on Russia and reduction of oil export (by 2 mbd) and petroleum products export (by 1.4 mbd).

Meanwhile, we maintain our overall view on the oil shortages in 2023 and expect it to be at $95 per barrel in 2023 due to OPEC+ production cuts.

Although Alaska is hedging the cost of fuel by buying Brent derivatives, this strategy will not be effective in the face of greatly increased crack spreads as the fuel cost per gallon remains more volatile than oil.

Thus, we expect strong cost increases for Alaska Airlines next year. While the company has been quite successful in passing the cost of fuel on to the consumer, to return to the zone of high margin either a strong drop in the oil cost, or a fare hike of another 15-20% is necessary.

Due to high market competitiveness and consumer sensitivity caused by declining real incomes, we expect Alaska not to increase the cost much. According to our estimate, in 2023, the company’s EBITDA margin will decline again from 10.78% to 6.76%, excluding special expenses.

Valuation

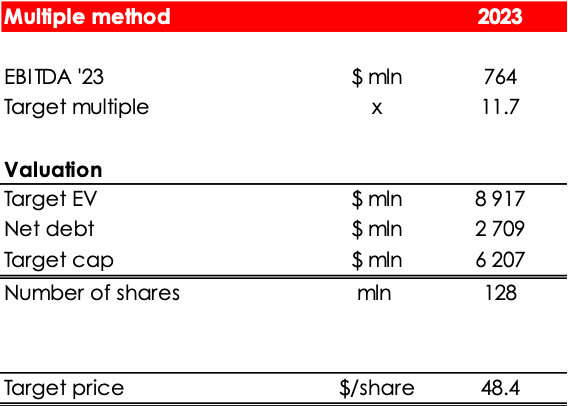

We have revised our EBITDA forecast upwards from $550 mln (-49% YoY) to $1054 mln (-1% YoY) for 2022 but downwards from $1140 mln (+47% YoY) to $764 mln (-28% YoY) for 2023 due to the following factors:

- Expectations of a further increase in crack spreads because of stronger sanctions and a ban on import of Russian oil.

- Higher Alaska Air Group labor cost projections – the deal with the pilots’ union implies more significant wage increases relative to our initial expectations.

We are evaluating ALK fair value price based on 2023 EV/EBITDA multiples. For the valuation purposes we also include projections of net debt due to intensive CAPEX program.

We have set ALK fair value stock price at $48.4. Rating is HOLD. Upside – 4%

Invest Heroes

Conclusion

Despite persistent strong demand for airline services, we believe the sector will face high increase of cost that will be too difficult to pass on to consumers. We do not recommend buying Alaska Air Group stock at the current price, as we estimate it is fairly valued.

To manage the position, we recommend keeping an eye on financial statements of Alaska and industry research (IATA, FAA, S&P Global).

Be the first to comment