Hispanolistic/E+ via Getty Images

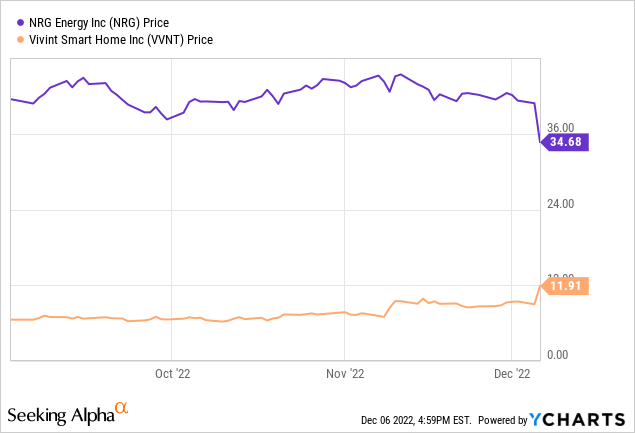

Today (Tuesday, Dec. 6th), NRG Energy (NYSE:NRG) announced it reached a definitive agreement to acquire Vivint Smart Home (NYSE:VVNT) in an all-cash transaction for $12 per share, or $2.8 billion. That was a 33% premium as compared to Vivint’s close yesterday. The deal for Vivint Smart Home accelerates NRG’s consumer-focused growth strategy as the deal will create a leading essential home services platform. Vivint offers an engaging customer experience through multiple device connectivity united into a single expandable platform that has incorporated AI and ML algorithms into its operating system. Vivint has operated a vertically integrated business model provides top-to-bottom services including: hardware, software, sales, installation, support, and professional monitoring. Combined with the company’s reputation for superior customer experience, NRG will acquire a complete end-to-end Smart Home experience which it can then leverage for growth through its utility business model.

The reaction in terms of stocks’ price direction is not surprising (see below), but the magnitude of the drop in NRG stock (~15%) is irrational in my opinion. But that creates an excellent opportunity for investors to pick up a solid utility company – with a 4.35% forward yield, and a forward P/E of only 11x – on the cheap. Let me explain.

The Deal

Including the assumption of $2.4 billion in debt, the total transaction value is $5.2 billion. NRG expects the annual run-rate Adjusted EBITDA, inclusive of $100 million of expected synergies, to be an estimated $835 million. If we assume that will be the case, the deal has an implied multiple of only 6.3x Adjusted EBITDA.

In my opinion, that is not an overly high multiple for this kind of growth asset – which has lots of upside potential – and does not rationalize a $6/share drop in the stock price, or an estimated $1.7 billion drop in NRG’s market-cap.

In NRG’s Presentation today, the company said the deal exceeds its investment hurdle rates: “highly accretive at 6.3x run–rate EV / Adj EBITDA1 with a 16% FCF Yield, and run rate $835 MM of Adj EBITDA, including $100 MM synergies.”

The deal will expand NRG’s national customer network by 1.9 million and significantly increases the company’s TAM opportunity through its 5.5 million existing customers (pre-Vivint) and beyond. Per Wood MacKenzie, that TAM is estimated to be $165 billion and growing at a 13% CAGR.

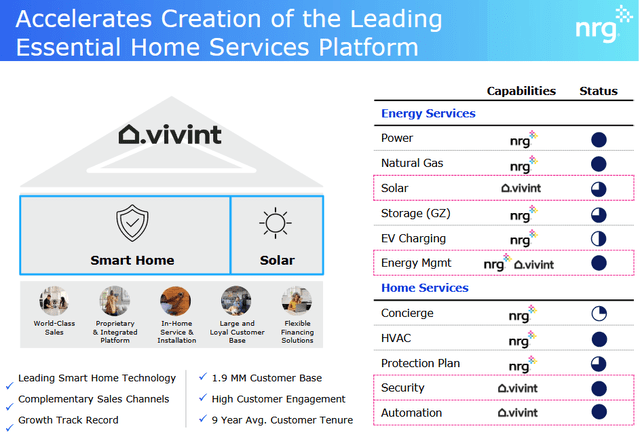

While some hard-core utility investors might believe this transaction is less “transformative” because it moves NRG away from the nuts-and-bolts of direct energy production and transmission, NRG believes the deal actually improves and diversifies its financial profile with more predictable earnings through Vivint’s subscription based model and long customer tenure (~9 years) in an attractive growth sector. In particular, the graphic below – taken from NRG’s presentation today, reference earlier – shows what Vivint brings to the party:

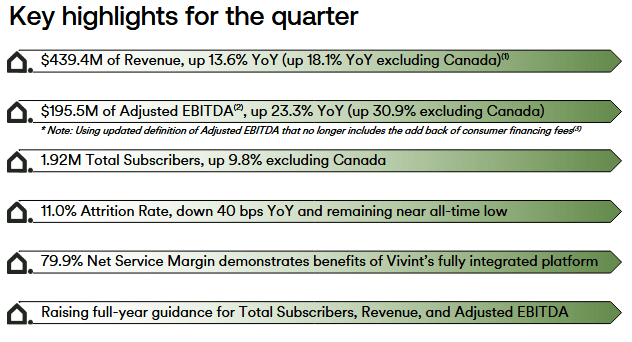

I said earlier Vivint was a “growth asset” earlier, and here’s why (the slide below was taken from VVNT’s Q3 presentation):

Vivint

As you can see, Vivint had an excellent Q4: with strong growth in revenue, EBITDA, and a net service margin of ~80%. The company raised full-year 2022 guidance on revenue, subscribers, and adjusted EBITDA. Vivint will be free-cash-flow positive in FY22.

Given integration of Vivint’s platform with NRG’s utility footprint, I suspect that NRG will be able to accelerate Vivint’s growth trajectory going forward.

Financing

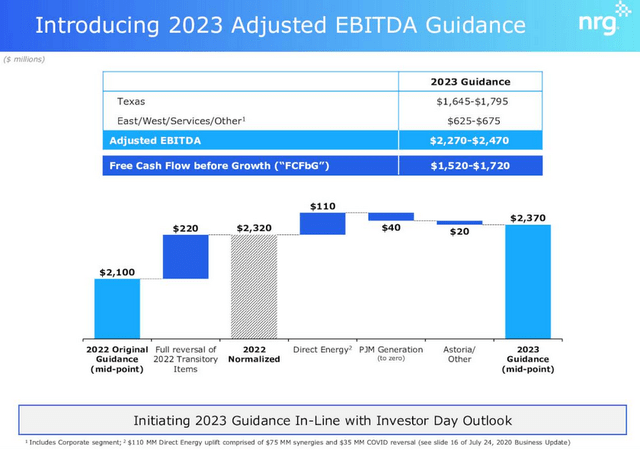

In the Q3 EPS report, (NRG generated revenue of $8.51 billion, +28.7% yoy, a $620 million beat), we can see that NRG ended the quarter with $379 million in cash and $2.4 billion available under its credit facilities. While the deal is a bit of a stretch, the nice thing about operating a relatively stable utility company is that there is a fairly clear line-of-sight into future revenue, earnings, and cash-flow. Consider NRG’s FY2023 free-cash-flow profile (the slide below was taken from the company’s Q3 Presentation, which was given prior to the Vivint announcement):

Note the mid-point of FY2023 FCF guidance is $1.62 billion. That kind of strong FCF profile, combined with the company’s solid credit ratings (S&P BB+, Moody’s Ba1 – both “Stable”), and the fact that the company only has $1.1 billion in debt maturation between now and 2027, indicate NRG can quite easily digest the Vivint acquisition. Again, the market reaction was overblown in my opinion.

That is especially the case since NRG reported in the deal presentation that:

Vivint’s $2.7 billion of debt will remain in place given its attractive terms and pricing.

That being the case, the company expects to issue $2.3 billion in new debt financing and plans to pay down $900 million of Vivint debt in its FY2023 capital allocation plan.

Shareholder Returns

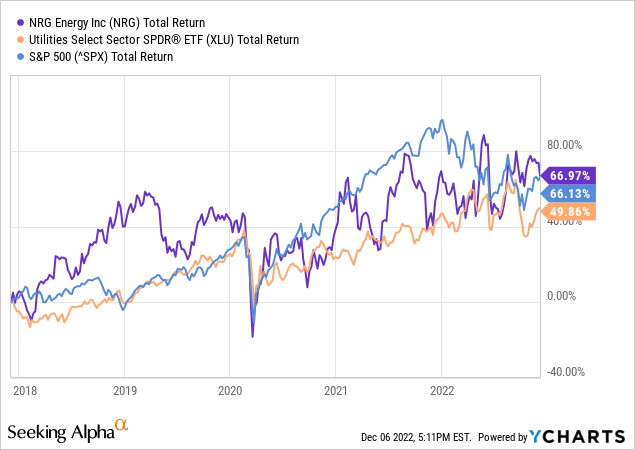

The drop in NRG’s stock raises its go-forward yield, based on NRG’s recently announced a $1.51/share annual dividend (beginning in Q1 FY23), to 4.35%. That compares very favorably to the yield of the Utilities Select Sector SPDR ETF (XLU), which is currently 2.88%.

The 7.3% increase in the dividend this year followed an 8% increase last year.

NRG recently announced that the Board of Directors had approved a $600 million incremental share repurchase program – which at the time was expected to be completed in 2023. That was on top of the existing $1 billion share buyback program authorized in its FY2022 capital allocation program announced in late 2021. In the deal announcement previously referenced, NRG said:

NRG intends to complete its existing $1 billion share repurchase program over the near term, of which $360 million was remaining as of November 30, 2022. In 2023, NRG expects to use its excess free cash flow to fund the Vivint acquisition, reduce acquisition-related debt, and maintain its common stock dividend growth policy. In 2024, the Company intends to return to its 50% return of capital / 50% growth capital allocation policy.

I take that to mean that the deal will push out the recently announced $600 million buyback plan by one year, to 2024.

Risks

There are always risks associated with integrated newly acquired assets. That said, the integration risks with the NRG/Vivint deal appear relatively low considering these Smart Home platforms are not rocket-science, and of course the Vivint platform dove-tails very nicely with utility-like capabilities and services that NRG already provides. However, in general the “Smart Home” arena has a pretty narrow moat and is open to competition. That being the case, NRG will need to quickly and efficiently integrate Vivint’s platform into its business to achieve solid follow-through.

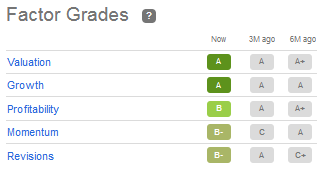

Meantime, to go along with the solid credit ratings mentioned earlier, Seeking Alpha gave NRG strong equity factor ratings prior to the acquisition announcement:

Seeking Alpha

However, it remains to be seen what kind of financing terms NRG will be able to realize. If the rate/rates are too high, the market may react negatively and push the stock down further.

Summary & Conclusions

I like this deal, and I don’t agree with the market – NRG does not appear to have over-paid for a growth platform that greatly enhances its enterprise going forward. Given Vivint’s demonstrated track rate and EBITDA profile, I don’t expect NRG to have a hard time financing the deal. And even if the debt is relatively expensive, NRG’s strong free-cash-flow profile should enable it to pay it down relatively quickly.

Meantime, NRG’s go-forward yield of 4.35% looks very attractive in my opinion, while is forward P/E of only 11x makes it a steal. I would not be surprised to see the stock recover roughly one-half of the stock drop today when cooler heads prevail over the coming days. In my opinion, that is a relatively safe 10%+ total return opportunity over the next 12-months, but which will likely be achieved much sooner than that. NRG is a BUY.

I’ll end with a 5-year total returns of NRG versus the XLU ETF and the S&P 500 and note, even after the big drop today, NRG is the leader of the group:

Be the first to comment