AsiaVision/E+ via Getty Images

Investment thesis

In my previous article on China Life Insurance (NYSE:LFC), titled “One Year Cash Flow Greater Than Its Value,” I concluded that buying shares in this mega-cap company offered great value.

Three months have passed and with the turbulent time we live in we see that “cheap share prices can get even cheaper.”

The investment community perceives that LFC is not worth more than USD$7.70 per ADR as that is what it is currently trading at. In Hong Kong, it trades under the code (HK.2628) and is now trading around HKD 12 per share. That is roughly one dollar less than what it was when I last put a “buy” on the share. Bear in mind that 1 ADR on the NYSE equals 5 ordinary shares.

Let us examine how the company has performed for the full year of 2021, now that their financial results are out.

2021 full year financial results

Net profit attributable to equity holders of the Company was RMB 50.9 billion, which was an increase of 1.3% from 2020. This is USD 8.11 billion.

The two main operating profits come from premiums and from investing income. Total net premiums earned in 2021 was RMB 611.3 billion which was slightly lower than the RMB 618.8 billion paid out in claims expenses and other benefits. However, this was offset by their gross investment income which rose from RMB 198.6 billion to RMB 214.1 billion in 2021, which equates to USD 34.1 billion.

The weighted average return on equity was 10.97%

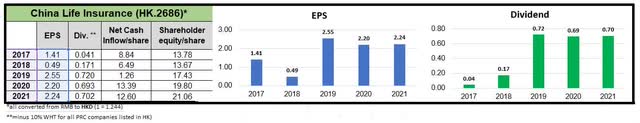

China Life – 5-year records of EPS and Dividends (China Life 2021 FY Results)

Their dividend payout ratio is quite low, as it has been around 30% for several years. The positive side of that is the safety of the dividend. It is well covered even by using earnings per share.

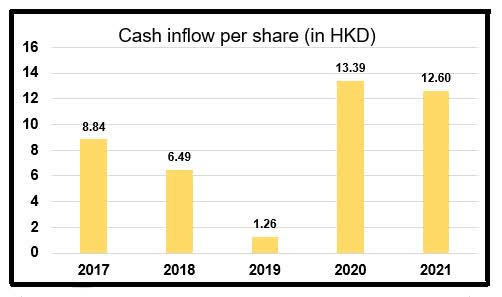

For what it is worth, we can look at their cash flow generation per share over the last 5 years, it would make the dividend payments per share very small.

Cash flow per ordinary share (China Life FY 2021 Results. Graph by author)

It has a high level of solvency ratio with its comprehensive solvency ratio at 262.41%. As a comparison, Legal & General (OTCPK:LGGNF) in which I am invested, and recently covered, had what is considered a high solvency II coverage ratio of 187% at the end of 2021.

Their total assets increased by 15.0% from last year to reach RMB 4,891 billion by 31st December 2021.

LFC Valuation

When I last wrote on LFC the share price was HKD 13, it was cheap because its P/E was just 6.16, its P/BV was just 0.69 and it came with a dividend yield of 5.9%

Fast forward, and with international wars and further tightening in COVID restrictions in China, LFC is now even cheaper trading around the level of HKD 12 per share.

China Life – Better value (Quamnet Hong Kong)

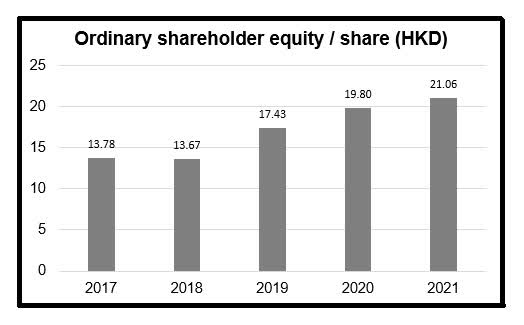

When we look at LFC’s ordinary shareholder’s equity per share, we can see that it is close to the net book value stated above.

China Life – Shareholder equity per share (China Life 2021 FY Results)

So, what is each share in LFC worth?

Earlier when we looked at solvencies, we compared LFC with LGGNF. Both are large insurance companies and fund managers. If we were to do the same when we check their price to book value, we know that LGGNF trades at a ratio of 1.6

That is even lower than their competitor Brookfield Asset Management (BAM) which is currently priced at a price/book ratio of 2.0

Is it fair that a giant like LFC should be given a price to book value ratio of just 0.58?

If it was given a ratio of 1, the price would have to go to HKD 20 to 21

That means it has to double from here. But is that reasonable? Back in 2017, the company only earned 37% less than what it earned in 2021, and had an equity book value of HKD 13.78 – but it was trading between HKD 23 and 26 per share.

China Life – Share price in 2017 (Yahoo Finance)

Risk to the thesis

There has to be an explanation why it is trading at such a low price.

It seems that the main reason for its low share price is a result of investors’ perceptions of whether it is as good as its number says it is.

If you read any articles about a Chinese company these days you are bound to get several responses like this one comment I got in my previous LFC article.

I wouldn’t trust any Chinese company’s financials. From experience, I know that Chinese firms lie about their business revenues, costs, profits. And would you trust or invest in a company with 70% communist state ownership?”

I would like to dissect this and give you my own personal view. A view that is based on living and working in Asia, including Hong Kong, China, over the last three decades.

Let us start by the lack of trust in Chinese companies’ financials. Generally speaking, the large companies with independent management and boards have better corporate governance than the smaller family-controlled companies which often lacks a truly independent board.

I stay far away from the latter. Not just in China, but anywhere else.

With regards to China’s communism, it is important to keep things in a proper context. The China of 2022 is not the same as it was in 1949. I believe that they are not going to confiscate private “property,” like the shares in China Life Insurance or any other company for that matter.

What is the problem with a state owning the majority of the shares in a company?

In Norway, where I was born and raised, and in Singapore, where I now reside, a large part of the big companies listed on their stock exchanges are ultimately controlled by the state. These companies are well run, make billions of dollars and for the most have shareholder-friendly policies in place. After all, with a large part of the dividends going back into the state coffers to run their countries affairs they will ensure there is ample return of capital to shareholders.

At least that is my own experience. Others may disagree.

On the issue of trust and corporate governance, since my previous article on LFC, there was news on 9th January that LFC’s Chairman Mr. Wang Bin, which is also the Secretary to the Central Commission for Discipline Inspection and the National Supervisory Commission is currently under disciplinary review and investigation by the Central Commission for Discipline Inspection and the National Supervisory Commission for suspected serious violations of discipline and law.

It took the board just four days to replace Mr. Wang Bin with a new Chairman.

Hundreds of thousands of people have been investigated for corruption in China over the years. That is a good thing. I would be more worried if we did not read of any such action by the authorities there.

Conclusion

Based purely on their earnings and cash generation, it would not be far-fetched for LFC to trade around HKD 20 per share.

For that to happen we need to see investors’ sentiment and perception towards many large PRC-based companies improve.

We also need to see a larger inflow of capital from institutional investors into emerging markets in general, and to Hong Kong, China in particular.

Investor perception is important. Over the last decade, the place to be invested was in “FAANGs” in the US. We have seen a small shift towards value stocks like energy and financials, but will that trend continue going forward?

Truth be told, I don’t know.

Perhaps, we should take note of one of the late investor legend John C. Bogle, and his wise words of “when there is a gap between people’s perception and reality, it is only a matter of time before reality takes over.”

This is in fact what we as value investors are looking for.

What I do know is that unless the financials of LFC are not stating the true condition of their financial position, which I doubt, an investor buying the share at the present level is left with a good safety margin.

Therefore, it is still a buy, in my personal opinion.

Be the first to comment