Copper Futures, Global Growth Outlook, Coronavirus – TALKING POINTS

- Copper price outlook gloomy as COVID-19 intimidates Chinese demand

- Coronavirus threatens to derail global stabilization, pressure commodity

- Copper futures have plunged over 10 percent, falling to 17-year uptrend

COPPER PRICES AT RISK OF AGGRESSIVE SELLOFF

Much like crude oil, copper is an integral part of the global supply chain of key resources countries and major industries use as an input in their growth models. It is also the eighth-most traded commodity just below gold and above aluminum. Due to its wide application across a variety of sectors, it serves as a helpful proxy for gauging how investors view the outlook for global growth and future demand.

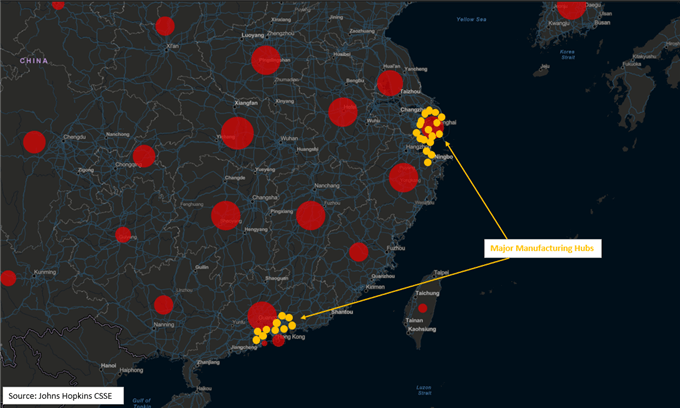

China is the largest consumer of copper by a large margin, and as such, the commodity is naturally being held hostage by the coronavirus outbreak as it threatens the Asian giant’s growth trajectory. Its volatility is amplified due its frequent use in highly-cyclical industries like manufacturing, industrial machinery and construction that are typically hit first amid global slowdown.

Most of China’s manufacturing plants and key trading ports are located along its coastal perimeter, the epicenter of its economic vitality and international artery for global commerce. Delayed timetables, port congestion and a myriad of other disruptive by-products will likely undermine Chinese economic activity. As a result, copper prices may suffer as demand for the cycle-sensitive commodity falls with growth projections.

Starts in:

Live now:

Mar 02

( 04:03 GMT )

Recommended by Dimitri Zabelin

Geopolitical Risks Affecting Markets in the Week Ahead

COPPER OUTLOOK BEARISH AS COMMODITY TESTS 17-YEAR UPTREND

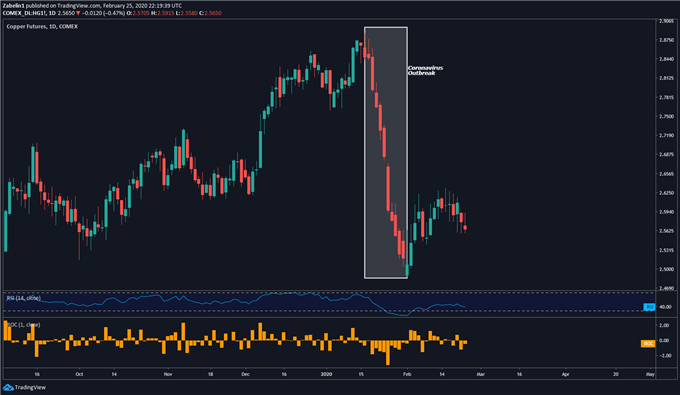

Since the outbreak of the novel coronavirus, copper prices have plunged over 10 percent and are flirting with testing a 17-year uptrend. The commodity’s decline reflects investors’ premonitions that global stabilization may be derailed by COVID-19 and the multi-iterated effect it has on growth. Reduced air travel, tourism and disrupted supply chains are a few of many factors affecting sentiment and dampening economic activity.

Copper Futures – Daily Chart

Copper futures chart created using TradingView

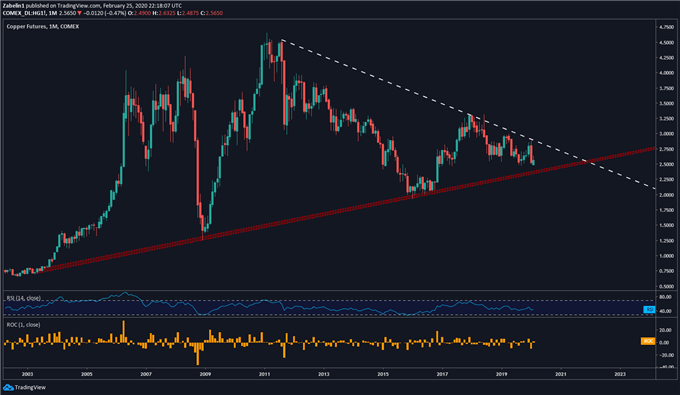

A monthly chart also reveals copper prices have on a broad downtrend after peaking in 2011 and began to accelerate in the beginning of 2018. Not entirely by coincidence, this also marked the start of the US-China trade war that ultimately led to the current global slowdown and Chinese growth hitting a 30-year low. Naturally, the regional giant’s growth trajectory fell and unsurprisingly brought copper prices down with it.

Copper Futures – Monthly Chart

Copper futures chart created using TradingView

COPPER TRADING RESOURCES

— Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitrion Twitter

Be the first to comment