OwenPrice/E+ via Getty Images

Since our inception, we believe it is our people and our values that have enabled us to build a profitable, sustainable enterprise. We’re confident our formula will work for the next 40 years as well.

Jeff Liaw (Copart’s Co-Ceo)

Introduction

Copart, Inc. (NASDAQ:CPRT) reported its Q4 and full-year 2022 earnings last week. While we usually share a summary table with the results from Consensus Gurus, we were surprised to see that they don’t cover Copart. We take this as a positive as the lesser-known our companies are, the less fully-priced they’ll be and the more opportunities we might have in the future to build our position.

We can tell you right off the bat that Copart’s earnings were strong, but the best thing about the release was management’s relentless focus on the long term. As long-term investors, that’s exactly what we want to see.

So, without further ado, let’s get started!

The numbers

The headline numbers

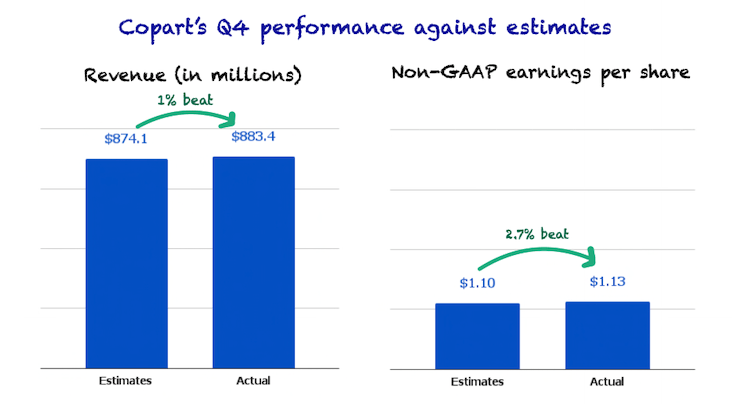

Copart managed to beat analysts’ estimates for both the top and bottom lines.

Made by Best Anchor Stocks

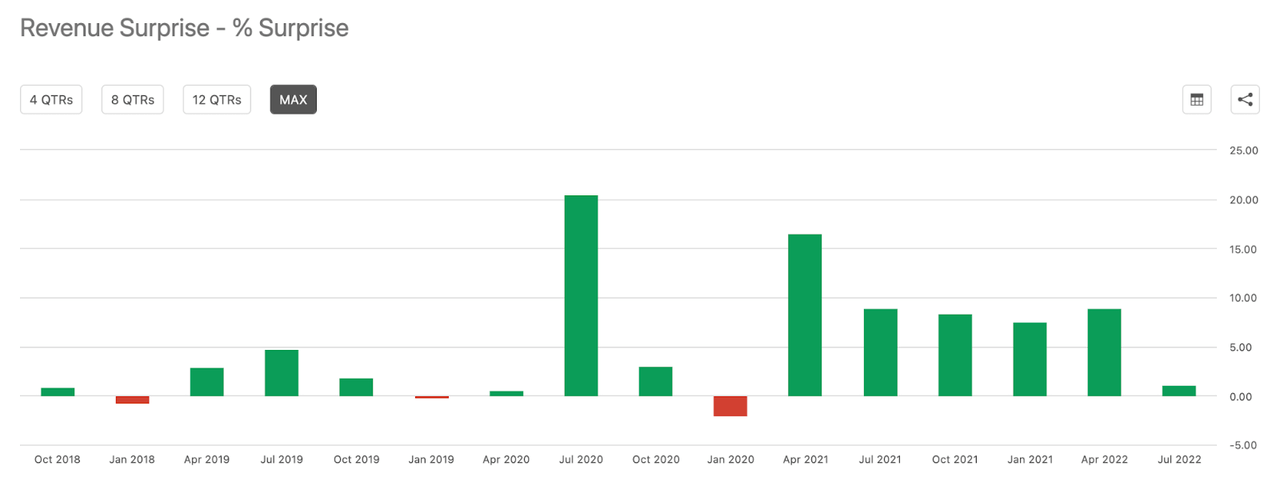

Management doesn’t share quarterly or yearly guidance, so we don’t really know if they beat their own estimates. However, what seems pretty clear is that analysts who follow Copart have continuously been too pessimistic about the performance of the business. Copart has managed to beat their top line estimates 80% of the time in the last 4 years:

Seeking Alpha

80% “hit rate” does not seem exceptional, and we certainly know companies that have done better in this regard, but it’s also important to consider the size of the beats and misses. Beats have been sizeable, while misses have been minuscule.

Remember that outperformance in company fundamentals will eventually lead to stock outperformance. Stocks have certain expectations embedded in them, and if management can outperform them, investors should end up with a good result. If management “only” manages to meet these expectations, there are probably better opportunities elsewhere.

Now, let’s dig a bit deeper into the top line.

Digging into the top line

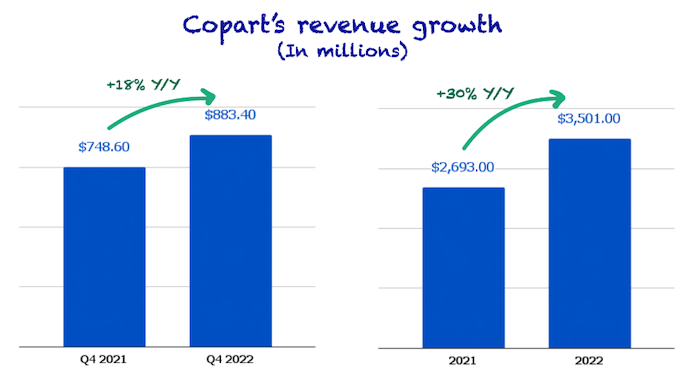

Copart reported revenue of $883.4 million for the quarter, an increase of 18% year over year. For the full year, revenue came in at $3.5 billion, a 30% year-over-year increase:

Made by Best Anchor Stocks

Yearly revenue accelerated when compared to the prior year (+22% year over year). However, Copart also enjoyed some tailwinds this year, namely higher Average Sales Prices with a lagging total loss frequency decrease. The company also faced a significant currency headwind this quarter due to the dollar’s strength. Copart conducts a good portion of its business abroad, so a strong dollar means less international revenue in dollar terms, all things equal.

Q4 revenue would’ve been $899.8 million in constant currency, a 20% year over year increase. Currency was also a headwind to yearly revenue, but not as sizeable because the dollar’s strength has been a thing of recent months. When it comes to currency, we highly doubt it will be a meaningful contributor or detractor to the company’s long-term performance.

Units impacted by total loss frequency

Global units, the number of cars that end up in a Copart facility, were up 5.1% year over year in Q4. The increase was stronger in international markets, +12% Y/Y, than in the U.S., +4% Y/Y. That makes perfect sense considering that Copart has more opportunity to grow in international markets than the domestic one, where it has been operating for 40 years now.

There are two things worth noting when it comes to global units. First, Copart managed to grow units faster than its closest competitor, IAA. In the most recent quarter, IAA saw volumes decrease by 3.2%, citing volume loss from one of its customers. Copart’s management mentioned that market share was a tailwind to volume, so we already know where IAA’s volume loss went:

We grew on both a 1- and 2-year basis due to a combination of share gains and a continued recovery in driving activity and accident frequency and severity.

Source: Jeff Liaw (Copart’s Co-CEO) during the Q4 earnings call

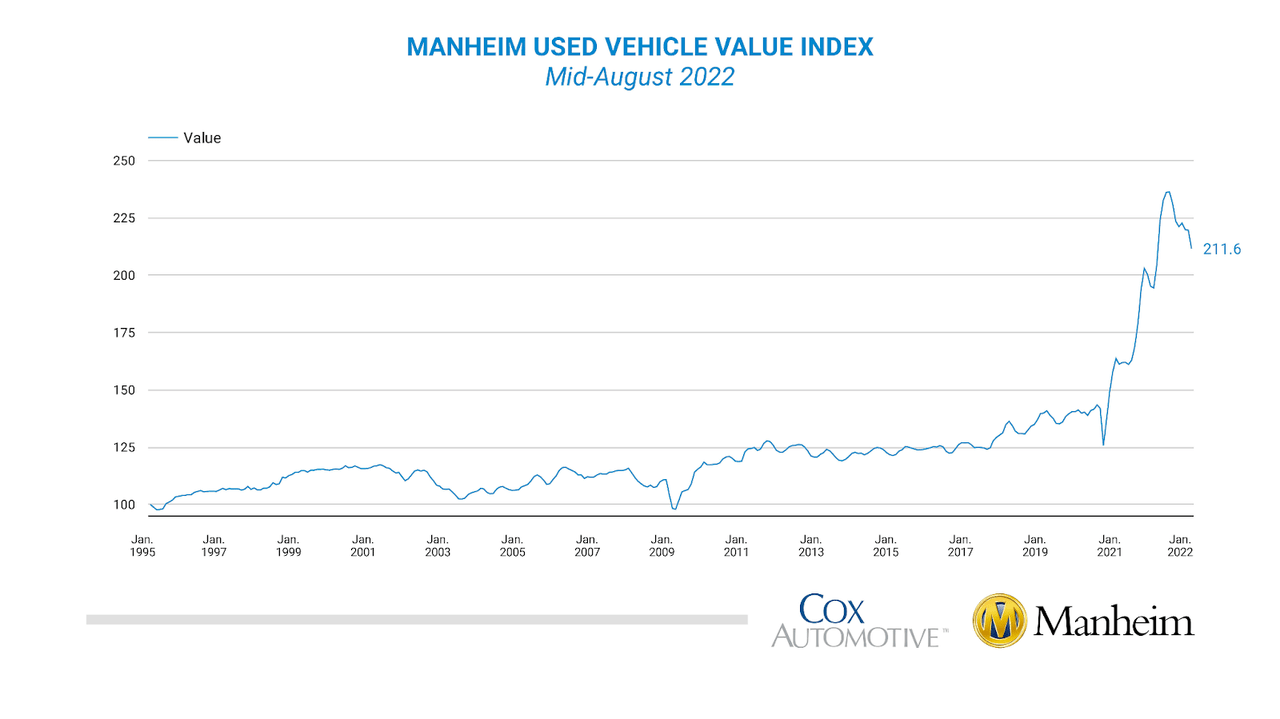

The other thing worth noting is that high used car prices were a headwind to volume. When used car prices are higher, it makes more sense to repair a car than to deem it a total loss, impacting Copart’s supply. Used car prices have indeed come down from their peak, but when viewed on a year-over-year basis, they remain elevated still:

Manheim

Higher used car prices are not all that bad for Copart, but we’ll go over this later on.

Revenue mix shifting to purchased vehicles

Copart has two main revenue streams: service revenue and purchased vehicles. Service revenue refers to revenue from vehicle sales where Copart acts as an intermediary. In these cases, the company doesn’t take ownership of the vehicle and makes money through fees when it is auctioned through its website. Purchased vehicles refer to vehicle sales where Copart has taken ownership of the vehicle (for whatever reason) and sells it at a higher price, pocketing the difference.

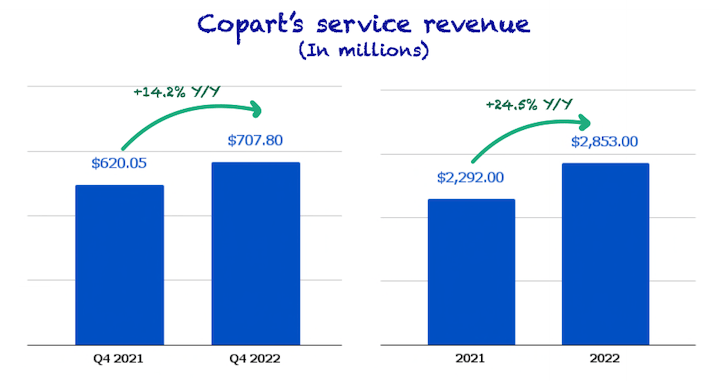

Service revenue grew 14.2% in Q4 and 24.5% in 2022.

Made by Best Anchor Stocks

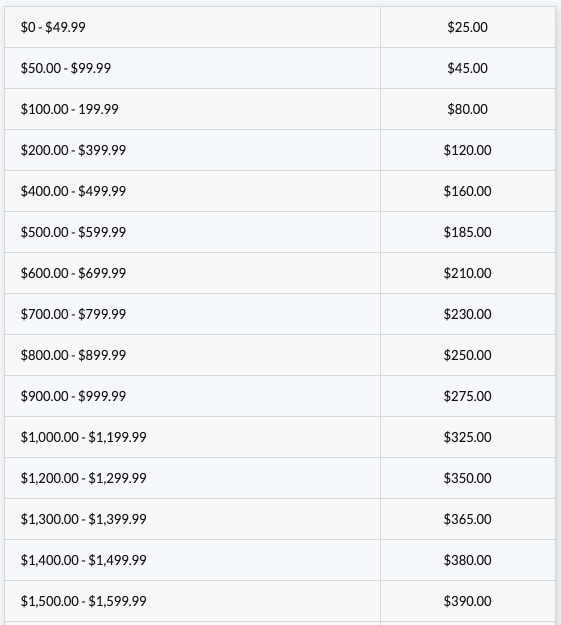

Growth was mainly driven by higher Average Selling Prices, or ASPs. Higher ASPs lead to higher service revenue because Copart makes more money when prices are higher. This is illustrated in the table below with the company’s fee structure:

Copart

Service revenue grew faster in the U.S. than in international markets despite coming from a larger base. The explanation of this is probably two-fold:

-

Copart’s Cash for Cars business in the UK, where Copart purchases cars from individuals.

-

In countries like Germany, Copart has yet to convince the insurance industry to adopt the U.S. model. To do so, the company is taking ownership of the cars to show its customers that it’s a more profitable and better model for everyone.

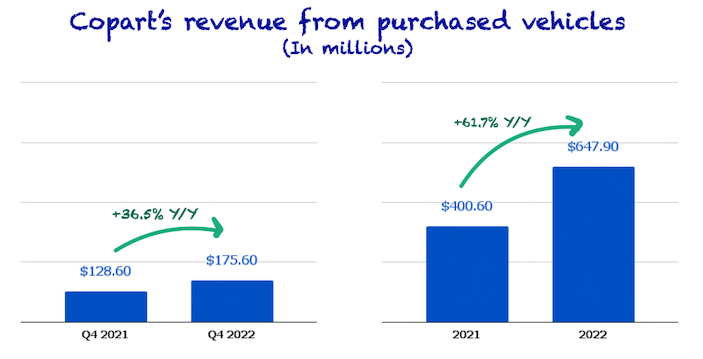

Purchased vehicle revenue is growing faster than service revenue all around. U.S.-purchased vehicles grew 39.3% year over year in Q4, and 61.8% in 2022. In international markets, it was pretty similar, with purchased vehicles up 31.5% in the quarter and 61.5% for the year.

Made by Best Anchor Stocks

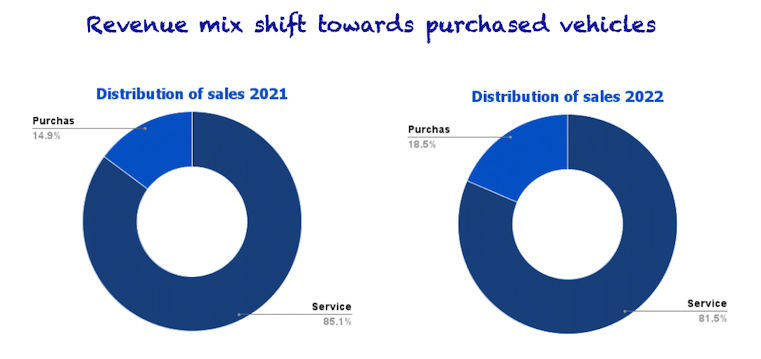

Service still makes up the majority of Copart’s revenue, but the revenue mix shifted 400 basis points to purchased vehicles.

Made by Best Anchor Stocks

This is somewhat normal in an environment of decreasing total loss frequency, as a large chunk of the volume that generates service revenue comes from insurers. If that volume is only slightly up due to higher used car prices, purchased vehicles might outpace service revenue. It’s true, though, that higher ASPs are also a tailwind to service revenue, so this is unlikely to explain the divergence.

A more feasible explanation is the increase in purchased vehicles in international markets such as Germany and also management’s willingness to increase this revenue stream. Copart makes less profit from purchased vehicles than acting as an intermediary, but it also has access to more volume, which might make sense from a returns standpoint. Margins are lower for purchased vehicles, but they are still beneficial for the company’s financials.

Digging into profitability

The mix shift between service and purchased vehicles impacted profitability. Buying and selling vehicles is obviously less profitable than facilitating a transaction.

The other thing that impacted profitability was inflation. Copart typically offers an “all-included” model for insurers where it takes care of things like towing and storage for a “fixed cost.” This is called the Purchase Incentive Program or PIP:

Under PIP, we agree to sell all of the vehicles of a seller in a specified market, usually for a predetermined percentage of the vehicle sales price. Because our revenues under PIP are directly linked to the vehicle’s sale price, we have an incentive to actively merchandise those vehicles to maximize the net return. We provide the vehicle seller, at our expense, with transportation of the vehicle to our nearest facility, as well as DMV document and title processing.

Source: 10-K

The above means that, under PIP, Copart will be the one impacted by inflation with no possibility to pass on price increases to customers. It’s true that if inflation is broad-based and used vehicle prices increase as well, some of this impact would be offset by increasing service revenue. Either way, I doubt Copart would be willing to hike prices significantly to insurers, as management is laser-focused on building a long-term relationship with them.

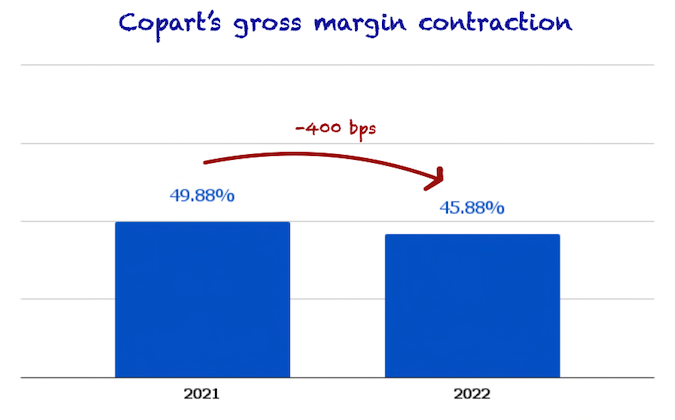

Both of these impacts caused gross margins for the year to contract 400 basis points:

Made by Best Anchor Stocks

Gross margins are much better in the U.S. (46.3%), where the mix of service revenue is much higher than in international markets (26.1%).

Some people might take the divergence as negative, considering that international is the next growth opportunity for Copart. Still, I view this data point as an opportunity for Copart to improve margins going forward. If the company can convince customers in international markets to adhere to the U.S. model, margins should approach those of the U.S.

From a profitability standpoint, it was not the best result for Copart, but nothing too worrying in an environment where management relied more on purchased vehicles to make up for the loss of volume due to a declining loss frequency. Used car prices are not sustainable at the current level, so we can expect this dynamic to reverse in the future.

Cash flow and balance sheet

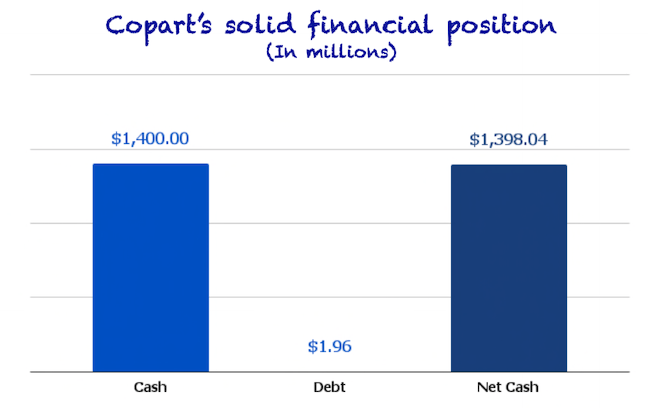

From a financial strength point of view, it was a very positive quarter. Copart ended the quarter with $1.4 billion in cash and an undrawn revolving credit facility of $1.2 billion. Fearing the surge in interest rates, management decided to retire $400 million in debt, incurring a prepayment penalty of $16.8 million. As a result, the company ended the quarter with negligible debt outstanding, improving its net cash position:

Made by Best Anchor Stocks

The solid financial position was aided by the improvement in operating cash flow, which increased 19% year over year for the full year.

All in all, Copart has a power-house balance sheet which should allow the company to weather any tough period. This resilience is not the result of luck but of careful planning. Copart knows it has to be there for its customers regardless of the situation:

We recognize the arguments in favor of more financial leverage, but we know that our approach assures our customers that whatever comes our way the 2009 financial crisis, massive storms in Sandy, Harvey, Ida, COVID-19 and all that lies ahead, Copart will stand uncompromised and ready to serve our customers.

Source: Jeff Liaw (Copart’s Co-CEO) during the Q4 earnings call

Qualitative highlights

The numbers are essential in any investment thesis, but so is the story, as it will impact the numbers in the future. So let’s go over some qualitative highlights.

The right mentality around capital allocation

Copart’s management laid out the priorities for capital allocation, and we are very aligned with their strategy. We don’t have much to add here, so we’ll let Copart’s co-CEO, Jeff Liaw, do the talking:

The priority certainly is always to invest in, and this is what any good steward of capital would, I think, is the framework they would approach the question with, which is how do we maximize those returns over 30-, 40-, 50-year horizons. And if that is your framework, we would always elect to invest productively in the business long-term.

There is power in the network. There’s power in physical capacity. There’s power, as you heard me say, in owning it and controlling it in perpetuity. We generate cash, of course, net of those investments as well. As you know, from our history, we buy shares back. We do so aggressively in real volume. We also do so episodically as opposed to via a predictable routine buyback program. So at some point, we don’t announce in advance. But at some point, we, of course, will buy shares back that ultimately is the use of residual capital.

Source: Jeff Liaw (Copart’s Co-CEO) during the Q4 earnings call

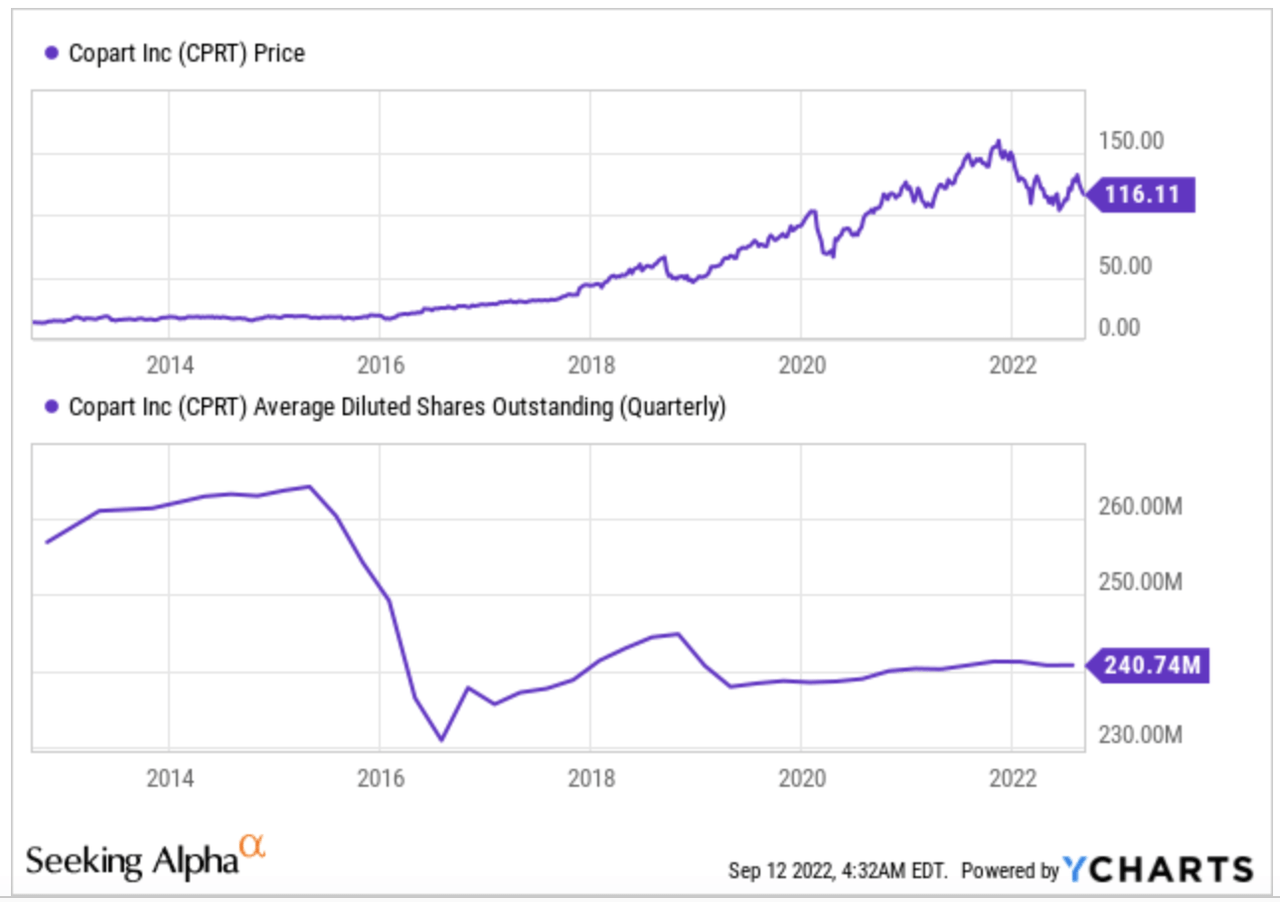

First, investing in the business to widen its moat. Secondly, episodic buybacks. This is precisely what good capital allocators do. We doubt the CFOs or CEOs of multibillion companies don’t know this, but most fail to put it into practice.

When it comes to Copart, we know it has a history of doing buybacks episodically, so we have no reasons to believe it will be different this time. The company has done two significant repurchases of stock, both of which occurred when the stock was tanking:

YCharts

Doing more and more for insurers

Copart is vertically integrating many insurer functions in a post-pandemic environment (emphasis added):

The early days of the pandemic were such that many companies, insurance companies included, wanted to avoid in-person engagement for themselves and their customers for obvious reasons to avoid the transmission of COVID-19 itself. And then since then, of course, they have faced some of the same hiring and retention challenges that the economy more broadly has as well. And as a result, they are asking us to do more, and we are offering to do more.

Source: Jeff Liaw (Copart’s Co-CEO) during the Q4 earnings call

While the pandemic accelerated this “outsourcing” trend for insurers, Copart’s management believes it’s a long-term trend:

So I think that’s a long-term trend anyway really before the pandemic but certainly accelerated by the pandemic and likely will persist. So we are happy to perform those services on behalf of our insurance companies. We think we can ultimately do so more efficiently and do it well for them on terms that make economic sense for them and for us.

Source: Jeff Liaw (Copart’s Co-CEO) during the Q4 earnings call

We view this as positive for two reasons. First, it will increase switching costs for its customers quite significantly. The more services you outsource to a provider, the more dependent you become on that provider. Secondly, it opens up a new universe of revenue possibilities for Copart.

The mix between ASPs and volume. Which is better?

Throughout the article, we have discussed how high used car prices are good and bad for Copart. On the one hand, it increases ASPs, so Copart makes more service revenue with every transaction. On the other hand, high used car prices lead to a decreasing loss frequency ratio as it makes more sense to repair cars. The latter decreases the volume for Copart, so even if the company makes more per car, it sells fewer cars.

The obvious question is: are high used car prices better than lower used car prices for Copart? Unfortunately, the answer is unclear over the short term, even for management (emphasis added):

But even 5 years ago, when we were facing the same questions, do we, in general, favor high used car prices or low used car prices, we’ve always been ambivalent about it. The lower used car prices will no doubt lead to more assignments to us and will probably be to lower realized ASPs, all else equal as well.

So the unit economics will be modestly worse, but we’ll certainly see greater unit volume as well. So we — I think to be transparent, Craig, don’t know precisely, right? The matter of degrees. And so if the volume increases significantly and the price moderates modestly, there’s no doubt that’s beneficial to us. Could there be other such scenarios, I think, yes, the 40-year trend says that the economics will work themselves out quite well in the end. But as for what happens for what happens in a given month or quarter or perhaps even fiscal year, harder to be precise about that.

Source: Jeff Liaw (Copart’s Co-CEO) during the Q4 earnings call

We’ll take management’s words here. While it’s obviously unclear how the mix of high ASPs and volume will play out over the short term, we believe it will play in Copart’s favor over the long term. The digitization of cars should increase total loss frequency, increasing volumes. These cars will most likely be newer when totaled too, which should increase ASPs as they might be perfectly fine to drive in emerging geographies.

Still very early, but EVs seem like a strong tailwind

Management also discussed about the economics of electric vehicles and how they impact their business. The takeaway is that electric vehicles (“EVs”) are more easily to total than conventional ICE (internal combustion engine) cars due to a combination of more advanced technology and the absence of repair networks.

EV volume is still low, but shows signs of potential:

As for auction returns, though, as you noted, it’s early and therefore, the addressable population remains small on balance, the returns on electric vehicles are meaningfully higher than for internal combustion engine equivalents, though, again, with the caveat that the expression equivalent is a very rough one because the perfect apples-to-apples comparison is not always readily available.

Source: Jeff Liaw (Copart’s Co-CEO) during the Q4 earnings call

Conclusion

All in all, it was a good quarter from Copart. The market didn’t like the company’s margin compression, but we believe it has ample opportunity to drive margins higher over the long term.

In the meantime, keep growing!

Be the first to comment