Zerbor/iStock via Getty Images

According to a Reuters article, the Biden administration plans to broaden curbs on U.S shipments to China of semiconductors used for artificial intelligence and chipmaking tools. The plan is expected be implemented next month.

The letters, which the semiconductor/semiconductor equipment companies publicly acknowledged, forbade them from exporting chipmaking equipment to Chinese factories that produce advanced semiconductors with sub-14 nanometer processes unless the sellers obtain Commerce Department licenses.

In rapid succession, the US has attempted to stymie Mainland China’s technology innovation through sanctions and entity lists. Instead, they have served as a catalyst for the Chinese to embark on their drive to become self-sufficient in semiconductor production through numerous government programs such as “Made in China 2025.” To counter the movement, the US has established programs of its own, such as the “CHIPS Act.”

Negative Impact on Non-Chinese Equipment Companies

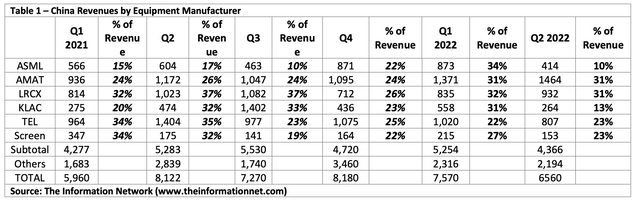

Table 1 shows revenues by these companies from Q1 2021 through Q2 2022. ASML’s revenue for equipment sales to China in Q2 2022 dropped YoY to $414 million from $604 million in Q2 2021. Revenues from China equipment sales dropped to 10% of total revenues for the quarter.

ASML (NASDAQ:ASML) has been fighting significant supply chain headwinds, which I discussed in a July 21, 2022 Seeking Alpha article entitled “ASML: January Fire Responsible For Big Revenue Pushouts To 2023.”

KLA (NASDAQ:KLAC) has also been impacted, dropping YoY to $264 million in Q1 2021 from $275 million in Q1 2021. Revenues from China sales dropped to 13% of total revenues for the quarter.

As an aggregate for all six companies analyzed in Table 1, subtotal revenues from China equipment sales dropped sequentially from $5,254 million to $4,366 million, according to our report entitled “Mainland China’s Semiconductor and Equipment Markets: Analysis and Manufacturing Trends,

Chinese Equipment Companies are Benefiting from Sanctions

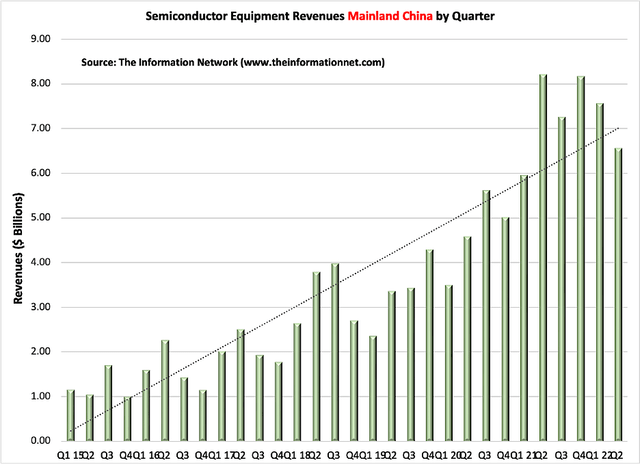

Chart 1 shows equipment imports into China by quarter. In Q2 imports dropped 13.3% into China while global equipment revenues increased 7.0%. While some of this decrease is attributed to Shanghai Covid lockdowns during the Q2 period ending June 1, Q1 revenues also dropped 7.5% QoQ, before the Shanghai lockdowns.

Chart 1

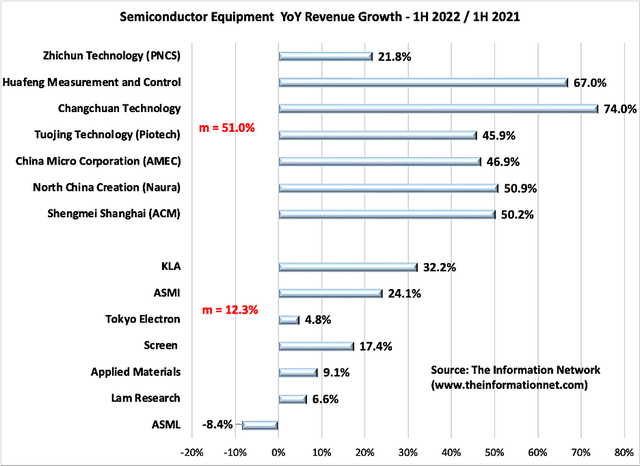

In Chart 2, I show that Chinese equipment suppliers’ revenues are growing significantly faster than non-Chinese companies, and this slower growth is reflected in imports (Chart 1) as China moves to replace non-domestic semiconductor equipment with home-grown equipment.

Chart 2

Chart 2 above shows H1 2022 / H1 2021 revenues for the Top 7 domestic Chinese equipment manufactures and the Top 7 non-Chinese equipment manufacturers. Chinese companies exhibited a mean HoH growth of Chinese manufacturers of 50.1%, which was down from a 80.1% YoY change in Q1, which is attributable to Shanghai Lockdowns in Q2.

Mean growth rate was versus 12.3% for non-Chinese manufacturers, a slight improvement over 1Q. Much of that increase in HoH growth came from ASML, which somewhat sorted out its EUV shipment problems, as QoQ revenues grew 61% in Q2 vs -35% in Q1.

China’s SMIC Reaches 7nm

These sanctions have largely failed. Chinese foundry Semiconductor Manufacturing International (SMIC) (OTCQX:SMICY), for example was blocked from using ASML’s EUV lithography equipment yet still managed to reach the 7nm node, which I first reported in a May 18, 2022 Seeking Alpha article entitled “Applied Materials: SMIC Move To 7nm Node Capability Another Headwind.“

Most impacted has been ASML, with sales losses of its EUV systems, its loss of software IP to China’s Dongfang Jingyuan Electron, and continuous threats of sanctions on ASML’s DUV lithography, which I detailed in my above referenced article on ASML.

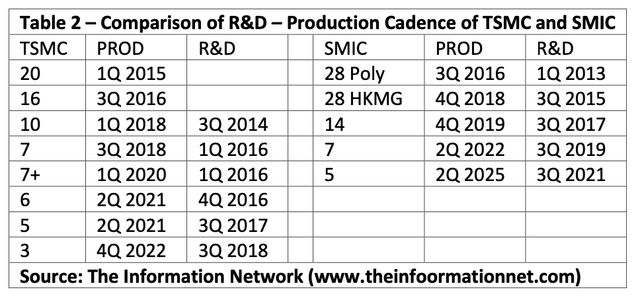

How I Forecast SMIC will Reach 5nm in 2025

As I stated above, I reported back May 18, 2022 that SMIC reached the 7nm node. This was two months before reports by Techinsights published their findings.

Translating that data to SMIC, which was in high volume production at 14nm in November 2019, the company should have transitioned to its N+1 node in 1Q 2021 and then the N+2 node in 2Q 2022. I estimate the N+1 node is at 8nm and the N+2 node is at 7nm.

For 5nm, with SMIC on a 3-year cadence, which is behind TSMC’s 2-year cadence, SMIC will reach production of 5nm in 2025, as illustrated in Table 2. I used this type of analysis in my thesis that SMIC had reached the 7nm node as well.

Also as noted in Table 2, SMIC started R&D in 3Q 2021. In the past year, the company has been able to optimize eight of the most critical and most difficult technologies of 5nm and 3nm.

But with sanctions on EUV lithography systems, SMIC can still reach 5nm without EUV systems. The company reached 7nm without EUV, which was accomplished by TSMC in its first generation 7nm chip. And both companies did it using DUV immersion and multiple patterning techniques of deposition, etch, lithography.

You can learn more about multiple patterning in my January 27, 2020 Seeking Alpha article entitled “ASML: My Top Semiconductor Processing Equipment Company Pick.”

Investor Takeaway

China had Free Rein for 20 Years

China’s stated goal is to become self-sufficient in the production of semiconductors for its domestic market and to develop technology that is competitive on the world market. The U.S. had a chance to stop China from being a technology powerhouse and ultimately an existential threat 20 years ago but buckled under lobbying from industry consortium SEMI to benefit its semiconductor equipment members.

Twenty years later, the U.S. has attempted to take corrective action by imposing sanctions on Chinese (and Russian) companies, starting with China’s Huawei, which was placed on a trade blacklist that restricted American companies from doing business with the major provider of network equipment and smartphones. The U.S. also imposed sanctions on Chinese chip companies and on equipment companies from selling advanced equipment to Chinese chip companies.

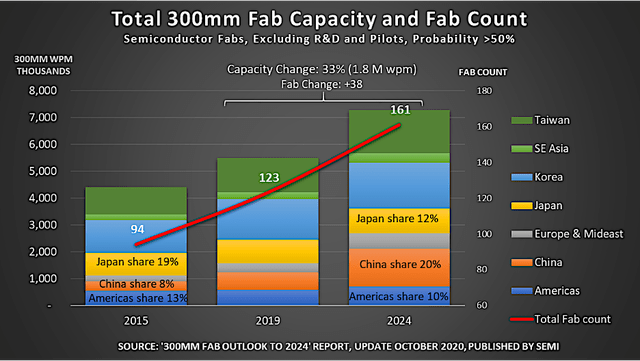

Chart 3 from SEMI shows that China will rapidly increase its global share of 300mm capacity, from 8% in 2015 to 20% in 2024, reaching 1.5 million 300mm wpm in the final year of the reporting period. While non-Chinese companies will account for a substantial portion of that growth, Chinese-owned organizations are accelerating their capacity investments. These companies will represent about 43% of China’s fab capacity in 2020, a proportion expected to reach 50% by 2022 and 60% by 2024.

Chart 3

Sanctions Aren’t Working

Despite the intentions of sanctions, we need to consider the comment by President Joe Biden on the Russian sanctions imposed after their invasion of Ukraine:

“Sanctions never deter,” Biden said during a press conference at a NATO summit in Brussels, Belgium.

These sanctions on China, like those on Russia, have so far proven ineffective in preventing technology gains by Chinese semiconductor and equipment companies. In fact, what it has done is accelerate the advancement of advanced chips from companies like SMIC and YMTC. Equally important, they have been a catalyst for the advancement and growth of sophisticated equipment that are able to process chips at 5nm. These domestic equipment companies not only sell to Chinese semiconductor companies, they are also selling to non-Chinese companies, which will be a future detriment.

ASML which has already been impacted by US sanctions on shipping EUV lithography systems to China. ASML faces competition from Japan’s Nikon (OTCPK:NINOY) and China’s Shanghai Micro Electronics Equipment (Group) Co., Ltd. (SMEE) in the DUV lithography segment.

For SMIC, as deposition and etch systems from Applied Materials and Lam Research have been installed for the 7nm node, this same equipment can be used for 5nm. What needs to be determined is the impact of US sanctions, which is limiting the node capability of exported equipment to 14 nm. This will impact these equipment companies.

SMIC is building a new 300mm fab in China. At present, chips planned for production are at 28nm and above, which would not be affected by the sanctions. However, as noted above, Chinese equipment companies such as AMEC and Naura are already at the 5nm node, and they will probably be used by SMIC and other semiconductor companies instead of AMAT and LRCX.

Financial Metrics

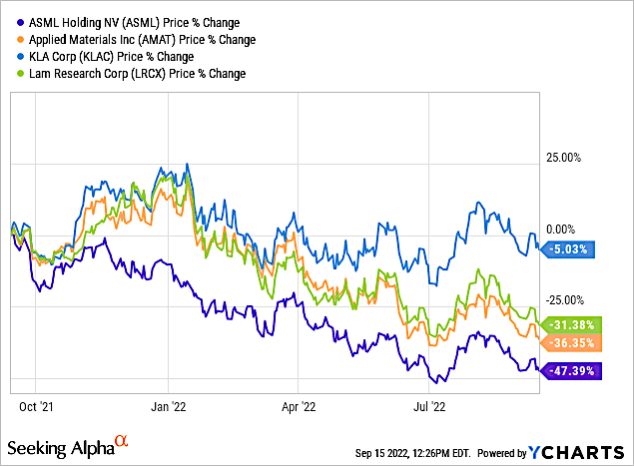

The revenue impact of China sanctions on top non-Chinese companies discussed above doesn’t tell the whole story. In Chart 4, I show share prices for the past 1-year period, and the decrease in share price for ASML is consistent with strongly impacted China revenues. But the share price for ASML at -47.4% is also impacted by significant problems with ASML’s supply chain, which has impacted revenues from non-Chinese companies. This is consistent with a -8.4% HoH global revenue growth in Chart 2 above.

YCharts

Chart 4

Chart 4 above also shows that KLAC, strongly impacted by China revenues, has demonstrated strong global HoH revenue growth of 32.2% in Chart 2. While share price is -5.0% for the year, its performance is significantly greater than competitors AMAT, LRCX, and ASML.

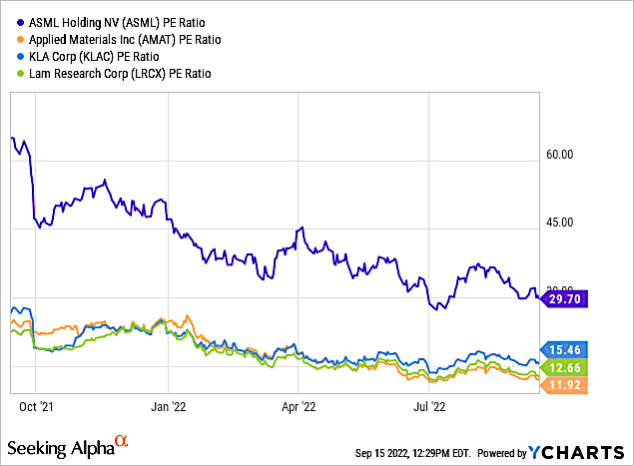

Chart 5 shows PE Ratio of the same four companies. ASML’s PE ratio of 29.7 is significantly higher by more than 2X that of peers.

YCharts

Chart 5

As I discussed in several recent Seeking Alpha articles on each of these companies, KLAC continues to outperform the overall WFE industry and peers, maintaining a 55% share of the process control market. The company’s strength comes from the increasing need for semiconductor companies to monitor chip processing as smaller nodes are reached. A defect that can reduce yield, which can be monitored by KLAC’s metrology and inspection equipment, has a greater impact on production losses at 5nm than at 24nm nodes.

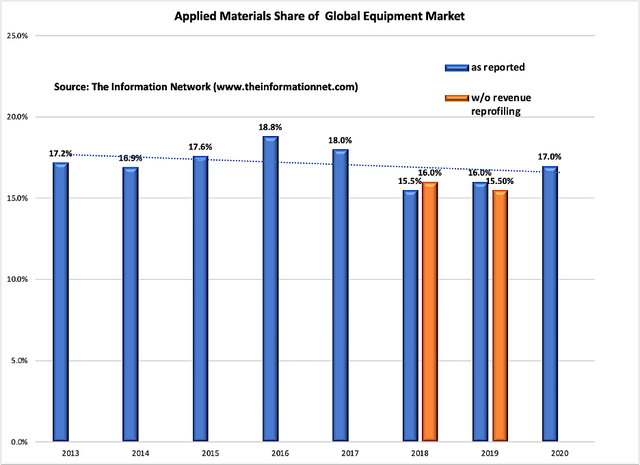

AMAT continues to underperform the overall WFE industry and peers. It’s share of the WFE industry has continued to drop since new management took over the company as they too underperform. This is illustrated in Chart 6 according to The Information Network’s report entitled Applied Materials: Competing Analysis of Served Markets. Data in Chart 6 includes AMAT moving $331 million from 2018 to 2019 to pump up share, as the company is desperate to maintain an image of success.

Chart 6

On ASML, I am still waiting for the CEO to explain the impact of the fire at the company’s Berlin factory making EUV lithography components. ASML has significant problems in shipping EUV lithography systems, and has resorted to shipping incomplete systems to customers and then, when components are available, having them installed at the customer fab so they can get paid.

LRCX is strongly dependent on NAND chips from suppliers Micron (MU), Samsung Electronics (OTCPK:SSNLF) and SK Hynix (OTC:HXSCL), and these companies are under pressure as consumer electronics product sales drop.

I rate KLAC a buy, ASML and AMAT a sell, and LRCX a hold.

Be the first to comment