MF3d

|

CI Australian Equities Fund |

**PORTFOLIO |

#BENCHMARK |

VALUE ADDED |

|

Financial Year Ending |

|||

|

30 June 2022 |

-1.8% |

-6.5% |

4.7% |

|

30 June 2021 |

28.0% |

27.8% |

0.2% |

|

30 June 2020 |

-1.4% |

-7.7% |

6.3% |

|

30 June 2019 |

7.8% |

11.5% |

-3.7% |

|

30 June 2018 |

14.6% |

13.0% |

1.6% |

|

30 June 2017 |

11.8% |

14.1% |

-2.3% |

|

30 June 2016 |

6.9% |

0.6% |

6.3% |

|

30 June 2015 |

13.7% |

5.7% |

8.0% |

|

30 June 2014 |

19.8% |

17.4% |

2.4% |

|

30 June 2013 |

31.9% |

22.8% |

9.1% |

|

30 June 2012 |

-2.2% |

-6.7% |

4.5% |

|

30 June 2011 |

15.6% |

11.7% |

3.9% |

|

30 June 2010 |

12.7% |

13.1% |

-0.4% |

|

30 June 2009 |

-18.2% |

-20.1% |

1.9% |

|

30 June 2008 |

-12.7% |

-13.4% |

0.7% |

|

30 June 2007 |

33.5% |

28.7% |

4.8% |

|

30 June 2006 |

29.3% |

23.9% |

5.4% |

|

30 June 2005 |

38.1% |

26.4% |

11.7% |

|

30 June 2004 |

24.9% |

21.6% |

3.3% |

|

30 June 2003 |

4.2% |

-1.5% |

5.7% |

|

SINCE INCEPTION* |

11.8% |

8.2% |

3.6% |

|

SINCE INCEPTION^ |

827.8% |

378.6% |

449.2% |

*Annualised

^Cumulative (4 July 2002)

**Before fees and expenses

# S&P ASX 200 Accumulation Index

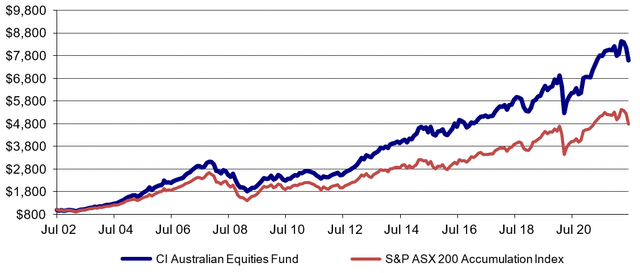

CI Australian Equities Fund – Net of Fees – $1000 Invested Since Inception

Source: National Asset Servicing

“As far as the laws of mathematics refer to reality, they are not certain; and as far as they are certain, they do not refer to reality.” Albert Einstein

“Those who have knowledge, don’t predict. Those who predict, don’t have knowledge.” Lao Tzu

“A wise man has doubts even in his best moments. Real truth is always accompanied by hesitations.

If I could not hesitate, I could not believe.” Henry David Thoreau

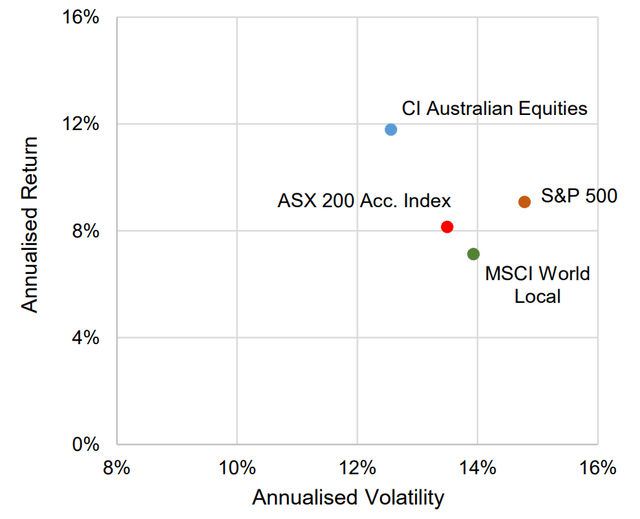

CI Australian Equities vs ASX200 – (since inception to 30-Jun 2022)

Market and Portfolio Performance

The ASX200 Accumulation Index fell -11.90% over the quarter, and fell 6.47% over the year.

Stronger contributors to portfolio performance over the quarter included Ampol (OTCPK:CTXAF, strength in refiner margins and ongoing volume recovery), Brambles (OTCPK:BMBLF, takeover interest from CVC Capital Partners, and favourable market reaction to Costco (COST) plastic pallet decision) and CSL (ongoing plasma volume recovery). The stocks whose performance over the period disappointed included Oz Minerals (OTCPK:OZMLF, falling copper price and a market update showing the effects of inflation on its cost base), Seek (market fears of a slowdown in its job ad volumes) and Wisetech (OTCPK:WTCHF, caught up in growth stock sell off generally).

Of course, most years are made up of two half years – but the financial year just ended was marked by some very divergent performances between sectors and across time periods. The ASX200 rose 3.8% in the first six months to December 2021, but fell 9.9% in the second period. Likewise, some of the biggest sector moves comprised consumer discretionary (up 2.7% first half but down 23% in the second period), Information technology (down 2% in the first half and down a further 37% in the second) and conversely Energy (flat in the first half but up 30% in the second).

It is an interesting time to reflect on returns across various asset classes. Both stocks and bonds performed poorly over the last 12 months pulling back 10 year returns to single digit levels, while small cap stocks have produced returns at only a small premium to cash and bonds. Short rates (CASH) have outperformed long rates over 1,3, 5 and 10-year periods.

Only physical commodities offered respite, a function of the inflationary forces driving their prices higher. It is also not surprising that in more volatile times, gold and the USD have been robust.

|

% Return (p.a.) |

||||

|

Total Return |

1 YR |

3 YR |

5 YR |

10 YR |

|

ASX200 |

-6.47% |

3.34% |

6.83% |

9.29% |

|

ASX300 Industrials |

-9.56% |

2.20% |

4.98% |

9.83% |

|

ASXS300 Resources |

2.95% |

7.73% |

15.06% |

6.99% |

|

ASX Small Ordinaries |

-19.52% |

0.38% |

5.07% |

5.37% |

|

MSCI AC World (AUD) |

-7.60% |

7.43% |

9.91% |

13.78% |

|

CI Australian Equity Fund |

-1.81% |

7.43% |

8.90% |

12.64% |

|

Australian 10 yr Government bonds |

-14.40% |

-4.12% |

0.50% |

2.26% |

|

CPI* |

5.10% |

2.80% |

2.30% |

2.20% |

|

Commodities basket (RBA, AUD) |

26.10% |

16.30% |

16.80% |

5.80% |

|

Rural commodities basket (RBA, AUD) |

26.60% |

11.60% |

10.0% |

6.60% |

|

Gold (AUD) |

11.23% |

9.31% |

8.96% |

5.31% |

|

US Dollar (vs AUD) |

8.44% |

0.69% |

2.0% |

3.9% |

|

Cash (12-month deposit reinvested) |

0.25% |

0.95% |

1.46% |

2.38% |

* to March 2022

Source: Factset monthly returns, RBA, NAB Asset pricing

Investment cycles can last longer than many people expect, but the above returns suggest incrementally that the industrial sector could be an interesting hunting ground.

As with our report for the March quarter of 2022, the quotes above dovetail with our ongoing view as to the prevailing level of uncertainty being as high as we can remember it being for quite some time. There are a number of possible ways in which the global economy and financial markets could go, ranging from the pessimistic – deep recession and further market falls – to a muddle through scenario and the markets and economies stabilise (at the optimistic end of the range).

We cannot predict what will happen – hence our search for companies with the opportunity to add value, combined with management teams with both the capability and the intentionality to do just this over a medium-term timeframe. One of the ways we look at the market is through the lens of our subsets of value – allowing us to invest in whichever parts of the market appear the most prospective at any given point in time.

In addition, recent falls in commodity prices (oil, iron ore, copper) and bond yields would also indicate some softness in activity. Whether this leads to a plateauing in the level of inflation and therefore the end of interest rate rises remains to be seen. Certainly though we are finding more fertile ground in growth stocks (where we have recently added to our position in CSL), and are watching closely as cyclicals start to underperform.

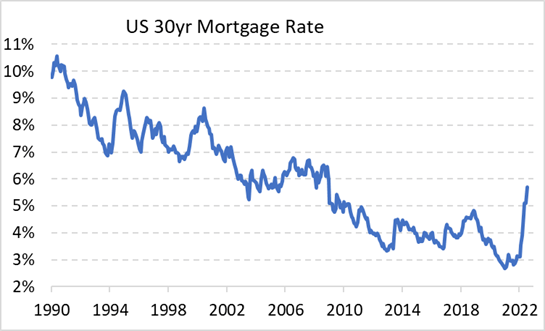

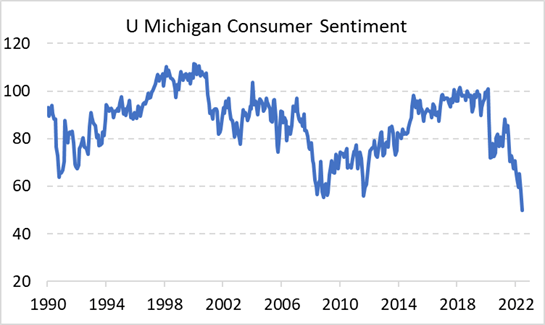

We observe some softness creeping in to certain indicators and leading indicators of activity. In the USA consumer confidence has fallen, which together with the rapid rise in the mortgage rate, would indicate consumer spending may be less robust over the next periods.

Source: UBS Source: UBS

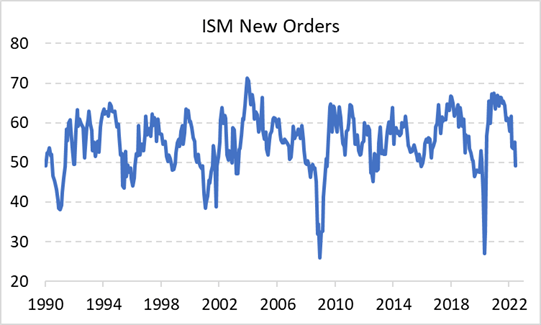

Likewise, the new orders section of the ISM index, as well as the falling copper price, would indicate industrial activity may have peaked for the time being.

Source: UBS

Commodities and mining stocks are typically seen as providing protection against inflation. This is due to underlying industry costs rising with inflation, lifting the cost curve and marginal cost of supply over time, supporting higher commodity prices. This holds over the longer term. However, in the shorter term, costs and commodity prices can become quite disconnected. Over the last 2-3 years rapidly rising commodity prices have more than offset any production or cost related challenges for Australian miners, resulting in expanded margins.

With commodity prices having reached historically elevated levels, well above cost curve support, we are now seeing a period where rising commodity prices are no longer providing an offset to inflationary pressures. At the same time the cost pressures that the Australian mining sector has been combatting over recent years, principally due to labour sourcing challenges, have been exacerbated with additional pandemic related labour constraints, combined with rising input costs for raw materials and supply chain disruptions.

This has created challenging operating conditions and resulted in accelerating cost inflation. As commodity prices stagnate at elevated levels, or even begin to retrace back to more reasonable prices, we will, and are beginning to see, margin pressure in mining companies. A notable recent example has been portfolio holding Oz Minerals, but over the last half we have seen increasing costs reported from a range of mining companies. With revenues linked to commodity prices, these companies are price takers and are not able to pass through these costs to customers like many industrial companies are able to.

Interestingly we are observing the start of a pattern of tax rises around the globe. To date they have come at the corporate level, more particularly in commodities where profits are high. India have announced a windfall tax on fuel exports, Italy and the UK have announced new taxes on energy companies, Chile are planning to increase mining royalties and the Queensland government has increased royalty rates on coal miners.

We would think tax increases such as these will become more widespread, especially if commodity prices remain at elevated levels. Given the state of government debt levels and budget deficits around the world it would not surprise us to see some form of tax increase spill over to the individual level over time.

The Portfolio

Brambles (OTCPK:BXBLY)

On the very last day of the financial year Brambles announced its long awaited decision as to whether it would go ahead/participate with one of its major US customers’ (Costco) plans to convert its pallet pool from wood to plastic. The answer was no – a response met with some initial enthusiasm by the market as evidenced by the fact that the stock has outperformed in the week since the announcement. The reasoning behind the decision revolved around insufficient return on capital for the risk and cost involved.

In light of the fact that the capital expenditure required would have been upwards of USD$500m (plastic pallets are circa 4X more expensive than wood) and this would have impacted on free cash flow, one can see why there has been a general sense of relief that management did not pursue this option. We understand this, but wonder if in the medium term the company may have opened up an opportunity for someone with deep pockets to enter the US pooling market, where BXB has long been by far the largest player.

Cleanaway (OTCPK:TSPCF)

The last six months have been disappointing for Cleanaway, a stock we have held for some years – initially as a turnaround and latterly as a stalwart. Subsequent to the change in management some twelve months ago the news emanating from the company has not been as positive as management would have liked. Notwithstanding several industry tailwinds favouring the company, there have been a number of earnings downgrades, fires at a couple of facilities, fines to be paid to regulatory authorities and landfill issues in Queensland.

We remain of the belief that there are a number of opportunities for the company to create value if management is sufficiently intentional and focused on the job at hand.

Tabcorp Holdings (OTCPK:TABCF)

We initiated a position in Tabcorp Holdings during the June quarter. We see the company as an attractive turnaround opportunity on a number of fronts: (i) greater management focus following the demerger of the larger lotteries business in early June, assisted by a refresh of senior executives; (II) industry reform closing the gap on fees and taxes paid by TAH vs. competitors; (III) new initiatives to speed up product development including harmonisation of regulatory approvals across licences and a new app development framework which allows forcross–platform development; and (iv) improving operating trends against the closure of retail operations during Covid-19 lockdowns last year.

The company has had its challenges historically, many of its own making. However, the demerger and industry reform could mark a change in fortunes. The history of demergers suggests the “ugly sister” often performs well post-split. Industry reform is also firmly on the agenda after early success in Queensland and a national campaign in conjunction with pubs and clubs. We think TAH offers value latency even before assuming any further success around industry reform, with a free cash flow yield materially higher than the company’s reported earnings yield. We also see the potential for significant value upside if management can “level the playing field”. Finally, we note historical M&A interest in TAH at 60% above current levels, although that is not part of our investment thesis.

Star Entertainment (OTCPK:EHGRF)

Star Entertainment was a moderate detractor from performance in the quarter, impacted by the NSW inquiry into the company’s suitability to operate its Sydney casino (the Bell review). We expected some share price weakness through this period, but were both surprised and disappointed at the extent of the alleged misconduct that emerged during the public hearings. The extent of SGR’s wrongdoing relative to Crown Resorts (OTCPK:CWLDF) is debateable, but it’s clear that any misconduct can put an operator’s “suitability” at risk given the high-risk nature of the casino environment.

There are a range of potential outcomes from here, but the precedent set in NSW for Crown is instructive; their licence was retained following a management clean-out, board renewal, and a period of remediation. The Victorian and WA inquiries also suggest operations are likely to continue while remediation activities are undertaken, given the economic impact of closure. As a result, the extent of management changes and Board renewal is to date what we have been anticipating, and is appropriate in the circumstances.

We believe this a positive development and a good opportunity to change the culture of the organisation and its relationship with the regulators in NSW and Queensland. A new CEO was recently announced with extensive experience with regulators and government in both states. We believe there is attractive value latency at the current share price despite the regulatory uncertainty. Domestic gaming revenues have recovered strongly following Covid-19 lockdowns but SGR’s enterprise is 30% below pre-Covid levels.

Cash flows also improve materially from here as major projects finish and capex rolls off, and there is an opportunity to realise latent value via a property transaction, a model that has been widely adopted by US casinos. Finally, SGR’s assets are attractive and difficult to replicate, including long-term monopoly licences. The recent takeover of Crown shows there is private interest at in this type of asset once regulatory uncertainty clears.

Treasury Wine Estates (OTCPK:TSRYY)

We also built on a position in Treasury Wine Estates during the quarter. The company has faced a number of headwinds over the preceding 3 years including: (i) US price competition; (II) Chinese tariffs on Australian wine; (III) Covid-19; and (iv) higher grape prices following small Australian vintages. Management has navigated these challenges well; the business was restructured including the creation of new operating segments for greater focus on key brands, the divestment of low margin commercial volumes in the US, supply chain optimisation and the reallocation of Penfold’s volumes from China to previously neglected markets.

The business is now on a more sustainable footing with less reliance on China (approx. 30% of group earnings in FY20) and more exposure to long-term premiumisation trends (consumers choosing quality over quantity). Competitor results and industry channel checks also suggest the higher margin on-premise and cellar door channels are recovering from lockdowns and restrictions. The company’s multi-regional sourcing model positions the company to take advantage of lower grape prices in Australia and NZ.

Finally, we believe the strength of the Penfold’s brand in Asia is underappreciated with an investor at a recent conference remarking that in Asia it’s “either French or Penfold’s”. There is some uncertainty around where the sales base is following the reallocation of volumes from China, but we’re confident in high single-digit to low double-digit sales growth once it’s found.

We believe TWE evidences a number of value latencies before the successful execution of some of the company’s growth initiatives, including the release of new Penfold’s country of origin (French, China) wines in China later this year, which won’t be subject to the prohibitive tariffs applied to Australian wine.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment