NicoElNino

Continental Resources (NYSE:CLR) is one of the larger pure-play petroleum companies, with a market capitalization of roughly $25 billion. The company’s strong business means it remains near all-time highs in a volatile oil environment and, as we’ll see throughout this article, the company has the ability to drive substantial shareholder returns.

Continental Resources’ Assets

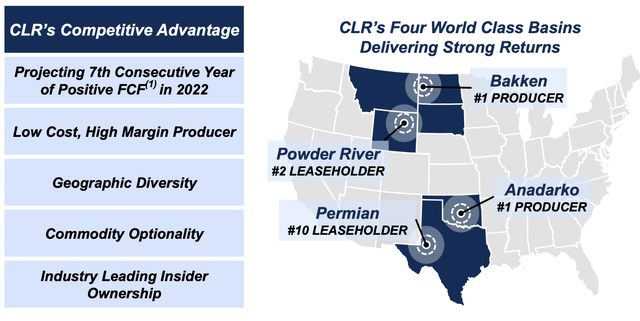

Continental Resources has a strong portfolio of assets that we expect to enable strong returns for investors.

Continental Resources Investor Presentation

Continental Resources has significantly revamped its portfolio and moved into an environment where it’s generating strong and consistent FCF. The company has high margins and a distributed portfolio of assets in some of the most important oil-producing assets in the United States. The company is continuing to maintain a unique ability to respond to volatile oil prices.

Continental Resources’ Performance

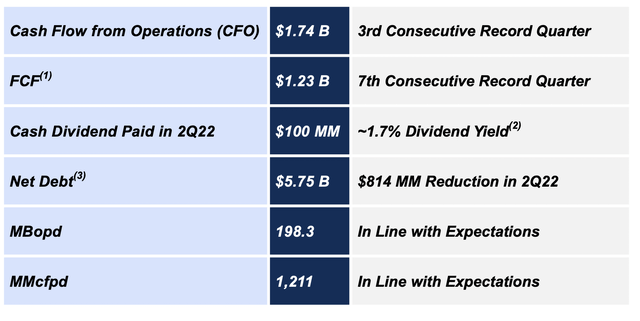

Continental Resources’ business has continued to perform incredibly well, supporting continued performance.

Continental Resources Investor Presentation

Continental Resources is continuing to produce substantially, with almost 200 thousand barrels/day of production and more than 1 billion cubic feet per day in natural gas production. The company has managed to use its financials to substantially reduce its net debt with $5.75 billion in net debt currently, reduced by >$800 million in 2Q 2022.

The company’s pace of debt decreases show its financial strength in a strong price market. The company paid $100 million in dividends and is maintaining its dividend yield of <2%. Right now, the company is directing most cash to net debt pay down; however, it still has the cash to drive substantial overall shareholder returns.

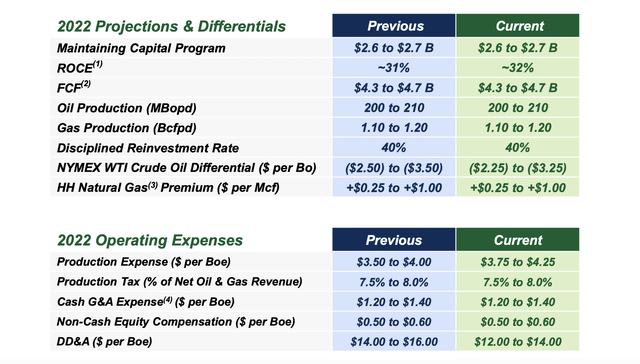

Continental Resources’ Guidance

The company’s overall financial strength is shown through its continued financial performance in line with its guidance.

Continental Resources Investor Presentation

Continental Resources is guiding for $2.65 billion in capital spending with FCF after capital spending of roughly $4.5 billion. That’s an almost 20% FCF yield, showing the company’s strength as it continues to be disciplined about reinvestment while generating massive cash flow. The company gets a slight decrease in oil premium but a large increase in natural gas premium.

The company is expecting costs to rise slightly from a production perspective; however, overall, cash flow is expected to remain strong.

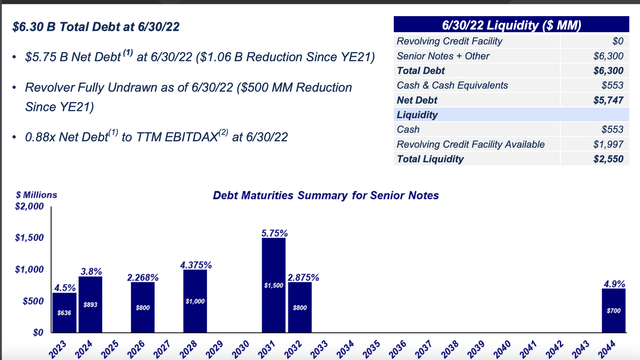

Continental Resources’ Financial Assets

Continental Resources has an impressive portfolio of financial assets to drive future shareholder returns.

Continental Resources Investor Presentation

Continental Resources is continuing to improve its debt profile. The company’s net debt of just under 0.9x net debt to TTM EBITDAX is incredibly manageable, and the company’s debt maturity profile is filled with low interest debt that it can comfortably pay off as it comes due. Through the end of the decade, the company has just under $3.5 billion in debt due, a number it can easily afford.

Continental Resources’ Shareholder Returns

Continental Resources has the ability to drive future shareholder returns.

The company’s current guidance is for $4.5 billion in FCF, representing a 20% FCF yield. The company is semi-optimistic with prices here in its assumption, so there’s definitely a chance that they could drop some. The company’s debt load is incredibly manageable, and the company has the cash flow to continue increasing it.

The company’s debt costs it roughly $200 million in annual interest and at the rate the company is paying it, that would allow it to repay all of its debt in 7 quarters. The company’s strong financial positioning means that once it reduces its debt further, it can undertake a variety of different shareholder return paths, making the company a valuable investment.

The company is continuing to spend capital on a variety of growth businesses, but regardless of how it spends the cash, we expect substantial shareholder returns.

Continental Resources’ Thesis Risk

The largest risk to Continental Resources’ shareholder return is crude oil prices. Brent crude prices are $86/barrel and WTI is <$80/barrel. Henry Hub is still strong at roughly $8. The company’s cash flow is strong, however, there’s no guarantee that it continues. That means that the company could struggle to maintain future shareholder returns.

Conclusion

Continental Resources has a unique and impressive portfolio of assets. The company is continuing to generate substantial FCF, and we expect that it’ll be able to grow that FCF. The company is struggling with recent price weakness, which could hurt its ability to drive returns, however, OPEC+ has also shown a consistent interest in protecting prices.

Going forward, we expect Continental Resources to continue focusing on shareholder rewards, making the company a valuable long-term investment. The company is continuing to make operations more efficient, which will enable these long-term returns to grow. Let us know your thoughts in the comments below.

Be the first to comment