Aaron Yoder/iStock via Getty Images

Last time, I looked at Exelon (EXC) which spun off its generation business, Constellation Energy (NASDAQ:CEG), in early 2022. For background, utility companies are often made up of merchant power generators and transmission and distribution companies. CEG is the former and EXC is the latter. In general, T&D is seen as a lower-risk area of the industry whereas power generators can go through bigger swings as commodity prices ebb and flow and legislation changes can have significant impacts.

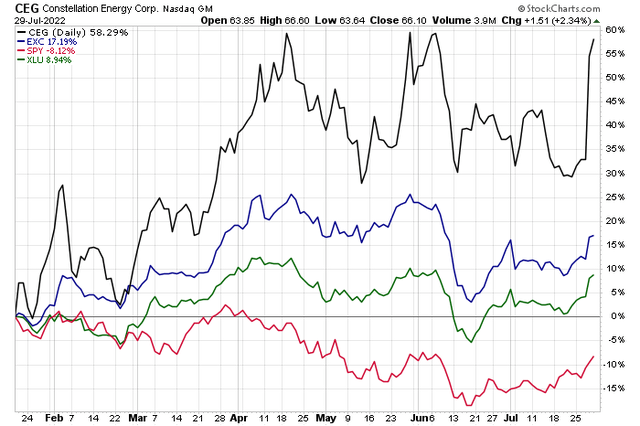

And that is just what we saw last week when Senator Manchin (D – WV) surprisingly came out in support of the Inflation Reduction Act (‘IRA’) of 2022. The proposal includes several provisions beneficial to CEG. The stock climbed more than 16% last Thursday in wake of the news – beating the Utilities Select Sector SPDR ETF (XLU) and even clean energy stocks. The IRA legislation includes valuable production tax credits (‘PTCS’) that could be worth upwards of $3 billion of EBITDA and $2 billion of free cash flow from 2024-2026 to CEG, according to Bank of America analysts.

Returns Post-Spin Off: CEG Leads EXC, XLU, SPY

For background, Constellation Energy Corporation is a competitive generation and retail company that operates the largest US fleet of nuclear and other carbon-free electricity. The company has a 100% carbon-free goal by 2040 for owned assets with a 95% interim goal by 2030. Approximately 90% of the generation output is nuclear or renewables with the assets concentrated in the Mid-Atlantic/Northeast (IL, PA, NJ, MD, & NY). The retail business is the second largest in the US with a 23% C&I market share, according to BofA.

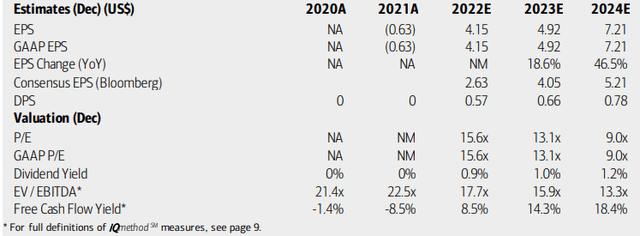

On valuation, shares look cheap but come with more uncertainty than EXC. BofA sees EPS jumping from near $4 today to above $7 for FY2024. That impressive growth rate makes its current P/E multiple near 16 times (using 2022 EPS) quite reasonable. The stock pays a small dividend yield, however. Its EV/EBITDA is elevated but the stock has a very impressive free cash flow yield.

Constellation Energy: Earnings, Valuation, Dividend Forecasts

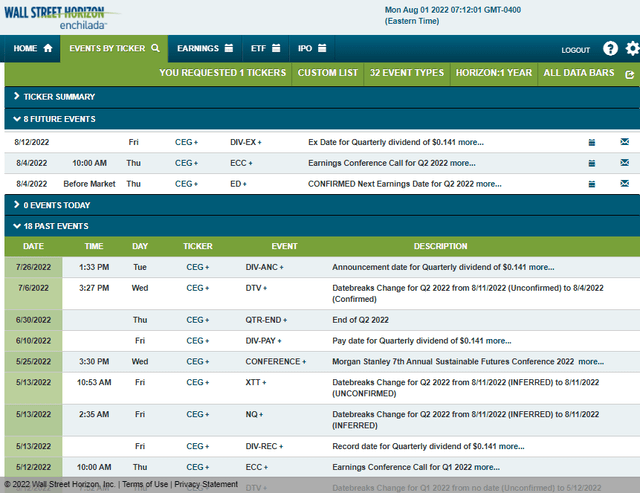

The $21.6 billion market cap company included in the S&P 500 and Nasdaq 100, based in Baltimore, has its Q2 earnings date this Thursday BMO with a conference call to follow. There’s also an ex-dividend date upcoming on August 12, according to Wall Street Horizon. Options data implies an 11% stock price move between now and the August 19 expiration date.

Corporate Event Calendar: Earnings, Ex-Div Date On Tap

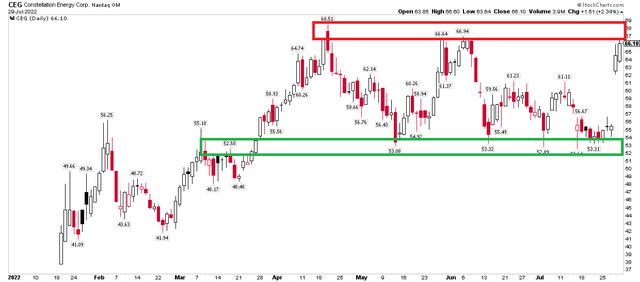

The Technical Take

You can see the massive gap higher around the positive news of the IRA last week. The stock is back at key resistance on its third try to breakout above the upper $60s. Technicians like to say that there are no such things as triple tops, so be on the lookout for a bullish breakout post-earnings from EXC. On the downside, $52-$53 is support and, of course, that big gap lingers ($55.50). Gaps often like to get filled – particularly when they occur within a trading range.

CEG Stock: Trading Range – 3rd Attempt At The Upper $60s, Gap Lingers

The Bottom Line

CEG’s riskier merchant generation business compared to EXC’s T&D operations carry a higher degree of risk, but earnings growth looks strong in the years ahead. The current valuation looks reasonable and the trading range over the last four months has been relatively strong vs the S&P 500. I like the stock here and would be particularly bullish on a close above $69.

Be the first to comment