SimonSkafar

ConocoPhillips (NYSE:NYSE:COP) is one of the most storied names in energy. The company has traditionally rewarded investors, despite energy firms normally destroying shareholder capital. The European energy crisis, and a wider pattern of capital discipline in the industry, have created a path for future sustainable profitability. The company’s free cash flows are trading at very attractive rates, providing investors with a strong buy signal.

A History of Rewarding Investors Against the Odds

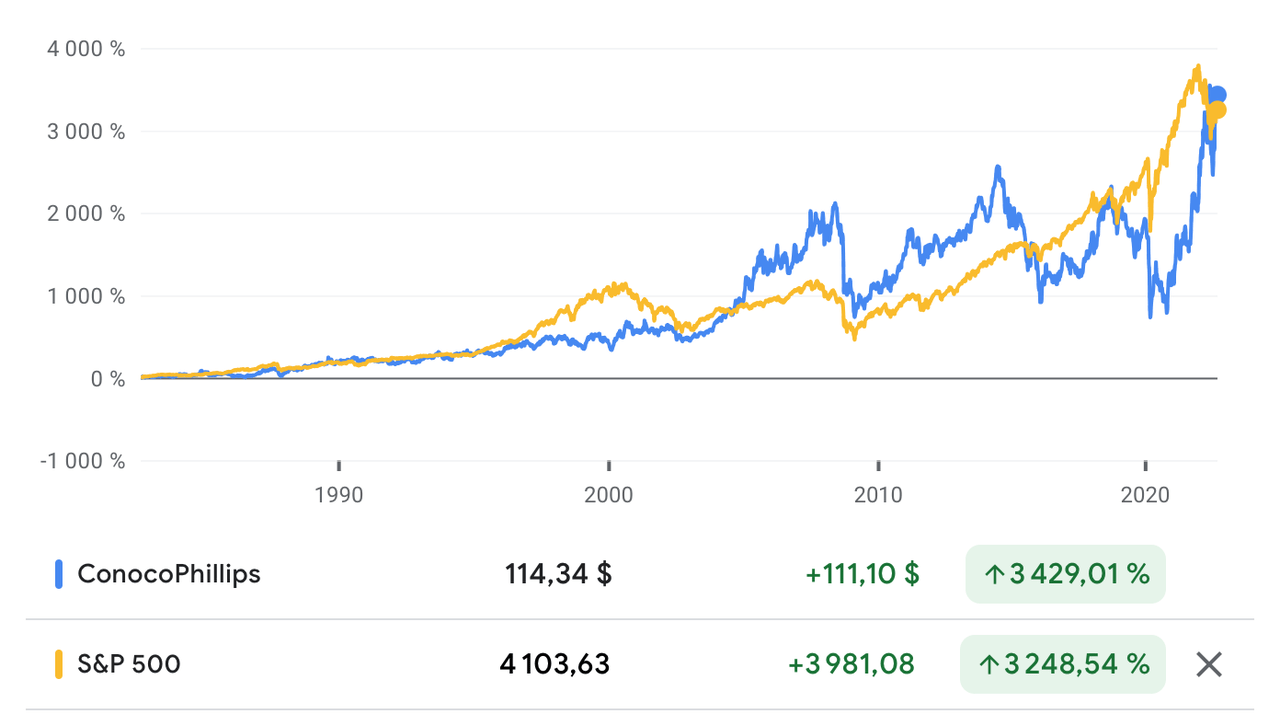

The pareto principle has a wonderful way of making its presence felt. Energy firms are, in principle, bad buy-and-hold investments. Indeed, Hendrik Bessembinder found that, if held across their life, 96% of stocks do not have returns that beat T-bills, with just 4% of stocks earning virtually all lifetime value creation by stocks. The vast majority of stocks only beat T-bills when held for short periods of time. ConocoPhillips is unique in that, since listing in 1982, the firm has beaten the S&P 500, earning a more than 3,429% share price gain for its shareholders, compared to over 3,248% for the S&P 500.

Google Finance

Year-to-date, the stock is up more than 55%, compared to a decline of more than 14% for the S&P 500.

Fossil Fuels Still Matter

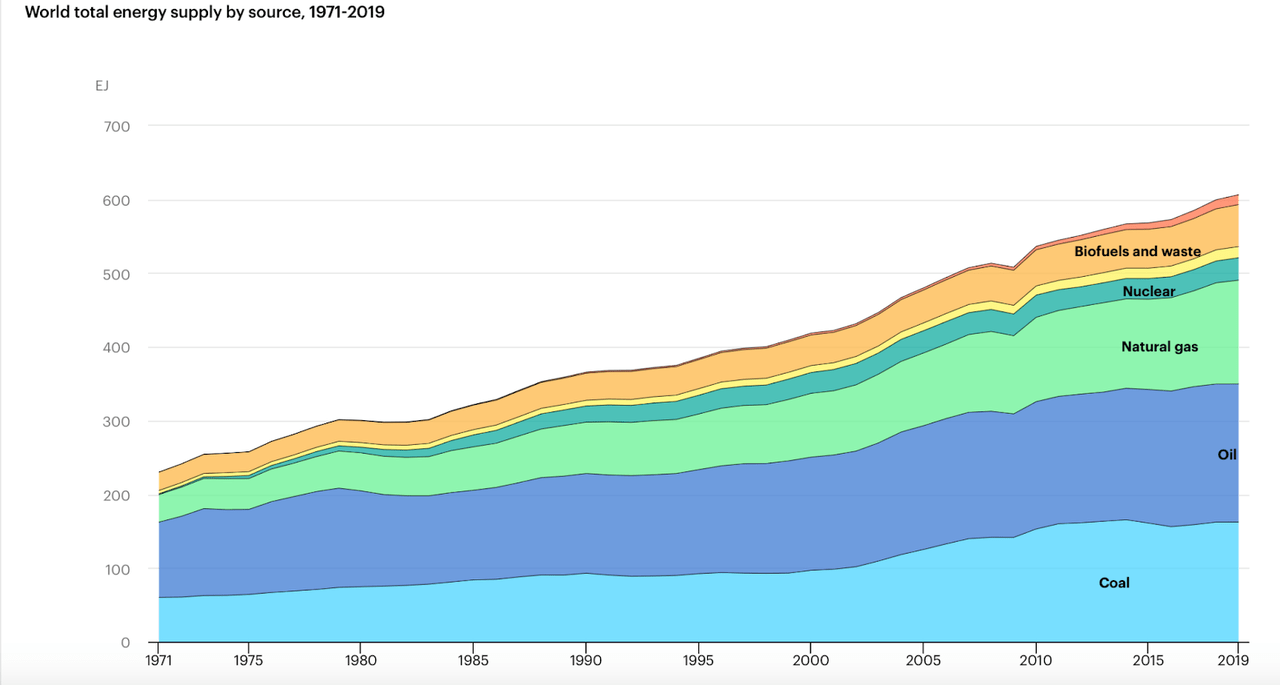

The end of the fossil fuel era has been pronounced over the last decade. Yet, in reality, between 1971 and 2019, fossil fuels declined from 86% of total energy supply, to 83%. Rather than rapid transition, Vaclav Smil has argued that energy has been characterized by inertia.

International Energy Agency

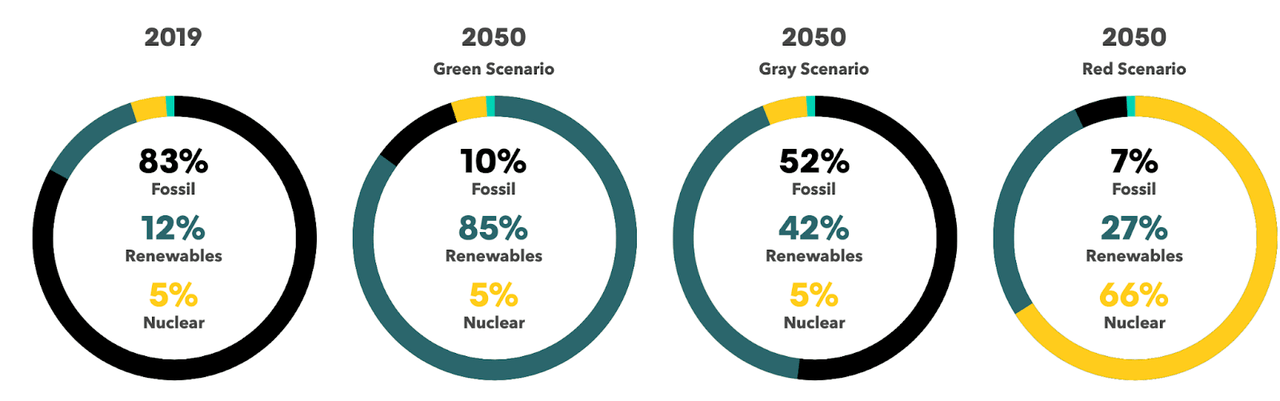

Bill Gates has argued that, because fossil fuels play such an important role in the economy, and that cars, and the creation of electric vehicles, are merely soft problems that do not fundamentally move the needle, the kind of rapid transition that policy assumes, are misleading, and, in fact, the world needs a “miracle” to shift from fossil fuels. The 2021 report by Bloomberg New Energy Finance shows that, in a “gray scenario” in which fossil fuels decline by just 2% a year, fossil fuels will make up 52% of total energy supply.

Bloomberg New Energy Finance

That gray scenario is more likely given that the Russo-Ukrainian War has forced Europe to reconsider the use of coal, with Germany, Italy, Austria and The Netherlands all indicating that a return to coal is possible. More importantly for our thesis, despite all the rhetoric of a green and rapid transition, even Europe is not ready for a pivot to renewables. Rather than a rapid shift to renewables, Europe will be forced to shift its supply of oil and gas, from Russia, to oil and gas from allied countries and regions, such as the United States.

ConocoPhillips Will Benefit from the Russo-Ukrainian War

In a period of deglobalization, cheap fossil fuel supplies are less important than strategically secure supplies. So, even in the event of a resumption of relations between Russia and the European Union (EU), the EU would find itself compelled, for geopolitical reasons, to continue a policy of breaking free from Russia. Rather than competing for the world’s supply of oil and gas, Europe will compete only for an even more limited supply of oil and gas from friendly countries. That will certainly push up demand for American and Middle Eastern energy supplies.

That makes ConocoPhillips’ joint venture (JV) with QatarEnergy to develop the North Field East liquefied natural gas project, strategically important. ConocoPhillips is QatarEnergy’s third international partner (the others are France’s TotalEnergies SE (TTE) and Italian energy firm Eni S.p.A. (E)), and will have a 25% stake in the JV company, and the JV will own a 12.5% stake in the $28.75 billion NFE expansion project, with a capacity of 32 million tonnes a year ((t/y)). The project is the second-largest LNG project in history, and will begin production before the end of 2025.

The company also announced a heads of agreement (HOA) with Sempra Infrastructure, a division of Sempra (SRE). The deal will allow it to expand its LNG projects and carbon capture activities, through a multi-phasal approach.

Capital is Exiting the Market

The oil and gas markets traditionally follow Kaldor’s cobweb model, with a large lag between production decisions and future prices. That has encouraged firms to expand assets during booms, issuing equity, assuming debt, and funding capital expenditures, until supply goes in excess of demand, the bubble bursts, and prices fall, with capital exiting the market, and waves of consolidation and bankruptcies occurring, until profitability returns with the market clearing. Energy investors will recognize this pattern in the last decade of the sector, with the post-Great Recession period being one of consolidation, bankruptcies, and capital discipline. Thus, there is an inverse relationship between asset growth and future returns, what is known as the asset growth effect.

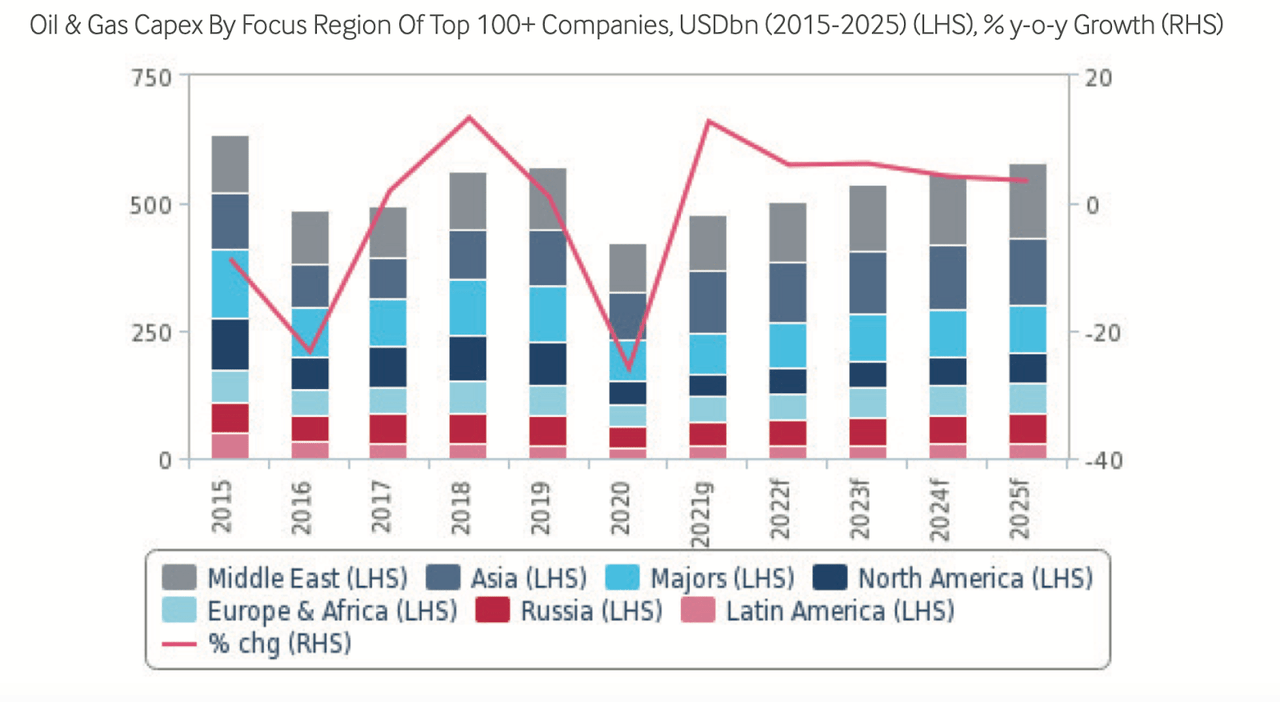

In the wake of the 2008 crash, and more recent events, the industry has become much more capital disciplined, with SP Global reporting last year that mangers had stressed that “high oil prices won’t sway them from continued capital and production discipline,” with the focus being on maintenance capex growth of between 10% and 15%. Even if in 2022, the ultimate capex growth is 20%, that remains historically low and well below the 50% capex growth that current prices would suggest. So, while global capex has risen, it-s still far short of earlier peaks, with Fitch Solutions highlighting the unevenness of the pandemic recovery and continued caution on the part of oil & gas companies, despite rising prices.

Fitch Solutions

A combination of lobbying by ESG and impact investors, and government actions, has deepened the exit of capital from oil and gas. Oil and gas firms have underinvested, in aggregate, in oil and gas, and shifted, admittedly very superficially, capital to renewables. This has occurred despite the fact that demand for oil and gas has continued to grow.

We have the balancing act of Western governments urging a rapid transition to a domestic audience, and then asking OPEC to ramp up production. Meanwhile, OPEC has become more disciplined about capital allocation, and so far refused to give into pressure to respond with the kind of ramp up the West needs, especially in this period. This contraction of capital in the industry is a good thing for investors, because it keeps supply at a profitable and sustainable point. Growth is the enemy, and it’s an enemy the industry has learned to avoid.

ConocoPhillips is One of the Most Profitable Energy Businesses in America

In the last decade, revenue has declined from more than $62 billion in 2012 to nearly $48.35 billion in 2021, in line with an industry-wide shift. That retrenchment is clear in the balance sheet, where total assets have declined from more than $117 billion to nearly $90.7 billion, in that time. Year-to-date, the company has earned revenue of nearly $68.86 billion. However, and this highlights the inverse relationship between asset growth and future returns, the company’s gross profitability has risen from nearly 0.23 to 0.25, between 2012 and 2022. In the trailing twelve-month period, gross profitability is 0.35, just above the 0.33 threshold recommended by Robert Novy-Marx. While net income dipped from nearly $8.43 billion in 2012, to just over $8 billion in 2021, in the TTM period, it is $15.91 billion and this while using fewer resources. Free cash flow has risen from -$250 million in 2012, to more than $11.67 billion in 2021, rising to nearly $16.66 billion in the TTM period. Return on invested capital rose from 14.1% in 2012, to 14.9% in 2021. At 26.6% in the TTM period, ROIC is at its highest level in a decade.

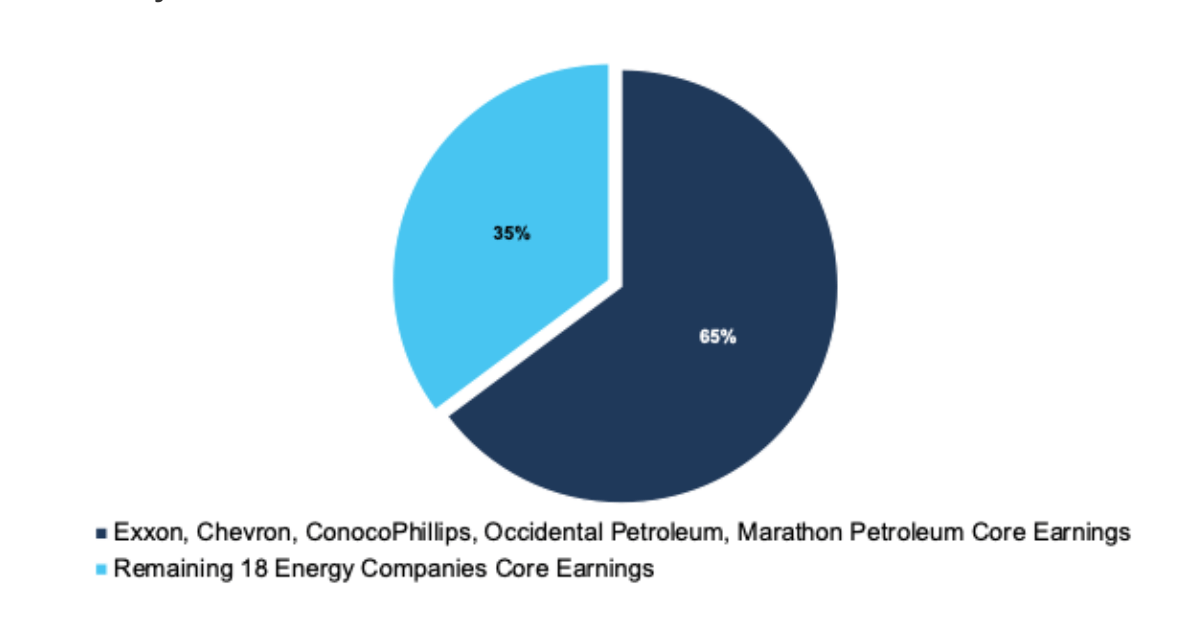

Once again returning to Pareto’s principle, research conducted by renowned financial service firm, New Constructs, LLC, shows that just five firms generate 65% of the S&P 500 Energy sector’s core earnings, a measure of the profitability of a business’ core operations. ConocoPhillips is one of those five companies, the others being Exxon Mobil (XOM), Chevron Corporation (CVX), Occidental Petroleum Corp. (OXY), and Marathon Petroleum (MPC).

New Constructs, LLC

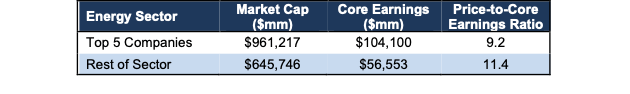

New Constructs research also shows that these firms remain undervalued, with a price-to-core earnings ratio of 9.2, compared with 11.4 for the rest of the sector, despite generating more core earnings, and having a larger market cap than the rest of the sector.

New Constructs, LLC

Risks

The industry’s recent capital discipline is the biggest potential source of risk for the company’s ability to earn long-term returns for its investors. The restraint shown by managers has never, to my mind, been seen, and it’s rational to wonder if managers will be able to maintain it in the long run. If that discipline loosens, or managers fall to pressure to expand production, they may miscalculate and lead to yet another boom-and-bust cycle.

Valuation

With FCF of $16.66 billion in the TTM period and an enterprise value of $154.98 billion, ConocoPhillips has an FCF yield of nearly 10.75%. Compare this with the S&P 500’s FCF yield of 2.05%, according to an analysis by New Constructs. New Constructs also calculates an FCF yield of 4% for the energy sector.

Conclusion

ConocoPhillips has a history of rewarding its investors, in an industry that has often destroyed shareholder value. With recent shifts toward more capital discipline, and opportunities from the European energy crisis, the company is in a position to be a big winner in coming years. The industry’s restraint supports, not just profitability, but sustainable profitability. In addition, the company’s FCF are trading at very attractive rates.

Be the first to comment