mtcurado/iStock Unreleased via Getty Images

Price Action Thesis

Like its leading oil and gas peers, ConocoPhillips (NYSE:COP) stock has also been battered over the past month as the market turned its attention to recessionary fears.

As a result, COP fell more than 35% from its June highs to last week’s lows (July 8’s close). We observed that COP is likely at a near-term bottom as a bear trap (significant rejection of selling momentum) formed. Therefore, dip buyers have likely rushed in, taking advantage of the steep decline. Its technicals also seem oversold, probably discouraging astute traders/investors from setting up more directionally bearish bets at this juncture.

However, our long-term charts suggest that the decline may not be over yet. We believe that the market could use the current bottom to draw in more dip buyers before setting up another bull trap (significant rejection of buying momentum).

Accordingly, we urge investors waiting to buy the dips to bide their time further. Moreover, investors sitting on massive gains can wait for a short-term rally, before cutting exposure.

We rate COP as a Hold for now.

ConocoPhillips – June’s Bull Trap Was A Significant Warning Signal

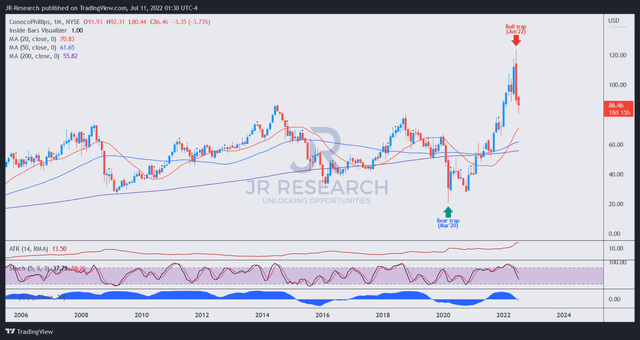

COP price chart (monthly) (TradingView)

As seen in COP’s long-term chart above, June’s bull trap was validated. We have been awaiting this signal for some time after a massive surge in 2022 pushed it to its June highs. We believe that June’s warning signal has also decisively resolved March 2020’s bear trap.

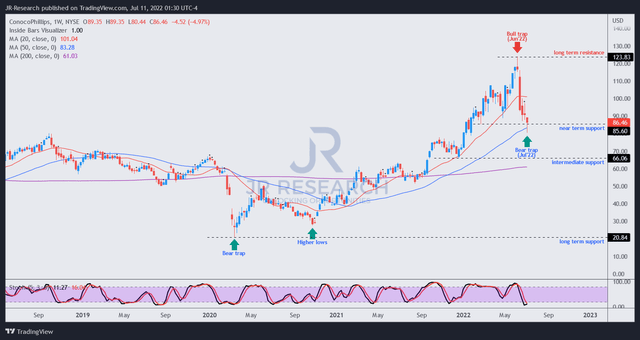

COP price chart (weekly) (TradingView)

Notwithstanding, over the past four to five weeks, the market’s hammering of COP sent it into oversold zones. In addition, we also noticed a discernible bear trap formed last week (July 8’s close) that rejected further selling. As a result, we are confident that its near-term support will likely hold for now.

However, we usually accord higher precedence to its long-term chart if we observe significant price structures. Given June’s massive bull trap, we believe further caution is warranted, and investors should not buy the dip now.

Investors should let the price action play out and observe whether a possible short-term rally would culminate in a lower-high bull trap. That would indicate another red flag, suggesting that the market does not intend to allow COP to retake higher highs.

Also, investors should watch for a re-test of its near-term support ($86) before pulling the buy trigger. Therefore, we think it’s premature for investors to add exposure now.

WTI Crude And Natural Gas Price Action Is Worrying

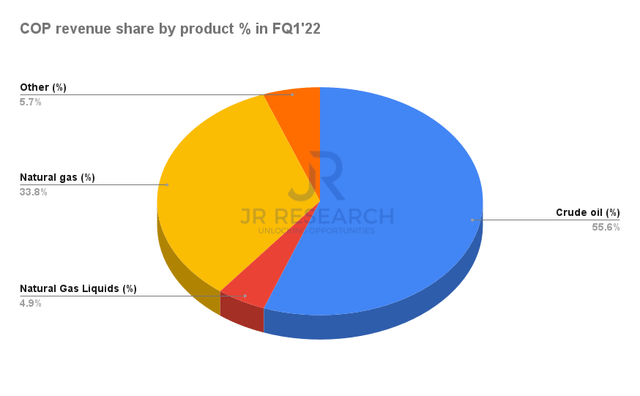

ConocoPhillips revenue by product % in FQ1’22 (Company filings)

Given ConocoPhillips’ significant exposure to crude oil and natural gas, we believe it’s also critical for investors to study both markets’ price action.

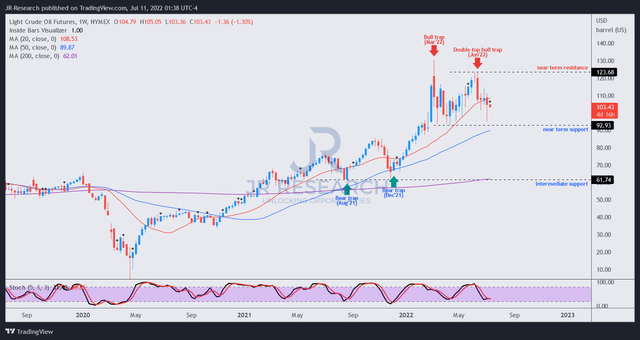

WTI futures price chart (TradingView)

We observed that the WTI futures (CL1:COM) exhibited two noteworthy bull traps in March and June 2022. As a result, they also appeared to have resolved the bear traps that undergirded its advance since August 2021.

Notably, the bull trap seen in June 2022 is a double top, the most potent of bull traps in our arsenal. Therefore, we are confident that the consolidation seen in WTI crude from March to June was a distribution phase. However, given the warning from June’s double top, we are not convinced that its near-term bottom could hold eventually.

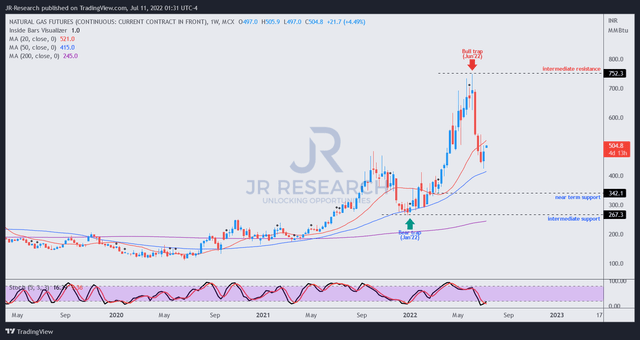

Natural gas futures price chart (TradingView)

In addition, natural gas (NG1:COM) also met with a bull trap in June, which sent NG1 spiraling down. However, we also noted that it’s likely at a near-term bottom, which could also attract dip buyers.

However, the price action from its long-term charts continues to look menacing; therefore, we are not convinced that it’s at a sustained bottom.

Thus, the price action in CL1 and NG1 doesn’t augur well for COP for a sustained bottom at the current levels.

Is COP Stock A Buy, Sell, Or Hold?

We rate COP as a Hold for now.

We believe COP is likely at a near-term bottom, which could appeal to dip buyers. In addition, astute traders/investors could also have used the recent bottom to cover their directionally bearish positions, driving buying momentum further.

However, we believe the respite is likely transitory and expect a lower-high bull trap to form subsequently.

We urge investors to abstain from buying the current dips and wait for more constructive price action.

Be the first to comment