Kevin Frayer

H & M (OTCPK:HNNMY) (OTCPK:HMRZF) would be facing a more straightforward recovery story if not for events in Eastern Europe. The Sweden-based global fashion retailer, whose operations are heavily concentrated in Europe, has seen sales and earnings hit hard these past two years on the back of tough COVID restrictions on the continent. With those finally abating, it is the fallout from the war in Ukraine that is now weighing here, overshadowing solid results covering the first half of the year.

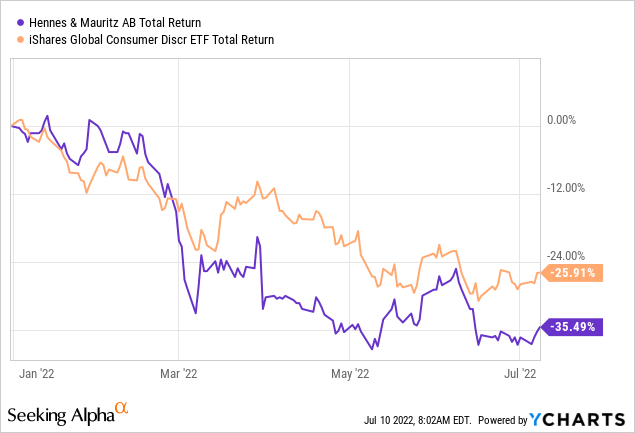

As a result of the above, these shares have struggled quite a bit in recent months, ultimately falling around 25% year-to-date in Stockholm trading. The dollar-denominated ADRs have performed worse, falling over 35% over the same period due to the strength of the dollar, significantly underperforming the iShares Global Consumer Discretionary ETF (down around 25%) in the process.

While the company is facing an increasingly bleak macro outlook, especially in Europe, H & M stock is now trading at levels last seen back in mid-2020, when COVID was proving a massive disruption to operations. With only very modest long-term growth needed to justify the current share price, these shares may appeal to longer-term oriented value investors who don’t mind short-term volatility. Buy.

Brief Company Overview

With annual sales of over SEK 200 billion (~$19B), H & M is the world’s second largest clothes retailer after Zara owner Inditex (OTCPK:IDEXY) (OTCPK:IDEXF). The company operates a total of 4,700 stores worldwide, the majority of which are in Europe. E-commerce represents around one-third of total sales.

Source: H&M Six Month Report 2022

Although apparel can be a fickle industry – ultimately depending on constantly evolving consumer tastes – H & M had nevertheless experienced robust growth in the years preceding the pandemic thanks to its value offering, with store count and sales duly increasing at a robust clip over the years.

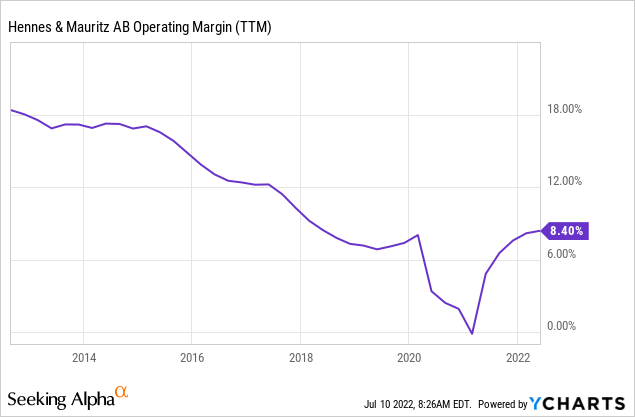

Earnings growth, however, has been much weaker, with the firm seeing margin erosion on the back of fierce competition from both online-only and other hybrid players like Inditex. With sales increasingly migrating to the online channel, an inefficient store footprint has proved a drag on margins.

A Solid Start To The Year But Headwinds Ahead

H & M has certainly faced its share of structural issues, but things were starting to look up just before COVID, with sales growth accelerating and profit margins stabilizing back in 2019. The pandemic upended that, as temporary store closures and the firm’s concentrated European operating footprint – where restrictions were among the toughest globally – put a dent in revenue and earnings.

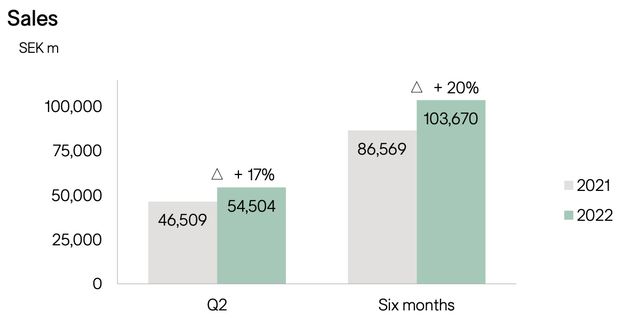

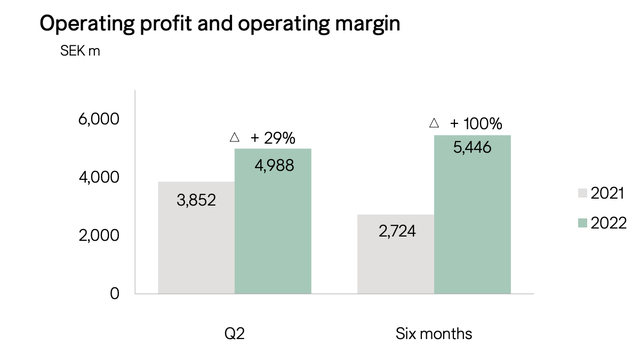

With the company now largely free of those restrictions, financials have rebounded as expected. Revenue for the first six months of the company’s fiscal 2022 (which ends in November) was SEK 103,670 million (~$9.9B), up 15% in local currency terms. Operating profit was SEK 5,446 million (~$520m), an increase of around 100% versus H1 2021, with the firm’s operating margin up 220bps year-on-year to 5.3%.

Source: H&M H1 2022 Results Presentation

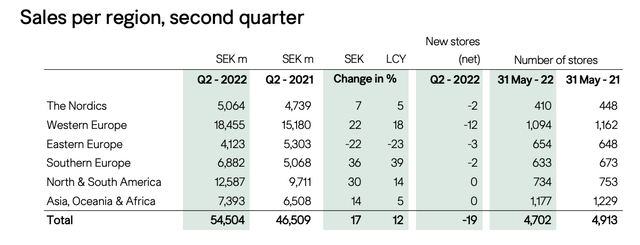

Sales growth did slow sequentially in the second quarter, with revenue up 12% in local currencies versus 18% in Q1, but this was mostly due to the situation in Eastern Europe. Sales were up 17% in local currency terms excluding Russia, Ukraine and Belarus. The balance sheet remains in strong shape, with cash exceeding total financial debt, and management announced a SEK 3 billion buyback program, equal to around 1.4% of the float at the current share price.

Source: H&M H1 2022 Results Presentation

The war in Ukraine will have an impact on operations in the coming quarters. Russia and Belarus, where sales have been suspended, and Ukraine, where operations have been heavily disrupted for obvious reasons, collectively account for a mid-single-digit percentage of the company’s stores and sales. Indeed, management indicated that sales for June (which falls in the company’s fiscal third quarter) were expected to be down 6% year-on-year, 5 points of which are due to the suspension of sales in the aforementioned three countries.

Furthermore, indirect effects from the war might also disrupt operations in the near term. Higher inflation – via elevated labour, energy and raw materials costs – could eat into margins for one, especially as the company is not so easily able to raise prices to offset this. Also, European consumers look set to become increasingly fragile financially, with inflation set to significantly eat into household income. A contraction in discretionary spending wouldn’t be much of a shock, then, which would further crimp sales and margins here.

Upside To Fair Value

Notwithstanding the potential for significant near-term volatility, I still think these shares look attractive due to the extent of the sell-off. At roughly SEK 131 in Stockholm trading, H & M shares are back down to levels last seen in the first half of calendar 2020, when COVID was at its most disruptive to H & M’s business.

Management’s long-term goal is to double sales by 2030 at the latest (relative to 2021 levels) and for “profitability to exceed 10 percent over time”, implying double-digit operating margins. The revenue goal doesn’t appear to be overly aggressive (the baseline year was obviously artificially depressed due to COVID), while modest margin expansion should be achievable given the inherent fixed cost leverage in the business.

Source: H&M H1 2022 Results Presentation

More importantly, the current share price is cheap even assuming lower levels of growth. Discounting 5% annualized revenue growth out to 2030, falling to 3% thereafter, and stable margins get me to a fair value of SEK 166, or 25% above the prevailing price. Buy.

Be the first to comment