Dilok Klaisataporn

Article Thesis

Altria Group, Inc. (NYSE:MO) has seen its shares come under pressure in recent weeks due to an FDA ruling that impacts JUUL and due to the market worrying about possible nicotine reduction regulation. The JUUL impact on Altria is negligible on an operational basis, however, as JUUL wasn’t a relevant profit source anyways. At current prices, Altria offers a very high dividend yield and trades at a pretty low valuation. This combination is attractive. Recession resilience, inflation resistance, and no exposure to global currency rate movements are other positive factors to consider when thinking about an investment in Altria Group, Inc.

JUUL Worries Lead To Sell-Off That Is Overblown

At the end of June, the FDA has officially withdrawn authorization for JUUL products. JUUL was able to revert that ban temporarily while the company’s appeal continues, but many analysts believe that the JUUL ban will be maintained in the end. This news has sent Altria’s shares from a high of $57 to as low as $41, which equates to a drop of 28%. That corresponds with around $29 of lost market capitalization, based on a share count of 1.8 billion.

This reaction would be justified if either of the following were true:

1: Altria lost $29 billion in cash or cash equivalents, thereby reducing the company’s value by a similar amount.

2: Future profits, discounted with an appropriate discount rate, will be $29 billion lower compared to a scenario where JUUL products continue to be sold.

I am convinced that neither of these two scenarios is true and that the hefty drop in Altria’s shares, from an already inexpensive level, is thus a clear overreaction. The first item can be completely ruled out, as Altria will not lose any cash at all. It will have to write down its equity stake in JUUL, but that is by far not as large as $29 billion, and it will be a non-cash item anyways. Neither Altria’s ability to pay dividends, its ability to buy back shares, nor its ability to reduce debt will be impacted in any way when there is a non-cash asset impairment.

When it comes to the second potential justification for the hefty drop in MO’s share price, it again seems highly unlikely that Altria’s JUUL investment would have ever generated profits this high. So far, JUUL is unprofitable and the growth momentum for JUUL was not strong in the recent past. This is why Altria had written down this asset considerably even prior to the ban — there wasn’t a meaningful likelihood that this would turn into a huge profit source, without a ban or with a ban. Essentially, from a future earnings perspective, the JUUL ban doesn’t really have a significant impact on Altria.

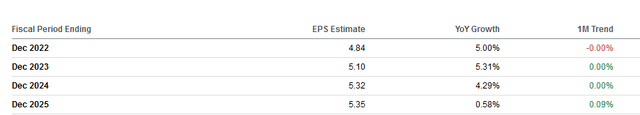

This is reflected by analysts’ consensus earnings per share estimates over the coming years:

Seeking Alpha

As we can see in the above table, the earnings per share estimates for 2022, 2023, and 2024 have not changed at all over the last month, i.e. since the FDA news broke. Earnings per share estimates for 2025 have actually moved up marginally since that news broke. Analysts are predicting that Altria will continue to deliver solid mid-single-digits earnings per share growth in the coming years. Compared to how Altria has performed in the past, this is on the conservative end, as Altria has mostly been able to deliver high-single-digit annual earnings per share growth. But a slowdown in Altria’s EPS growth, as suggested by the analyst community, is far from a disaster. In fact, I do believe that Altria would be a compelling investment today even if it would grow its earnings per share by only 1%-3% a year going forward. That would be well below current analyst estimates and also below Altria’s management’s guidance. But even in that scenario, Altria should deliver 10%+ annual returns, mainly thanks to its hefty dividend yield of almost 9%.

MO Stock Trades At A Historic Discount

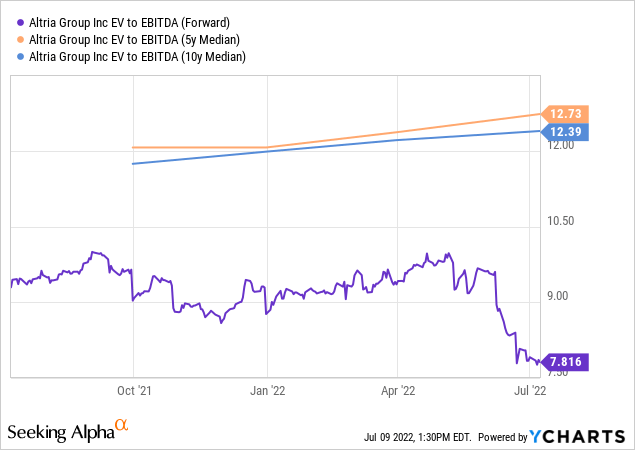

Altria was not expensive when shares were trading in the mid-to-high $50s, but they weren’t ultra-cheap then, either. But following the recent share price slump that seems way overblown relative to the actual, negligible impact of the JUUL ban, Altria has become incredibly cheap:

We see that Altria has been trading at a 10x EV/EBITDA multiple prior to the recent sell-off, which already presented a major discount compared to how Altria was valued in the past, as a 12-13x EBITDA multiple is how the company was, on average, valued historically. Following the recent share price drop, Altria is now trading at less than 8x EBITDA. If Altria were to trade at the historic median a year from now, its shares would climb by more than 50%, which shows how historically cheap the stock is today.

Altria also looks very inexpensive on an earnings multiple basis, as shares trade hands for 8.5x this year’s profits right now. Altria’s management has recently reiterated its guidance for the current year, thus there is a high certainty that profits will indeed come in around expected levels, despite potential macro headwinds such as a looming recession, inflation, and so on. With shares offering an earnings yield of 11.8% right now, Altria is priced for a perpetual decline – which is not at all aligned with its historic growth pattern or with what analysts are predicting for the future.

Altria historically has raised its dividend in July or August, and since the current payout ratio of 74% is below the goal of 80%, it seems likely that we will see another meaningful dividend increase a couple of weeks from now. I do believe that a dividend increase to around $0.95 to $0.97 is realistic, which would result in a payout ratio of 78% to 80%, which would be in line with management’s target. A $0.95 quarterly dividend would result in a dividend yield of 9.2% at current prices, versus a dividend yield of 8.7% prior to the (likely) dividend increase.

Altria Offers Protection Versus All Kinds Of Macro Worries

The market, and investor sentiment, are currently plagued by several macro issues. High inflation hurts consumer spending, rising interest rates hurt equity prices, especially long-duration/growth stocks, and investors also worry about a potential recession. Last but not least, US companies that do a lot of business overseas will see their earnings come under pressure due to weakening foreign currencies, such as the Yen and Euro.

Luckily, Altria offers compelling protection against all of these issues. Its product is very recession resilient, as studies show that smokers do actually smoke more during a recession. Even during the pandemic and lockdown phase, Altria saw its profits rise. Inflation isn’t a problem either, since Altria’s costs are pretty low anyways – gross margins are close to 70% and have grown over the last year. Higher energy costs, higher industrial metals costs, etc. are not a problem for Altria, and the company is also not significantly impacted by high transportation costs. Some companies are hit very hard by these issues, such as Target (TGT) and other retailers operating with slim margins. But Altria should do well in an inflationary environment, especially since massive pricing power will allow the company to continue to increase the cost per pack of cigarettes over time.

Since Altria is only selling cigarettes in the US, a weakening Euro, Yen, etc. are not impacting the company negatively. Its peer Philip Morris (PM), which does business outside of the US only, will be feeling a large negative impact from a strengthening US Dollar this year while Altria is insulated.

Takeaway

Markets aren’t always rational – sometimes they overinterpret good news, and sometimes they overinterpret bad news. The JUUL ban will not really impact Altria, and yet, its market cap has dropped by almost $30 billion in recent weeks. This makes for a good buying opportunity, I believe. Even in a no-growth scenario, the 9% dividend yield alone would generate compelling total returns. When we add some earnings per share growth, buybacks, and the potential for multiple expansion, Altria could easily deliver double-digit annual returns from the current level. With Altria being resilient versus all kinds of macro headwinds, this makes 9%-yielding Altria especially attractive from a risk-reward perspective, I believe.

Be the first to comment