Torsten Asmus/iStock via Getty Images

(This article was co-produced with Hoya Capital Real Estate)

Introduction

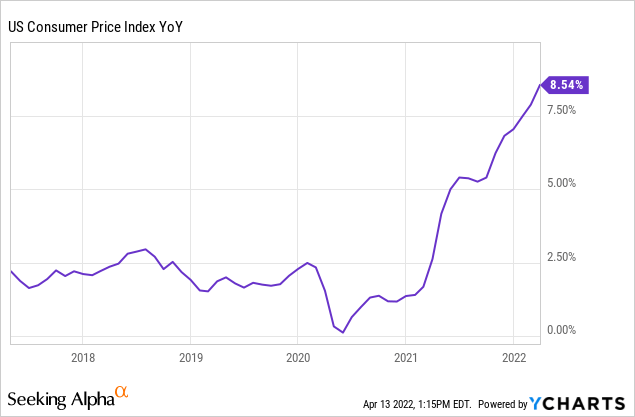

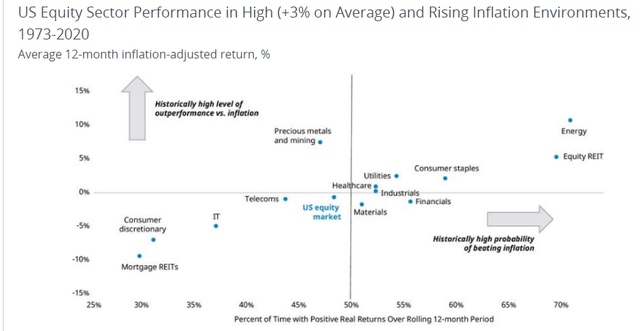

The above chart shows why investors are considering a shift in their asset mix as our “temporary” inflation keeps getting new reasons to stay longer. Adding to the original set of reasons (government spending, labor shortages, supply-chain bottlenecks, all driven off of COVID-19), the invasion of Ukraine is interrupting not only fossil fuels and vital metals, but also shipments of grains.

As the above chart shows, all equity sectors do not react the same when inflation goes above 3% with expectations that it will remain there for some time. Energy being one of the best and Mortgage REITs at the bottom come as no surprise as energy costs can drive inflation and rising interest rates, used to fight inflation, deteriorate asset values tied to those rates.

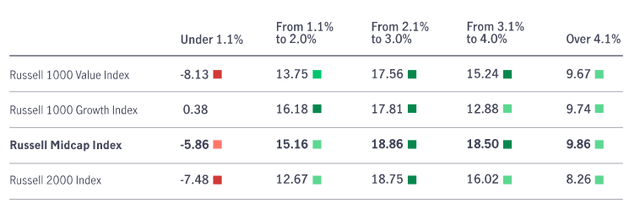

I found the next chart interesting As I read it, as inflation cross 4%, size and growth/value spectrums become less critical in stock selection. This shows 12-month rolling returns under different inflationary environments.

The article goes on to explain what factors John Hancock see behind these results.

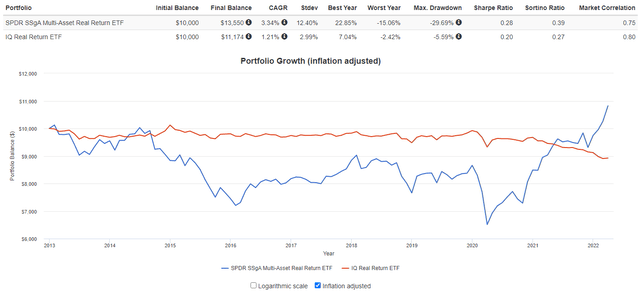

After looking at the returns for both the SPDR SSGA Multi-Asset Real Return ETF (NYSEARCA:RLY) and IQ Real Return ETF (CPI), I would deem RLY hold-during-inflation-spikes-only investments.

Exploring the SPDR SSGA Multi-Asset Real Return ETF

Seeking Alpha describes the WTF as:

SPDR SSGA Multi-Asset Real Return ETF is an exchange traded fund managed by SSGA Funds Management, Inc. The fund invests in ETPs that invest in the public equity, fixed income and commodity markets of the global region. For its equity portion the fund invests in ETPs which invest in stocks of companies operating across diversified sectors. The underlying ETPs invests in value and growth stocks of companies across all market capitalizations. For its fixed income portion the fund invests in ETPs which invest in government bonds and inflation protected securities issued by government and its agencies. RLY started in 2012.

Source: seekingalpha.com RLY

To achieve their real return goal via price growth and income, RLY invests in five classes of assets, as they define as:

- Inflation protected securities issued by the United States government;

- domestic and international real estate securities;

- commodities;

- publicly-traded domestic and international infrastructure companies; and

- publicly-traded companies in natural resources and/or commodities businesses.

The managers describe their investment approach as:

Investment process relies on a proprietary quantitative model as well as the Adviser’s fundamental views regarding factors that may not be captured by the quantitative model.

Source: ssga.com RLY

While they execute their strategy by owning focused ETFs, they use two benchmarks to gage how they are achieving their purpose.

Bloomberg U.S. Government Inflation-Linked Bond Index This index includes U.S. Treasury inflation protected securities that have at least 1 year remaining to maturity on index rebalancing date, with an issue size equal to or in excess of $500 million. The notional coupon of a bond must be fixed or zero.

DBIQ Optimum Yield Diversified Commodity Index Excess Return This index employs a rule based approach when it rolls from one futures contract to another for each commodity in the index. The Index represents 14 commodities drawn from the Energy, Precious Metals, Industrial Metals and Agriculture sectors.

RLY has $287m in assets and has a 10.7% yield (TTM). The ETF comes with 50bps in fees.

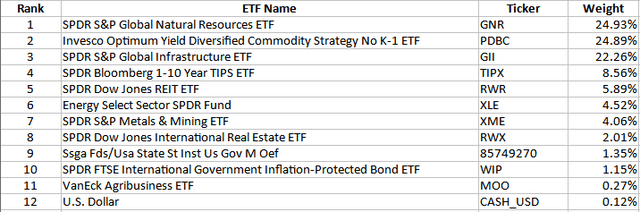

RLY Holdings review

Currently, RLY holds shares in 11 other ETFs.

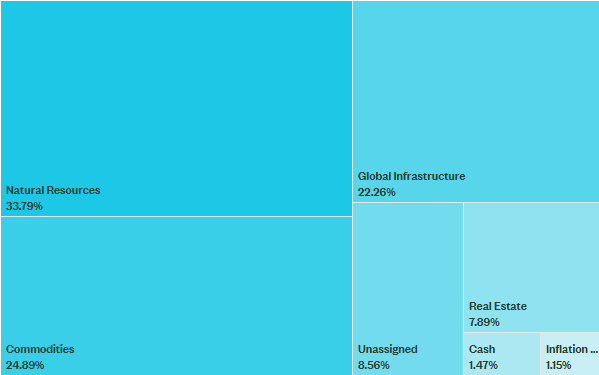

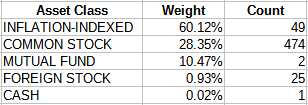

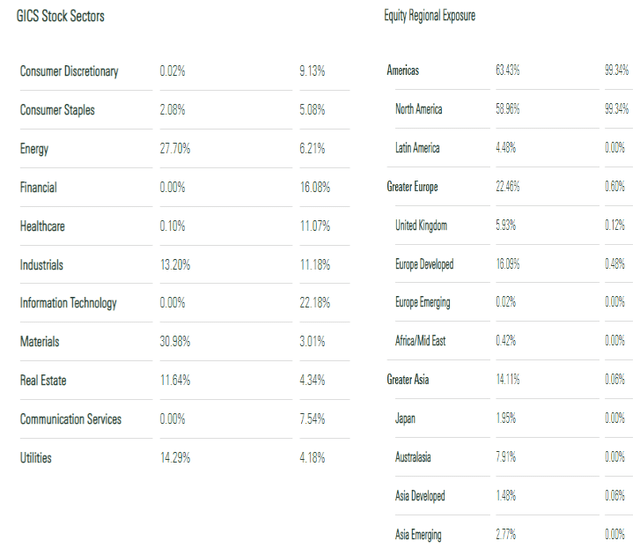

When combining the assets of each ETF, the sector allocation looks like this:

saga.com

With three ETFs dominating RLY’s weight (72%), their focus results in three sectors: Natural Resources, Infrastructure, and Commodities account for 81% of the assets. To get a read on how the Top 5 ETF positions are investing; here is the top holding(s) in each.

GNR ETF: Nutrien Ltd (NTR) provides crop inputs and services. It offers potash, nitrogen, phosphate, and sulfate products; and financial solutions. The company also distributes crop nutrients, crop protection products, seeds, and merchandise products through approximately 2,000 retail locations in the United States, Canada, South America, and Australia.

PDBC ETF: Futures on Zinc and Aluminum.

GII ETF: Enbridge Inc. (ENB) operates as an energy infrastructure company. The company operates through five segments: Liquids Pipelines, Gas Transmission and Midstream, Gas Distribution and Storage, Renewable Power Generation, and Energy Services.

TIPX ETF: TSY INFL IX N/B 0.625 01/15/2024 & TSY INFL IX N/B 0.625 01/15/2026.

RWR ETF: Prologis, Inc. (PLD) is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. Prologis leases modern logistics facilities to a diverse base of approximately 5,500 customers principally across two major categories: business-to-business and retail/online fulfillment.

Fidelity.com; compiled by Author

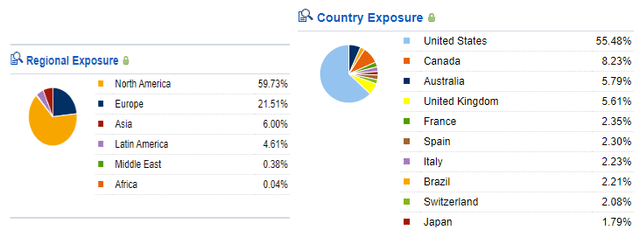

RLY is international in nature with 54% of the assets outside the United States. Based on the country allocation, little seems in EM countries. CPI is almost 100% in US assets.

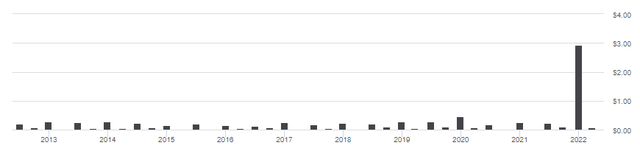

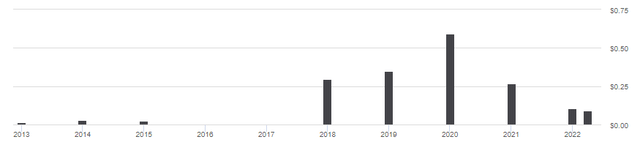

RLY Distribution review

From the documents I searched, the large payout at the end of 2021 was classified as ordinary dividend income. That said, I suspect some was Short/Long-term Capital Gains from the underlying funds, but I didn’t confirm that. What’s important is the 10+% yield shown on RLY’s homepage reflects that payment. The normal yield for RLY is close to 2%.

A brief look at the IQ Real Return ETF

Seeking Alpha describes this ETF as:

IQ Real Return ETF was launched by New York Life Investment Management, and is managed by IndexIQ Advisors LLC. The fund invests in public equity, fixed income and commodity markets of the United States. For its equity portion, the fund invests in Large-Cap stocks of companies operating across diversified sectors. For its fixed income portion, the fund invests in U.S. treasury inflation-protected securities (“TIPS”). For its commodity portion, it invests through other funds in commodities. The fund seeks to track the performance of the Bloomberg IQ Multi-Asset Inflation Index. CPI started in 2009.

Source: seekingalpha.com CPI

CPI has just $29m in assets and generates very little yield (.38%). The managers charge 29bps in fees. Bloomberg describes the Index as:

The Bloomberg IQ Multi-Asset Inflation Index is designed to give exposure to inflation-sensitive underlying securities and track the performance of weighted long positions across equity, fixed income and commodities.

Source: bloomberg.com Indices

New York Life lists three reasons to own CPI:

- Strategic, multi-asset approach: Combines inflation-sensitive building blocks from three major asset classes: 60% TIPS bonds, 30% equities, and 10% commodities.

- More efficient inflation exposure: Multi-asset allocation can offer potential opportunities during inflationary periods while mitigating outsized duration risk inherent in pure TIPS strategies.

- Low-cost inflation hedging solution: CPI seeks to offer inflation-concerned investors a differentiated inflation hedging solution at an attractive cost (29 bps).

As the CPI ETF just changed its benchmark index, and announced a revamped inflation-beating strategy, past history might not reflect future performance, which investors are warned about even without a strategy change. This link explains the new approach CPI is taking.

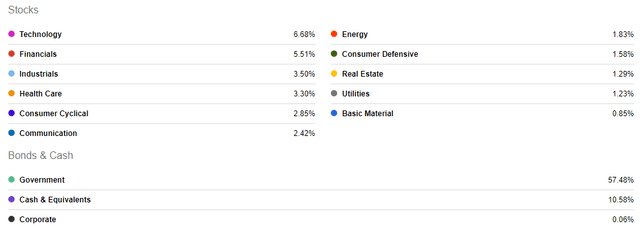

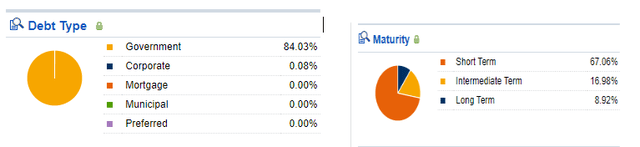

CPI Holdings review

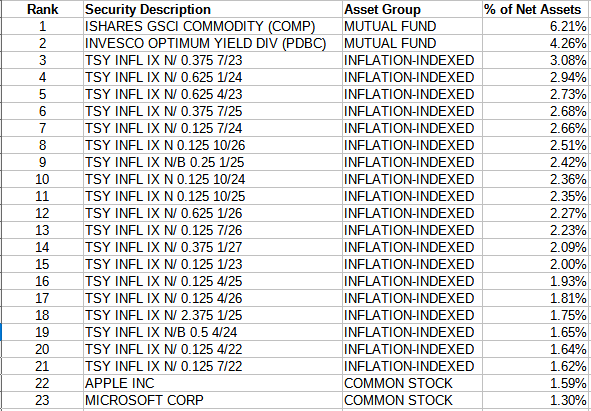

The percent differ between sources as the data dates are not the same. Seeking Alpha was the only one that provided sectors for the equity allocation. Its high cash allocation probably reflects cash held in the two Mutual Funds held by CPI.

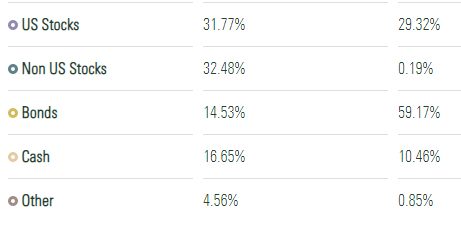

As you can see, this ETF holds vastly different assets than RLY does. This is basically a TSY INFL fund with equity exposure whereas RLY appears to be about 10% in that asset class.

NY Life.com; compiled by Author NY Life; compiled by Author

With 60% of the assets spread across 40 TSY inflation-linked bonds, CPI will be slow to adjust to inflation rapidly accelerates, as we have experienced since last summer. As revealed by the equity sectors, CPI hasn’t focused this segment on stocks that should do better in high inflation times.

CPI Distribution review

Consistent income from this ETF is just not in its design. When done, they pay in December.

Comparing RLY versus CPI

Author’s note: Unless noted, the following charts are from Morningstar Fund Comparison.

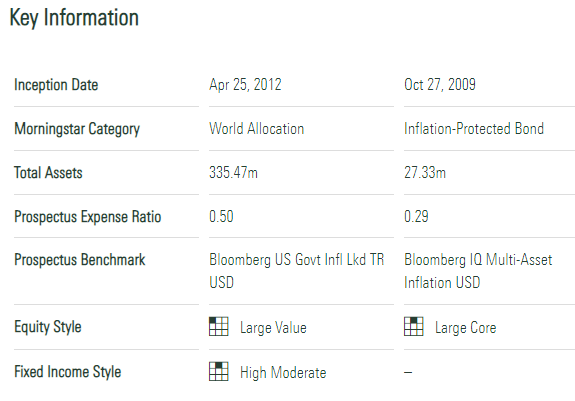

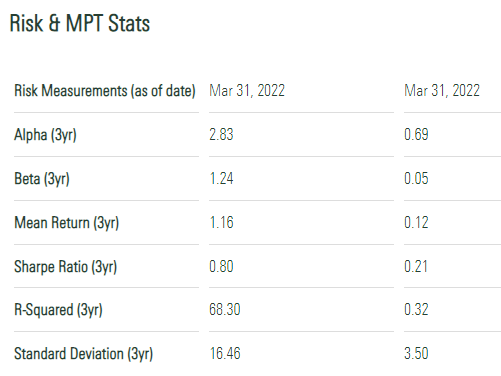

Morningstar.com Comparison Morningstar.com Comparison

Except for StdDev, all these factors favor owning RLY over CPI. The table did not explain what the R-squared was measuring, usually CAGR versus the benchmark. If so, CPI’s benchmark tells investors nothing of importance.

Morningstar.com Comparison

The above shows the funds use very different assets to meet their objective. As we will soon see, one works well, the other does not.

1st Col: RLY; 2nd Col: CPI (Morningsatar.com Comparison)

Even within the equity allocation, there are wide differences in sector and country exposures. As a casual observer, not sure how you beat inflation without decent exposure to both energy and materials. Results seem to confirm that thought.

Return and Risk

Since the idea is beating inflation, I checked the charting box that accounts for that data. Looking at annual data, RLY was ahead 50% of the years; CPI only 20% of the last ten years. To be clear, none of the data above is inflation adjusted. The 3/31/22 inflation portfolio balances come to: RLY-$10,821, CPI: $8,924. In short, CPI failed to match inflation and RLY had a real return under 1%. CPI’s only great “feature” is its volatility almost matches PortfolioVisualizer’s cash asset.

Portfolio Strategy

There are various strategies for trying to keep up with the harms caused by inflation. For investors more concerned about generating income to cover their higher living costs, they might turn to owning more high-yield assets like Business Development Companies, or BDCs, or higher yielding “junk bond” funds. Another one which I covered was using floating-rate funds whose income should rise, slowly, as interest-rates are increased to fight inflationary pressures.

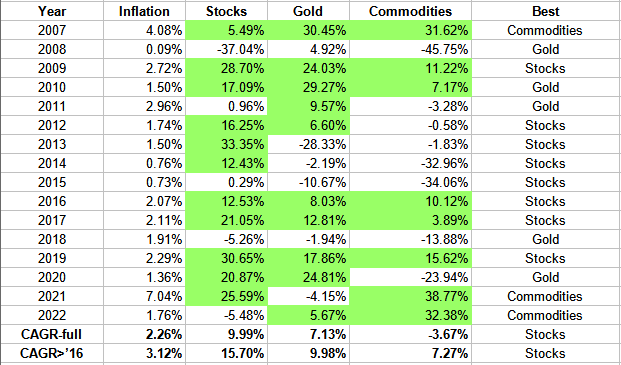

Gold and Commodities are usually mentioned as inflation hedges. The next table gives annual returns compared to the US stock market.

PortfolioVisualizer.com; compiled by Author

While Gold has beaten inflation, there doesn’t seem to be a strong correlation between Gold and inflation. There are ETFs that invest in gold for those investors; such as the iShares Gold Trust ETF (IAU). There are also Commodity funds investors can consider. Juan de la Hoz’s recent article PDBC Vs. DBC: Which Is Best For Commodity Bulls? compared two such funds. While commodities have had great years, they have had real stinkers too. I suspect that thanks to oil, commodities have been inflation over the past five years.

Final Thought

Investing in Real Return funds is a true case of the investor either believing what assets worked before will this time or the Fund’s manager are good at allocating their assets into the ETFs that will beat inflation this time around. In either case, RLY past returns point me into only suggesting owning RLY while inflation is starting. With the price up 50+% from the COVID low, that time might have passed by now, or at least, a big part of the inflationary reaction gain. Not knowing myself drives my overall Neutral/Hold opinion.

Be the first to comment