JHVEPhoto

ConocoPhillips (NYSE:COP) is an American multinational corporation that’s dropped more than 15% as oil prices have cooled down. However, the company is still one of the largest upstream companies with a market capitalization of more than $130 billion, well-timed COVID-19 acquisitions, and an asset portfolio that’ll support future returns.

As we’ll see from all of this put together, ConocoPhillips has the ability to drive substantial shareholder returns.

ConocoPhillips 2Q 2022 Results

ConocoPhillips had reasonable 2Q 2022 results showing its financial strength.

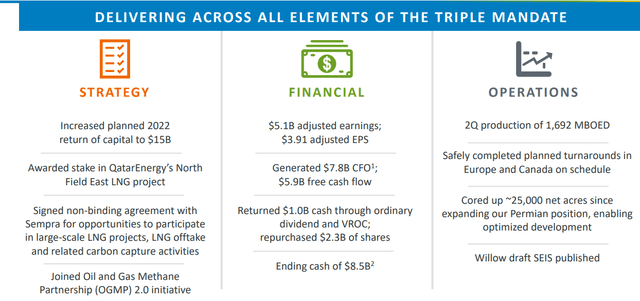

ConocoPhillips Investor Presentation

The company generated almost 1.7 million barrels / day in production, with turnarounds completed on schedule. The company has continued to firm up its acreage position, which tends to allow longer laterals and lower costs. Financially, the company is targeting double digit shareholder returns, with $15 billion in returned capital.

The company was awarded new stakes in QatarEnergy’s LNG projects. The company is looking to expand its position in the LNG markets. The company generated almost $6 billion free cash flow (“FCF”), representing an almost 20% FCF yield. The company has continued to repurchase shares and dividends and continues to have a strong net cash position.

ConocoPhillips Price Performance

The company has continued to generate strong price performance, showing the strength of its assets.

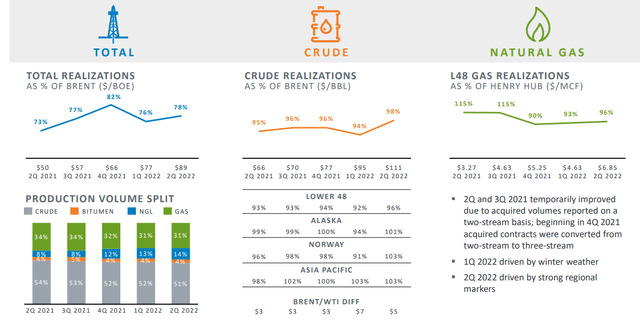

ConocoPhillips Investor Presentation

The company has performed incredibly well with price realizations in an expensive market. The company has achieved strong total realizations as a % of Brent, despite significant gas volumes, and crude realizations especially have performed incredibly well. The company’s natural gas realizations have dipped down but are still near peak prices.

Continued strong price performance here shows increased efficiency in the company’s operations and the ability to generate higher profits as a result.

ConocoPhillips Guidance

The company’s guidance is for strong and continued shareholder returns going forward.

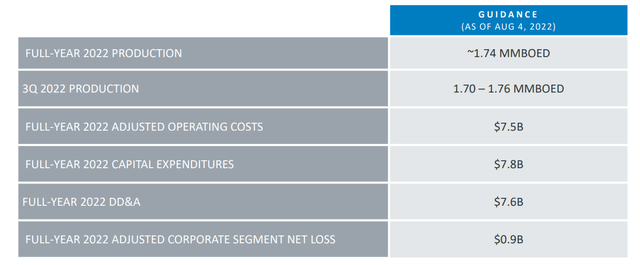

ConocoPhillips Investor Presentation

The company’s guidance is for continued strength in its portfolio. The company’s FY 2022 production guidance is 1.74 million barrels / day, with just a hint under that, or 1.73 million barrels / day in the 3Q. The company’s FY 2022 capital expenditure guidance is almost $8 billion, or just under $2 billion per quarter in capital spending.

That’s a number that the company can comfortably afford given the company’s 2Q 2022 almost $8 billion in CFO. We expect the company to continue generating strong FCF going into the end of the year.

ConocoPhillips Shareholder Return Potential

ConocoPhillips has the ability to drive substantial shareholder returns. The company’s shares outstanding went up as a result of recent acquisitions during COVID-19, however, we still see the acquisitions as opportunistic.

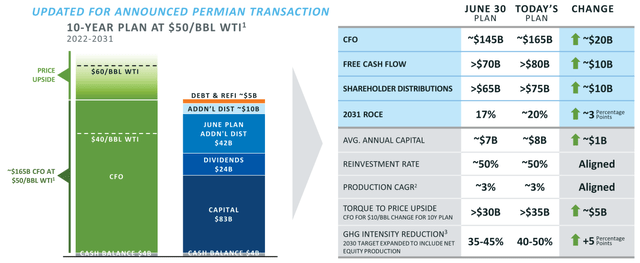

ConocoPhillips Investor Presentation

At $50 / barrel WTI, the company expects to generate $80 billion in FCF with the majority provided as shareholder returns. Each $10 WTI that can add roughly $30 billion showing the substantial strength in the company’s financial positioning. We expect the company to continue its dividend spending forecast of roughly $24 billion, which it can afford, providing roughly 3% returns.

The rest will be share buybacks. The lower the company’s share price remains over the next few years, the better. The company’s 2022 repurchase plan is roughly $6 billion, and recent share price weakness will support the long-term opportunity for repurchases. It’s worth noting the company’s dividend budget could provide higher yields as share count decreases.

That share repurchase program is substantial.

Thesis Risk

The largest risk to our thesis is crude prices. The company is profitable at $60 WTI with the ability to generate roughly $100 billion in shareholder returns, or a roughly 8% annualized return over the next decade. That presents $60 WTI as roughly the minimal average price for the company to match historic market returns. Before that, the company will struggle to perform.

Conclusion

ConocoPhillips recent share price weakness presents substantially opportunity, especially for a company that’s looking to aggressively invest in and reduce its outstanding share count. The company has a dividend yield of 3% and the ability to generate a double-digit dividend yield from its continued investments and repurchases.

Overall, the company’s strength makes it a valuable investment. The company is generating massive cash flow and as long as WTI prices stay above $60 / barrel, which we expect they will, we expect the company to generate substantial shareholder returns. All of that together makes the company a valuable investment.

Be the first to comment