J. Michael Jones/iStock Editorial via Getty Images

Perhaps the most interesting retailer I have come across is a firm called Ingles Markets (NASDAQ:IMKTA). With a market capitalization of just $1.64 billion, this player is far from a large firm in the retail space. And with an emphasis on supermarket chain operations across the southeastern portion of the US, it’s not normally the type of prospect that I would consider to be attractive. But the fact of the matter is that, over the past few years, management has done a really good job growing the company’s top and bottom lines. Fast-forward to today, and we are seeing a little bit of weakness on the bottom line, due largely to inflationary pressures. But this doesn’t change the fact that shares of the business are incredibly cheap at this moment. So cheap, in fact, that I cannot help but to retain my ‘strong buy’ rating on the company’s stock even after some mixed results in the third quarter of this year.

A stellar prospect

Back in July of this year, I wrote a follow-up article to see where Ingles Markets was from a fundamental perspective compared to the prior time I had written about it. In that article, I referred to the company’s continued progress as remarkable. Shares had generated upside, as a result, that outperformed the broader market. And despite this strong performance, shares of the company were still fundamentally attractive from a valuation perspective. This led me to reaffirm my ‘strong buy’ rating on the stock, indicating that I felt that the company should significantly outperform the broader market for the foreseeable future. Fast-forward to today, and we have seen outperformance. But I don’t know if I would necessarily call it significant. While the S&P 500 is down by 5.1% since the publication of this aforementioned article, shares in Ingles Markets have dropped by a more modest 2%.

In all honesty, the return disparity between the company and the broader market might have been greater had we not seen some mixed results during the third quarter of this year. On the positive side, we did see revenue increase nicely, climbing from $1.28 billion in the third quarter of 2021 to $1.46 billion in the third quarter of this year. This increase took place even as the number of stores in operation stayed flat at 198. The most sizable portion of the increase then came from a rise in comparable store sales. Excluding gasoline, comparable store sales grew by 5.7% year over year. This was aided by a 2.3% increase in the number of transactions the company saw at its locations and by a 3.4% increase in the average size of its transactions.

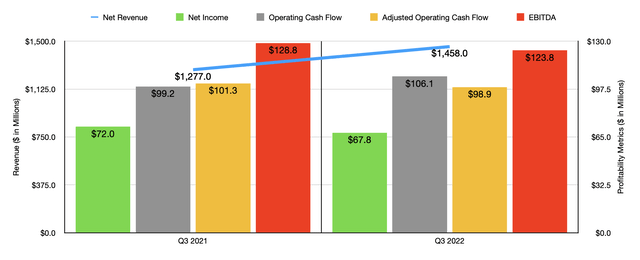

At first glance, this picture looks rather solid. However, the company did see some weakness in the bottom line. Net income, for instance, came in at $67.8 million during the third quarter of 2022. This was down from the $72 million reported the same time one year earlier. On this front, the company was negatively impacted by its gross profit margin dropping from 26.4% down to 24.1%. Though this may not seem like a big difference, when applied to the revenue the company generated in that quarter, the difference accounted for $33.5 million in missed profitability on a pre-tax basis. Inflationary pressures and a rise in sales volume also hurt the company to the tune of $8.6 million of additional cost (relative to sales). Plus there were some other miscellaneous items like repairs and maintenance, professional fees, and bank charges that all hit the firm as well. But not every profitability metric was worse year over year. Operating cash flow, for instance, rose from $99.2 million to $106.1 million. But if we were to adjust for changes in working capital, it would have dipped from $101.3 million down to $98.9 million. And over that same window of time, we would have seen EBITDA drop from $128.8 million down to $98.9 million.

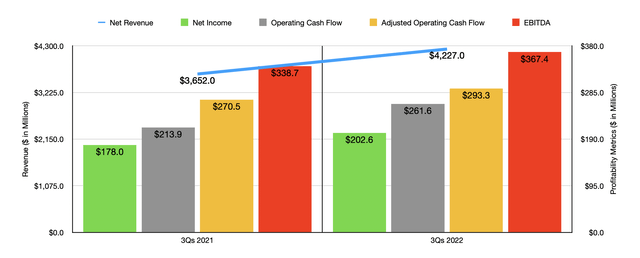

Despite this bottom line weakness, results for the first nine months of the 2022 fiscal year as a whole have come in stronger than they did the same time one year earlier. Revenue of $4.23 billion beat out the $3.65 billion reported one year earlier. Net income for the company rose from $178 million to $202.6 million. Operating cash flow rose from $213.9 million to $261.6 million. And if we adjust for changes in working capital, it would have risen from $270.5 million to $293.3 million. And finally, we have EBITDA, which rose from $338.7 million to $367.4 million.

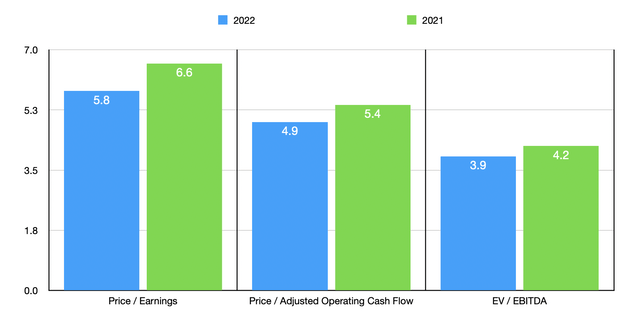

Management has not really provided any guidance for what the rest of the 2022 fiscal year will look like. But if we annualize the results experienced so far, we should anticipate net income of $284.2 million, adjusted operating cash flow of $332.1 million, and EBITDA of $504.6 million. These members imply a forward price to earnings multiple of 5.8, a forward price to adjusted operating cash flow multiple of 4.9, and a forward EV to EBITDA multiple of 3.9. These numbers stack up against the readings that we get using the data from 2021 of 6.6, 5.4, and 4.2, respectively. As part of my analysis, I did compare Ingles Markets to five similar businesses. On a price-to-earnings basis, these companies ranged from a low of 7.1 to a high of 57.4. In this case, Ingles Markets was the cheapest of the group. Using the price to operating cash flow approach, the range was between 3.9 and 19.4, while the EV to EBITDA approach yielded a range of between 3.3 and 21.1. In both of these cases, one of the companies was cheaper than our prospect while another was tied with it.

| Company | Price/Earnings | Price/Operating Cash Flow | EV/EBITDA |

| Ingles Markets | 5.8 | 4.9 | 3.9 |

| Grocery Outlet Holding Corp. (GO) | 57.4 | 19.4 | 21.1 |

| Natural Grocers by Vitamin Cottage (NGVC) | 9.7 | 4.9 | 3.9 |

| Sprouts Farmers Market (SFM) | 12.1 | 7.7 | 4.9 |

| Casey’s General Stores (CASY) | 23.6 | 10.2 | 11.9 |

| Albertsons Companies (ACI) | 7.1 | 3.9 | 3.3 |

Takeaway

Based on the data provided, it seems to me as though Ingles Markets is a truly solid company with great returns and an incredibly low share price. Although the company has experienced some margin pressure recently, something that should continue in the near term, I do believe that it will eventually adapt like it always has in the past. And eventually, the market should realize its full value and push shares up significantly from where they are today. Because of this, I am keeping my ‘strong buy’ rating on the stock for now.

Be the first to comment