Gumpanat/iStock via Getty Images

Investment summary

Unprofitable med-tech continues to attract heavy selling activity in the back end of FY22. Investors have punished companies this year that have either dwindled, or yet to show any signs of profitability/return on capital to beat the WACC hurdle. After examination of CONMED Corporation (NYSE:CNMD) I’ve found the stock displays a loose affinity to the kind of equity premia we are seeking exposure to, but rather aligns more with the cohort of names described above.

Net-net, the stock looks to be fair and reasonably priced, and it has deep customer networks and a wide product offering – each attractive feature. However, with a lack of tangible value heading into a weakening economic climate, plus the tight profitability metrics, these aren’t factors I’d like exposure to looking ahead. I rate CNMD a hold with a $92 valuation. Note, I do not discuss CNMD’s dividend in this report.

BioRez acquisition to add value beyond FY22

CNMD is acquisition heavy and typically completes a few too many acquisitions each year, depending on its current capital expenditure (“CAPEX”) cycle. The company most recently announced its acquisition of Biorez, Inc. on 1 August, on a $85 million (”mm”) all cash consideration. Embedded into the deal is up to $165mm in earnout payments over the next 4 years, based on growth milestones. The transaction was financed through CNMD’s existing credit facility and didn’t alter the capital structure.

Biorez, located in New Haven, CT, has a key differential in its BioBrace Implant technology. It labels the implant as a ‘bioinductive scaffold’ that reinforces soft tissue healing and tissue propagation at the site of healing. The FDA approved technology is also indicated to reinforce tissue under suture repair, or from suture anchors. It is indicated for use during tendon repair surgery, namely rotator cuff, patellar, Achilles, biceps, or quadriceps tendon reinforcement. It doesn’t provide mechanical support, however, and is used in the healing phase[s] only.

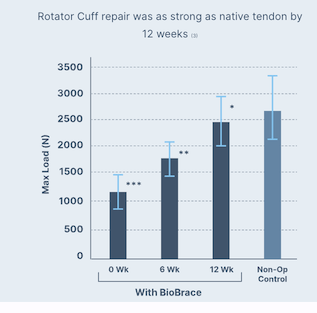

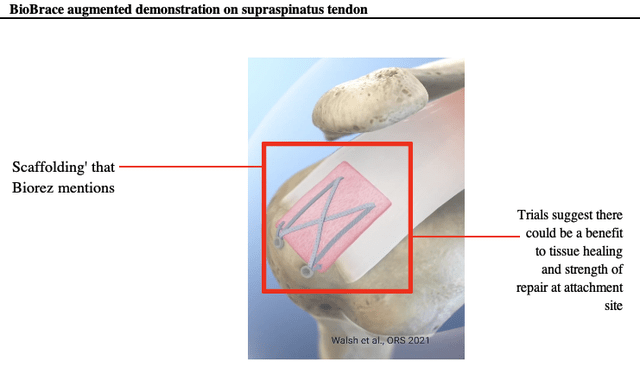

Carter and colleagues (2021) illustrated BioBrace’s 3-D scaffold allows for induction and remodelling of host tissue whilst facilitating load sharing amongst other connective tissue. Meanwhile, Walsh et al. (2021) corroborated findings in connective tissue fibres using large animal models. These were further supported by McMillan an co-authors (2021) in the Journal of Ortopaedic Experience & Innovation. Findings from Walsh and colleagues are seen in Exhibit 1 where rotator cuff tendon repair using BioBrace showed a return to baseline [native tendon strength]. A takeout from Walsh & Co’s work is seen in Exhibit 2, demonstrating the ‘scaffolding’ in situ in patellar tendon repair using digital recreations.

Exhibit 1. Efficacy data holds up well for the segment and this adds to the value created by the purchase

- Biorez also has 20 patents granted to protect the segment and have filed another 10 that are pending.

Data: Biorez

Exhibit 2.

Note: Annotations made by HB Insights. Image is to provide visual aid to understand the process/technology itself, and is not an advocate for the product itself. (Data: HB Insights, Biorez)

The acquisition is expected to push EPS ~$0.10 lower in FY22, however, is tipped to be accretive to earnings in the subsequent years. As a result, management lowered FY22 guidance by c.$10mm to $1.140 Billion at the upper end, calling for 8–12% at the top. Earnings guidance has also been narrowed from $3.65 to $3.55 at the upper end.

Investors however weren’t galvanized by the news at all. Price action was weak following and this was corroborated by flat movement in long-term trend indicators like momentum and on balance volume (”OBV”), as seen below. Given the company’s growth strategy and capital budgeting decisions ideally, I’d look to see somewhat more of a correction to the upside as indication of the market’s bullish psychology around the stock. That didn’t and still hasn’t happened, however, and shares continue in sideways territory pulling back to range ever so slightly last week. The question then becomes how much upside can we expect to capture in this name on similar future announcements, and, from this quick assessment, it doesn’t appear much at present. It therefore remains a story of earnings and investment for CNMD.

Exhibit 3. Despite aligning with the company’s growth strategy and being well publicised the market didn’t budge from the Biorez transaction.

- This begins to suggest that the market may have already correctly discounted these kinds of updates into the stock price.

- Any future acquisition updates could therefore yield the same medium-term result on the chart.

Image: HB Insights, Data: Refinitiv Eikon

CNMD Q2 earnings continue long-term trends

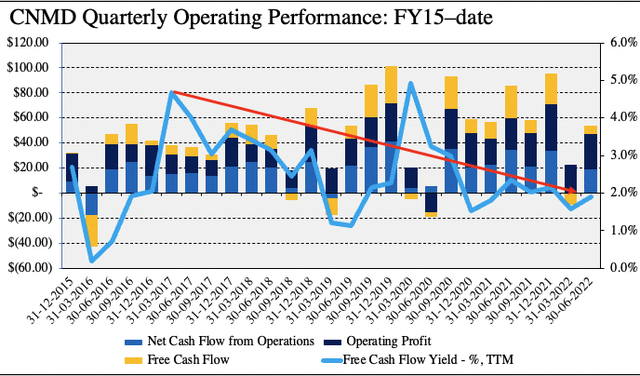

As seen in Exhibit 4, quarterly operating trends have been lumpy in the 3-years to date, whereas realized FCF yield is also at its lowest mark in years. These trends weaken the fundamental momentum CNMD brings into the forward-looking climate, that of a weaker economic outlook and, various threats to company earnings & investment.

CNMD is now back at Q2 FY19 levels of operating performance, albeit trading around its pre-pandemic market capitalization. This must be factored into the debate also. If you believe investors have correctly discounted the stock to this current market cap then we might anticipate similar operating trends as observed back in FY19, as seen below.

Exhibit 4. Quarterly operating performance has been lumpy over the past 3 years

- Investors have discounted the stock’s market cap back to FY19 levels, alongside the FCF and operating measures provided.

Note: Free cash flow calculated as [NOPAT – investments], FCF yield calculated as function of enterprise value on TTM basis. All figures are calculated from GAAP earnings with no reconcilications. (Data: HB Insights)

Turning to the quarter and total sales were up 980bps YoY. The In2Bones acquisition was completed in June, and CNMD booked ~$2.1 million in sales revenue from the segment. Meanwhile, the company’s global organic growth was 9% and international sales spiked to 17% YoY. Global orthopaedics turnover was also up c. 13.7% and was underlined by international sales revenue growth of 12%. CNMD also saw some upside with its Buffalo Filter segment with a 20% YoY growth, reversing a series of underwhelming performances.

It bought this down to a loss of $168.3 million or $5.65 per share, up from $0.41 in EPS the year prior. Despite the fact CNMD converted quarterly cash flow of $13.03mm [$7.13mm] long-term debt also increased by 39.5% over the same period, bringing the leverage ratio to 4.7x vs. 3.5x in Q1 FY22.

Hence, earnings trends have softened for the company in recent years, resulting in negative return on invested capital in Q2 FY22 and ultimately compressing corporate value.

Valuation and conclusion

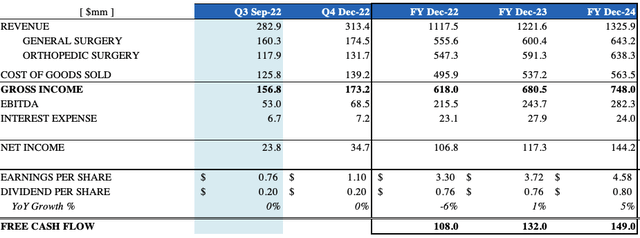

Whilst fundamentals have been softening for CNMD in recent periods there’s question it will continue trudging forward well into the future in my estimation. We see top-line growth of CAGR 9% into FY24 and estimate the company to convert $149mm in annual free cash flow by that time, up from a projected $108mm this year. As seen in the chart below, both general and orthopedic surgery divisions are poised for growth, and I believe there’s good chance numbers will converge to the upside as both volume procedure and average price per procedure (“APP”) look to drift higher in years to come.

Exhibit 5. CNMD forward estimates supportive of further upside in years to come.

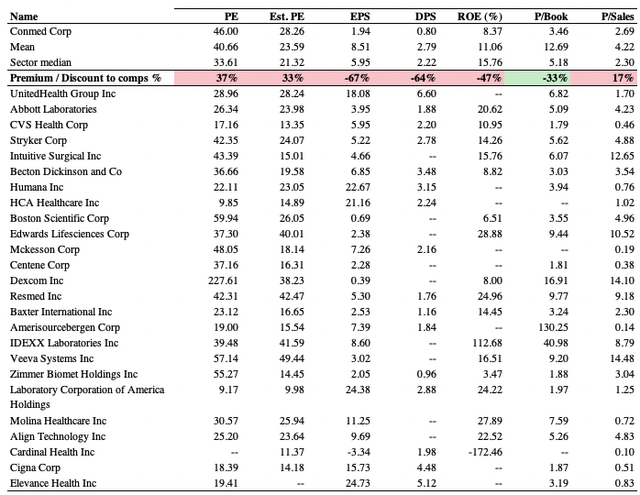

Meanwhile, shares are trading at a premium to peers across metrics used in this analysis. Trading at 46x P/E and 28.3x forward P/E are each respectively 37% and 33% above the peer group, and in my estimation unjustifiably so. CNMD realized an 8.37% ROE as seen in Exhibit 6, but when the stock is priced at 3.45x book value, this drops to a 2.43% investor ROE. We’ve forecast FY22 EPS of $3.30 – in-line with consensus – and at 28x this number sets a price target of $92.4, suggesting CNMD could be slightly undervalued.

Exhibit 6. Multiples and comps

Data: HB Insights, Refinitiv Datastream

Net-net, there are still a few too many uncertainties in CNMD’s investment debate around its earnings and investment trends for my liking. Whilst the earnings trajectory continues to worm its way higher in these choppy times, drilling down into some more concrete metrics reveals there’s a lack of flesh to place on the skeleton in the name right now. Balancing the risk/reward calculus is valuation and I’ve priced CNMD at $92 based on FY22 earnings. Alas, with tightening operating metrics, narrowed guidance from recent acquisitions and a lack of meaningful upside capture from valuation, I rate CNMD a hold.

Be the first to comment