porcorex/iStock via Getty Images

This article is part of a series that provides an ongoing analysis of the changes made to Wallace Weitz’s 13F portfolio on a quarterly basis. It is based on Weitz’s regulatory 13F Form filed on 5/13/2022. Please visit our Tracking Wallace Weitz’s Weitz Investment Management Portfolio article for an idea on his investment philosophy and our last update for the fund’s moves during Q4 2021.

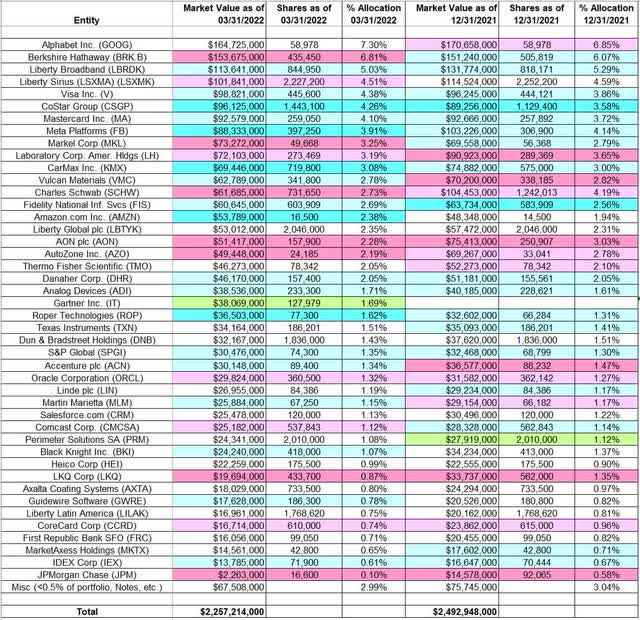

This quarter, Weitz’s 13F portfolio value decreased ~10% from $2.49B to $2.26B. The number of holdings increased from 59 to 60. The top three positions are at ~19% while the top five holdings are at ~28% of the 13F assets. The largest stake is Alphabet at 7.30% of the portfolio.

Weitz Investment Management’s equity funds are Weitz Partners Value Fund (MUTF:WPVLX), Weitz Value Fund (MUTF:WVALX), Weitz Partners III Opportunity Fund (MUTF:WPOIX), and Weitz Hickory Fund (MUTF:WEHIX). The flagship Weitz Partners Value Fund (1983 inception) has generated alpha, but the fund is behind the S&P 500 index over the last decade. The current cash allocation is just 3.5%: this is far below the ~18% average cash over the last decade.

New Stakes:

Gartner, Inc. (IT): IT is a 1.69% of the portfolio position purchased this quarter at prices between ~$258 and ~$323. The stock currently trades well below that range at ~$230.

Stake Increases:

Liberty Broadband (LBRDK): LBRDK is a top-three ~5% of the 13F portfolio stake established in Q4 2014 as a result of the spinoff of Liberty Broadband from Liberty Media. Liberty Media shareholders received one share of LBRDA for every four shares of Liberty Media held. In Q1 2015, there was a ~60% increase at prices between $44.50 and $56.50. The position has seen selling since 2018. The year saw a combined ~14% selling at prices between $69 and $97 and that was followed with a ~40% reduction in 2019 at prices between $75 and $125. Q1 to Q3 2020 had seen another ~45% selling at prices between ~$91 and $145. The stock currently trades at ~$109. There was a ~8% increase over the last two quarters.

Visa Inc. (V): V was a minutely small stake as of Q3 2016. It is now a large 4.38% position. The bulk of the buying happened in Q4 2016 at prices between $75 and $83.50. The two years through Q2 2020 had seen a 45% reduction at prices between $124 and $210. The stock is now at ~$190. Last quarter saw a ~4% stake increase and that was followed with a marginal increase this quarter.

CoStar Group (CSGP): CSGP is a 4.26% of the portfolio position purchased in Q1 2020 at prices between ~$52 and ~$74 and the stock currently trades at ~$56. There was a ~23% stake increase Q2 2020 at prices between ~$53 and ~$73. That was followed with a ~20% stake increase last quarter at prices between ~$75 and ~$100. This quarter also saw a ~28% stake increase at prices between ~$53 and ~$79.

Note: The prices quoted above are adjusted for the 10-for-1 stock split in June.

Mastercard Inc. (MA): MA is a 4.10% stake established in Q4 2014 at prices between $70 and $89. Q3 2015 and Q1 2016 saw a stake doubling at prices between $80 and $98. The stock has seen selling since 2017. Recent activity follows: 2018 saw a one-third reduction at prices between $152 and $223. That was followed with a ~35% selling in 2019 at prices between $190 and $290. The three quarters through Q3 2020 had also seen another ~20% reduction at prices between ~$203 and ~$366. The stock currently trades at ~$311. There was a minor ~5% increase last quarter and a marginal increase this quarter.

Meta Platforms (META), previously Facebook: The 3.91% META position was purchased in Q1 2018 at prices between $152 and $193 and increased by ~175% next quarter at prices between $155 and $202. There was another ~35% increase in Q3 2018 at prices between $160 and $218 and that was followed with a ~22% increase next quarter at prices between $124 and $162. The five quarters through Q3 2020 had seen a ~40% reduction at prices between $146 and $304. There was a ~30% stake increase this quarter at prices between ~$187 and ~$346. The stock is now at ~$164.

CarMax, Inc. (KMX): The ~3% KMX position was purchased at a cost-basis below $60 per share in Q1 2018 and increased by ~45% next quarter at prices between $59 and $80. The three quarters through Q1 2019 saw a ~90% increase at prices between $57 and $81 while the next three quarters saw a ~40% selling at prices between $69 and $100. This quarter saw a ~25% stake increase at prices between ~$97 and ~$127. The stock currently trades at ~$87.

Vulcan Materials (VMC): The bulk of the 2.78% VMC position was established in H2 2018 at prices between $88 and $130. There was a roughly one-third stake increase in Q1 2020 at prices between ~$77 and ~$148. Last quarter saw a ~20% reduction at prices between ~$169 and ~$211. The stock is now at ~$145. There was a marginal increase this quarter.

Fidelity National Information Services (FIS): FIS is a 2.69% of the portfolio stake established in Q3 2020 at prices between ~$134 and ~$156. The stake was increased by ~55% over the two quarters through Q1 2021 at prices between ~$124 and ~$151. That was followed with a ~40% stake increase last quarter at prices between ~$102 and ~$125. The stock currently trades at ~$92. This quarter saw a minor ~3% stake increase.

Amazon.com (AMZN): AMZN position saw a ~70% stake increase in Q4 2018 at prices between ~$69 and ~$95. 2019 had seen another ~40% increase at prices between ~$80 and ~$100. The two quarters through Q3 2020 had seen a one-third selling at prices between ~$95 and ~$177. This quarter saw a ~14% stake increase. The stock currently trades at ~$106 and the stake is at 2.38% of the portfolio.

Note: The prices are adjusted for the 20-for-1 stock split earlier this month.

Roper Technologies (ROP): ROP is a 1.62% of the portfolio position purchased in Q2 2021 at prices between ~$403 and ~$470. The stock currently trades at ~$375. Last two quarters saw a ~27% stake increase at prices between ~$424 and ~$498.

Accenture PLC (ACN), Analog Devices (ADI), Black Knight (BKI), Guidewire Software (GWRE), IDEX Corp (IEX), Martin Marietta Materials (MLM), and S&P Global (SPGI): These small (less than ~1.5% of the portfolio each) stakes were increased this quarter.

Stake Decreases:

Berkshire Hathaway (BRK.B): Berkshire Hathaway is a very long-term stake and the second-largest holding in the portfolio at ~7%. Recent activity follows: the three quarters through Q1 2019 had seen a ~30% selling at prices between ~$189 and ~$224. That was followed with a ~60% selling in Q1 2021 at prices between ~$228 and ~$266. The stock currently trades at ~$268. There was a ~14% trimming this quarter.

Note: Wallace Weitz is known to have owned Berkshire Hathaway stock (Class A equivalent shares) continuously since 1976 riding it from around $35 per share to the current price of ~$403150. The Berkshire Hathaway A shares were sold in Q2 2021 while keeping the B shares.

Liberty Sirius (LSXMA) (LSXMK): The top-five 4.51% of the portfolio stake in Liberty Sirius stock came about as a result of Liberty Media’s recapitalization into three tracking stocks in April 2017. The stock started trading at ~$38 and currently goes for $35.62.

Markel Corp. (MKL): The 3.25% Markel stake was built in H1 2019 at prices between $958 and $1090. Q4 2019 saw a ~140% stake increase at prices between $1100 and $1200. The stock currently trades at ~$1282. There was a ~12% trimming this quarter.

Laboratory Corp of America Holdings (LH): LH is a large 3.19% long-term stake. The bulk of the position was built in the 2008-2010 timeframe at lower prices. The last thirteen quarters have seen a ~60% selling at prices between ~$107 and ~$314. The stock currently trades at ~$226. They are harvesting gains.

Charles Schwab (SCHW): SCHW is a 2.73% portfolio stake established in Q3 2018 at prices between $49 and $54 and the stock currently trades at ~$60. There was a ~60% stake increase in Q4 2018 at prices between $38 and $52. H1 2021 had seen a ~20% reduction at prices between $51.50 and $76. That was followed with a ~40% selling this quarter at prices between ~$76 and ~$96.

AON plc (AON): AON is a 2.28% long-term stake from 2010 established in the high-30s price-range. The five quarters through Q4 2017 had seen a two-thirds reduction at prices between $107 and $146. There was another one-third selling over the two quarters through Q1 2019 at prices between $137 and $173. The four quarters through Q1 2021 had seen a ~80% stake increase at prices between ~$154 and ~$234. Last three quarters have seen a ~63% selling at prices between ~$227 and ~$334. It now trades at ~$252.

AutoZone (AZO): The 2.19% AZO stake was primarily built in Q1 2021 at prices between $1118 and $1432 and the stock is currently at ~$1993. There was a ~40% selling over the last four quarters at prices between ~$1386 and ~$2191.

Comcast Corporation (CMCSA), CoreCard Corp (CCRD), previously Intelligent Systems Corporation, JPMorgan Chase (JPM), LKQ Corporation (LKQ), and Oracle Corporation (ORCL): These small (less than ~1.5% of the portfolio each) stakes were reduced this quarter.

Note: Weitz Investment Management has a ~7% ownership interest in CoreCard Corp.

Kept Steady:

Alphabet Inc. (GOOG) (GOOGL): GOOG was a minutely small position first purchased in 2008. It is now the largest position at 7.30% of the portfolio. The stake was built in 2010 and 2011 at a cost-basis of ~$250 per share. Recent activity follows: Q3 2020 saw a ~25% selling at prices between $1415 and $1728. The stock currently trades at ~$2157.

Liberty Global PLC (LBTYK): Liberty Global is a long-term holding that has been in the portfolio for more than a decade. It is currently at 2.35% of the portfolio. 2017 had seen a ~12% trimming and that was followed with a ~16% reduction next year at prices between $20 and $37. The five quarters through Q1 2020 had seen another ~12% trimming. That was followed with a ~42% selling next quarter at prices between $14.84 and $23.35. The stock is now at $22.59.

Axalta Coating Systems (AXTA), Dun & Bradstreet (DNB), First Republic Bank (FRC), Heico Corp. (HEI), Liberty Latin America (LILAK), Linde plc (LIN), MarketAxess Holdings (MKTX), Perimeter Solutions SA (PRM), Salesforce.com (CRM), Texas Instruments (TXN), and Thermo Fisher Scientific (TMO): These small (less than ~2% of the portfolio each) stakes were kept steady this quarter.

The spreadsheet below highlights changes to Weitz’s 13F stock holdings in Q1 2022:

Wallace Weitz – Weitz Investment Management’s Q1 2022 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from Weitz Investment Management’s 13F filings for Q4 2021 and Q1 2022.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment