Chinnapong

Days after Voyager Digital (OTCPK:VYGVF) issued a default notice to Three Arrows Capital (3AC), the firm halted withdrawals, deposits, and trading on July 1, 2022. On July 6, 2022, the company declared bankruptcy. Why did Voyager risk so many customer assets to threaten its liquidity? Why did Voyager demand to secure its loan to 3AC with assets?

FSInsight effectively characterized 3AC as running a “Madoff-Style Ponzi scheme”. Before they disappeared, the founders made good use of their reputation to borrow from institutional lenders. This unfortunately included Voyager Digital.

3AC Cratered From Leverage

Before the firm declared bankruptcy, investors who searched for 3AC learned that the firm had an estimated $10 billion in assets under management. After Voyager’s CEO, Stephen Ehrlich, looked at that huge sum, he, like many others, did not believe he would need assets to back loans of over $660 million. Within a few months, 3AC’s AUM shrank to $4 billion. The devaluation in crypto tokens hurt 3AC’s ability to pay its debt.

On June 17, 2022, 3AC admitted that it had $3 billion worth of cryptocurrencies under management as of April 2022. It invested over $200 million in Luna (LUNA-USD) tokens in February 2022. When Luna lost its peg to the dollar, Luna lost nearly all its value in about a week. Luna’s demise is due to the failure of Terra’s algorithmic stablecoin (UST-USD). When unknown holders dumped large amounts of UST, the stablecoin started to depeg.

Luna failed for two reasons. First, it offered between 1.00% and 14.31% in interest rates. At its height, Terra offered between 17% and 20% on UST. Second, Luna failed to limit withdrawals before peak selling.

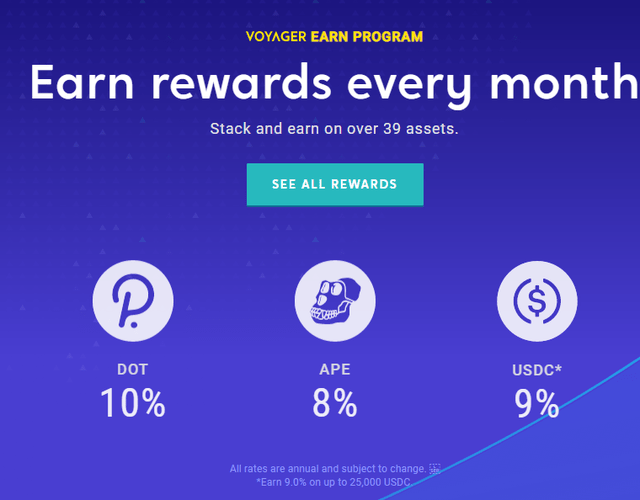

Voyager Digital is also guilty of offering excessive rewards. It signed an international deal with the Dallas Mavericks. To attract customers, it offered $100 worth of crypto awards. Voyager offered annual rates of between 8% to 10% on over 39 assets.

Voyager Digital

Voyager Halted Activity On July 1, 2022

In an attempt to learn from Luna’s mistake, Voyager halted withdrawals, deposits, and trading. CEO Stephen Ehrlich blamed poor market conditions. In addition, he said it would give the company more time “to continue exploring strategic alternatives with various interested parties while preserving the value of the Voyager platform we have built together.”

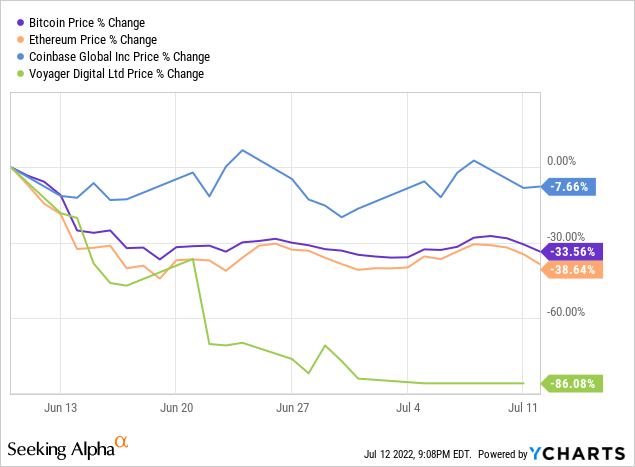

Oddly enough, both Bitcoin (BTC-USD) and Ethereum (ETH-USD) prices fell slightly and recovered. Could Voyager have averted a bankruptcy filing by waiting for those two coins to rebound?

Above: BTC and ETH prices in the last month compared to Coinbase and Voyager Digital.

What could have been done does not matter. Voyager stated that it had $1.3 billion in crypto assets. It had more than $350 million in cash held for benefit of account for customers at Metropolitan Commercial Bank. The bankruptcy filing will protect its three divisions: Voyager Digital Holdings, Voyager Digital LLC, and Voyager Digital, Ltd.

Among the companies that file for Chapter 11, around 25% will survive. During the lean times for the shale production market, Chesapeake Energy (CHK) filed for bankruptcy. It paid a heavy price by buying shale oil firm WildHorse Resource Development for $4 billion in 2019. When oil prices fell, the firm filed for bankruptcy. In February 2021, it emerged from bankruptcy.

Voyager may survive, too. This depends greatly on the health of the cryptocurrency market.

Layoffs In Crypto Sector

On July 5, 2022, Celsius Network (CEL-USD) cut around 25% of its staff. It cut 150 jobs in an attempt to avoid insolvency risks. Celsius froze withdrawals in mid-June 2022.

Coinbase’s (COIN) CEO, Brian Armstrong, wrote on a blog post that the company would focus on driving greater operating efficiency. Product leaders will have insight into profits and losses. They will make decisions based on those figures. The job cuts are a red flag for the cryptocurrency platforms. Trading volumes will shrink considerably as Bitcoin and Ethereum prices risk falling to multi-year lows. FTX’s support for the crypto industry helped send Bitcoin back close to $22,500. The rally proved short-lived. Bitcoin prices fell below $20,000.

MicroStrategy’s (MSTR) CEO Michael Saylor still believes that Bitcoin is the best investment. He bought $10 million more Bitcoin. The market does not agree. Investors are accumulating the U.S. dollar as a safe-haven asset.

The market has no appetite for taking risks. The Federal Reserve’s pace of interest rate increases is hurting lenders. It is forcing lenders in the crypto market to sharply cut down their excessive leverage.

Your Takeaway

The bullish calls on Voyager since September 2021 are wrong. CEO Stephen Ehrlich lent money to 3AC. The company likely sought high returns to fund its customer reward programs. 3AC then defaulted.

Seeking Alpha

Voyager was among over a dozen cryptocurrency ideas under research in the last year. Other stocks include mining firms like Hut 8 Mining (HUT). These days, I continue to watch the market through the Grayscale Bitcoin Trust (OTC:GBTC) and the Grayscale Ethereum Trust (OTCQX:ETHE). Investors should not abandon the idea of holding a very small position of less than 2%. Historically, the crypto winter eventually ends.

Investors should increase their interest in Bitcoin and Ethereum as prices fall. The financial system needs alternative crypto platforms. This introduces more competition and more choices for consumers.

Be the first to comment