Art24hr/iStock via Getty Images

A Quick Take On Conduent

Conduent (NASDAQ:CNDT) reported its Q2 2022 financial results on August 2, 2022, missing expected revenue and EPS estimates.

The company provides business process outsourcing for transaction-intensive organizations worldwide.

Given the now-shelved spin-off of its Transportation segment and slowing macroeconomic conditions, my outlook on Conduent is a Hold for the near term as we await hearing management’s plans for the future.

Conduent Overview

Florham Park, New Jersey-based Conduent Incorporated was founded to provide a range of outsourced business process services to companies, governments and transportation concerns.

The firm is headed by President and CEO, Cliff Skelton, who was previously President of Fiserv Output Solutions.

The company’s primary offerings include:

-

Commercial Industries

-

Government Services

-

Transportation

The firm acquires customers through its direct sales and marketing efforts and through various partner channel referrals.

Conduent serves virtually all major industry groupings, the U.S. government and various transportation entities.

Conduent’s Market & Competition

According to a 2021 market research report by Grand View Research, the global market for business process outsourcing was an estimated $232 billion in 2020 and is expected to reach $446 billion by 2028.

This represents a forecast 8.5% from 2021 to 2028.

The main drivers for this expected growth are increasing usage of digital tools and delocalized talent to maximize business efficiencies.

Also, the versatility of outsourcing services is increasing as other types of service process automation and intelligence adds to return on investment for enterprises.

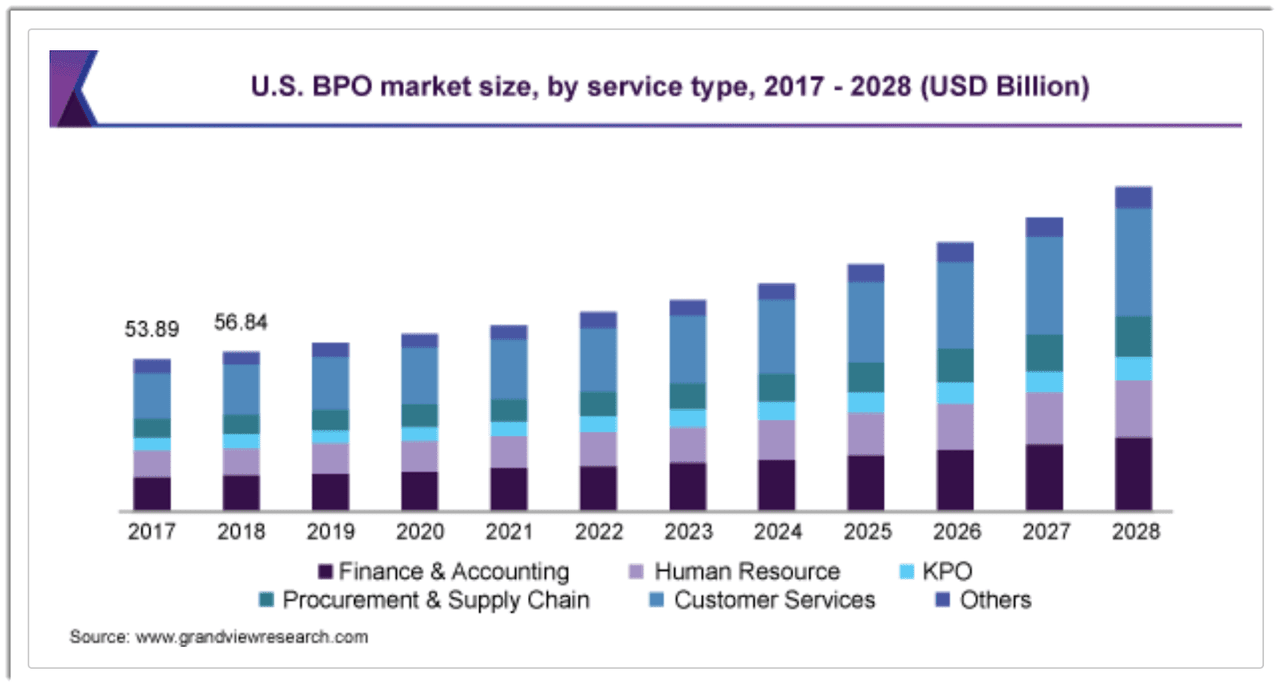

Below is a chart showing the historical and expected future growth trajectory of process outsourcing services in the U.S.:

U.S. BPO Market (Grand View Research)

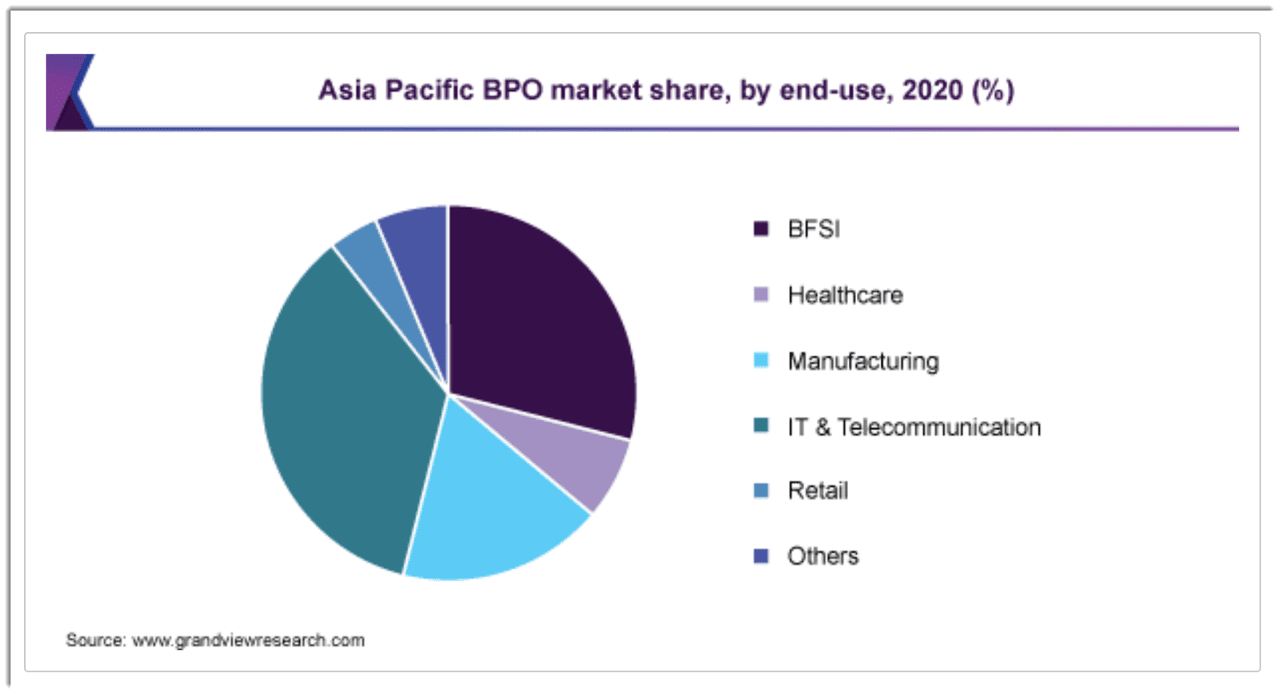

The Asia Pacific market is forecast to see the highest CAGR from 2021 to 2028, and the chart below indicates the breakdown of that market by end-use industry in 2020:

Asia Pacific BPO Market (Grand View Research)

Major competitive or other industry participants include:

-

24/7 Intouch

-

Appen

-

TDCX

-

Accenture

-

TaskUs

-

Genpact

-

Tata Consultancy

-

Cognizant

-

Teleperformance

-

Telus International

-

TTEC

-

VXI

-

Sutherland

Conduent’s Recent Financial Performance

-

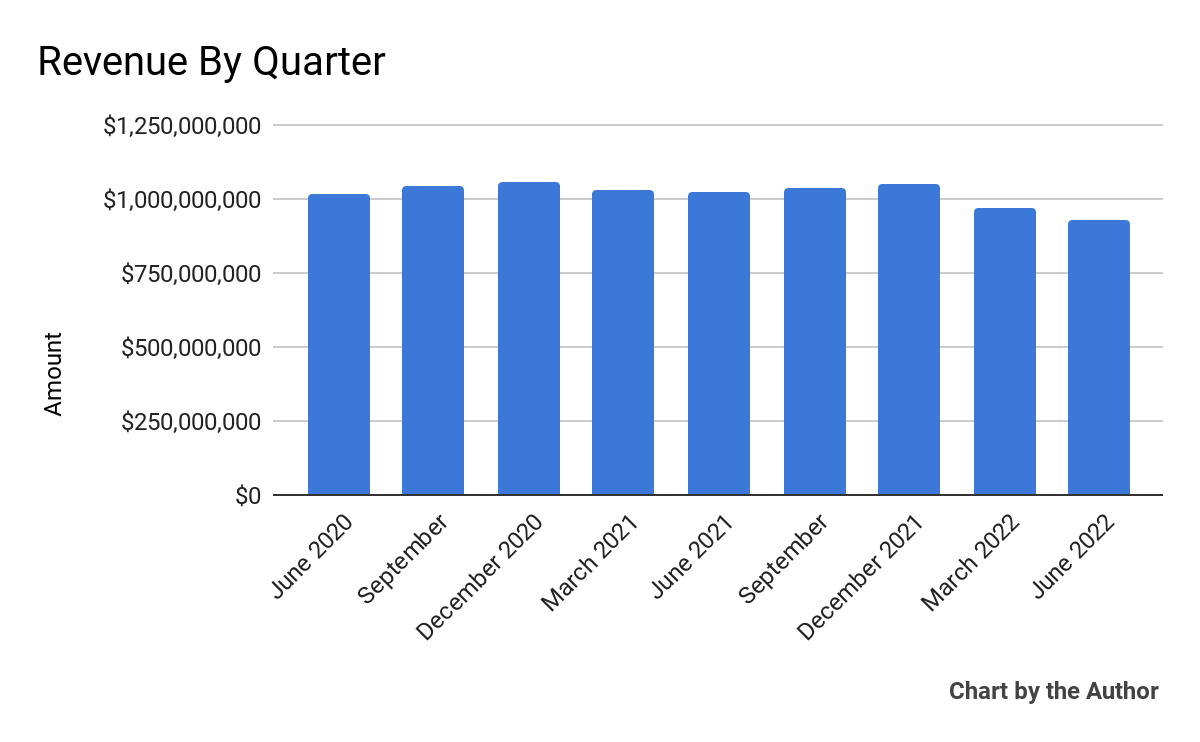

Total revenue by quarter has dropped in recent quarters:

9 Quarter Total Revenue (Seeking Alpha)

-

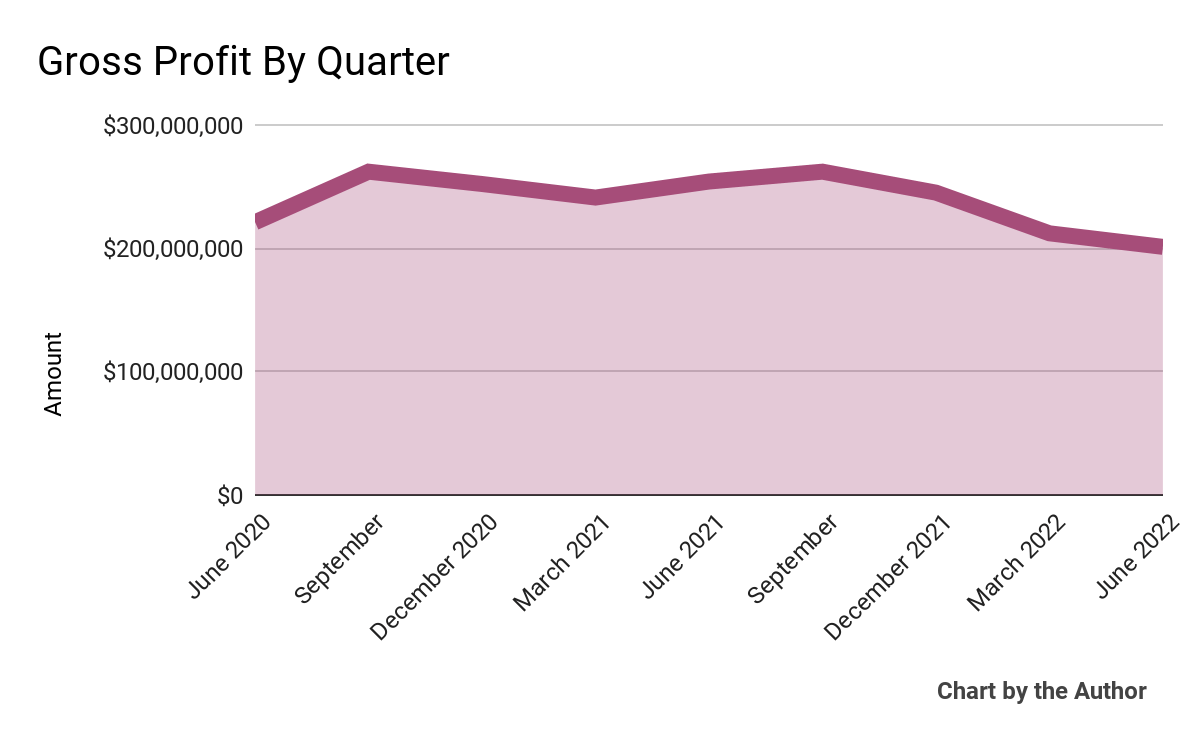

Gross profit by quarter has followed a similar trajectory to total revenue:

9 Quarter Gross Profit (Seeking Alpha)

-

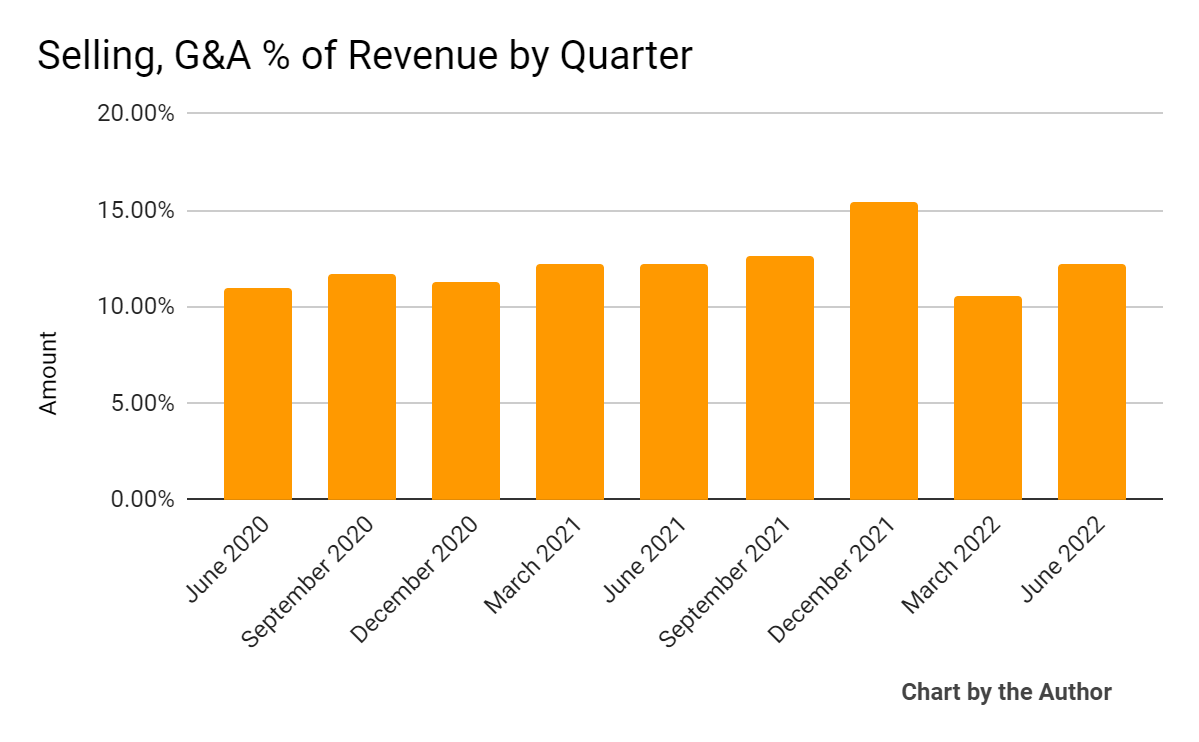

Selling, G&A expenses as a percentage of total revenue by quarter have produced the following results:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

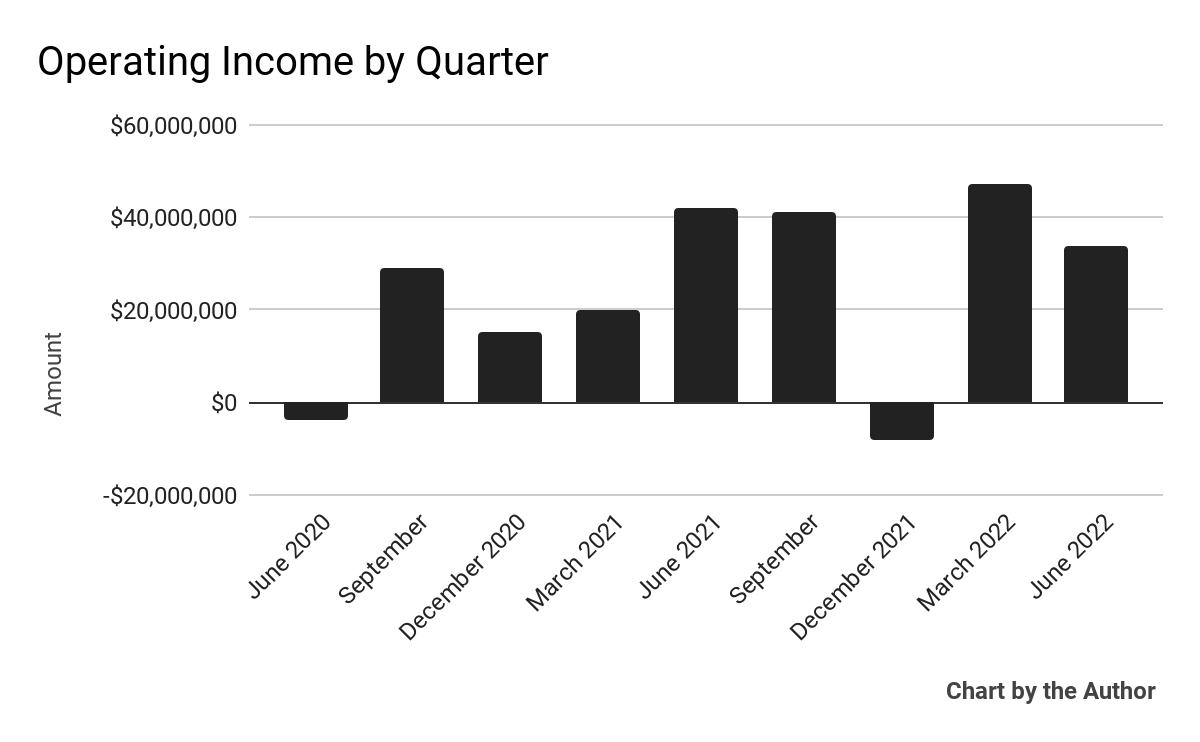

Operating income by quarter has fluctuated according to the following chart:

9 Quarter Operating Income (Seeking Alpha)

-

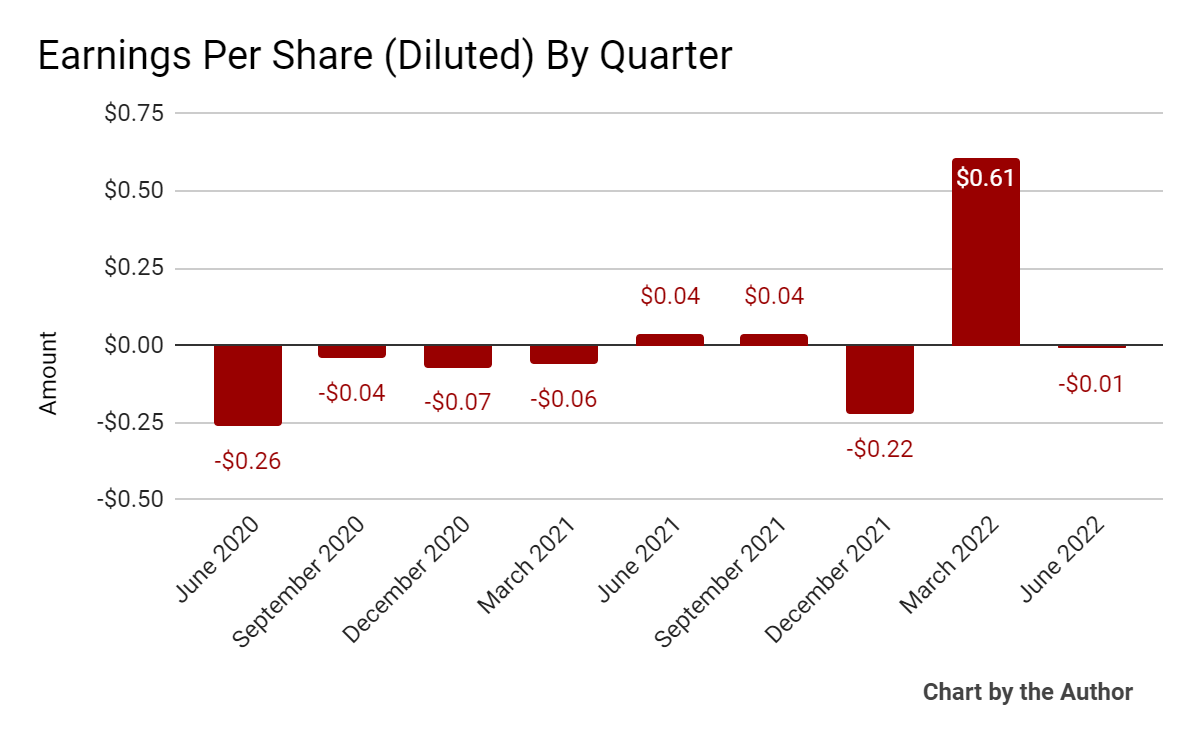

Earnings per share (Diluted) have varied greatly in recent quarters:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

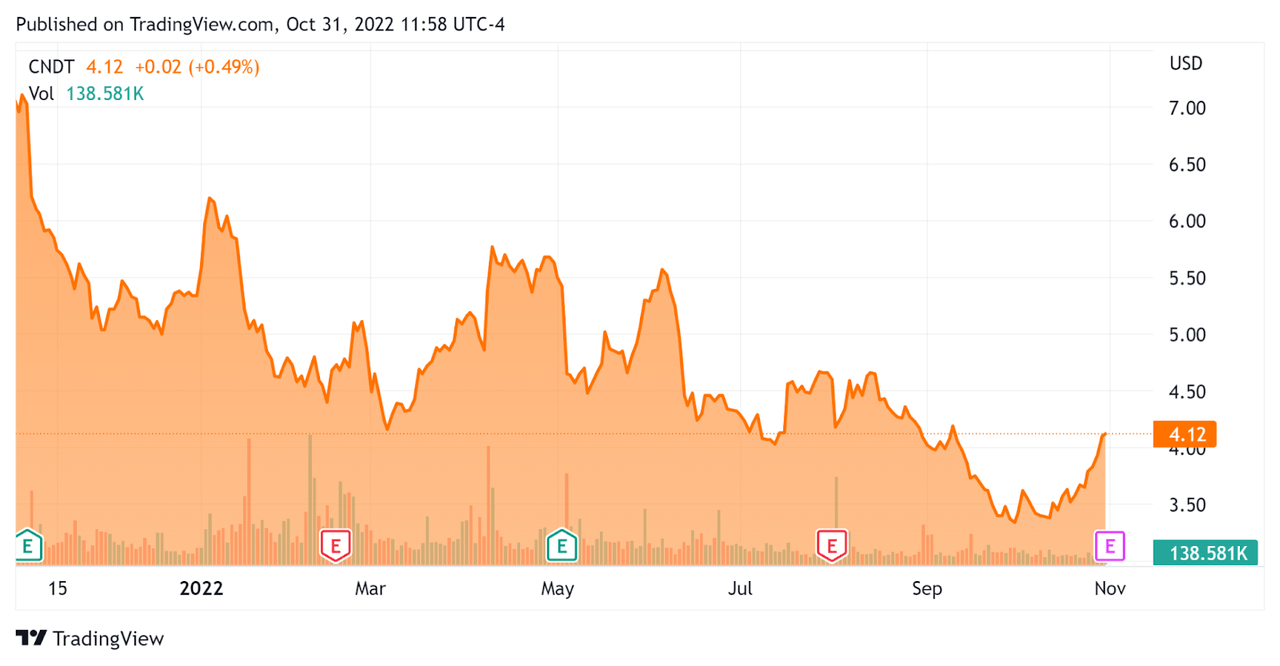

In the past 12 months, CNDT’s stock price has fallen 41% vs. the U.S. S&P 500 Index’s drop of around 15.4%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Conduent

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value/Sales |

0.51 |

|

Revenue Growth Rate |

-4.1% |

|

Net Income Margin |

2.7% |

|

GAAP EBITDA % |

8.8% |

|

Market Capitalization |

$884,760,000 |

|

Enterprise Value |

$2,050,000,000 |

|

Operating Cash Flow |

$135,000,000 |

|

Earnings Per Share (Fully Diluted) |

$0.42 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be TTEC Holdings (TTEC), although TTEC is much larger and operates in different segments of the customer experience/business process outsourcing market; shown below is a comparison of their primary valuation metrics:

|

Metric |

TTEC Holdings |

Conduent |

Variance |

|

Enterprise Value/Sales |

1.30 |

0.51 |

-60.8% |

|

Revenue Growth Rate |

9.9% |

-4.1% |

–% |

|

Net Income Margin |

4.3% |

2.7% |

-37.3% |

|

Operating Cash Flow |

$209,730,000 |

$135,000,000 |

-35.6% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

Commentary On Conduent

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted the lack of high-margin government stimulus which resulted in a dropoff in revenue.

The company has also decided not to spin off or sell its transportation system operations and payment business, likely due to lower valuation expectations in the current market environment.

Leadership also plans to conduct an Investor Day setting out its future priorities and plans without the previously contemplated spin-off or sale transaction.

As to its financial results, adjusted revenue dropped 8% year-over-year and adjusted EBITDA was down 26.9%, both in line with expectations.

Management did not disclose any retention rate information, whether at the level of its customer or dollar-based retention rate results.

The company has experienced relatively minor foreign exchange headwinds.

For the balance sheet, the firm finished the quarter with $519 million in cash and equivalents and $1.29 billion in debt.

Over the trailing twelve months, free cash flow was $43 million, with $92 million in CapEx.

Looking ahead, management expects adjusted revenue in 2022 to be $3.9 billion at the midpoint of the range, with its Government segment expected to perform better than previously forecast.

The primary risk to the company’s outlook is its Commercial segment, which is more susceptible to a macroeconomic downturn than its Government and Transportation segments.

Given the now-shelved spin-off of its Transportation segment and slowing macroeconomic conditions, my outlook on Conduent is a Hold for the near term as we await management’s plans for the future.

Be the first to comment