Daria Nipot

Introduction

My thesis is that Amazon (NASDAQ:AMZN) is facing challenges like everyone else in these times of macro uncertainties.

AWS Challenges

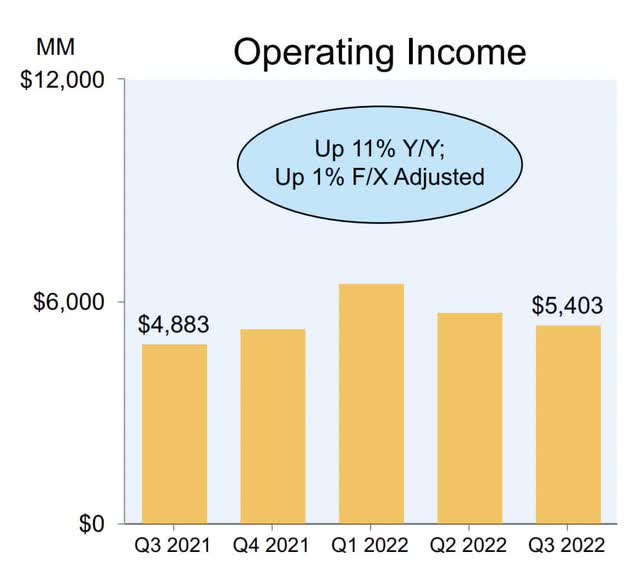

Per the 3Q22 presentation, the F/X adjusted operating income for AWS is only up 1% over 3Q21:

AWS operating income (3Q22 presentation)

In the 3Q22 call, CFO Brian Olsavsky explained the AWS operating income concerns:

I’d say what’s happening lately is, yes, the stock-based comp (“SBC”). There’s – we have seen inflation in our wages this year and particularly on our check employees is heavily concentrated in AWS. So that’s 1 element of it. We’re also seeing energy costs that are materially higher than they had than pre-pandemic electricity and the impact of natural gas pricing. So those prices up more than 2x over the last couple of years and contribute to about 200 basis point degradation versus 2 years ago.

This slowdown in AWS operating income is unsettling but we have to remember that AWS is still the hyperscale cloud leader and they’re well positioned for the future. Many companies would like to be hyperscale cloud providers but only AWS, Microsoft (MSFT) Azure and Google Cloud (GOOG) (GOOGL) are in that club on a global level. Further, Google Cloud still has negative operating income and summing up the last 12 quarters, Google Cloud had cumulative operating losses of over $12 billion.

Commerce Challenges

Overall 4Q21 sales were $137.4 billion and 4Q22 sales are only expected to be between $140.0 billion and $148.0 billion. If they come in at $144 billion which is the midpoint of guidance, then this is only $6.6 billion more than we saw in 4Q21. Also, the AWS segment by itself should be at least $3.5 billion more than the 4Q21 level so that only leaves about $3.1 billion to be spread out among the other segments. This means 4Q22 could be flat with respect to 4Q21 and 4Q20 for the 1P segment below:

Amazon volume (Author’s spreadsheet)

CFO Olsavsky noted in the 3Q22 call that sales growth has moderated:

As the third quarter progressed, we saw moderating sales growth across many of our businesses as well as the increased foreign currency headwinds I mentioned earlier, and we expect these impacts to persist throughout the fourth quarter.

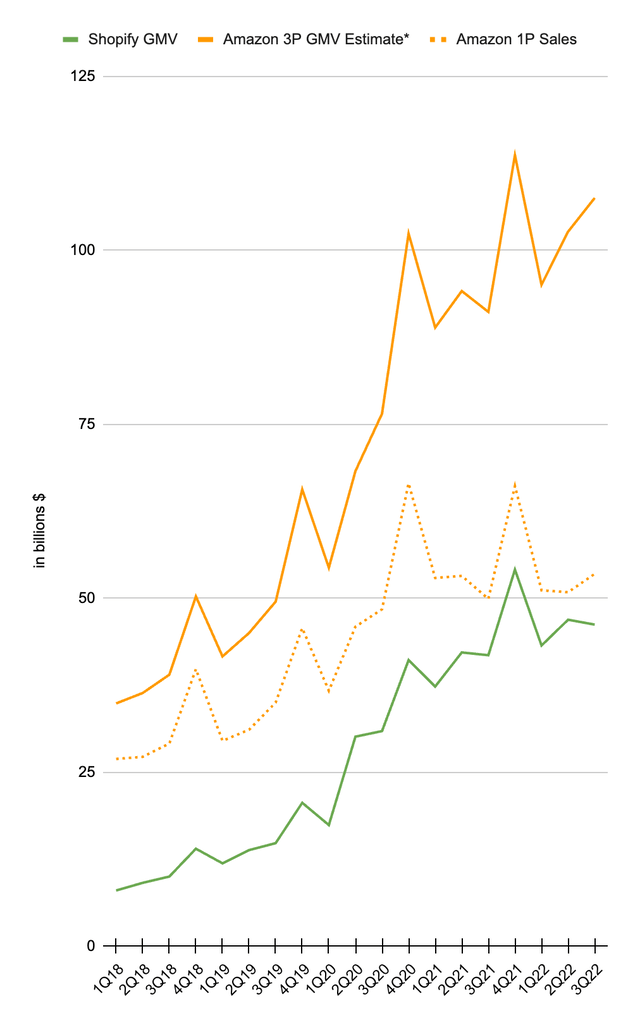

We see above that Amazon is not alone in terms of facing challenges during recent quarters. The numbers for Shopify (SHOP) have also been less than what we’ve been used to in terms of Y/Y growth. Shopify is not a marketplace but both Shopify and Amazon help merchants move GMV and both are seeing a slowdown. Both companies will do well in the long run as the world keeps shifting to digital but they benefited from a pull-forward with Covid and they’re feeling the impact of a slower economy at this time.

Valuation

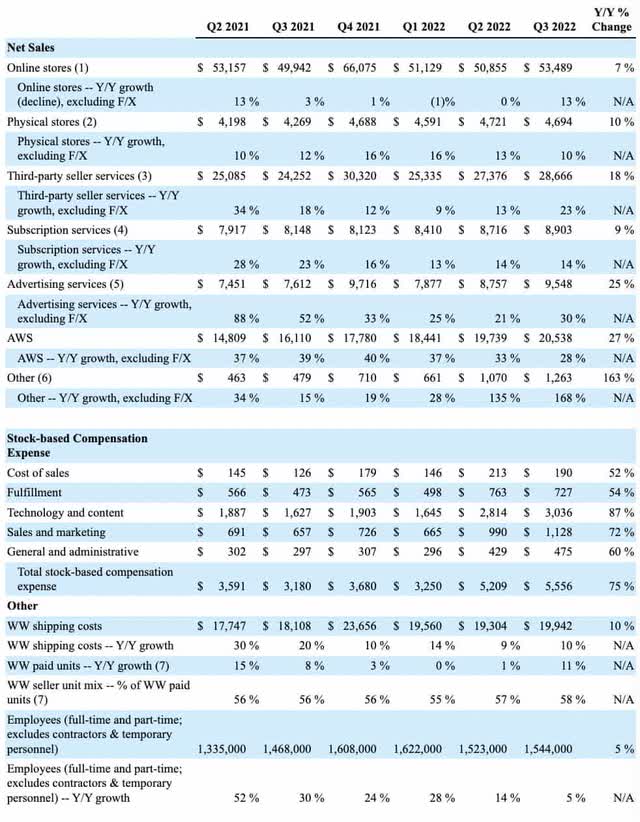

The overall 3Q22 sales of $127.1 billion are broken down by segment in the 3Q22 release. Normally we see a nice jump up in the last quarter but 4Q22 guidance is only $140 to $148 billion. The elevated SBC numbers pointed out by CFO Olsavsky are concerning, especially the 87% increase in technology and content:

Amazon segments (3Q22 release)

Given the way interest rates keep going up, I no longer feel justified using an operating income multiple of 23 to 25x to value the AWS segment. I think a multiple of 20 to 23x makes more sense now. Also, I now feel more comfortable using trailing-twelve-months (“TTM”) as opposed to an annualized number. TTM operating income for AWS is $22,929 million or 9M22 + FY21 – 9M21 or $17,636 million + $18,532 million – $13,239 million. Applying a multiple of 20 to 23x and rounding to the nearest $10 billion gives the AWS segment a valuation range of $460 to $530 billion.

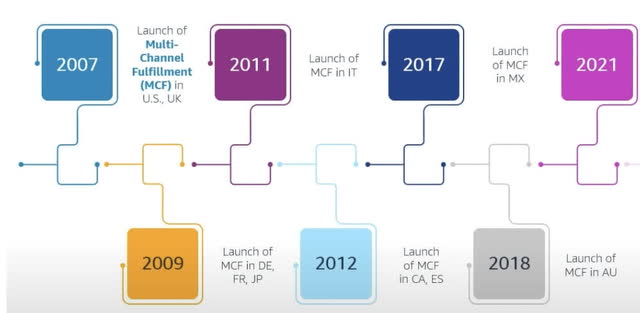

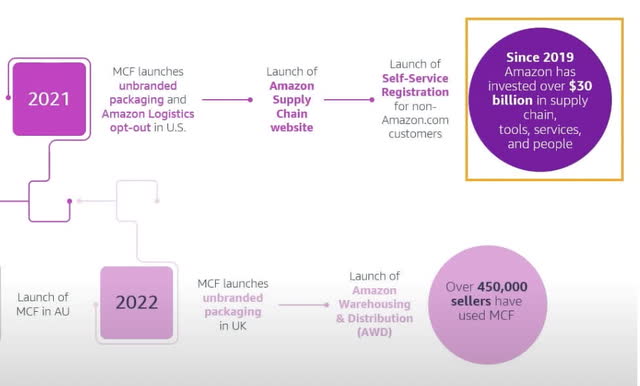

The Expanding Your Business: New Multi-Channel Shipping & 3PL Solutions session from Amazon Accelerate 2022 has a visual showing the major investments in the Amazon supply chain. Many of these investments have been obfuscated in income statement lines over the years and it is hard to put a valuation range on Amazon’s supply chain:

Amazon Supply Chain (Amazon Accelerate 2022)

Amazon Supply Chain (Amazon Accelerate 2022)

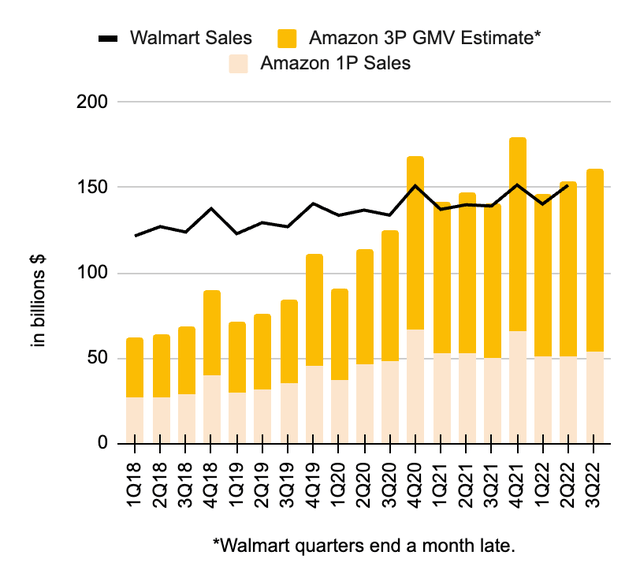

It’s easy to get caught up in the current macro challenges and forget what Amazon has accomplished in recent years. 4 years ago in 3Q18, the sum of Amazon’s 1P Sales plus 3P GMV was only about half of Walmart’s (WMT) sales whereas now Amazon and Walmart are at similar volume levels:

Volume for Amazon & Walmart (Author’s spreadsheet)

Amazon has a much higher percentage of 3P sales than Walmart. In the 3Q22 call, CFO Olsavsky said 3P sales went up from 56% of total paid units in 3Q21 to 58% in 3Q22. At the time of this writing, Walmart has a market cap of about $387 billion based on the 2,714,237,937 share count as of August 31st from their 10-Q through July 31st multiplied by the October 30th share price of $142.51. I think Amazon’s remaining segments outside of AWS are worth well over 2 Walmarts or at least $775 billion rounding to the nearest $5 billion. This means my total valuation for Amazon including AWS is easily $1,235 to $1,305 billion and probably much higher.

Per the 3Q22 10-Q, there were 10,201,654,176 shares outstanding as of October 19th. Multiplying by the October 30th share price of $103.41 gives us a market cap of just $1,055 billion.

The market cap is lower than my valuation range so I think the stock is a buy for long-term investors.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Be the first to comment