onurdongel

(Note: This article appeared in the newsletter on June 25, 2022 and has been updated as needed.)

Back when the now major shareholder, Jerry Jones, invested a substantial amount of money into Comstock Resources (NYSE:CRK), I wrote an article and followed up with more articles that he was looking for large gains. People like Jerry Jones generally invest when they see a chance for big gains. Back then, Jerry Jones paid $6 per share for about $475 million in stock in one transaction. At times he would pay more per share for the shares purchased. But overall, he invested more than $1 billion.

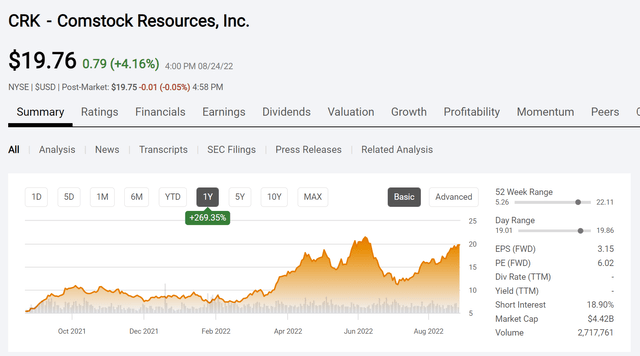

Comstock Resources Stock Price History And Key Valuation Measure (Seeking Alpha Website August 24, 2022.)

The interesting thing about the transformation is that the market could have cared less at the time. The stock actually traded below the price that Jerry Jones paid for any of his shares for a decent time period as shown above. Investors who wanted to get in on a recovery could have gotten invested in the common stock for a bargain price.

But as is typical for any industry downturn, this issue was ignored. Now the investment that Jerry Jones has made nearly tripled, and he has excellent chances at further price appreciation. Of course, now that the stock has appreciated considerably, there is far more market interest than there was when Mr. Jones invested.

So many times, I get questions about “will a stock go lower” or “I am waiting for a (lower) price”. Yet here is a successful investor who invested in a failing company, turned that company around, and is now enjoying the rewards without the worry about getting a lower stock price for his money. Because of this, I often tell any investor to get in at a bargain price (but make sure it is a bargain price) and then hang on.

A lot of investors worry about a 15% or even 20% decline. Yet here is someone who invested a substantial portion of his wealth and then remained invested when the stock price dropped to reduce the investment value significantly more than many investors tolerate.

What is the difference? An investor like Jerry Jones does his due diligence and comes up with a plan. Some plans fail. But he has an execution strategy that he pursues because he has the “no matter what happens” covered. That is what due diligence is all about. That stops the “but the stock went down questions” because he has that covered before he ever invested.

In contrast to Jerry Jones, I often received questions like “why did the stock price drop?” and “what do I do now”. Those questions need to be answered before you invest because when it happens it is part of your investing strategy.

The commodities area is often extremely volatile, and it has low visibility. So, it is not for everyone. Many of these stocks swing 30% or sometimes more for no real good reason. I take that into consideration when I advise many investors to consider a basket of stocks so that an investor is not awake at night due to the volatility of an investment in this area of the stock market.

Similarly, many investors ask about a target price. But the time to sell is when there is a sellers’ market. The danger of setting a price target is that an investor can miss a substantial amount of appreciation by selling at the wrong point in the cycle. The average investor can watch experienced industry insiders to determine when the proper time to sell arrives. At that point, then a proper valuation would be in order.

This industry is barely out of the recovery stages. There are large investors like John Goff who is now Chairman of the Board of Crescent Energy (CRGY). He and many others have long felt that the current market is a buyers’ market and not a sellers’ market. Therefore, despite all the volatility, they are not selling, and neither am I for that matter.

When experienced industry people begin to sell noncore assets (as Exxon Mobil (XOM) announced) and you start seeing energy companies acquired for great prices, then it is probably time to get out before the next decline. Maybe, as an investor, you will not get “top dollar”. But you will get a good price.

In the meantime, someone like Jerry Jones is still holding onto his investment even though there was a pretty steep decline in recent weeks (followed by a climb back up). The first quarter report was excellent as cash flow increased roughly 50% from the previous year. Comstock does need to repay debt. Current commodity prices will allow that debt to be repaid.

Management already retired a small outstanding amount of debt in May. They of course retired more in the second quarter. That will probably set the trend for the remainder of the fiscal year and the foreseeable future. The payback for investors in Comstock Resources is appreciation. That is likely to happen with a stronger balance sheet.

The market is well aware that cash flow, for example doubled in the second quarter. You can easily guess why. But the market wants that same now conservative debt ratio at lower natural gas prices. As progress is made towards that goal, the stock price will respond.

Generally, most acquirers want a bargain with as few problems as possible. This company is working hard towards that goal. The influx of money a few years back resolved a lot of financial issues. Now, the reduction in debt will allow the low-cost operations to take center stage.

The company may or may not be sold in the future. But it will have the characteristics that a lot of potential acquirers want to see (and that includes future lower debt levels). The company is well located to get product to market at a low cost.

There are a lot of investors out there that are worth noting like Mr. Jones. Not all of them make the correct decisions. But it never hurts to note when one of them makes a significant investment because it might signify a decent investment opportunity. So far Mr. Jones investment is off to a decent start even though it took a couple of years to show that result.

The interesting thing will be to see if he keeps the company long term or decides at some point to sell it and look for another interesting chance. Large investors like Mr. Jones have a lot of faith in the due diligence they do. They also usually have a long-term horizon. So, the faith they have in that due diligence allows them to get through periods (like fiscal year 2021) on the way to a decent gain.

Typical holding periods for this kind of investor are typically in the five-to-ten-year range. They generally do very well through all the volatility that worries a lot of far smaller investors. It takes a significant event for a large investor to change course. For those of us who follow industry insiders and large investors, most of us will be waiting to see numbers of them sell.

Be the first to comment